Finding solutions to 3 fundamental economic problems – huge challenge for new Government

As a country with a high literacy rate, Sri Lankan voters have already taken the right decision. The majority believes the UNP-policy package would produce feasible and justifiable solutions to improve the economic growth and result in the societal wellbeing of everyone in Sri Lanka. Many voters have accepted the UNP Government’s policy package because of its practical nature and effectiveness in bringing viable social and economic outcomes that are capable of generating solutions to three fundamental economic problems – huge fiscal deficit, external trade deficit and an excessive public debt balance while continuing the already implemented “100-day social protection programme” since January this year.

The UNP has promised to implement a Five-Fold-Five Year development policy plan covering technology, education, skills and health related human resource development, agriculture-industry- services based regional productivity centres, public sector reforms, healthy external relations, domestically and externally sound job creations, knowledge-based high-tech industry, economic zones, FDI related free-trade zones that are capable of rejuvenating and strengthening prevailing economic conditions in Sri Lanka. It is assumed that this plan is a “five-year step-by-step”-step by step-development programme”, capable of earning necessary resources through the programme itself. Moreover they have proposed wastage-malpractices-free safeguards while strengthening democracy, freedom and good governance as pre-conditions for implementing a well, disciplined economic development process in the country.

The UNP has promised to implement a Five-Fold-Five Year development policy plan covering technology, education, skills and health related human resource development, agriculture-industry- services based regional productivity centres, public sector reforms, healthy external relations, domestically and externally sound job creations, knowledge-based high-tech industry, economic zones, FDI related free-trade zones that are capable of rejuvenating and strengthening prevailing economic conditions in Sri Lanka. It is assumed that this plan is a “five-year step-by-step”-step by step-development programme”, capable of earning necessary resources through the programme itself. Moreover they have proposed wastage-malpractices-free safeguards while strengthening democracy, freedom and good governance as pre-conditions for implementing a well, disciplined economic development process in the country.

However, the new government has huge challenges; firstly to find resources for the “100 Day Development Programme” and secondly, maintaining the most essential Treasury level fiscal consolidation aimed at lower budgetary balance, manageable public debt balance and increasing inflow of export incomes. This article discusses the prevailing economic realities, especially connected to the adverse fundamental economic challenges and continuation of 100-day development promises and merits of the proposed five-fold-five-year development programme of the new UNP government.

Prevailing adverse economic realities

Prevailing adverse economic realities

Critical fiscal situation of the Government

The huge fiscal deficit is the serious fundamental economic reality the new Government has to face. There is big gap between the revenue and expenditure, accumulating over the years which will prevent it from offering further free gift packages in the manner politicians have promised. The Treasury funding coffers almost empty and it needs to collect taxes and duties to meet day to day recurrent expenses such as wages and salaries, pensions, Samurdhi and need to borrow money to meet the rest of the expenses such as poor relief, health and education expenses, development expenses, repayment of debts and interest and other expenses.

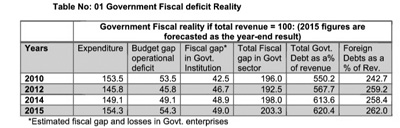

The Government’s overall fiscal reality is clearly shown in Table 1. The most serious concern is that the government expenditure is 50 per cent more than the revenue while an equal amount is seen as overall losses in the public sector institutions. Hence the total fiscal gap in the public sector is almost 100 per cent which has forced the government to borrow money constantly to meet the daily expenses. Moreover, the government has to borrow money even for settling old debt and interest.

According to Table 1 actual “operating fiscal deficit” of the government is around 50 per cent and it’s in a serious condition in terms of fundamental economic misery, affecting the whole economy. A large fiscal deficit leads to diverse adverse impacts on the economy. Firstly the six times worth of borrowing at present together with huge debt service burden almost equal to 25 per cent to 30 per cent worth of export earnings. Secondly, there is hardly any resources available for mostly needed education, healthcare, poor relief and other essential work.

According to Table 1 actual “operating fiscal deficit” of the government is around 50 per cent and it’s in a serious condition in terms of fundamental economic misery, affecting the whole economy. A large fiscal deficit leads to diverse adverse impacts on the economy. Firstly the six times worth of borrowing at present together with huge debt service burden almost equal to 25 per cent to 30 per cent worth of export earnings. Secondly, there is hardly any resources available for mostly needed education, healthcare, poor relief and other essential work.

