Columns

The content and quality of economic growth

View(s):The Central Bank Annual Report for 2012 describes last year’s economic performance as a healthy growth. The Central Bank Governor said: “The stage is set for a high growth trajectory over the next few years. That is why Sri Lanka is targeting an ambitious medium-term macroeconomic framework.” Does the economic performance of last year substantiate these assertions?

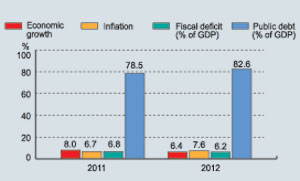

Last year’s economic growth of 6.2 per cent could be described as a reasonable growth performance owing to the inhospitable conditions in which it was achieved. However, what requires to be analysed is not the magnitude of the growth statistic that was discussed in this column of March 31, but the content, substance and quality of growth and the resultant economic developments.

Do the achievements of growth hide inherent economic weaknesses? Will the economic performance of last year enable sustained economic growth or does it have attributes that could destabilise the economy? Is it a platform for a higher trajectory of economic growth? After examining the growth statistics of last year we turn to address these vital fundamental economic issues.

Sector performances

All three sectors — agriculture, industry and services — grew though at a lower rate than in the previous two years when GDP growth was 8.3 and 8 percent. This decline in growth was due largely to weak external demand, tight monetary conditions to correct the trade imbalance, and bad weather that affected agriculture and hydropower generation. In the context of the external and internal shocks faced by the economy, the growth performances of all three sectors are surprisingly good and unexpected.

Agriculture, often described as the backbone of the economy, contributes only about 11 to 12 percent to GDP. Agricultural production was severely affected by drought followed by floods. Growth in food crop agriculture appears to have been unaffected by the bad weather that was flaunted about as a setback to the economy. Despite lower production of tea and rubber and a stagnant paddy production, agricultural output grew by 5.8 percent in 2012. Agricultural growth was sustained by significant growth in fisheries and livestock.

Although manufactured exports fell by 7.8 percent, the industrial sector that accounts for about 30 percent of GDP grew by 10.3 percent. Growth in manufacturing, mining and quarrying, electricity, gas, and water was modest. Construction that grew two-fold contributed to this high industrial growth. The large investments in infrastructure by the Government and the construction of hotels no doubt contributed significantly to this doubling of construction growth.

The services sector, which is the largest component of GDP contributing nearly 60 percent to GDP, grew at 4.2 percent: the lowest rate in recent years and much below 8.6 percent achieved in 2011. There were slowdowns in key subsectors such as wholesale and retail trade. Growth in services was achieved mostly by increases in communications and tourism. Tourist arrivals reached over a million and contributed a billion US dollars.

External trade

One of the key weaknesses of last year’s economic performance was the shrinking of both manufactured and agricultural exports. Exports declined by 7.4 percent from the previous year owing to weak global demand and lower prices. Earnings from garments, thelargest export, fell by 2.3 percent mainly due to slack economic conditions in the US and European Union countries and the withdrawal in 2010 of the GSP Plus facility by the EU. Agricultural exports, including tea, contracted by 7.8 percent due to a shortfall in tea production owing to drought and disruption of markets in the Middle East.

Despite the fall in export earnings, the trade deficit narrowed marginally by 4 percent from US$ 9.7 billion in 2011 to US$ 9.3 billion due to a decrease in imports. In spite of the large trade deficit, the balance of payments recorded a small surplus of US$ 151 million owing to higher workers’ remittances, tourist earnings, other services incomes and net capital inflows.

Imports decreased last year owing to the currency depreciation, higher tariffs, and restrict credit. A wide range of imports decreased. The exceptions were fuel, machinery, and building materials. While imports of consumer goods contracted by 18 percent, intermediate goods imports decreased by 6 percent. In contrast, imports of investment goods increased by 5 percent.

Pertinent issues

In discussing the economic growth performance, it is reasonable to be guided by two observations that Governor Ajith Nivard Cabraal made recently in a television interview. He mentioned that there was not much point in debating whether the economic growth was a notch higher or lower. It was the thrust and direction of growth that mattered.

This is particularly relevant in the context of the country’s state of economic statistics and the difficulties of estimating growth in many areas of economic activity. Therefore it is more relevant to use the growth statistic as an ordinal measure than a precise figure. Whatis relevant is the overall thrust of economic performance and the qualitative assessment of growth of sectors and subsectors of the economy.

The second pertinent observation the Governor made was that the GDP growth was not an achievement or otherwise of the Government, the Central Bank or any other agency. It is the performance of all nationals, corporate bodies, private firms and Government enterprises. If one views the GDP growth in this perspective, a more objective assessment and evaluation of the economy’s performance is possible.

Role of government

This does not mean that the Government’s role is unimportant to the final outcome of the economy’s performance. Far from it: Government policies have an important bearing on economic performance. They determine the incentives and inducements to invest, the quantum of investment, the types of economic activities private individuals and private enterprises undertake and their productivity.

For better or worse, government expenditure has an important bearing on the level and momentum of economic activity, especially of an economy such as ours. Yet much of the actual performance is dependent on individual decisions and actions of individuals and business enterprises.

Composition of growth

More significant than quibbling with the growth figures is the quality of the growth achieved. Is the 6.4 growth in fact a healthy growth? What are the sources of growth? What has the growth momentum led to? These are valid questions to ask and ponder over.

The rate of growth of 6.4 percent is quite acceptable but where has it led to? Do the figures imply that the economic growth is substantial? The earlier analysis of the composition of growth would answer these questions to some extent. The economic growth of 8.3, 8.0 and 6.4 per cent in the past three years led to massive trade deficits. The public debt has increased and the foreign debt component has reached new heights. High economic growth is leading to serious fundamental economic problems of lower revenue collection, large fiscal deficits, huge trade deficits and increase in domestic and foreign debt.

In contrast, the recent high economic growth in China and India resulted in these countries amassing high balance of trade surpluses that enabled them to invest in foreign countries. Their foreign reserves are high and they are net lenders to the rest of the world.

Rethink economic strategy?

When one considers these facts and figures, it is difficult to describe the growth achieved as healthy, even though the growth figure is quite respectable. There is a need to take cognisance of these unfavourable features as they could jeopardise the stability of the economy and long term growth. Is there a need to charter a different economic strategy to avoid the problems that have emerged, ensure economic stability and enable sustained economic growth?

Follow @timesonlinelk

comments powered by Disqus