24th September 2000

News/Comment|

Editorial/Opinion| Plus| Business|

Sports| Sports Plus| Mirror Magazine

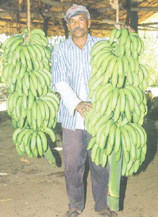

The ripened glory of commercial agriculture. These Cavendish Banana

bunches weighing over 50kgs are the results of a pioneering agri-venture

in Mahaweli System by Informatics Ltd.

See more feature.

Imported labour for FTZs?

By Dinali Goonewardene

The Board of Investment (BOI) is considering proposals to import labour for the garment sector. "We are debating whether foreign labour should be allowed into the country to fill capacities and generate export orders," BOI Chief, Tilan Wijesinghe said at a recent meeting organised by the Garment Buying Offices' Association."There has been pressure from several companies within the Katunayake zone to import labour. Within the Katunayake Export Processing Zone there are 6800 vacancies and within 12 BOI zones we have 12,000 vacancies," Mr. Wijesinghe told The Sunday Times Business.

"We have not permitted the request hence the necessity to change policies or laws does not arise," he said in response to a query whether regulatory changes would have to be implemented.

Economists were of the view that the principle underlying whether labour would be imported was whether it was cheaper than Sri Lankan labour. Countries with cheaper labour include Bangladesh, Vietnam and China. The minimum wage in the garment sector in Sri Lanka is Rs.2950 but the average employee takes home around Rs.6000 based on regular attendance and productivity incentives.

"There is an acute shortage of labour in the garment sector and that results in idle capacity in the factories," Former Chairman, Apparel Exporters Association, Lyn Fernando said. He said a decision to import labour would be welcome.

Unemployment in Sri Lanka was 8.8 per cent in the first three quarters of 1999. The unemployment rate has declined from 15.9 per cent in 1990 to 9.5 per cent in 1998 according to government statistics. Although this also reflects changes in the method of computation, questions have been posed about the need to import labour while unemployment prevails.

Prospective employees view living conditions as unattractive with the lack of accommodation and transport facilities proving a major barrier to employment in the sector. The media has portrayed working conditions as being woe-begone in numerous teledramas and this has led to the perception of bad working conditions, Lyn Fernando said.

He believes migrant labour would also be free of encumbrances such as families and trade unions, which would be in the interest of higher productivity.

The career span of women working the machines is also restricted with limited scope for promotions. The age group, which falls into this category ranges between 17-35 after which most retire or marry, factory owners said. Women in this age group also find it more lucrative to work in the Middle East.

Although the debate rages at the BOI and the industry clamours for migrant labour, analysts believe the social issues relating to migrant labour will have to be addressed.

Onlookers view these developments as spearheading competitiveness in

an era of globalisation but political analyst are also certain that leftist

political parties like the Janatha Vimukthi Peramuna would be aghast at

the suggestion

Big UDA plans for the little England

The Urban Development Authority (UDA) is on a drive to develop Nuwara Eliya and revive tourist interest in the city. Plans for the city include a multi storied shopping complex and a high altitude sports complex, Chairman, UDA, T K N P de Silva told The Sunday Times Business. An investment of Rs.150 mn is envisaged next year, he said.The racecourse, which belongs to the Municipal Council, will be acquired by the UDA and a sports complex will be constructed in the middle of the course. A lower pulse rate is recorded at high altitudes and the new sports complex will enable athletes to train in conditions they will experience overseas, Dr. de Silva said.

The sports complex will be pitched at international sportsmen and prospective investment in the project is slated at Rs. 100 mn. The project will be handed over to the Sports Ministry. Meanwhile the track will be given to the Turf Club, he said.

Lawson's Street in Nuwara Eliya will also receive a face-lift with the construction of a multi-storied shopping and office complex. The UDA also plans to discourage vegetable plantations and substitute flowers instead.

A fruit growing campaign is also billed to take off, with the Agriculture Department stepping into supply plants at a nominal value. The cultivation of fruits such as pears and peaches will be encouraged.

A satellite township in Hawa Eliya, Nuwara Eliya is also planned where shanties will be relocated and housing projects started. The project will also see new bus terminals being constructed in the city.

The UDA has already dredged the city's lake and intends clearing out unsightly fruit and vegetable growers who occupy the racecourse.

But hotel occupancy in the hill country has been on the wane and has

dropped to 27.2 per cent from January to June 2000 compared to 34.3 per

cent YOY.

