16th July 2000

Front Page|

News/Comment|

Editorial/Opinion| Plus|

Business|

Sports| Sports Plus|

Mirror Magazine

![]()

- Auditors query Telecom accounts

- Foreign buyer for CDIC

- Savers fight shy of CSE

- SEC verdict on Sampath

- It's too taxing - expert says - Tax amendment

- Chasing the caviar dream —India and Sri Lanka compared - Biz broadsides - by Rajpal A.

- News

- In the sky

- Diary

- Right of reply

- HNB launch Singithi Setha special loan scheme

- Insurance Corp gets new digital Ericsson PABX from Metropolitan

- Hotelshow 2000 to showcase regional goods and services

- KBSL bags RS/6000 award for sixth year

Auditors query Telecom accounts

Sri Lanka Telecom's (SLT) auditors have qualified their financial statements stating that the company does not insure its property, plant and equipment and does not take an insurance policy on other insurable risks.

The state also owes Rs. 281 mn by way of telephony services, and these balances cannot be confirmed, auditors PricewaterhouseCoopers (PwC) said in SLT's December 31, 1999 accounts.

Commenting on the lack of a proper insurance cover, PwC says that a sinking fund has been created with the People's Bank for Rs. 62 mn, which is set aside to meet any future uninsured loss. "These financial statements have been prepared on a going concern basis on the assumption that a substantial loss in excess of the amount provided would not arise", PwC said.

The government has not settled its debts owed to SLT prior to privatisation. These debts have been outstanding since October 31, 1997 as specified in the shareholders agreement. "We are therefore, unable to state whether Rs. 281 mn shown as receivable from the government is fairly stated."

SLT is also facing legal action from private operators. Suntel and Lanka Bell are claiming Rs. 587 mn in damages on account of loss of profit resulting from the stay order secured by SLT. After the balance sheet date, Lanka Internet Services Ltd has filed action against SLT, claiming Rs. 1.5 bn as damages for defamation arising out of an advertisement placed by SLT. "The ultimate outcome of these matters cannot presently be determined and no provision for any liability that may result has been made in the financial statements," PwC said.

SLT reported a marginal growth in earnings before interest, tax, depreciation and amortisation (EBITDA) recording Rs. 10,641 mn compared to Rs. 10,155 mn in 1998.

However, interest expenses on borrowings for network expansion continued to grow from Rs. 1.89 bn in 1998 to Rs. 3.31 bn in 1999. In 1999, SLT borrowed Rs. 25.6 bn compared to Rs. 18.5 bn. An additional Rs. 24.3 bn have been earmarked for further expansion this year.

SLT's revenue grew marginally from Rs. 17.08 bn in 1998 to Rs. 18.28 bn in 1999. The lucrative international settlement (inpayments) dipped from Rs. 7.69 bn to Rs. 5.76 bn in 1999.

The diresctors attributed the drop to 'some international calls by passing SLT's gateway'.

Domestic revenues nearly doubled, as SLT raised its tariffs and expanded its network. Domestic call revenue grew from Rs. 4.82 bn to Rs. 7.29 bn in 1999.

Earnings per share too dropped from Rs. 1.23 to 70 cents in 1999.

SLT paid NTT Communications Corporation Rs. 451 mn a management fees for 1999.

In post balance sheet events, PwC noted that SLT has not complied with lending requirements to submit periodic auditing financial statements. However, the directors believe that the lenders were aware of the likely shortcomings in SLT's accounting records when signing the loan agreements, and have not notified SLT of any breach. The directors do not believe that the lenders will materially alter any of the terms of these loans to SLT's detriment.

Under contingencies, SLT has appealed against a Telecom watchdog's determination to revise interconnection tariffs charged to wireless operators. The balance outstanding as at December 31, 1999 stood at Rs. 357 mn. However, should this appeal fail, Rs. 63 mn is doubtful of recovery, PwC said.

