Columns

Fiscal consolidation critical economic challenge for new government

View(s): The election of Maithripala Sirisena as President is another opportunity to resolve fundamental economic problems. A majority of citizens voted for a change in the prevalent political milieu that did not respect law and order, the rule of law and the independence of the judiciary. It was a vote to usher in good governance and reduce large scale bribery and corruption.

The election of Maithripala Sirisena as President is another opportunity to resolve fundamental economic problems. A majority of citizens voted for a change in the prevalent political milieu that did not respect law and order, the rule of law and the independence of the judiciary. It was a vote to usher in good governance and reduce large scale bribery and corruption.

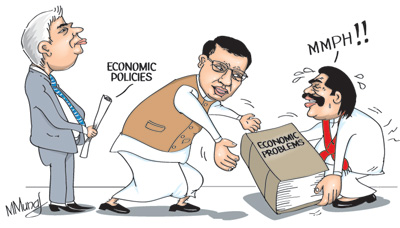

Although economic policies were peripheral during the campaign, except for the high cost of living, promises of subsidies and as usual extravagant election promises, pragmatic economic policies are needed to resolve fundamental weaknesses in the economy. Although the election did not give a mandate for a change in economic policies, changes in the political milieu would have economic consequences of paramount significance. The political and constitutional reforms envisaged in President Sirisena’s campaign for good governance and law and order have a significant bearing on economic performance.

Good governance

Good governance is essential to achieve sustainable economic growth and long term economic and social development. The new regime must promote an environment that is conducive to higher investment that is needed to spur economic growth. Sustained economic growth requires not only appropriate economic policies, but good governance that ensures law and order, the rule of law, reduction of corruption, guarantee of property rights and certainty and predictability in economic policies. Creating an economic environment conducive to higher levels of investment for economic development would be a priority for the new regime.

Challenges

Challenges

The new government will have to face serious economic problems left by the previous government’s economic policies that paid scant attention to fundamental economic principles. The economic challenges this year, and for the next few years, are formidable.

The three most important challenges facing the economy are the containment of the fiscal deficit, reducing the foreign debt and lessening the trade deficit. Of these the reduction of the fiscal deficit is most crucial. The problem of the foreign debt was discussed in last Sunday’s column.

Reduce fiscal deficit

The most important economic objective of the Government should be to reduce the fiscal deficit. The new regime must align expenditure in line with revenue so as to reduce the fiscal deficit to 5 per cent of GDP in 2015. It must increase government revenue collection from its low 11 per cent of GDP to around 20 per cent of GDP in the next three years. One of the disappointing features of recent fiscal performance has been the decline in the revenue to GDP ratio from 14.3 to 11 per cent.

Fiscal consolidation

Bringing down the fiscal deficit to the desired 5 per cent this year is difficult due to shortfalls in government revenue and the overshooting of expenditure. However, containing the fiscal deficit is vital for stabilisation of the economy and economic growth. Inflationary pressures generated by large fiscal deficits increase the cost of living and cause severe hardships, especially to the lower wage earners pensioners and fixed income earners. They lead to strikes with demands for higher wages and industrial unrest. Wage increases add to the costs of production and reduce export competitiveness. The depreciation of the currency to restore export competitiveness would lead to further inflation and increased hardships to people.

Fiscal deficits lead to borrowing and in turn to huge debt servicing costs. Sri Lanka’s huge accumulated debt is a result of persistent deficits over the years. The massive public debt leads to crippling debt servicing costs, distort public expenditure priorities and hamper economic development. The containment of the fiscal deficit to a reasonable level is therefore essential.

Policies to reduce fiscal deficit

The containment of large fiscal deficits is undoubtedly difficult to achieve in the current fiscal and political context. The change of regime provides an opportunity to undertake reforms to reduce the deficit.

Fiscal consolidation is difficult due to the limited revenue base; large debt servicing costs; huge expenditure on public service salaries and pensions; big losses in public enterprises; a large defence expenditure that has continued to increased; wasteful conspicuous state consumption and expenditure on poorly targeted subsidies and welfare.

Paradoxically, these large expenditures provide opportunities for expenditure reductions that would trim overall government expenditure. Military hardware expenditure could be brought down and fresh recruitment of personnel should be minimal. If the expenditure on defence can be brought down by even 1 per cent of GDP, then its burden on the public finances could be eased significantly.

Losses incurred by public enterprises are a huge fiscal burden. Reforms of these public enterprises to reduce public expenditure provide a significant means of reducing expenditure. In the past the privatisation of loss making enterprises, such as the estates, provided both relief to public expenditure, as well as revenue from the privatisation proceeds offset the deficit. Now that the government has changed, this option should be explored again. Furthermore, enterprises that are not privatised must be reformed and efficiently run. The government must take substantial steps to reform public enterprises and should not expand public ownership to incur further losses.

The other area of fiscal consolidation is in increasing government revenue by about 2 per cent each year. Tax reforms should reduce past fiscal slippages significantly to increase revenue. The reform in trade and excise taxes, a broader tax base and more effective tax collection should be put in place to achieve higher revenue collection that would reduce the fiscal deficit. Increasing revenue depends very much on the realistic nature of the tax reforms and the administrative capacity of the Department of Inland Revenue.

Cutting expenditure

The Mahinda Rajapaksa Government undertook an ambitious programme of infrastructure development through foreign borrowing. Some of these infrastructure developments, such as roads, bridges and energy generation will contribute to economic development in the long run. However, in consideration of the country’s fiscal constraints, impact on debt, balance of payments difficulties and other priorities, it is important to reconsider the pace and priorities of investment expenditure.

Conclusion

Among the formidable economic challenges facing the Government is the need to reduce the fiscal deficit. A strong political will and pragmatic policies are needed to progressively reduce the fiscal deficit. Both these were lacking in the previous regime. The realisation of a reduced fiscal deficit is not an easy one. Nevertheless it is imperative.