The high rate of inflation last year made it very clear that whatever be the causes for such increases in prices, inflation hurts. It hurt the poor and wage earners the worst. As the year advanced, the country learnt another lesson that, Sri Lanka’s competitiveness in international markets was being eroded owing to the impact of inflation. It was not that other countries were not affected by inflation; but their rate of inflation was significantly less than that of Sri Lanka’s rate of price increases. Other countries, especially those competing with us in global markets, had rates of inflation that were less than one half of ours. Besides critical input costs such as oil, electricity and transport were much less. Consequently their costs of production did not rise as much as ours.

|

Last year’s high rate of inflation adversely affected the living conditions of the poor owing to the high price increases of essentials. This was particularly so as the food inflation was very high. Prices of essential items of food such as rice, bread, sugar, milk, lentils and vegetables, among other essential food items, increased sharply. In addition prices of energy and transport too increased creating severe hardships to the poor in particular. On the other hand, the costs of production of inputs for manufacture were rising. Apart from the direct inputs for particular industries, the costs of electricity, gas and oil pushed up the costs of production. And what was important was that the costs of production in Sri Lanka increased more than in our competing countries. To compound the problem for exporters the value of the rupee was kept stable while it even appreciated at times. The end result of this was that exports of manufactures suffered badly and brought about even closures of some industrial establishments resulting in the unemployment of thousands. With this experience behind us the need for controlling inflation is very clear.

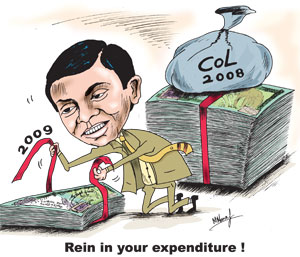

Economists and business leaders have emphasized the vital need to control inflation. They have stressed that the control of inflation should be of the highest priority of the Government and the Central Bank. Research institutions too have pointed out that the control of inflation cannot be achieved without reducing government spending. Fiscal discipline is vital and that is a key weakness in the country. Monetary policy alone cannot control inflation that is unleashed by high fiscal deficits. Besides it has been pointed out again and again that the resort to tight monetary policies has adverse effects on investment. One of the key factors that created inflation was the sharp rise in import prices of essential imports. The import induced inflation too had to be controlled by internal monetary measures. Yet the task was too great for monetary policy alone. The sad part of the inflationary story is that the government sought to blame the oil shock alone without taking countervailing policy measures to reduce the impact of this uncontrollable adverse development by reducing government expenditure.

The expectation is that the rate of inflation would be significantly less this year. The Central Bank has even projected inflation to fall to a single digit level. It has pointed out that the rate of inflation decelerated to 14.4 per cent in December, 2008 and that this deceleration was for the sixth month in succession. Further, inflation is expected to drop more in the period ahead, reaching a single digit level by early 2009. The expectation of this deceleration in inflation is based on the tight monetary policy stance adopted by the Central Bank together with favourable developments in the supply side and low import prices.

There are several important issues that we would like to spotlight. First, while the global recession is likely to continue over most of 2009 and probably throughout the year and thereby keep oil and food import prices down, it may not be as low as the current prices. Already there are signs of grain price increases. Low food prices are unlikely to be sustainable as demand for food increases. Farmers may curtail production if prices are too low. Oil prices are very volatile, as recent experience should have taught us.

The prediction of oil prices is hazardous. Actions of OPEC and other oil producing countries, as well as international political factors, have a bearing on international supply of oil. Therefore excess reliance on lower import prices may be misplaced.

Second, there is no reason to be exuberant about the extent of deceleration in prices. The fact is that our rate of inflation is still high and higher than that of our competitors. What matters is whether we could reduce the rate of inflation to those of our competitors. Otherwise we would lose our competitiveness in international markets. Therefore the current deceleration in prices should not lead to complacency in the control of inflation. If we are unable to keep down inflation to international levels, the depreciation of the currency may be inevitable in the interests of exports.

Third, there is a need for continued policy measures to ensure the control of inflation to reasonable levels. Inflation in the country is the result of three factors, fiscal deficits, money creation by the Central Bank and imported inflation caused mostly from the excessive rise in prices of oil, essential intermediate goods and food prices. However, cost push inflation cannot proceed without the monetary authority accommodating the increases in costs by increasing the money supply. It is also true that reductions in the rate of growth of money can slow down income growth and reduce employment in the future. The blame on the imported nature of inflation must be tempered by the realization that inflationary pressures emanating externally are accommodated by money creation within the economy.

The current deceleration in inflation must be accompanied by further fiscal and monetary measures to bring it down to internationally comparable levels to retain the country’s competitiveness. While 2009 may not witness international inflationary measures, domestic economic policy could sustain inflation at an unacceptable level. The need to control inflation is not over. |