In May 2000, SLT filed action against a certain party [LISL] claiming Rs. 102,008,120 mn in damages for allowing their network to be used to provide international telephony services. SLT is claiming Rs. 174, 518,740 mn as damages from another private operator [Suntel] for allowing foreign calls to terminate in Sri Lanka without routing through SLT's international gateway.

SLT also estimates Rs. 10 bn as damages to its equipment in 2000, resulting

from the military conflict in the north.

Foreign buyer for CDIC

By Dinali Goonewardene

A proposal to sell a 75 per cent stake in CDIC Sassoon Cumberbatch Stockbrokers (CSCS) to Chinkara Holdings is presently being whetted by market regulators. Chinkara Holdings which is registered in the Bahamas was incorporated last year and is backed by fund managers.

Informed sources said that Carson Cumberbatch and Company Limited,the National Development Bank and Sassoons would be selling their stake in the broking firm. However People's bank is expected to retain its shareholding in the firm. The Citi National Investment Bank which linked Lanka Securities Ltd with First Capital of Pakistan were instrumental in orchestrating this deal.

Chinkara Holdings is expected to infuse expertise to the broking firm while providing access to a new foreign client base. Sassoons who were CSCS's foreign partners did not play an active role in the firms operations.

CDIC Sassoon Cumberbatch stockbrokers was incorporated in 1992 and its initial stakeholders were the Capital Development investment Company (CDIC), Sassoon's and Carson Cumberbatch and Company Ltd. People's Bank subsequently bought a stake in the company. However CDIC has been trying to sell its stake in the company for the last two years. Deregulation of financial services in the budget 2000 has attracted foreign investment to stock broking firms. Foreign firms may now buy a 100 per cent stake in local broking firms.

First capital Securities Corporation of Pakistan were quick to capitalise

on this and signed a Memorandum of understanding with Lanka Securities

Ltd to buy a 60 per cent stake in the company, in the wake of the deregulation.

Savers fight shy of CSE

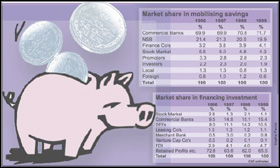

The Colombo Stock Exchange accounted for only 4.3% of the cumulative savings mobilised by the financial sector consisting of commercial banks, the National Savings Bank, finance companies and the stock market in 1999, the CSE annual report says. However if the promoters share is discounted, the savings mobilisation from investors amount to less than 2% in 1999, the report adds. (see chart )An analysis over the past four years indicates a downward trend of the capacity of the stock market to mobilise savings.

Estimates suggest that the stock market accounted for 1.1% of the financing of the private sector investment in 1999.An estimated 65% of the private sector investment was financed through retained earnings and private savings

The stock market has lost ground in financing investment over the past years the report says adding that commercial bank borrowings and internal funding of investment have been the main sources in funding investment

However if the economy is to grow at the targeted 8% GDP growth levels and the targeted investment levels of 30% 35% of GDP is to be achieved, the capital market needs to play a far more significant role in both mobilizing savings and chanelling savings investment. Recourse to short term borrowing and internal funding of investments is unlikely to achieve the targeted levels of investment and growth the report adds.

Overall there has been a decline in capital raised on the CSE from Rs. 4.8 bn in 1998 to Rs. 3.1 bn in 1999.Investment mobilised through the stock market through prospectus and rights issues, as a percentage of investment by the private sector and pubic corporations was 1.1% in 1999 as against 2.1% in 1998.

The Central Bank annual report says that there was a slow down in lending activities by long term credit institutions despite an overall increase in private sector investment last year.

For example loans approved by long-term credit institutions declined

by nearly 32% in 1999 and loans granted by these institutions declined

by over 11% over the previous year. The reduction in the funds raised through

the stock market in 1999 has to be considered in the context of the decline

in demand for long term credit during the year.