On the other hand, huge accumulated debt is a result of persistent fiscal deficits over a number of years. Although the fiscal deficit is expressed as around 6 per cent of GDP, it is extremely excessive because “public sector actual operational fiscal deficit” is almost twice or 100 per cent of the government revenue. As a result, total accumulated debt has gone up to around six times of the revenue while the foreign debt will soon reach three times of revenue. This is very serious because the country needs to earn more foreign exchange to settle the foreign debt servicing costs while there are almost nil outcomes from those debt-financed infrastructure projects.

Similarly, the government is the biggest borrower in the domestic financial market. Higher domestic government-borrowing leads to lower private sector investment and this results in lowering overall volume of production and increasing the cost of living in the country. It eventually leads to lower export production while our products become expensive in markets abroad.

Similarly, the government is the biggest borrower in the domestic financial market. Higher domestic government-borrowing leads to lower private sector investment and this results in lowering overall volume of production and increasing the cost of living in the country. It eventually leads to lower export production while our products become expensive in markets abroad.

Peculiar Income Expenditure Reality

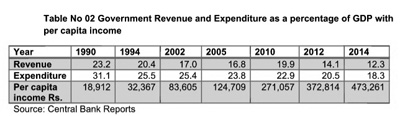

The emerging revenue and expenditure situation of the government exemplifies adverse implications during the last two decades irrespective of increase in the per capita income since 2006. Table 2 shows daunting aspects of revenue and expenditure, linked to per capita income at current market prices. According to Table 2, government revenue declined from 16.8 per cent to 12.3 per cent of the GDP when the per capita increased by 380 per cent in 2014 from 2005.

Government expenditure is full of waste, corruption and unwanted costs in addition to an excessive number of workers with lower productivity in the public sector. On the other hand, expenditure on priority areas especially education, health and social protection began to reduce year to year while increasing expenditure on unproductive areas. When considering the expenditure pattern in the recent past, the evidence suggested that the government has forgotten the core principle of economic resources being scarce and that resources should be utilised prudently with a proper prioritization of activities.

Accumulated Huge Debt Reality

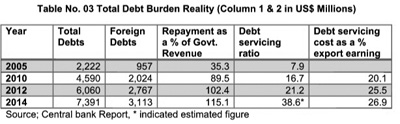

The unbearable volume of accumulated debts, both foreign and domestic has gone up to almost Rs. 8,000 billion as at end of April 2015, which is a result of annually rolled-up fiscal deficit in Sri Lanka. Out of the total, foreign debt is around Rs. 3,500 billion, which is the biggest misery, developed three times since 2005. Majority of foreign debt financed projects are unproductive and idle, large scale infrastructure construction. Eventually, the debt servicing cost has become a huge burden on government revenue and is almost absorbing the entirety of revenue since 2012 (102 per cent and 115 per cent of revenue in 2012 and 2014). Table No 3 shows the debt and repayment ability clearly.

The ongoing debt reality shows that the government has reached the doorstep of a vicious cycle of debt fuelling debt and heading for a major debt crisis as discussed in these columns on May 3.

Persistent Trade Deficit and Current Account Reality

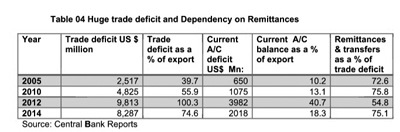

A continuous trade deficit as shown in Table 4 in Sri Lanka indicates poor level of export earning, export production, investment, FDI situation, tourism type-services and earnings from services. Evidence suggests that the authorities have continuously failed in addressing these issues for years. The markets for export products have deteriorated continuously as a result of poor international relations in the past.

Despite the continuous trade deficit, the balance of payments is likely to be managed owing to foreign workers’ inward remittances which are hard-earned money and could be used as capital inflows for further investment in Sri Lanka. In the first half of 2015, the trade deficit has further widened irrespective of reducing imported oil prices. Accordingly the estimated trade deficit is around US$5000 million at the end of June 2015, which indicates a worsening export trade reality.

Way Out: The UNP’s five-fold-five-year policies?

It is assumed that the UNP’s Five-Fold-Five-Year programme is a new direction of economic development in Sri Lanka for sustaining economic growth and a new way of taking advantage of political freedom, improved law and order, enforcement of rule of law, democratic governance and qualities of good governance for sustainable development in the country. The new government intents re-adjusting economic priorities and cutting down extravagant, ostentatious wasteful government sector spending and reducing huge expenditure on projects that are costly than benefits. Moreover, good governance may improve the quality of economic management and discipline in the country.

