Columns

Paradox of high reserves and continued foreign borrowing

View(s):The state of external finances of the country could be confusing. We are repeatedly told by the Central Bank, the custodian of our reserves, that the foreign reserves position is healthy. On the other hand, we are made to understand that the government is seeking a credit facility of US$ 500 million from the IMF, and if that does not work out, then there would be another sovereign bond issue of US$ 500 million.

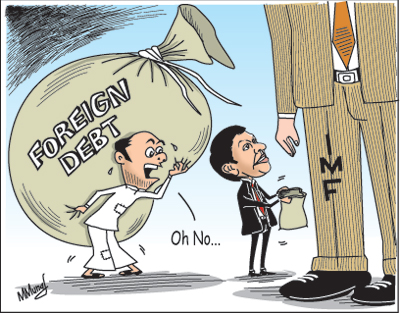

Why we need to borrow when our foreign reserves are high is certainly a puzzle.We have been told that the IMF is here for mere discussions and not for the purpose of approving a new credit facility. The IMF team from Washington, the Central Bank says is a routine one to review the performance of the devaluation of the rupee early this year. However, there is speculation that the Central Bank will ask the IMF to grant further credit, though such a decision is not likely to be taken by this mission immediately.

High foreign reserves

The September Press release of the Central Bank on the external finances boasted of the high foreign exchange reserves. It spoke about the large inflows of capital that were offsetting the large trade deficit and assured the country that the external reserves were very healthy. The Central Bank maintained that: “Gross official reserves amounted to US dollars 7,099 million by end July 2012, while total international reserves, which include gross official reserves and foreign assets of commercial banks amounted to US dollars 8,744 million.”

Sri Lanka’s foreign reserves are rising, helped also by a lower import bill, according to the Central Bank.

It supported its assessment of the healthy foreign reserve position as being due to several favourable factors. “Foreign currency inflows to the financial market continued to strengthen the capital and financial account of the BOP during the first seven months of 2012.

Foreign investments at the Colombo Stock Exchange increased by US$ 227 million, on a net basis, by end August 2012, while there has been a significant increase in foreign investments in Government securities, with net inflows to Treasury bills and Treasury bonds during the first eight months of 2012 amounting to US$ 810 million. Further, long-term inflows to the Government amounted to US$ 2,169 million during the first seven months of 2012. In addition, long-term borrowings by commercial banks during January-August 2012 amounted to US$ 927.5 million. Meanwhile, Foreign Direct Investment (FDI) inflows, including foreign loans to BOI companies, of which data becomes available only quarterly, recorded an inflow of US$ 452 million during the first six months of 2012 and more inflows are expected to materialise during the year.”

IMF mission

Given this robust reserve position, the Central Bank Governor said the discussions with the IMF team were routine one to discuss issues regarding the country’s economic situation, perhaps to give some advice, but certainly not for borrowing. According to Central Bank Governor Nivard Cabraal and Bank officials, the IMF team from Washington is in Sri Lanka on a routine economic review mission to study the impact of the policy changes made in February and March when the rupee was devalued against the US dollar. They maintained that there were no discussions on any additional loan facility.

With external reserves being as claimed by the Central Bank to be as healthy, surely there is no need to ask for more. The Central Bank is no Oliver Twist. Nevertheless there was a twist in the tale and there was information that the government was seeking a fresh extended credit facility of US$ 500 million.

If this was not forthcoming, a new sovereign bond issue of the same amount would be issued. So whatever way we were getting the funds, we were increasing our debt to strengthen foreign reserves that are already high!

Foreign debt

The composition of the public debt has changed considerably with foreign debt increasing by much more than domestic debt. Of the total debt, foreign debt is nearing Rs. 3 trillion mark (Rs. 2,975 billion) up by 27 per cent or Rs. 646 billion from end of last year.

Within the overall public debt, the share of foreign debt has increased to 48.3 per cent by end July in comparison to 44.6 per cent a year ago. Domestic debt had increased by only 13.5 per cent or Rs. 381 billion to Rs. 2.8 trillion in the first seven months of this year.

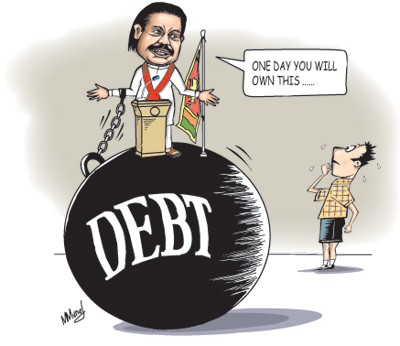

Sri Lanka’s foreign debt is rising sharply. At the end of last year (2011) the foreign debt had increased to Rs.2.3 billion. In the last seven months it has increased by 28 per cent to nearly Rs. 3 trillion (Rs. 2,975 billion). Part of this increase is due to the devaluation of the Rupee. The rest is due to increased borrowing. The foreign debt as a proportion of total debt has increased to 48.3 percent by end July in comparison to 44.6 percent a year ago. In comparison, domestic debt increased by only 13.5 per cent to Rs. 2.8 trillion in the first seven months of this year. The total public debt increased 20 per cent in the first seven months of this year. In spite of this huge increase in foreign debt and the claim that the reserves are high, the government is likely to continue borrowing.

Reflection

As it often happens, the Central Bank statement that it does not want an IMF facility is likely to change as the county needs more foreign resources to meet its debt repayment and interest payments and to meet the large trade deficit. It is better for the government to borrow from the IMF as its interest rate and repayment period would be of advantage. Commercial borrowing is at a large premium owing to the deteriorating credit rating.

The plain truth is that although the official reserves are high, the impending liabilities are such that they are inadequate to meet contingent liabilities. We need to borrow to repay loans, meet interest costs and cope with the massive trade deficit. The foreign debt is high and rising.

Follow @timesonlinelk

comments powered by Disqus