News

Supermarkets and suppliers already smarting under 2013 taxes

View(s):By Bandula Sirimanne and Chamal Weerakkody

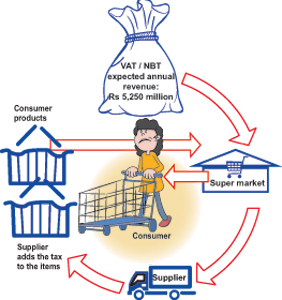

Supermarkets are already feeling the impact of the 12 per cent value added tax (VAT) that came into effect on January 1. The Budget for 2013 has slapped both VAT and the Nation Building Tax (NBT) on trading businesses with a quarterly turnover of Rs. 500 million and over.

Of particular concern to traders is that stocks that remained unsold up to midnight December 31, 2012 are also taxable under the new terms. Supermarket owners have asked for time to dispose of stocks that remained at year end.

The Inland Revenue Department issued a circular last week explaining how the VAT and the NBT will be payable by wholesale and retail businesses. Some supermarkets are insisting that suppliers take back unsold stocks.

“Returning already invoiced stocks to suppliers is highly irregular, but we have no choice,” said one supplier. “The supermarkets threaten not to buy our products if we don’t comply.”

Up to last Thursday, suppliers had not been given a list of “VAT-able” items. Suppliers say they cannot sell goods to supermarkets until they get the list.

The owner of a small-to-medium enterprise said his main sales are through supermarkets. “We may have to close shop as small-time competitors will definitely undercut our prices,” the businessman said.

Importers of consumer commodities say they have to bear the burden of the VAT, the Nation Building Tax (NBT), Customs taxation, exchange rate variations, and import and transport costs.

Follow @timesonlinelk

comments powered by Disqus