Taxation of betting and gaming business in Sri Lanka

In recent times, with the revival of tourist industry, the debate of promoting betting and gaming activities has surfaced at various levels.

The following activities fall within this -

(a) Off-course betting – ie. bets on races in other countries.

(b) Casinos

(C) Other types of miscellaneous betting and gaming activities.

Betting

The relevant legislation is “Betting on Horse Racing Ordinance, No. 9 of 1930″ as amended in 1943.

According to Section 9, a valid bet on which any tax can be charged is only on “on-course bets”. No tax can be charged under that Ordinance on off-course betting as now taking place in Sri Lanka.

The Attorney General has ruled that although the “Provincial Councils” can collect betting taxes, they are not empowered to impose such a tax under the 13th Amendment to the Constitution. However, the “Betting and Gaming Levy Act No. 40 of 1988″ has been enacted to provide for the imposition of an annual levy on persons carrying on the business of bookmaker or gaming. The Commissioner General of Inland Revenue (CGIR) is the relevant authority which administers this Act.

Except for a few prominent bookmakers, the others did not comply with the provisions of this Act and the CGIR was also not in a position to identify the relevant persons.

After a number of amendments, the latest amendment has been enacted on 02.04.2013, as “Betting and Gaming Levy (Amendment) Act, No. 19 of 2013″.

There are a few important changes effected by this amendment.

(i) Imposition of an additional levy of 5 per cent of gross collection.

(ii) Exemption from VAT and NBT, if this additional levy is payable.

(iii) If the gross collection does not exceed Rs. 1 million per month, the additional levy is not payable.

(Liable persons are required to furnish monthly returns to the CGIR and pay this additional levy monthly)

(iv) Registration of betting and gaming businesses with the CGIR.

If not registered. a maximum penalty of Rs. 10 million and/or imprisonment for a term not exceeding six months, can be imposed by a Magistrate.

The normal levy payable on betting which was Rs. 100,000 from 1988 to 2001 was substantially increased thereafter and w.e.f. 01.04.2013 the normal levy payable will be as follows -

Betting business carried out -

(i) through Agents – Rs. 2 million

(ii) using live telecast – Rs. 200,000

(iii) without using live telecast – Rs. 25,000

If the CGIR can register at least 90 per cent of bookmakers in Sri Lanka and follow up the compliance continuously, the revenue from betting activities under the normal levy can be increased substantially.

However, the ascertainment of “gross collection” for the purposes of the new additional levy of 5 per cent may be a “Herculean task”, without any fool-proof system of ascertaining such gross collection, accurately.

Gaming (Casinos)

Under the “Gaming Ordinance (1890)” unlawful gaming is a punishable offence. However, gaming which takes place in any rest house under a Local Authority or any proprietary club or in a duly licensed hotel, is not covered by the Ordinance. However, any “promiscuous gaming” is punishable. Although this term has not been defined in the Ordinance, it normally means the gaming activities open to the public. Therefore, many institutions introduce the requirement of membership, to avoid this situation.

In 1987 a Committee was appointed to look into the various aspects in relation to Betting, and in 1990 another Committee was appointed on gaming. On the basis of recommendations, new legislation was drafted to provide for the licensing of casinos and the imposition of licence fee. However, nothing has happened so far on such legislation.

In the meantime, a Bill (Bill No. 183) titled “Gaming (Special Provisions)” was gazetted on 19.06.2006 by the, then Prime Minister, “to provide for the designation of areas in which persons intending to start the business of Gaming can setup their establishments and to provide for matters connected therewith or incidental there to”.

On 07.12.2010, an Act titled “Casino Business (Regulation) Act, No. 17 of 2010″, had been enacted. The object clause has stated that, “An Act to provide for the designation of areas in which persons engaging in the business of casinos can set up their establishments and to provide for matters connected therewith or incidental there to.”

This is very similar to the object of the above mentioned Bill No. 183 gazetted on 19.06.2006.

Under Section 2 of this Act, no person shall engage in the business of a casino from and after January 01, 2012, without a valid licence issued in that respect by the Minister, and within a specific area to be designated by the Minister by Order published in the Gazette.

It is not clear whether the relevant regulations required to be made under Sections 3 and 4 of the Act have been published. How can the Minister issue any license without relevant Regulations in place?

How can the existing Casinos operate on or after 01.01.2012, if the relevant licenses have not been issued?

It is very important to make comprehensive regulations taking into consideration all concerns including economic and social aspects before the proposed expansion of gaming activities in Sri Lanka.

The imposition of an annual levy under the Betting and Gaming Levy Act No. 40 of 1988, on gaming activities was also a failure.

New conditions, as explained earlier, imposed by the Amendment Act No. 19 of 2013, are applicable to gaming activities as well.

At the moment such gaming establishments are conducted by very prominent persons in Sri Lanka and the CGIR should not have any difficulties in identifying and registering them, under the Act.

The normal levy payable on gaming activities which was Rs. 1 million from 1988 to 2001 was also substantially increased thereafter and w.e.f. 01.04.2013 the normal gaming levy payable will be as follows – For carrying on the business of gaming including playing casino – Rs. 100 million.

If the CGIR can register all persons carrying on the business of gaming who are liable to pay the above levy, a considerable amount of revenue can be collected, at the above rate.

The problems discussed earlier on the new additional levy @ 5 per cent on gross collection applicable from 01.04.2013, may be a nightmare for the CGIR, in relation to gaming businesses unless a proper system of estimating such gross collection is established by the authorities, in relation to gaming activities.

