Columns

Fiscal and monetary policy coordination vital to contain inflation and trade deficit

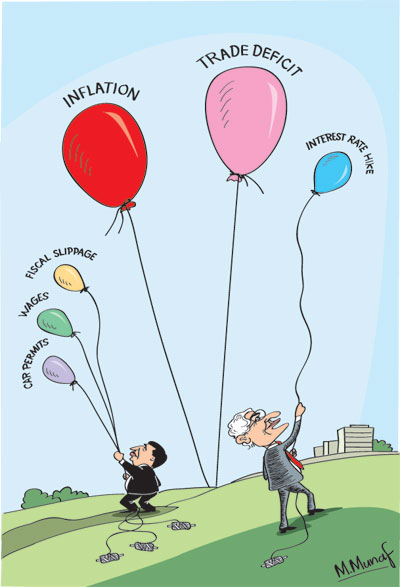

View(s): The recent increase in the policy interest rate by the Central Bank was a move in the right direction. The objective of the increase in interest rates was to contain aggregate demand to contain inflation and imports. Yet, some could argue that its increase by 50 basis points was too little.

The recent increase in the policy interest rate by the Central Bank was a move in the right direction. The objective of the increase in interest rates was to contain aggregate demand to contain inflation and imports. Yet, some could argue that its increase by 50 basis points was too little.

However, changes in the interest rate are particularly suited to bring about smoother and fine adjustment compared to other measures such as credit ceilings. Also, it has “an announcement affect” that the Central Bank will follow a tight money policy. It is however important for monetary and fiscal policies to be complementary to each other for containing inflation and curtailing the trade deficit.

Central Bank’s objectives

Governor Dr. Indrajit Coomaraswamy explained the Central Bank’s objectives in increasing the policy interest rate as being partly due to fiscal slippage arising from a delay in implementing revenue measures, including the increase in the Value Added Tax (VAT), and the continued high credit growth to the private sector of 28 per cent in May, which is likely to continue in August as monetary policy works with a lag. Inflation running at 4.8 per cent and increased imports in May are also reasons for the interest rate hike.

Contrary view

Some economists are of the view that interest rate policy as an instrument to contain inflation is not ideal because high interest rates may not reduce inflation and could affect investment and economic growth adversely. Admittedly, if interest rate policy is not supported by appropriate fiscal policies, it will nullify what monetary policy is attempting to do. Inflation rather than high interest rates is the larger evil. If inflation increases it would distort prices and have detrimental effects on economic growth. However supportive fiscal policies are vital for the efficacy of monetary policy.

The use of interest rates to contain the supply, availability and cost of credit is a double edged weapon. While in this instance, and in most circumstances, the interest rate hike is with the objective of containing aggregate demand to contain inflation and also to reduce import demand, it could have an unintended result of curbing investment, as the interest rate increase not only curbs consumption expenditure, but also increases costs of investment and thereby reduces output and economic growth. It is however impractical to continue with a low interest rate policy as inflation will rise as private sector credit continues to growth rapidly.

On the other hand, higher cost and lesser availability of credit could hamper economic growth. This is particularly so for small and medium industry that relies more heavily on borrowed funds. It is perhaps for this reason that the Central Bank has been slow to use this monetary policy instrument. Now the Central Bank has signalled that it will take remedial measures to control aggregate demand.

Aggregate demand

The need to restrain aggregate demand has been there for some time. The Central Bank and the government were reluctant to increase interest rates owing to its possible adverse impact on investment. Higher interest rates would have increased the public debt burden too. The high aggregate demand fuelled by low interest rates has been a factor in increasing the trade deficit and straining the balance of payments and also for the higher rate of inflation.

Import demand

One of the important objectives of the increase in the Central Bank’s policy interest rate was to increase market interest rates to dampen import demand. Being an open economy the propensity to import is high. Therefore when aggregate demand increases consumer imports increase and the trade deficit expands.

Trade deficit

In the first four months of the year, the trade deficit was reduced by 2.4 per cent compared to that of the first four months of last year owing to several policy measures that reduced import demand. These included the depreciation of the rupee, credit controls and increased tariffs. The reduction of the trade deficit was achieved entirely by a reduction of imports as export earnings declined during the first four months of the year by 5.9 per cent.

However in May imports rose 0.3 per cent, while exports continued its slide to decrease by as much as 12 per cent compared to May 2015 and the trade gap widened by 15.7 per cent to US$ 813.5 million. Imports that had shown a declining trend in the first four months increased slightly in May to cause some concern as exports have been continuously declining this year.

In the context of declining exports, further reduction of imports is important to ensure that this year’s trade deficit is not too large. The objective should be to contain this year’s trade deficit to around US$ 7.5 billion. As the trade gap widened in May and imports increased though by a small amount, it is important to be vigilant to constrain imports. This cannot be achieved by a hike of interest rates alone. Fiscal policies and exchange rate policies are vital.

Coordination of policies

The lack of coordination between fiscal and monetary policies has often been to the detriment of macro economic stabilisation. The increase in the policy interest rate should be coordinated with fiscal policies that do not negate the objectives of the increase in interest rates. There must be complementarities in monetary and fiscal policies to constrain imports. The lack of coordination between fiscal and monetary policies has often been to the detriment of macro economic stabilisation.

Conclusion

It is important for monetary and fiscal policies to be complementary to each other for containing inflation and curtailing the trade deficit. The Central Bank’s contractionary monetary policies should not be countered by expansionary fiscal policies. If the fiscal authority increases spending, then the Central Bank has to increase policy rates again.

The increase in the policy interest rate should be coordinated with fiscal policies that do not negate the objectives of the increase in interest rates. The concessionary duties for imports of motor vehicles, wage increases and increased public expenditure would negate the effect of the interest rate hike.

Leave a Reply

Post Comment