Policies for Treasury level reforms

Improving the Treasury revenue base and efficient collection of taxes from wealthy citizens and high income earners and implementing expenditure control should be the first and foremost operations at Treasury level. In addition to in-house Treasury reforms, a policy plan of public sector enterprise reforms for reducing losses, malpractices, mismanagement of resources and waste may help cut the prevailing fiscal deficit and break-through the ongoing fiscal deficit’s related vicious cycle of fundamental economic weaknesses in the country. Reform policies to eliminate huge losses in public enterprises like CEB, Petroleum Corporation, SriLankan, Mihin Air, CTB, and Railway, etc will help resolve the fiscal deficit problem.

Policies for enhancing regional agriculture based productivity

The new Government has region-specific policies to address diverse economic potential capabilities and has development policies capable of transformation of available resources into productive outputs meeting the aspirations of the people, especially fulfilling youth expectations. Although six years have passed since the end of the war, the previous government had failed to harness and explore the full development potential of the North and East. The UNP’s programme has given priority for implementing activities according to the regional diversity of agriculture, fisheries, industries and services and generating new employment in the regions.

Further, it has proposed new forms of agriculture, fisheries and industry that will enhance employment potential and attract young, newcomers to the job market. There are policies to harness the fertile uncultivated large extent of land and sea for harvesting of higher volume of fisheries products, food crops and cash crops. Such policies would help to reduce the trade deficit by cutting food imports and also export surplus production to rich markets in Japan, China, Europe and USA.

Policies for enhancing diversified industry, export

The Five Year economic plan has proposed enhancement and modernisation of existing industry-capacity and creating of new industrial opportunities particularly in value-added, agro-processing, technology and knowledge based service areas. Furthermore, proposed economic and export processing zones, industrial parks, village level cluster-programmes, regionally-based mixed-development projects, etc may help the income enhancing potential of the people. The new policy proposals to derive benefits from idle mega-projects such as the Hambantota harbor and Mattala airport could help to minimise debt and generate new jobs.

Policies for enhancing investment

In order to take advantages of regional peace, law and order and good governance, the UNP Government has proposed policies for promoting an investment culture, especially inflow of FDI, tourism and hospitality industries and provide opportunities for other franchise export trading giants which should provide solutions to tackle the fiscal deficit crisis, huge debt balance among other issues. Reliance on FDI-based investments is a better form of financing than foreign borrowing.

Policies for new types of foreign exchange earnings

The UNP’s new economic policies include proposals for increasing diversified exports, service projects of foreign exchange earnings and enhancing diversified export markets covering all destinations on the globe. The UNP is on the right track for reducing the trade deficit and strengthening foreign reserves needed for settling debts. Export promotion through bilateral and multilateral relations may enhance the stability of export markets. Policies for liberal trade may enhance products and services with comparative advantages in a wide range of exportable. Moreover, the policies for regionally based import substitution industry potential with sizable comparative advantages especially in North and East may improve more regional jobs creation and mobilisation of untapped resources.

Policies for enhancing migrant workers’ contribution

Proposed policies are aimed at higher investment in education, skill development and improvement of human resource development infrastructure and creation of a knowledge-rich generation, capable of obtaining jobs locally and internationally. It has planned to double the value of remittances from US$3.5 billion in 2014 to $7 billion within five years which is a realisable target for solving the adverse economic situation. Such a target may help improve living standards of the rural poor, provide income sources in addition to the support for the reconciliation of the balance of payments that could reduce the foreign debt burden and save the country from a foreign debt trap.

Power of policies: Conclusions

The power of UNP policies than promises in resolving fundamental economic problems like the huge fiscal deficit, massive public sector debt balance and the large trade deficit have been discussed briefly. These fundamental economic realities are going to be the biggest two-way challenges for the new government; on one side resolving daunting economic problems and driving the country on the right track and on the other, fulfilling the aspirations of the public and ensuring their wellbeing. The path available for the new government is not so easy. They need to have strong, Sri Lanka-specific, pragmatic policies together with political courage and commitment to implement policies in achieving sustainable economic growth and stability.

(The writer is a retired Director General (Economic Policy Planning) in the Ministry of Rural Economy in 2006. He was attached to the Ministry of finance: General Treasury from 1988 to 2002.

He could be reached at palithaeka@yahoo.com )