In recent media statements, the CGIR has stated that the IRD officials are visiting casinos regularly! I am afraid that those traditional visits may not be helpful in ascertaining the turnover of modern gaming activities!

Normally, profits and income of operators of betting and gambling activities are liable to income tax, at normal rates. Whether, the CGIR is satisfied with such declarations of income is a matter to be considered, in the light of enormous amounts invested by them in company shares, finance companies and in shipping businesses etc. They may be having deposits in Swiss banks or in other tax havens as well, in addition to the fabulous donations supposed to have been given to top politicians!

In relation to the winners from betting and gambling (from winnings over Rs. 500,000) a withholding tax (WHT) is deductible @ 10 per cent of such gross payment of winning whether paid in cash or kind. It can be presumed that the CGIR is not getting this revenue correctly at present.

Many people, specially those who promote gaming businesses used to refer to various, licences, they have obtained. The only licence they may be having is the liquor licence issued by the Commissioner General of Excise! The registration with the CGIR cannot be considered as a license given to operate a casino or the activity of a bookmaker! It is not clear how a license can be issued under the new Act as mentioned earlier without the relevant regulations.

World trends

“Casino” is a facility which houses and accommodates certain types of gambling activities. The industry that deals in casinos is called the gaming industry. Casinos are most commonly built near or combined with hotels, restaurants, retail shopping, cruise ships or other tourist attractions. Some casinos are also known for hosting live entertainment events such as stand-up comedy, concerts and sporting events.

Most jurisdictions worldwide limit gambling to persons over 16 to 21 years of age. Most games played have mathematically determined odds that ensure the “house” has at all times an overall advantage over the players. This advantage is called the “house edge”. In games such as poker where players play against each other, the “house” takes a commission called the “rake”. As a result the gaming operator cannot make a loss!

In modern times Video Lottery Machines (Slot machines) have become one of the most popular form of gambling in casinos.

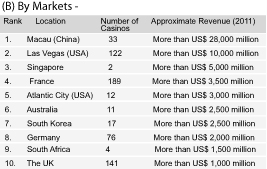

In many cases having a large number of casinos in a location has not produced big revenue. For example, the UK having 141 casinos is ranked 10th in revenue wise where as Singapore having only two casinos ranked 3rd. This may be a lesson for Sri Lanka as well, if it is serious about gaming activities.

In 2011, the biggest casino operators worldwide collected revenue nearly $55 billion as per the published statistics. SJM Holdings is the leader with $9.7 billion, followed by Las Vegas Sand Corp. with $7.4 billion and third, Ceasars Entertainment with $6.2 billion.

Other countries, including Sri Lanka, can learn a few lessons from the USA, on how to regulate the casino industry for the benefits of all concerned. There are about 900 casinos in the USA which is increasing each year. In the USA, the casino industry is not a federal subject but a matter for the states. Therefore, not so rich states without other potential sources of income go for the casino industry. Out of 50 states, in 38 states, the casino industry has been established at various levels.

Historically the main concern was security. Given the large amounts of currency handled within a casino, both patrons and staff may be tempted to cheat and steal in collusion or independently. Most casinos have security measures to prevent this. Security cameras located throughout the casino are the most basic measure. There were physical security forces and specialized surveillance force which operates closed circuit television which is called “eye in the sky”!

It is not only the countries with a sort of capitalist system that operate casinos. Most of the socialist countries also operate casinos. The Russian Federation has 169 casinos. Many other East European countries operate casinos. However, in China gambling has not been legalized, except in Macau. As a result Chinese gamblers have become main clients of Korean casinos! Close to Sri Lanka, in India only Goa has six casinos, including a very popular cruise based casino. Nepal has commenced casinos in 1968 and now has six casinos. Taiwan, North and South Korea, Mongolia and Vietnam are also having casinos. Japanese gambling business generates approximately $10 billion per year mostly contributed by the Japanese themselves.

Concerns

The purported economic benefits from casino gambling include tax revenues, increased employment, higher wages and payments to capital invested. However, in some countries all these benefits have been realized only during the initial few years. Therefore, hopes to achieve $4000 per capita target by commencing foreign casinos in Sri Lanka, may not be a reality.

As per the results of a study done in USA, about 1 per cent of the general population is believed to be “pathological gamblers”. These individuals are believed to cause an enormous amount of “social costs”.

Global AML (Anti Money Laundering)/CFT (Countering the Financing of Terrorism) net work – This system designed to identify illicit financing in the international financial system, coordinated by the US Treasury, has already enforced a reporting system on large transactions at casinos. I hope the relevant authorities will consider this aspect as well, if casino gaming operations are to be expanded in Sri Lanka.

Conclusion

The prohibition of so-called evil activities may not be the answer. Consider the case of “on-course betting” when horse racing was alive in Sri Lanka. It provided a lot of entertainment to various levels of people. But when horse racing was made inactive due to the prohibition of the publication of racing news, people did not give up betting altogether. They started “off course betting” which is illegal.

But now it is a thriving business in Sri Lanka. Let the casinos be expanded to a certain extent, with necessary regulations. Otherwise, the huge investments to be made may be in danger. At the same time the authorities should answer the social concerns properly without just lamenting that the casinos are the least evil!

( The writer is a senior tax and

investment consultant in

Sri Lanka).

Follow @timesonlinelk

comments powered by Disqus