SEC verdict on Sampath

The Securities and Exchange Commission has finally broken their long silence to give a verdict on the Sampath Bank vs HNB issue. The regulatory authority in a media release says that "it has now identified five companies and two individuals as having acted in concert in acquiring shares of Sampath Bank Ltd. and thereby violated the Takeovers and Mergers Code. The SEC's decision has caused legal analyst to question whether the regulator will prosecute parties acting in concert for not making an anouncement when they crossed the 30 per cent threshold. On being questioned as to whether they would prosecute SEC officials said they would subsequently consider all relevant issues. The SEC has the authority to prosecute, warn or compound in such instances.

The SEC release says that on the basis of the information obtained in the course of their investigations, the threshold limit as specified in Rule 31 of the Takeovers and Mergers Code of 1995, has been exceeded on or about June 20th. Although Sampath Bank shares were trading at around Rs. 70 on that date, a failure to make an announcement or mandatory offer at that price saw shareholders sell out at lower prices. Legal experts believe shareholders who lost out by selling at lower prices can successfully take legal action to recover losses.

The five companies and two individuals have now been asked by the SEC to make a mandatory offer as required by the Code within 35 days. The SEC release does not identify the parties but Stassens Exports, HNB, Smart Development Pvt. Ltd. HNB EPF, Distilleries Company Ltd and Masons Mixtures and M U D E Silva, D.N Daluwatte and PS Don are. believed to collectively own about 45% of Sampath Bank.

The SEC release says that in terms of the Code any person acting in

concert with such person who acquires 30% or more of the equity shares

of a listed company is required to make a mandatory offer to all the remaining

shareholders withing 35 days of such acquisition at not less than the highest

price paid by such person to acquire these shares within the preceeding

12 months. The Code also requires that such an offer shall also include

a cash alternative where securities are being offered to the shareholder

for accepting such an offer.

Tax amendment

It's too taxing - expert says

A tax expert criticised the move to change the Inland Revenue Act following the year 2000 budget recommendations.

Past President of the Sri Lanka Institute of Taxation (SLIT) and Attorney at Law C. P. E. Gunasingam said the budget proposal to empower assessors to make fresh assessments after a three year period has lapsed, amounts to tolerating the inefficiencies of the department and violating the rights of the tax payers.

Tax laws have traditionally imposed a time bar on Inland Revenue assessments after three years.

If the Inland Revenue disagrees with the return submitted by a tax payer it is required to give reasons for not accepting the return, The tax payer is expected to submit fresh assessments before the lapse of three years.

"But it has now turned into a tool for tax avoidance. Assessor's reasons are challenged to avoid tax payments. Therefore, I also propose to modify the provisions of section 115(3) to empower assessors to make fresh assessments in such cases," the budget speech 2000 stated.

"The law seeks to accommodate the inefficiencies of revenue officers and violates the rights of tax payers who should not under normal circumstances be assessed after three years," Gunasingam said.

The situation arises when Inland Revenue assessments are issued near the end of the three year deadline.

If the taxpayer refutes this assessment and the courts agree that the Inland Revenue's justification of the assessment is incorrect the new assessment can not be made before the three year time bar.

"If the assessment is issued within a reasonable time after the submission of the return the question of the tax payer using the time bar as a tool for tax avoidance does not arise," Gunasingam said.

And the tax payer certainly does not foresee that the Inland Revenue is going to submit incorrect justification for the assessment, he added.

The self assessment scheme where taxpayers calculated their tax liability was introduced to Sri Lanka in 1972.

Assessors were permitted to refute tax returns and impose arbitrary tax assessments till 1978 when amendments to tax law required assessors to give reasons for rejecting assessments.

Traditionally tax assessments were time bared after three years but an attempt was made to amend this law in 1995.

However representations against this move were made to parliament by

the Sri Lanka Institute of Taxation (SLIT) through Bernard Soysa, MP and

proved successful at the time.

Chasing the caviar dream —India and Sri Lanka compared

Some egregious commentary has been made by a contributor to the Island, regarding the so called go - go economies in Asia, and why Sri Lanka is lagging behind in getting a piece of this action.

