Government’s Balance Sheet

View(s):A balance sheet of any organisation such as a firm or even a family shows either income and expenditure, or receipts and payments, or credits and debits, or assets and liabilities. The balance sheet projects the financial position and financial progress. If the balance sheet does not look healthy, then there should be changes and reforms, which are painful sometimes.

The government also has a balance sheet, which is presented annually to the Parliament and to the people of the country – that is the government’s budget. There is, however, a problem because unlike the balance sheets of other organisations, the government’s balance sheet affects the people of the country.

Spending others’ money

The government spends people’s money. It is well-known that there can be a clear difference between spending from someone’s own money and spending from someone else’s money. When someone is spending his/her own money, there is an attempt to get a return worth more than what is spent; therefore, every rupee spent must give a return more valuable than a rupee. When there is legitimate power vested upon the government to spend someone else’s money, that caution might get diluted because the objectives might be different and accountability might be at risk.

The second aspect of the problem is related to the implications of the government’s balance sheet over the economic affairs and prosperity of the nation; these implications are typically categorised under two headings as the budget’s (a) development implications and (b) macroeconomic implications.

Government Budget 2018

The Budget Speech 2018, underlying the government’s latest balance sheet shows how the government has recognised the current economic challenges and spending requirements and, how the government intends to deal with them within the annual budgetary purview. While there can be both medium-term objectives and long-term goals of fiscal management, the budget is essentially an annual balance sheet presenting revenue-spending outlays. Even from a short-term perspective, budgetary performance throughout the year still depends on how effective and efficient the mechanism of delivery is.

Let us look at the Government’s Budget 2018, and grasp the status of Sri Lanka’s financial position, anticipated financial progress, and the challenges that people have to face in the coming years. For many years, Sri Lanka’s fiscal management has reflected fundamental weaknesses which have been accumulated and aggravated to this day.

Hambantota Port: Funded by borrowings

Recurrent Expenditure, exceeding Revenue

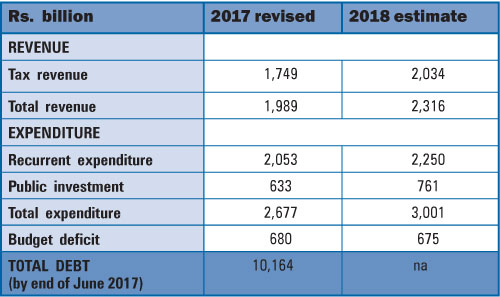

One of the main issues that the country has been sustaining over many years was the revenue that was not sufficient to cover even the recurrent expenditure. The expenditure outlay has two main components as recurrent expenditure and public investment, while recurrent expenditure is the continuation of the existing spending by the government. This includes public sector salaries and wages, interest payments on previous borrowings, and subsidies and transfers. These three expenditure items alone add up to more than the total tax revenue. Interest payments, being the largest expenditure item in the budget, account for 42 per cent of the tax revenue; salaries and wages account for 38 per cent and, subsidies and transfers 27 per cent of the total tax revenue.

According to the revised budgetary estimates this year 2017 too, the government’s tax revenue was close to Rs. 1,750 billion, and total revenue to Rs. 1990 billion, but the recurrent expenditure exceeded Rs. 2050 billion. This is no different from saying that the monthly income of someone is not enough to pay for that person’s day-to-day living expenses, so that the person has to borrow even to pay for part of that.

Capital Expenditure, financed from borrowings

The above is a fundamental issue in the government’s balance sheet which leads to detect another problem: any public investment that the government has undertaken in the past must have been purely financed through borrowings. As of 2017, Rs. 633 billion has been spent on public investment. It is well-known now for whichever the reason, some of the mega investment projects that the government has undertaken in the past have not been generating any return.

Apparently the interest payments on such borrowings and the operating a costs of such projects (salaries and wages plus maintenance) have magnified the recurrent expenditure component of the government budget.

Loan repayment, hidden in the Budget

A third issue arises due to the fact that the loan repayment component is actually hidden in the government’s balance sheet. The government’s borrowings should be repaid from the government’s tax revenue. While interest payment is reported under recurrent expenditure, the capital component or amortisation is not clearly visible because it is reported in net terms only.

When both the interest and amortisation payments are taken together, which is called the debt service payment, it is nearly similar to the total tax revenue of the government. As of 2017, the amortisation payment amounts to Rs. 850 billion and the interest payment to Rs. 725 billion, together accounting for Rs. 1575 billion, compared to Rs. 1750 billion total tax revenue. This means that the tax revenue is just sufficient to pay the annual loan instalment of the government. What this implies is that, not only the public investment component of the budget, but almost total expenditure outlay of the government should come from further borrowings, unless there are some other means of reducing the debt burden.

As far as total debt of the government is concerned, there are more things to say. While the exact amount of outstanding public debt is a point of controversy, as reported in the Central Bank data sources it was over Rs. 10 trillion by June 2017. However, it should be noted that the outstanding debts of the public enterprises which continue to borrow with government bank guarantees are not in the government debt; but their losses are usually taken care of in the government budget through transfers. Therefore, apparently the outstanding public debt of the government plus government agencies which ultimately fall on government budget should be bigger than what we really come to know as “public debt”.

2018 and beyond

Budget 2018 has actually recognised the most pressing challenges that Sri Lanka has currently faced with in its fiscal management; this recognition is reflected through its budgetary estimates for the coming year 2018. While facing the massive increase in the country’s debt service payment within the next few years, the budget envisaged relief in the government’s balance sheet. In addition, it also has optimistic expectations about the acceleration of economic growth, export promotion, foreign investment, and promoting blue-green economy. The basic question in issue is if the mechanism is efficient and effective enough to make the delivery as anticipated, without fundamental reforms in “policies and institutions” which are beyond the purview of an annual budget.

(This a new weekly column in the Business Times dealing with economic issues. The writer is Professor of Economics at the Colombo University)