Columns

Economic summit bares the truth: Good governance key to economic development

The economy can grow at a rapid sustained level only by expanding the tradable sector, increasing exports and attracting non-debt creating foreign inflows. And for these to be achieved there should be increased domestic and foreign investment that in turn requires good governance, law and order.

This was the message loud and clear from the main speakers at the Ceylon Chamber of Commerce Economic Summit on July 12-14 in Colombo which bared the flaws that prevent rapid sustained growth in Sri Lanka.

The high trajectory of economic growth that has been the objective of the government since the ending of the war can only be achieved by ensuring a society based on law and order, good governance and predictability in economic policy. The guarantee of property rights and a proper regulatory framework that is implemented strictly without fear or favour are basic elements needed to ensure an incentive oriented investment climate for local and global investors.

These guiding principles are not novel but are home truths. Yet their articulation by eminent visiting economists at this juncture is pertinent, timely and opportune. Alas, as often happens these guidelines are likely to fall on deaf ears and the country will continue to languish, unable to resurrect the economy to attain a high trajectory of growth.

Expanding the tradable sector

In the Keynote Address delivered by Dr. Kalpana Kochar, the World Bank’s Chief Economist for South Asia, three fundamental flaws that prevent rapid sustained growth were bared. She said that it will not be possible to achieve an economic growth of eight percent over time unless these weaknesses were addressed immediately. She pointed out that economic dynamism could only be infused into an economy of Sri Lanka’s size by growing the tradable sector, increasing exports and attracting non-debt creating foreign inflows. It is very pertinent at this time to underscore that it is non-debt foreign inflows that are needed, rather than foreign debt to resolve balance of payments crises brought about by unsustainable trade deficits.

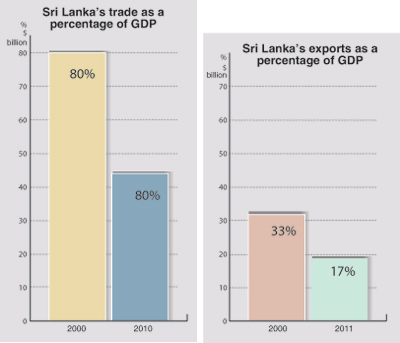

Plunging Export Performance

Dr. Kochar pointed out that the size of the Sri Lankan domestic market is such that export growth is essential for achieving a higher growth trajectory for the economy. Despite this, trade as a percentage of GDP, has declined from over 80 percent in 2000 to 44 percent in 2010. Total exports have declined from 33 percent of GDP in 2000 to 17 percent in 2011. Sri Lanka’s share of global exports has also declined. She pointed out that these facts taken together indicate that the Sri Lankan economy has been losing competitiveness. She attributed this, inter alia, to an overvalued exchange rate (before the introduction of a more flexible policy in Feb 2012) and movement toward a more closed economy through adjustments to the tariff structure.

Dr. Kochar revealed that while the structure of exports for Sri Lanka and Thailand was basically similar in 1980, today the depth and diversification of Thailand’s export sector is significantly greater. In addition, she said, Sri Lanka’s exports continue to be not linked to other similar higher capability products that would offer easy opportunities for greater value added diversification. While there has been some diversification of exports, the export structure continues to be dominated by a few products. This weakness has been a factor in the current decline of export earnings and reflects an inability to attract foreign investors for manufactures and services with high domestic value addition.

Inadequate FDI

Dr. Kochar pointed out that Sri Lanka requires investment of 35 percent of GDP to achieve 8 percent growth. National savings amount to only 25 percent of GDP. This implies that the savings/investment gap amounts to 10 percent of GDP that is currently equivalent to $6 billion. This amount needs to be raised through a mix of debt and non-debt creating inward flows.

She pointed out that as a lower-middle income country, Sri Lanka no longer has access to grants and concessional financing and the possibility of commercial borrowing is also being reduced. Hence, a major share of the financing of the gap of $6 billion needs to take the form of non-debt creating inflows, particularly FDI, which can also boost export performance.

Dr. Kochar said that it is noteworthy that Sri Lanka’s total stock of FDI amounts to only about $6 billion. Malaysia had an FDI stock of $73 billion in 2008 and attracted $8 billion in that year alone. Vietnam, which initiated market-oriented reforms much later than Sri Lanka, had a FDI stock of $43 billion and attracted an annual figure of $8 billion. This implies that Sri Lanka is a much less attractive location for FDI. Making the country attractive to foreign investors is the foremost challenge for rapid economic growth.

Non tradable sector

Kochar emphasised that a higher growth trajectory can only be achieved if a greater share of the resources is absorbed by higher productivity sectors, particularly exports. It is extremely difficult to sell in global markets if productivity is low. However in Sri Lanka a greater share of the country’s resources, both financial and human, has been absorbed by the public sector that is characterised by extremely low productivity. This was one of the reasons, she argued, for the dangerous external imbalances emerging last year. The state sector expansion is both overt and covert. The control of key financial services is a threat to private investment.

Governance

The weakness in the external finances that Kochar pointed out had its roots in Sri Lanka’s governance and economic policies. These were amply articulated at the conference by Gurcharan Das, Author, Columnist and Management Consultant, who said investment will be attractive if there was peace, the rule of law and good governance. Gurcharan Das said investors should feel that nobody is above the law and that good governance matters more than anything else.

“Without law and order or governance, you simply cannot attract foreign investment.” With free markets, Gurcharan Das observed that there should be good governance and reforms because with bad governance and no reforms, corruption tends to creep in. If governance is right, the private sector will take off in Sri Lanka.

Conclusion

Even the organized and articulate private sector has tended to be passive in its pronouncements on the economy and society. It has perhaps feared the repercussions of government interventions that would jeopardize their operations and profits. For this reason some firms have devised various methods through which they could play up to the government. What the private sector would have liked to have said was articulated by these visiting economists who addressed the Economic Summit.

The bottom line of discussions on the economy tend to gravitate towards the lack of good governance and a society based on the rule of law that assures safety of individuals, equality before the law, sanctity of property rights and predictability of government policies. These must be achieved as a foundation for sustained economic growth and development.

comments powered by Disqus