News

Environmentalists fear carbon tax will go up in smoke

Environmentalists have raised concerns over the lack of clarity on how funds from the proposed ‘carbon tax’ would be utilised to protect the environment.

The tax came into effect from January 1, but will only be compulsory from 2020

The tax came into effect from January 1, but will only be compulsory from 2020. The Department of Motor Traffic said that those who don’t pay the carbon tax this year will have to pay the 2019 charges along with the 2020 charges when they renew their revenue licence next year.

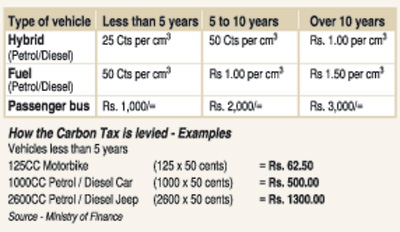

Finance Minister Mangala Samaraweera first proposed imposing a carbon tax on all motor vehicles in his 2018 budget speech. He told Parliament that funds collected through the imposition of the tax would in turn be “channelled to protect the environment.” The Government hopes to collect Rs.2.5 billion in revenue through this tax.

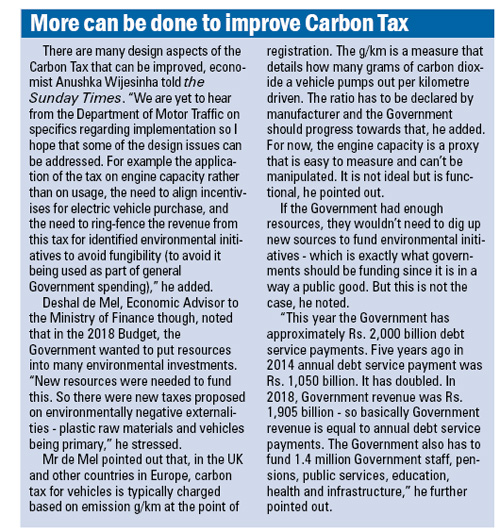

The carbon tax will be levied based on the engine capacity of the vehicle and under three categories – namely Hybrid (Petrol/Diesel), Fuel (Petrol/Diesel) and Passenger bus. Electric vehicles will be exempt from the carbon tax. The Government says that vehicles including state vehicles will be liable to pay the tax. The Finance Ministry has also emphasised that only a small amount will be levied from vehicle owners under the carbon tax. For example, the annual carbon tax for a 1000CC hybrid vehicle that’s less than five years old will be Rs.250, which would amount to less than one rupee a day.

Environmentalists however, pointed out that the Government has failed to specify which environment protection programmes would benefit through the tax, and expressed fears that the funds will be channelled to other avenues.

Hemantha Withanage, Executive Director of the Centre for Environmental Justice, said if the Government wished, the funds could be used, for example, to invest more on renewable energy sources or to build solar-powered electric car charging stations. Yet, more likely, they will be used to maintain the Government and politicians, which would make the carbon tax just another revenue generating exercise, he remarked.

Mr Withanage pointed out that money collected through the charge levied on vehicle emissions tests is also channelled to a special fund under the Department of Motor Traffic. “The Department claims these funds are being diverted to various emissions reduction projects, but we are yet to see much evidence of this. A similar fate might befall the carbon tax,” he claimed.

While there was value in the concept behind a carbon tax, he felt that the Government was following the wrong principle. “For example, it is wrong to completely exempt electric vehicles from the carbon tax when much of the electricity is generated through fossil-fuel burning sources,” he stressed.

Mr Withanage further said that an older passenger bus transporting about 60 passengers would be charged more under the carbon tax than a Pajero jeep that might normally transport four persons. He said there was no equity in the process as the rich have a bigger carbon footprint, and yet the poor are being taxed more.

“When speaking on environmentalism, the focus is on climate justice and equity. Unfortunately, there is neither justice nor equity under this tax,” Mr Withanage quipped.

Environmental Scientist Dr Sumith Pilapitiya said he agrees “in principle” to taxing people based on pollution as long as the money goes to clean up the environment. “If it goes for other purposes then there is no point, as the environment will continue to be damaged.”

Dr Pilapitiya warned that the tax will be counterproductive unless there is some guarantee that the revenue will be utilised for environment protection. However, he said he was not confident that such a thing would happen as all Governments have a reputation for channelling funds for purposes other than the ones they are intended for.

He opined that it would be better for the Government to come up with a legal framework detailing how funds collected through the taxes would be utilised, and to put the proposal up for public consultation, enabling interested individuals and groups to come forward with their input.

Environmentalists are right to be sceptical about revenue from the carbon tax being used for environment protection given the failure of other such projects, said Sajeewa Chamikara of the Movement for Land and Agriculture Reform.

“If you look at the emissions tests on vehicles, most of the revenue goes to several private companies who have a monopoly on testing centres. Similarly, hardly any revenue generated from the ticket sales at national parks goes back into them. The carbon tax itself is just another revenue generating exercise,” he claimed.

Repeated attempts to reach the Commissioner General of Motor Traffic, Jagath Chandrasiri on whether his department was aware of any specific environment protection programmes to which the revenue will be directed, proved unsuccessful. A Finance Ministry official, meanwhile, pointed out that Minister Samaraweera had mentioned a number of major environment conservation projects under the Government’s ‘Blue-Green Economy’ during his 2018 budget speech. These include converting all Government vehicles into hybrid or electric vehicles by 2025, flood mitigation efforts, drought resistance, cleaning lagoons and mangroves, ground water monitoring and sustainable disposal of waste. The official, who declined to be named, said he expected that the revenue from the carbon tax will be channelled towards such projects. “We will also welcome proposals from environmental groups regarding the areas they feel the revenue should be specifically diverted to,” the official stressed.