Clarion call for the business community

"The Sri Lankan business community needs to take an active role in politics. This is in order to create economic stability and strategy imperative to foster economic growth." These ideas were conveyed at a media conference organised by the new political party Purawesi Peramuna.Purawesi Peramuna introduced their national list members drawn from all spheres of the economy including, entrepreneurs, economists and management consultants.

"No political party has ever made use of the vast management talent the private sector and the ex- government top brass has. Our aim is to harness this experience and talent to reverse the current economic instability in the country", said former Chairman Federation of Chamber of Commerce, and Industry, Patrick Amarasinghe.

Purawesi Peramuna's National List includes Patrick Amarasinghe- Entrepreneur, Susil Siriwardena former, Commissioner Janasaviya, Priyantha Serasinghe -Group HR Director Maharaja Organisation.

Susil Siriwardena who once led the biggest poverty alleviation program in the country said they would be working towards a three-sector economy, comprising the government, private sector and the people.

"We will be looking at the poor not as a problem but as a part of the solution. The production capability of the poor will be directly employed to boost the GNP through grass root level projects. We will bring back the days where the state bureaucracy operated with efficiency and economic inefficiency was something unheard of," Mr. Siriwardena added.

Addressing the issue of under-employment in the country, Priyantha Serasinghe said the education system would be fine-tuned to produce what the private sector needs. The last government had a very good plan of creating affiliated colleges in consultation with the private sector. The whole idea was to create a qualification, which the private sector demands, and thereby increase the job security. But these colleges were later converted into universities and the common curriculum was once again brought. The whole idea was lost," he added.

Purawesi Peramuna also expects other political parties to follow suit

and appoint more professionals to their respective National Lists. The

election manifesto of Purawesi Peramuna quotes former President Premadasa,

" The people are awake but the leaders are asleep. Today it is the task

of masses to shake their leaders out of their long slumber".

BOI on world promotion

The Board of Investment will embark on a Rs. 120 mn global promotion campaign which will focus on Sri Lanka's business environment. The campaign will target India, North America, Europe and the Association of South East Asian Nations (ASEAN), Deputy Director General (Promotion), BOI, Shehara de Silva told The Sunday Times Business."Certain markets are important for political reasons while the strategy for India is important post Free Trade Agreement (FTA)," she said.

The BOI has tied up with CNBC for this year long campaign which will feature half hour programmes based on the local economy and sectors which are performing well. It will also be linked with other international media such as The Economist and Time AOL.

Meanwhile BOI Chief Tilan Wijesinghe is also keen to make representation to New Delhi requesting Sri Lanka be considered a domestic tariff area for Indian textiles.

"Close Cooperation between our two governments are necessary so that synergies between India's textile industry and our apparel industry can be exploited," Wijesinghe said.

The move would lead to shorter lead times in procuring fabric while

Sri Lankan apparel exporters would benefit from a subsidy given by the

Indian government to the textile manufacturing sector. This would also

ensure that apparel manufactured in Sri Lanka does not attract duty on

the Indian fabric component.

Mind Your Business

Feeling Bearish

At least two major foreign players and one local institutional investor are slowly withdrawing from the Colombo market, brokers say.The pull out is temporary but is causing concern because it might set the trend for a bear run, they say. These investors on the other hand say there would be chaos after the poll with either a hung Parliament or a minority government, so it is better to be safe rather than sorry...

Heads will roll

And, talking of the polls, we all know that if the greens win a lot of heads will roll but the same probably holds true for the top financial sector posts, even if the blues are returned. The professor will have to make way for the crossover champion who wants to do the budget again, the governor is tipped to become an ambassador and blue eyed boy from the board will probably take over as governor. And a lady banker with good family ties is also due for a promotion, they say.Bad plan

The local agents for a Korean car that entered the local market quite recently have been earning the wrath of customers lately for delayed shipments, though the company is advertising heavily and offering cars as gifts for cricket tournaments.So much so that some of them have now complained to the principals in

Seoul. Now the agency is discretely under review and may face serious consequences

if its performance doesn't improve, we hear.

Tea production gains mask industry weaknesses

Three factors account for the buoyancy in the tea industry. First, there has been an up- trend in tea production. Second, the demand for tea has increased and third, there has been a drop in tea production in Kenya, our main competitor in international markets. The increase in demand for tea coupled with the drop in Kenyan tea production have resulted in improved prices for tea this year. These gains may be short lived if trade unions disrupt production.The production gains in tea should not lull us into thinking that the tea industry is without fundamental problems. The plain truth is that the tea industry is performing well below its potential levels of productivity.

