News

Micro-finance wolves strike again with two more debtor suicides

In the Alayadivembu area, 22km from Ampara town, two members of young families committed suicide this month; they were in debt over small loans obtained from the micro finance credit companies operating in the Eastern Province.

Protest against micro finance companies in Batticaloa. Pic by Dev Adhiran

One victim, a 21-year-old mother of two, ended her life on Monday as she could no longer bear her burden of debt. The other, a father of three, committed suicide following a dispute with his wife who had wanted to obtain a fresh loan to settle another loan.

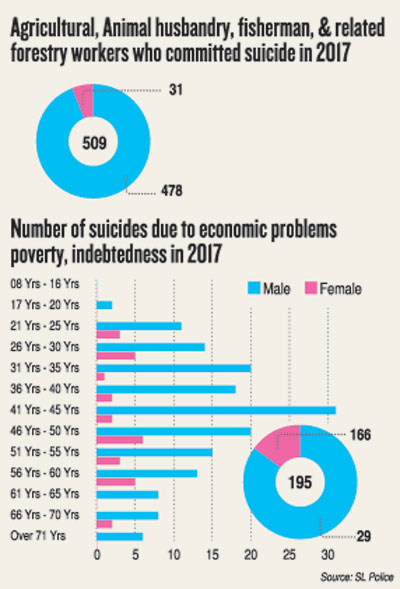

More than 60 suicides recorded this year in the East stemmed from family disputes over debts owed to micro finance companies, according to women-led civil society organisations working at grassroots level in the region.

“There has been a systematic exploitation of war-affected communities by micro credit companies that target women in particular to sell their shoddy loan schemes.

Once they fall into that debt trap, there is no coming back,” Manoharan Malathy, Project Coordinator of Social Architects, an organisation that is involved in rehabilitation initiatives for war-affected women in the east told The Sunday Times.

The debt trap designed by micro finance companies targets poor households in particular.

To become eligible for a quick loan all that the applicants need to do is form a group of at least five women who share a common need: instant money to fulfil urgent needs. There would be no questions asked about how they would repay the loan or their livelihood capacity.

“Broken families, family disputes, credit officers soliciting sexual bribes from women in debt – these are some of the main consequences of continuous exploitation by micro finance companies in the region. Some women leave their houses from early morning just to avoid credit officers from companies from which they have obtained loans,” Ms Malathy said.

Confirming the two most recent deaths, Alayadivembu Divisional Secretary Vedanayagam Jehadeesan, said that at least 15 people who had attempted suicide after taking loans were undergoing psychological counselling and assistance to overcome their indebtedness.

“In our area, these micro credit loans have become one of the major factors for social problems, broken families, displacement of war-affected poor families and, finally, suicides. War-affected people from remote villages have signed up for these loans without considering their family situation or repaying capacity. These companies’ penetration into society is very worrying,” Mr. Jehadeesan said.

Once snared in debt, a family is faced with dire choices: to sell valuable property, be displaced from their homes or go to West Asia as housemaids, Divisional Secretary Jehadeesan said.

“Many poor women who have immense debts feel their only option is to go and work as housemaids in West Asia, leaving their children behind. This leads to the break up of families, with the children ending up in children’s homes,” Mr. Jehadeesan explained.

The way the loan schemes often work is that each member of the applicant group is given Rs. 35,000 credit at the highest interest rate, 20-35 per cent annually, with repayment due in a maximum of one year. Each single applicant has two other women in the group signing as guarantors on forms written in English, which is not their language of use.

The very next day they get their money, and once they make an initial repayment their credit limit is doubled, encouraging them to borrow more – thus the scheme goes on.

Indebtedness is compounded when a person signs for many loans from various companies with more than 15 micro finance credit companies being active in the Eastern Province. Most families in Aalayadivembu area have each subscribed to at least five micro credit loans for various purposes. The struggling borrowers find themselves forced to obtain fresh loans from new lenders to pay outstanding instalments on existing credit.

In most villages, the practice is for a borrower to keep a diary of when credit officers are due to collect weekly payments of loans from various companies. Most of the days in a week are filled with such visits. When there are insufficient funds to make repayments the borrowers go missing from their homes to avoid the credit officers or they ask neighbours for fresh mini loans to pay the micro finance companies.

With debt-linked suicides mounting in the war-affected population of the east, several Divisional Secretariats have called meetings of their Divisional Development Councils (DDC) to discuss ways of controlling the situation.

Recently, following meetings by the Batticaloa and Eravurpattu DDCs, new regulations were introduced regarding debt recovery and the issuing of new loans.

“We have instructed micro credit companies to obtain clearance from the relevant Grama Niladhari certifying the beneficiaries’ financial strength to repay a new loan considering other loans they have already taken from other companies,” Batticaloa Tamil National Alliance (TNA) parliamentarian S. Viyalendiran, who presided Eravurpattru DDC meeting, said.

“Also, credit officers have been told not to visit residences to recover loans after the evening.”

Some micro credit companies oppose these moves, claiming that the regulations are arbitrary.

During an official visit to the North in April, Central Bank Governor Dr Indrajit Coomaraswamy announced a six-month moratorium for loans up to Rs. 50,000 obtained by residents of the Northern Province. Civil society organisations said that at least 59 borrowers in the region had committed suicide this year.

A Samurdhi officer attached to the Alayadivembu Divisional Secretariat, V. Sukirathakumar, said that though there are many effective micro credit programmes introduced by state agencies, their strict administrative procedures caused people to turn to micro credit finance companies for ready money.

“Samurdhi was introduced to eliminate poverty in remote areas of the country but its strict polices failed to generate sustainable livelihood for war-affected poor communities,” Mr. Sukirathakumar said.

He noted that as a prerequisite to receiving a Samurdhi loan an applicant was required to obtain clearance from micro finance companies active in the region so that the Samurdhi Authority could verify the applicant’s financial capability through the Credit Information Bureau of Sri Lanka (CRIB) – a process that saw many poor families be deemed ineligible for loans from state banks.

The 2017 Annual Report of the Finance Ministry records 11 new applications last year for licences to engage in micro finance lending. The total outstanding loan portfolio of major state micro finance institutions stood at Rs. 263 billion at the end of last year.

A senior official attached to the Micro Credit Unit of the Central Bank said addressing the problem of post-war household debt was still at policy level following comprehensive dialogue with stakeholders, including those trapped by debt, and remedies to address this urgent issue would be taken in the near future.