Columns

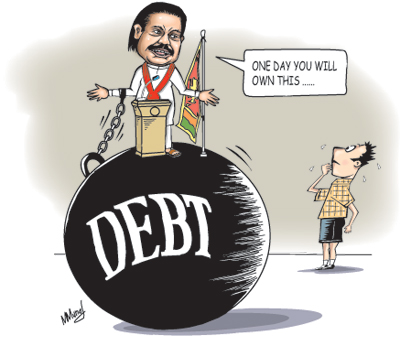

Euphoria of borrowing insensitive to debt burden

For several decades since independence there was euphoria about the country receiving more and more foreign aid. The hankering for aid was perhaps an understandable post-colonial syndrome. It was an important means of bridging the savings-investment gap, improving infrastructure, institutional and capacity building and supporting economic and social development. Today foreign aid plays an insignificant role in the country’s economy.

Now, 64 years since independence, we are rejoicing in being able to borrow more and more. We are a nation that is grateful to our lenders and proud of being able to borrow. We are insensitive to the burden of debt. Foreign borrowing has become essential to meet balance of payments deficits, maintain economic stability and invest in economic infrastructure. Foreign borrowing has escalated in the last several years and reached a peak.

Recent euphoria

The latest exuberance was seen with the Central Bank being able to borrow US 1 billion in the international capital market. Soon on the heels of this “achievement”, we boasted of having obtained the fifth and final tranche of about US$ 415 million of the Stand-by Arrangement (SBA) with the International Monetary Fund (IMF). Both these are considered not only achievements but an indication that the economy is doing well and that the international community is having confidence in the Sri Lankan economy. Nothing can be further from the truth.

IMF praises economic management

When the IMF disbursed the final tranche of US$ 415 million of the SBA to Sri Lanka on July 20, it said that Sri Lanka had built up international reserves to a comfortable level equivalent to 3.5 months of imports, while containing the budget deficit and maintaining inflation at single digit levels and the stability of the financial system. Furthermore, the IMF thought that Sri Lanka’s current monetary policy stance was appropriate, and stressed that “monetary conditions should remain firm in the near term given high headline inflation and possible second-round effects.”

At the beginning of this year the government implemented several policies to arrest the ballooning trade deficit which had risen to US$ 10 billion in 2011 and was threatening to exceed that in 2012. The Central Bank adopted a flexible exchange rate policy and allowed the currency to depreciate. The government raised import taxes on a number of basic food items and on vehicles. It also raised fuel prices and increased electricity tariffs to save expenditure on oil imports that were over 25 percent of import expenditure. The Central Bank increased policy interest rates to limit credit growth that was considered responsible for the huge surge in imports. These measures the IMF considers as being adequate to reduce imports and reduce the trade deficit to manageable proportions.

The release of the IMF tranche came with a certificate of good conduct. According to the Central Bank and the IMF, Sri Lanka has successfully achieved all the key objectives under the SBA facility from the IMF of rebuilding the external reserves, strengthening the fiscal position, maintaining monetary stability and fortifying the domestic financial system.

The IMF statement said: “Following robust growth in the first quarter of 2012, activity has started moderating in response to policy tightening and weakening global demand. Headline inflation has increased, but core inflation remains relatively stable, while tighter monetary and credit policies have begun slowing credit and import growth. The external current account deficit is narrowing, and international reserves have stabilized.

“The current monetary policy stance is appropriate, and monetary conditions should remain firm in the near term given high headline inflation and possible second-round effects. With a flexible exchange rate regime, monetary policy can increasingly focus on inflation control to achieve broader macroeconomic stability while allowing the exchange rate to act as a buffer for external shocks. Foreign exchange market intervention should thus be limited to smoothing excessive volatility, and steps should be taken to gradually deepen the foreign exchange market.”

Word of caution

However, the IMF did add a word of caution. “The slowdown in economic activity and declining imports are adversely affecting fiscal revenues, while interest payments on government debt are higher than budgeted. The authorities are committed to meeting their 2012 deficit target by restraining expenditure, but a redoubling of effort to strengthen revenue administration is needed. Furthermore, continued structural reforms are required to put state-owned energy enterprises on a sound financial footing.”

Fiscal deficit

We have pointed out in previous columns that attaining the fiscal deficit target of 6.2 of GDP is a tough task, given the slowing down of the economy and the experience in the first four months of this year when there was a revenue shortfall while expenditure ballooned. Public enterprises too are likely to incur higher losses. These developments were perhaps ignored by the IMF as “The authorities are committed to meeting their 2012 deficit target by restraining expenditure”. Neither a restructuring of expenditure nor reforms of public enterprises are likely to take place during this current year.

Advantages in IMF loans

There were several advantages of the IMF stand-by arrangement, quite apart from the replenishment of the external reserves. The intervention of the IMF breathed a degree of international confidence and enabled the government to borrow from international capital markets earlier this year and built reserves. It made the government take appropriate fiscal and monetary measures to contain the deteriorating balance of payments. The flexible exchange rate policies corrected the trade deficit to some extent. In the absence of these policies the country’s reserves would have been eroded to unsustainable low levels.

Borrowing from the IMF has the distinct advantage of low interest rates and repayment over a long period. In contrast, the government has borrowed US 1 billion at a high interest rate of about 3.75 percent or 373 basis points above LIBOR.

Foreign debt

The focus is on obtaining funds from international markets and the IMF and the reserves rising to adequate levels. The other side of the coin is forgotten. The reserves are not increasing due to higher earned inflows but by increasing the country’s debt and contingent liabilities. The country’s foreign debt has increased significantly in the last five years and reached a record level. By the end of 2011 foreign debt had more than doubled what it was in 2000 to reach US$ 24.5 billion. This year’s borrowings are likely to result in the foreign debt reaching around US$ 27 billion, though some of the recent borrowing will be used to redeem past debts.

External debt servicing costs

The large increase in the country’s foreign debt in recent years is increasing foreign debt servicing costs. The Ministry of Finance and Planning estimates debt service payments to be US$ 1,539.4 million in 2012. The sharp increases in debt servicing costs are due to increased borrowing in recent years; especially those since 2009. External debt servicing costs were 12.6 per cent of export earnings in 2011. The poor performance in exports and increasing trade deficit makes foreign debt servicing a strain on the balance of payments.

Wrapping up

There is no reason why we should be celebrating getting into further debt. It is imperative that the economy performs better to ensure much higher exports and reduced imports. The extent of borrowing, costs and terms of borrowing foreign funds and their uses have significant implications for macroeconomic fundamentals. Containing the foreign debt and decreasing debt servicing costs are vital for economic stabilisation and Sri Lanka’s economic development.

comments powered by Disqus