The productivity on the plantations are lower than those of other major tea producing countries. The tea plantations have within it serious problems, particularly with respect to labour. The strikes in the tea plantations which we are currently witnessing, could prove to be the seeds of its own destruction. The small holdings, on the other hand, could be supported with much better infrastructure, research, extension, processing, credit and marketing facilities, which could further enhance their productivity. These issues should not be swept under the carpet owing to the up- trend in tea production and the improvement in prices this year.

First let us evaluate the gains in tea production. In the first half of this year, Tea production increased by 12.7 per cent. This growth in tea production is impressive. In the past few years tea production has been growing each year and reaching new peaks. Tea production could exceed last year's peak production to reach a new high. Yet this may not happen due to the labour unrest on the estates.

Tea production fell in July owing to inadequate rainfall but showed signs of regaining production with the onset of rains, when production was dislocated by the estate unions striking. Despite the favourable weather, the strikes on the estates are likely to reduce production in September.

Most of the increases in tea production in recent years have been from low country small holdings. Production and productivity on small holdings have been increasing at an impressive rate in recent years. Last year, however, tea production on small holdings fell by 1 per cent while production the estates increased by 7 per cent. Productivity on small holdings is about twice that on the plantations. It is the productivity on small holdings that compare favourably with productivity levels in Kenya, other East African countries and India. Productivity on our estates is well below the national averages of productivity of other important producers of tea.

Our plantation productivity levels are considerably lower than those of Kenya and India. There is a need to increase our yields by expanding the extent under cultivation with high yielding VP teas on the estates and by improving cultural practices. Only a small proportion of tea estate lands are cultivated with VP teas. Years of neglect of estate tea production under state ownership have to be rectified. No doubt the recent gains are an indication of such improvements. What we have actually witnessed in tea production in recent years is a catching up in lost productivity

The most pressing issue which the estate management companies, the government and trade unions must address is the methods for wage determination. The current trade union actions are disrupting the industry at a time when increases in production could be achieved and when increased exports could fetch better prices owing to shortfalls in production in other tea producing countries.

A loss in production could be a serious setback to the industry. What the tea industry has failed to achieve is a system of wage payments related to the productivity of labour. There is little doubt that estate labour should be paid better. Higher wages must be geared to productivity gains. Fair and realistic norms must be worked out so that labour obtains higher payments for their work and the owners are able to pay labour better because increased labour productivity enables them to do so.

The increasing trend in tea production should not give the false impression

that the industry is very efficient and productive. In the case of small

holdings, improved infrastructure and better support facilities could further

increase their productivity. There is considerable scope for improvement

of the management of the estates to bring out their full potential. A method

of equitable wage determination and further improvements in the living

conditions of labour are needed to ensure that tea production is not disrupted

from time to time by trade union actions. Wages should reflect the productivity

of labour and wages should be increased with productivity gains.

Tilan: five years at the helm

He may be the youngest to head Sri Lanka's premier foreign investment agency but Tilan Wijesinghe believes success comes from - not merely maturity and experience - but in providing leadership to other employees and allowing them to grow along with the institution."To achieve a high degree of motivation in the public service one needs visionary and forthright leadership, where those who are being led rely on the head of the institution to guide them, to back them up in case bona fide mistakes are made, and to acknowledge a job that is well done," said the 41-year old director general and chairman of the Board of Investment of Sri Lanka (BOI).

"We must give employees a sense of achievement and accomplishment through a process of delegating authority."

The former banker and one-time national cricketer - who helped establish Asia Securities Ltd one of Sri Lanka's top stockbroking firms in just two years of operation by 1994 - completes five years as BOI's CEO this month and looks back with a sense of pride and achievement at the way foreign investment has picked up in this country despite the war.

"Look, the BOI has attracted foreign direct investment (FDI) worth US $ 715 million since September 1995 which is the highest ever during any five year period in the past. Isn't that an achievement, and mind you it was achieved with the same number of staff as in the pre-September 1995 period," he says, reflecting on the past few years of this high profile government job.

Consider some other pluses during Wijesinghe's tenure. Sri Lanka's net FDI last year of US $ 202 million was the highest ever on record for any single year, direct exports by BOI enterprises rose to close to US 3 billion this year from US 2.1 billion in 1995 while the total number of companies in the BOI has risen to 1,300 to date from 748 in September 1995.

Major projects like the expansion of the Colombo port, private sector power schemes, housing, expansion of the telecommunication industry and public sector programmes like industrial townships and Sri Lanka's first ever " IT (information technology) park" at the World Trade Centre in Colombo were launched in the past five years. The number of BOI-managed export promotion zones has also increased to 13 from four in 1995.

