Business leaders especially exporters, once again this week, urged the Central Bank (CB) and the Government to devalue or adjust the exchange rate by depreciating the rupee if exports are to stay competitive.

“Competitor countries like India and China have responded to these problems by devaluing their currencies,” said Dr Nihal Jinasena, head of Loadstar and the Jinasena Group, speaking at a seminar on the ‘Global Financial Crisis’, organised by the Association of Certified Professional Managers, on Monday.

Loadstar is one of the biggest producers of solid tyres in the world and also one of the exporters hardest hit by the global downturn.

A large 15% -20% devaluation of the Sri Lankan rupee is seen as essential at this point, he says. “It is now absolutely essential to have a 15% - 20% rupee devaluation for export industries to survive,” said Dr Jinasena.

However the Central Bank (CB) has already rejected such calls made in a front page news item in The Sunday Times last week by economists and exporters for devaluation or an IMF package if the country was to head off a possible foreign exchange crisis.Without mentioning The Sunday Times, the CB Governor Ajith Nivard Cabraal in a TV interview the same night as the newspaper hit the stands, said – showing a copy of the newspaper without its mast-head -, that some economists have been quoted as saying that the current reserve position is similar to the one that prevailed during the times of the controlled economy in 1976. He said there was no basis for this view.

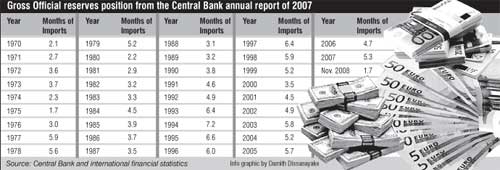

In a separate release issued by the CB, it said “there is no truth whatsoever in such a statement, as current levels of Gross Official Reserves are well above the levels that prevailed before 1977 and in fact, the reserves are even above the levels as at end 2004. Gross official reserves including Asian Clearing Union (ACU) balances stood at US$2560.5 million as at end 2008 compared to US$2195.8 million at end 2004.” The CB statement sent to all media, however, didn’t say how many months these reserves were worth.

The Sunday Times in its report quoted the CB’s data which said gross official reserves by end November 2008 were sufficient to finance around 1.7 months of imports.

However, a more comprehensive analysis of the CB’s 2007 annual report, shows that official reserves in 2004 were equivalent to 4.5 months worth of imports – much more than today. The CB data also shows that the position in 1975, under an import-controlled regime, was 1.7 months of imports and then rose to 3.0 months of imports in the following year (1976). (See table)

The Sunday Times report had quoted an economist as saying that the current reserves were similar to 1975-76, a point rejected by the CB in its statement but proved factually correct according to the CB’s own annual report. In fact the reserves had, as stated, risen in 1976 to 3 months of imports. (See same table)

The CB also denied any evidence that the Government of Japan will reduce or cut the committed funds for Sri Lanka, and that under the latest yen loan package announced in 2008, Japan has committed yen 35,000 million (US$388 million) for various infrastructure projects and programmes. Economist Muttukrishna Sarvananthan, who was quoted in The Sunday Times report on this point, wrote in to say he was retracting his statement due to an ‘error of judgement.’ (See full statement).

The CB statement said that the Bank acknowledges that in the face of the global financial crises, there has been a decline in Sri Lanka’s gross official reserves due to the sudden outflows of some foreign investments in Treasury Bills and Bonds, and the settlement of large amounts of petroleum bills during October and November, 2008.

However it said it has taken appropriate measures in the recently announced “Road Map: Monetary and Financial Sector Policies for 2009 and beyond.”

Among them are currency swaps with some central banks to boost gross official reserves; promoting investments in Treasury Bills and Bonds among the Sri Lankan diaspora (which was reported by The Sunday Times in the same article); a payment of a 20% bonus interest on NRFC and RFC deposits as a special incentive to encourage higher levels of inflows into NRFC and RFC accounts with effect from February 1, 2009.

The Central Bank said the claims made by certain persons that there would be a significant devaluation or that Sri Lanka will soon apply for an IMF bailout are erroneous and misleading.

The Sunday Times report didn’t not say that there will be a devaluation or an IMF bailout, but that Sri Lankan economists said that the economic situation was critical and therefore the alternatives were a devaluation, or a bailout, a position the CB Governor was quoted as saying did not arise.

Several exporters have urged and continue to urge devaluation or depreciation of the rupee to halt faltering reserves which according to the CB’s own data shows the end-November reserves to be less than 2004 and equal to 1975, but lower than 1976.Many exporters are complaining that other competing countries have devalued the currency and made exports more competitive compared to Sri Lanka. According to the IMF’s World Economic Outlook, Sri Lanka’s currency depreciated against the US dollar by just 1.24% by end 2007 to November 17, 2008 while Great Britain’s had depreciated by 33.06%, Pakistan’s by 23.08%, the Euro by 16.9% and India’s rupee by $19.2%. China had also depreciated its currency, accordingly.

According to financial news reports, the Russian rouble, which is pegged against a euro-dollar basket, depreciated by 22.6% from August 2008 to January 19, 2009 after the sixth mini-devaluation of the rouble by the Russian government.

Speaking at a public seminar this week, Deva Rodrigo, former Chairman of the Ceylon Chamber of Commerce (CCC) and a former partner at PricewaterhouseCoopers, said the reason the rupee has not depreciated here is due to a borrowing spree by the Government from commercial banks as opposed to the World Bank (WB) or the International Monetary Fund (IMF). He said the Government cannot replenish short term commercial loans when they are due for repayment, adding that this was bad for exporters and manufacturers.

Joint Apparel Association Forum head Ajith Dias says that the rupee must be allowed to depreciate to a ‘realistic’ level immediately, if devaluation is not possible.

“If the rupee is allowed to reach Rs 118 to Rs 120, this will address many of our problems. But we need this immediately, or we need a workable stimulus package,” he told a seminar this week.

The stimulus package for exporters, referred to by Mr Cabraal in The Sunday Times report last week as a means of placating exporters, is yet to come.

Planters’ Association chairman G D V Perera said the relief package needs to be implemented fast because the benefits must filter down and delays must be avoided.

But the Government relief is taking a long time to come and there are a lot of grey areas," he said.

"With the President's intervention, a Rs 5 billion relief package was set up but this is still to be implemented," he said adding: "up to now we have not got anything tangible. The Government should not only propose relief it must also deliver," (Please see analysis of this by The Economist on page 7)

In a statement, economist Muttukrishna Sarvananthan said he would like to withdraw the comments he made to The Sunday Times about Japanese aid cut to Sri Lanka.

“I have been made to understand by a Counsellor of the Embassy of Japan in Colombo that the merger of JBIC and JICA was done worldwide (just not only in Sri Lanka) in accordance with a policy decision taken by the Japanese Government for effective delivery of Japanese Overseas Development Assistance (ODA). Therefore, my inference that the merger of JBIC and JICA in Sri Lanka reflected a scaling down of Japanese aid to Sri Lanka is erroneous, which I very much regret,” he said, adding that “my comment that the Japanese aid cut was done ‘primarily because of bad economic policies pursued by the present Government and partly also due to human right abuses’ was also made by intuition.”

He said he was apologising to the Embassy of Japan, Government of Japan and the Government of Sri Lanka for ‘my error of judgement in making those comments.’

|