An Environmentally-friendly Vehicle Tax System for Sri Lanka

Prius vehicles are displayed for sale

There were many complaints in the news media regarding the increase in the Excise Duty of Toyota Prius cars which are used by most taxi companies for the transport of tourists from the airport, because of the high fuel efficiency, internationally accepted safety standards and the long term durability of the vehicle. When a former Minister now representing the joint opposition alleged that the duties of vehicles were revised recently to please the Indian authorities, I decided to carry out a study of the Excise Duty structure of motor cars.

Dr. R.H.S. Samaratunga, Secretary to the Ministry of Finance headed the Trade and Tariff department of the Ministry of Finance from the time the Tariff Committee headed by Nihal Jinasena was replaced by the Trade and Tariff Cluster of the National Council for Economic Development (NCED) and the Transport Cluster of NCED. This was during the time of President Kumaratunga. Prof. Amal Kumarage of the Moratuwa University was appointed as the Co-chair of the Transport Cluster with the responsibility of planning the transport strategy and the vehicle tariffs.

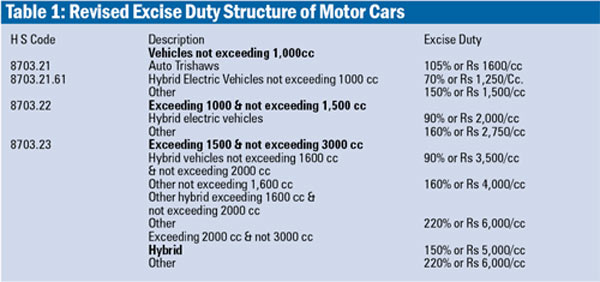

The writer was appointed as the Co-chair of the Trade and Tariff Cluster with the responsibility of rationalising the tariffs to three bands and introducing additional tariffs to protect local producers as well as the consumers. Dr Samaratunga was responsible for submitting the recommendations for implementation to the Secretary to the Treasury. Dr Samaratunga was a very intelligent and hardworking person with high integrity. The rational vehicle excise duty structure in Table 1 shows that there is no bias in this duty structure.

The term Excise Duty on vehicles implies that it is a charge levied because of the environmental impact of the particular vehicle. The current Excise Duty structure shown in Table 1 appears to be rational, if the emissions are directly related to the engine capacity. This assumption was correct 20 years ago before the launch of energy efficient hybrid motor vehicles. The weakness of the duty structure is in basing the excise duties of hybrid vehicles on engine capacity, rather than the certified fuel efficiency, which is directly proportional to the carbon dioxide emissions.

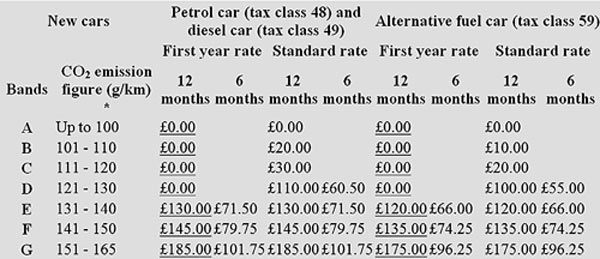

In developed countries the taxes are based on carbon dioxide emissions. This helps them to directly compare the environmental efficiency of all fossil fuel based vehicles. The EU environmental target for 2015 is 130g of carbon dioxide/km as the vehicle fleet average for all manufacturers. The 2021 standard is 95g/km. The tariff structure in UK based on carbon dioxide emissions, which is directly related to the fuel efficiency, is shown in Table 2. The CO2 emissions for the 2016 Toyota Prius with an engine capacity of 1797 cc vary from 70g/km, with an average fuel consumption of 94.1mpg. This is a 21.3 per cent increase from the 89g/km and 72.4mpg achieved by its predecessor.

The development of the 1.8-litre VVT-i Atkinson cycle petrol engine to produce a world-best 40 per cent thermal efficiency has contributed to this fuel efficiency. The link is given below. According to the link given below, the most fuel efficient Maruti-Suzuki petrol vehicle is the Alto K10 with a fuel efficiency of 24.07kpl produced by its 998 cc engine. The 2016 Maruti Alto 800cc is 9 per cent more fuel efficient than the previous model with a mileage of 24.7kmpl or 58mpg and hence now more fuel efficient than the Maruti K10. The Renault KWID with a 796cc engine and carbon dioxide emission of 102g/km, tops the list with a fuel efficiency of 25.17kpl or 59.2mpg. All these cars are available in Sri Lanka.

The 70g/km 1797cc Prius 2016 is 31.4 per cent more environment friendly than the Renault KWID, the most environment friendly car imported from India. The excise duty at Rs 1,500/cc is Rs. 1,194,000 for the Renault KWID. The excise duty on the Maruti 800 is similar. The excise duty on the 2016 Prius with a rated fuel efficiency of 94.1 mpg is Rs 4,000/cc x 1797 cc = Rs 7,188,000. Hence, the excise duty of the 2016 Prius is six times more than the 2016 Maruti 800 with a fuel efficiency of 58mpg, which is 38 per cent less than the 2016 Prius. These examples show the urgent need to change the excise duties of hybrid vehicles to be based on the certified carbon dioxide emissions.

Conclusions

The above data shows that there is an urgent need to base the excise duties of all hybrid cars on the certified fuel efficiency or Carbon Dioxide emissions, rather than the engine capacity, as in developed countries. A proposal to base the excise duties of all motor vehicles based on the certified fuel efficiency and the fuel used may be considered for the 2017 budget. There is also a need to equip at least the University of Moratuwa with a test bench, to certify the fuel efficiency of vehicles, to help Sri Lanka to develop minimum fuel efficiency targets for all vehicles.

The EU environmental target for 2015 is 130g of carbon dioxide/Km as the vehicle fleet average for all manufacturers. Sri Lanka should set this target for new car imports in 2019. There is also a need to consider an annual road congestion levy, based on the square area of each vehicle, to fund the road development. This needs to be given the consideration of our planners. This is the practice in UK.

References:

1kmpl = 2.35215mpg

http://www.customs.gov.lk/tariff/xid160527.pdf

http://carfueldata.dft.gov.uk/

http://carfueldata.dft.gov.uk/search-by-ved-band.aspx

http://carfueldata.dft.gov.uk/additional/aug2015/VCA-Booklet-text-Aug-2015.pdf

http://blog.toyota.co.uk/2016-toyota-prius-mpg

http://www.carblogindia.com/most-fuel-efficient-petrol-cars-in-india/