Apart from high staff morale, Wijesinghe is also elated by the fact that the BOI's success story is more to do with gains in productivity than any increase in staff. Despite the 74 percent increase in projects since 1995, the BOI has managed to service these projects with no staff increases and also in addition to a sharp increase in the organisation's annual capital budget, which rose to 2.3 billion rupees this year from 315 million rupees in 1995.

Excerpts from the interview:

By Feizal Samath

Q: You were the youngest to be selected for this job. How come?A: This I believe was as a consequence of my career at Asia Capital where within a relatively short period of two to three years, my colleagues and I at Asia - all in their very early thirties - had a very successful financial services business. Apart from Asia Securities being Sri Lanka's number one stockbroking company within two years of being set up, Asia Capital was able to attract around US $ 200 million to the Colombo Stock Exchange within a three-year period.

In addition we undertook some pioneering transactions including the launching of Sri Lanka's first-ever dedicated country fund. I believe these achievements contributed to my being identified for this post.

Q: How have you been able to cope in a different environment, particularly moving from the private sector to a public sector appointment?

A: On a personal note, when the president offered this post to me I thought I was going to be the director general and I would have a grey-haired chairman who I would have to report to. After having accepted this job, a few days later I glanced through the BOI Act and much to my surprise discovered that I was both the chairman and the director general of the BOI. But having said that, I believe the biggest challenge that I face moving from a private sector career to the public service is that leadership skills and the approach to leadership in the public sector play a far greater role in the success of that institution than in a private sector organization. The fundamental reasons for this is that the head of a public sector institution is not in control of the basic tool in motivating the employees of that institution like bonuses, remuneration, perks, promotions, etc.

All these attributes of motivating staff are governed by a complex set of rules and regulations. To achieve a high degree of motivation in the public service one needs visionary and forthright leadership where those who are being led, very clearly depend on the head of the institution to guide them and to back them up in case bona fide mistakes are made. Employees must be given a sense of achievement and accomplishment through a process of delegating authority. To me to adjust to that process was a significant aspect in my new career.

Q: Was it difficult to adapt to change?

A: No, not really. I believe within the public sector the basic levels of skills that is available - particularly in the BOI which has primarily recruited graduates - is higher than in the private sector. For example the private sector would have many school leavers straight after their OL's or AL's whereas all professional cadres at the BOI are university graduates or holding other professional qualifications.

The level of skills in the public service in terms of basic education and training - in a general sense - is better than in the private sector. What motivates public servants however are not salary and perks - which are possible at the discretion of the chief executive in a private organization - but a sense of achievement, a sense of accomplishment and a sense of carrying out national priority activities.

I know quite a few officers in the BOI who would work after hours, work on weekends in order to achieve a specific task at the right time and take tremendous satisfaction in having achieved that and then it is up to the chief executive to recognize this by just a simple word "well done " or "thank you".

I know a particular BOI officer who visits homes of zone workers or residents whenever he receives complaints of an affluent discharge by a particular factory, to listen to and take action on their complaints. This is dedication beyond the call of duty.

Q: One of the toughest jobs would be to attract foreign investment in an economy affected by war and unrest?

It is. However we have taken a slightly different approach to attracting investments. We ask investors to look at the totality of risk elements in doing business in a developing country rather than isolating only one element like war risk for instance. This is one of the fundamental messages we have tried to get through. Look at the investment regulatory risk - Sri Lanka has one of the best legal frameworks anywhere in Asia governing foreign investment. The bureaucratic risk - the BOI law provides investors comfort against future changes in law and we are ranked as an organization and a country where levels of corruption have not reached proportions that are seen in some East Asian countries. The other aspect where risk is mitigated is the fact that we have a highly trained workforce and superior infrastructure than some other countries in the Indian subcontinent.

But above all we have tried to attract investment on the basis that

Sri Lanka, despite the skirmishes from the north and the east has a relatively

stable macro economy and political framework. Investors have come to realize

that Sri Lanka - despite the conflict - is a country that would grow around

five percent per annum.

