Reducing corruption way out of the budget deficit trap

Reducing widespread corruption in Sri Lanka is the biggest step towards cutting the budget deficit, an island-wide opinion poll by Colombo-based Research and Consultancy Bureau (RCB) has revealed.

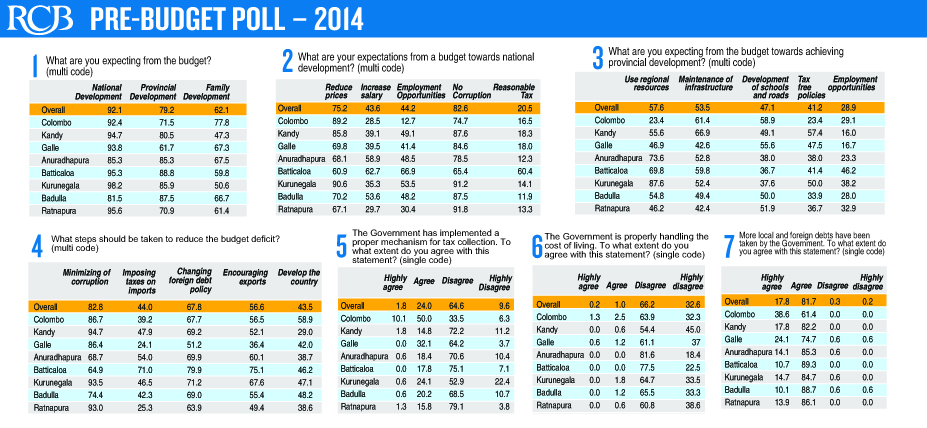

The pre-budget poll with the joint collaboration of the Business Times (BT) found that most of the 1,317 respondents spread across eight districts in Sri Lanka gave an 82.8 per cent vote towards ‘minimizing corruption’ as a step towards cutting the budget deficit.

Interestingly ‘changing the foreign debt policy’ secured a 67.8 vote from the respondents who picked more than one choice among five choices offered under the question “what steps should be taken to reduce the budget deficit”.

The RCB street poll was conducted in the districts of Colombo, Kandy, Galle, Anuradhapura, Batticaloa, Kurunegala, Badulla and Ratnapura over a 2-week period and was based on budget expectations by Sri Lankans.

The RCB street poll was conducted in the districts of Colombo, Kandy, Galle, Anuradhapura, Batticaloa, Kurunegala, Badulla and Ratnapura over a 2-week period and was based on budget expectations by Sri Lankans.

The poll had eight questions with a choice of answers ranging from three to five, all based on the budget and its links to national, provincial and family development. Respondents often provided more than one choice per question.

Some 92 per cent of the respondents agreed that the budget focus should be on national development and 82.6 per cent said they hoped for ‘no corruption’ from a national development-focused budget.

To the question “what are you expecting from the budget towards achieving a family’s development’, 90.9 per cent opted for ‘reducing the cost of living’ while ‘increasing salaries’ secured a 90.8 per cent vote as respondents provided more than one choice.

Asked to comment on the view that the government had implemented a proper tax collection mechanism, 64.6 per cent ‘disagreed’ in the overall tally across the eight districts of which Colombo gave a 50 per cent vote to the ‘agree’ choice and 33.5 per cent to the ‘disagree’ category.

To the question “the government is properly handling the cost of living”, 66.2 per cent of the respondents ‘disagreed’ with this view.

Some 81.7 per cent ‘agreed’ that the government has a lot of local and foreign debt.

Cut spending by privatising loss-making state agencies, BT poll respondents say

The government must cut spending on loss-making state institutions and instead privatise these agencies, respondents in a BT email poll this week on the forthcoming budget, are urging the authorities. These include Ceylon Electricity Board, Ceylon Petroleum Corporation, Railways, Ceylon Transport Board, Mihin Air and SriLankan Airlines and others. “Privatising these along with pension reforms beginning with a contributory pension for government employees (at least the new recruits as was done in 2003 but later reversed to fulfill an election promise), control of wasteful expenditure and stopping commission taking on large tenders and procurements, award of tenders and employment on a merit basis and early retirement scheme to reduce surplus

employees could reduce public expenditure

substantially over a short period. These steps have not been taken,” said one respondent, in comments that were also echoed by others in the pre-budget poll.

Here are excerpts of the comments received:

On overspending:

- This is clearly seen. University students are being made into tax spenders (Rs. 50,000 this financial year) bloating the state workers at the expense of society. Subsidies are given to producers in the form of fertilizer and electricity when cancer and other desperately ill patients are sleeping on corridors in the general hospital.

- State enterprises losses financed with taxes is obscene.

- SriLankan Airlines receiving Rs. 13 billion a year ($100 million) is an utter waste of money that is nothing short of incredible. There have been complains that the cost of roads per km is one of the highest in the world. Similar charges are being made about rail tracks, both constructed by the Indian and the Chinese.

On rising cost of living:

- The Central Bank (CB) is generating lower levels of inflation than before. But monetary policy could be improved. Next year’s single digit inflation target is a step in the right direction. But if there is more state spending and the CB is forced to print money, inflation will go up and the rupee will depreciate, pushing up the cost of living.

- Also high taxes generally keep prices up. The self sufficiency obsession of economic nationalists and rulers is a key reason for high prices for the poor, particularly in food. Sri Lanka has one of the highest food prices in the world due to protectionism and an inefficient farming sector. Probably the most inefficient rice, potato, and onion farmers in the world, certainly South Asia.

- Building material producers are also getting protection and fleecing those who seek shelter. Shoemakers are the same. To force these monopolists to be efficient and lower cost of living for the poor, import duties have to be reduced.

- The increase in cost of living is attributable to the economy having more money (currency and credit) in circulation than goods and services it produces compared to the previous year. The budget deficit (and printing money to fund it) is the primary cause for demand side inflation. Depreciation of the rupee contributes to supply side inflation.

On calls for a wage hike:

- Workers seem happy with the government policies and this is amply reflected at recent elections where they have overwhelmingly given the government a mandate; based on this giving a wage hike is not necessary.

- A wage hike may be imperative for state workers since life is difficult for everyone but the poor will bear the burden of the salary increases given to state workers (benefitting also politicians) through higher taxes, or borrowing or printing money (inflation). A wage hike for rulers and their (public) servants has to be affordable to productive citizens. If inflation is kept down and the exchange rate stable it is possible for tax spending state workers to live comfortably with a smaller salary hike. The answer is to stop recruiting unemployable graduates – employ them in productive areas – reduce the state workforce and raise their salaries. This will also help keep inflation and interest rates down, making housing loans cheaper. But for that the state workforce has to be reduced or allowed to shrink with retirements.

- That way everyone will benefit. It is a shame that when masons, carpenters, construction workers, bread deliverers, fish mongers and street sweepers are doing gainful work in productive sectors (without even A/Ls in some cases), university graduates who have learned at the expense of tax payers are becoming tax spenders for life.

- Wage increases would erode the competitiveness of goods and services produced and fuel inflation. One way to break the vicious cycle of inflation, wage increases, more money in circulation, depreciation of the currency and supply side inflation, more and more demands for wage increases is to compete in the global market place, improve productivity, produce more goods and services and overtake the growth of money supply. In short the government and the people have to tighten their belts and reverse the trend. This should be done gradually to avoid a contraction of the economy due to a drop in demand and to avoid a loss of jobs.