The Writer, Chandraprema, says that his book was reviewed belatedly in the Sunday Times, and that the reviewer crowed that the Asian economies have collapsed. He then proceeds to go fairly into raptures about the rebound of the Asian economies, and then also about what vast strides India for instance, is making in comparison to Sri Lanka economically.

First, let's take India's case. What a lot of nonsense is being said about India's so called vast growth rates and vast economic strides is probably not known to these rapture artistes.

Its true that investment is taking place in India, and that the economy is displaying some "movement'' of the kind that most rupees and cents economists would like to see. But, what's missing in the arguments of writers who go into ecstasies over that kind of economy, is the fact that both India and Sri Lanka are being cowed by the global economic diktat, and that India is now ahead of us in being able to resist the deleterious affects of that onslaught.

In reality, India is among the bottom 40 in the UN Human Development Index ranking. Sixty per cent of Indians have less than $ 1 a day to spend. Over 50 million of them sank below the official poverty line in the past decade of 6 per cent GDP growth.

This is the India, the fast growing engine that Mr C. A. C crows about. What sort of economic development is it, that sees 50 million people sink below the official poverty line, in a decade of a hyped 6 per cent growth ?

If this sort of economy is the promised land, then the less said about our prospects of chasing after it the better. Of course, caught up as we are in the vortex of the global transnational economy, it is probably correct to say that India has got more enmeshed in it. We too are enmeshed in it. Its not as if we are better off in that way. But, its not as if we are going to get any better chasing India's example either — which is not what the rapture writers would have you believe of course.

Recently, the Indian Tribune commented editorially on the Indian government's trend of doing away with measures such as quantitative restrictions. Quantitative restrictions are a term for restricting the import of certain non- essential items such as chutneys, or caviar, or dog food or what have you. But, the Indian government decided, as a part of a more or less clandestine deal before the visit of American President William Jefferson Clinton, that quantitative restrictions on 714 items will to be lifted. This is what the Tribune had to say about this move towards what was referred to as the caviar economy.

"Mr Maran's explanation for rejecting this option (of Quantitative Restrictions) is as bland as it is arrogant. He told The Economic Times, quoting Anne Krueger—an ultra-conservative right-wing economist, whom even American free-marketeers find embarrassingly dogmatic — that "we are now a confident, resurgent India... we need not bother about... QRs." There are, he conceded, countries like Colombia and Sri Lanka which maintain QRs, but "we do not want to be in this league" — never mind that Sri Lanka's per capita GDP is more than double India's.''

It is good for rapture theorists to learn that even today, Sri Lanka's per capita Gross Domestic Product is more than double that of India's. For one, it nails the canard that Sri Lanka only is a basket case, while India forges ahead.

If anything can reflect the truth on basket cases, it is probably the fact that India and Sri Lanka are both basket cases — having being forced to become so as a result of the burgeoning global economic diktat imposed by the transnational capital.

Sure, we can all have our economic theories, and ideologically, if somebody say that Sri Lanka is being embroiled in a war, and that there is a lack of growth given the country's potential — there can be absolutely no quarrel with that argument.

But, what's dangerous is when various promoters of sunshine theories goad us into chasing the mirage - - with visions of other countries progress that are quite dubious to say the least.

This kind of neo-liberal promotional stuff will be inevitable — and these theorists eventually goad us to privatize, do away with whatever positive restrictions we have, and just about do anything to attract the holy grail of "investment.'' Though we may be incarcerated/trapped, almost, and are not in a position to escape the global forces of the market, it does not mean that we have to cave in fully and create a caviar economy for ourselves too — just because somebody else two doors next is supposed to be doing it. And incidentally, the case of the rebound in the other Asian economies is much the same too – it is a case of the poorer getting poorer in these countries as well, amidst the supposed tall indexes of "growth.''

![]()

Front Page| News/Comment| Editorial/Opinion| Plus| Business| Sports| Sports Plus| Mirror Magazine

Please send your comments and suggestions on this web site to