Globalizing the International monetary Fund

By Dr. Nadeem Ul Haque

In a few days time, Mr. P.M. Nagahawatte - Deputy Governor to the Central Bank of Sri Lanka, and Mr. Faiz Mohideen Deputy Secretary to the Treasury, will travel to Prague to represent Sri Lanka at the Annual Meetings of the IMF and World Bank. The meetings will be an opportunity for them to discuss the activities of the Fund and the Bank in Sri Lanka and to exchange views on economic policy. But more than that, it is a chance for Sri Lanka to make its voice heard and to join in discussions on the global economy and in decisions on the work of the IMF and the international financial system.The word globalization may not appear on the formal agenda, but the theme will pervade the meetings. The rapid growth of international trade and investment has brought enormous progress to many countries. But capital flows can be volatile, exposing countries to the risk of financial crisis. And with some countries integrating into the global economy more quickly than others, the gap between rich and poor countries is growing ever larger.

Mr. Horst Kohler, who became Managing Director of the IMF in May 2000, has expressed his determination to strengthen the voice of developing countries within the institution. Since joining the IMF, he has travelled to Africa, Asia, Eastern Europe and Latin America to listen to views on the IMF's role and how it needs to change. He will now use his first Annual Meetings to outline his vision of the IMF's future, presenting ideas on how to make the IMF more effective in today's rapidly evolving world economy.

In his travels, Mr. Kohler learned that countries generally share his conviction that the IMF should focus its work more sharply on policies that foster economic growth and financial stability, those relating to the government budget, money and credit, the exchange rate, and financial markets. Good policies in these areas help countries reap the benefits of globalization. They become better able to withstand economic shocks, including shocks from outside. And these policies contribute to economic growth, which is indispensable for reducing poverty.

Sri Lanka has, with Fund help, progressed substantially in the last two decades in the direction of developing a more open, private sector-led economy. These policies have developed an economy that is fairly resilient and able to sustain growth even in the midst of domestic strife and external crises. The country now needs to achieve peace and proceed to the implementation of second-generation reforms, which will foster the institutional foundations of a modern economy. With such institutions developed, Sri Lanka can truly benefit from globalization.

The IMF works to promote the health of the economies of each of its member countries and the global economy. Like a good doctor, it must focus on prevention where possible and cure when necessary. Prevention means helping countries become less vulnerable to crises. This calls for a sharper focus in the IMF's policy dialogue with its members on such issues as balance of payments deficits, the exchange rate, and the strength of banks. It means a new emphasis on making high-quality economic information available to the public regularly and promptly. And it requires stronger relationships between governments and countries private lenders and investors.

But crises have not always been prevented. Indeed, the past decade has seen financial crises strike around the globe, including Mexico, Thailand, Indonesia, Korea, Russia, and Brazil. Like contagious diseases, some of these crises have spread rapidly from country to country, attracting labels like Asian flu. So the IMF is continuing to examine how best it can help countries manage and resolve crises.

Countries in difficulties often do need IMF loans to ease adjustment and support reform. But IMF loans can only be temporary. Conditions are attached to IMF loans to ensure that the money is put to good use. And experience shows that economic reforms work best when the country is committed to them. So, to improve country ownership of policy programs, the Fund is looking at how conditions might be better tailored to individual country circumstances.

We value the work of the Fund. Mr. Kohler has heard this repeatedly from developing country members. The IMF has a role to play in helping all of its 182 members share in the benefits of globalization. This includes the poorest and most heavily indebted. Under the Initiative for Heavily-Indebted Poor Countries, the IMF has played its part in substantially reducing the debt burdens of 10 countries over the past year, and is aiming for another 10 by the end of 2000.

This represents significant progress in reducing debt burdens and freeing resources for poverty reduction. Some have asked why debt reduction has not proceeded faster, but time is needed to ensure that debt relief goes hand in hand with policies including good governance that create the conditions for a better future. The IMF is also supporting these policies with concessional loans from its Poverty Reduction and Growth Facility and it is working more closely than ever with the World Bank under a recently-announced enhanced partnership to promote sustainable growth and poverty reduction. Here in Sri Lanka, the Ministry of Finance has worked closely with the IMF, the World Bank, and several civil society organizations to develop policy and reform initiatives for a coherent plan for poverty reduction.

These are crucial issues. Indeed, they have proven of vital importance for Sri Lanka as it becomes increasingly engaged with the global markets that have grown so rapidly in recent years. Mr. Kohler has reminded member countries that the IMF belongs to all its members and that all members can present on an equal basis their ideas and their objectives. The Prague meetings provide an opportunity for voices and ideas from around the world to be heard as the world's financial leaders prepare the IMF for the new century.

The writer is the senior Resident Representative of the International Monetary Fund

![]()

Front Page| News/Comment| Editorial/Opinion| Plus| Business| Sports| Sports Plus| Mirror Magazine

Please send your comments and suggestions on this web site to