Columns

Will we miss the opportunity to reduce our foreign indebtedness?

View(s):A congruence of increased exports, remittances and tourist earnings was expected to strengthen the external finances this year and also provide space to reduce the country’s high indebtedness. The recent communal violence that erupted in Aluthgama and Beruwala areas if not contained could be a severe threat to these favourable developments in the external finances that were unfolding in the first half of the year. The security and law and order conditions must be restored to prevent a fall in tourist earnings, remittances and exports.

Favourable developments in external finances in the first four months of this year evoked expectations of a significant balance of payments surplus this year. Increased export earnings, a lower trade deficit, higher inflows of remittances and increased earnings from tourism were expected to result in a balance of payments surplus of about US$ 3 billion at the end of this year. If such a surplus were achieved, it could have been used to reduce the country’s high foreign indebtedness and avoid further foreign borrowing. It provided an opportunity to reduce the risk of external debt unsustainability.

Favourable developments in external finances in the first four months of this year evoked expectations of a significant balance of payments surplus this year. Increased export earnings, a lower trade deficit, higher inflows of remittances and increased earnings from tourism were expected to result in a balance of payments surplus of about US$ 3 billion at the end of this year. If such a surplus were achieved, it could have been used to reduce the country’s high foreign indebtedness and avoid further foreign borrowing. It provided an opportunity to reduce the risk of external debt unsustainability.

Exports

The revival of exports since the middle of last year is expected to gain momentum in the coming months owing to the resurgence of Western economies and should improve the trade balance. In the first four months of the year, export earnings increased by 17 per cent compared to that of last year to reach US$ 3.7 billion. A simple projection gives export earnings of US$ 11 billion. It is not unrealistic to expect export earnings to reach over US$ 12 billion this year, if global demand continues to improve. On the other hand, if communal tensions prevail and economic sanctions are imposed or if there is disruption of exports due to security factors, the expected export earnings in the second half of the year may not be realised.

Trade deficit

Trade deficit

If import expenditure could be contained at last year’s level of US$ 18 billion then the trade deficit could be around US$ 6 billion. However it is likely that import expenditure would rise owing to increased expenditure on oil imports due to higher thermal electricity generation and increase in international oil prices. Besides this, increased exports require higher intermediate imports, as the country’s exports have high import content. Considering these factors, it is reasonable to expect the trade deficit to be around US$ 7 to 8 billion.

Remittances

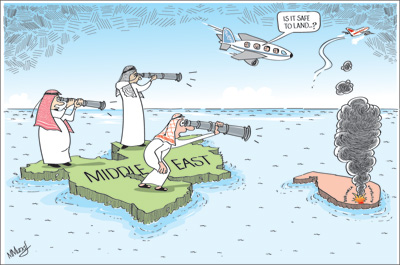

Remittances into the country have been the saving grace of the country’s external finances. About 60 to70 per cent of the large trade deficit recorded in recent years has been offset by remittances. In 2013, remittances of US$ 6.4 billion offset about 80 per cent of the trade deficit of US$ 7.6 billion. Remittances have been growing at 11 per cent and are likely to be over US$ 7 billion this year. Consequently, the trade deficit is likely to be more or less offset by remittances. However, recent communal tensions have created uncertainty about future remittances since the majority of our workers are in the Middle East and there could be a lower intake of new workers to that part of the world.

Balance of payments

These developments together with other service receipts, foreign direct investments and portfolio investments were expected to generate a significant balance of payments surplus of about US$ 3 billion. Such a surplus would enable the country to use the surplus funds for repayment of some loans and refrain from further borrowing. Such an improvement in the external debt position is possible this year. Whether it would happen depends on whether the projections used would materialise and whether law and order situation is restored immediately to mitigate the risk factors.

Prospects at risk

At the end of May, foreign tourist arrivals had increased by 26.5 per cent to 624,178, giving expectation of a record 1.4 million tourists in 2014. Now such an increase is unrealistic to expect. Tourism is the first casualty with travel bans to Sri Lanka already imposed from Middle Eastern countries that constitute about one fourth of tourists, exceeding those from European countries. The 20 per cent growth in tourists from the Middle East in the first five months of this year has already been affected adversely during the peak period of their travel with large numbers of cancellations and few new bookings by Middle Eastern tourists. If the situation is not brought under control and there is further threat of communal violence, then Muslim countries may impose economic sanctions as well.

The threat to tourism is not confined to those from the Middle East. Tourists from Britain and the West also could curtail their visits to Sri Lanka because they read the current situation as unstable. Adverse travel advisories from these important destinations are not unlikely.

There are other serious economic threats too. The Middle East accounts for 11 per cent of total exports and for over one half of remittances. Tea exports in particular would be affected as a high proportion of the country’s tea exports are to Middle Eastern countries. What if Middle Eastern countries also impose an oil embargo?

Concluding reflections

Good years and bad are inevitable economic fluctuations. Proper economic management would use the gains in foreign earnings of the good years to strengthen the external finances and develop resilience to withstand the lean years rather than face crises during difficult years.

This year could have provided an opportunity to strengthen the external finances of the country by using the expected balance of payments surplus to reduce debt, but the insecure conditions in the country are thinning such hopes. Already the violent events of past weeks have been a setback to tourism.

Firm measures are vital to ensure peaceful conditions and social harmony that are essential for the continuation of the improving trend in external finances and to ensure that the economy does not suffer a setback, as it did after July 1983.