2nd July 2000

The bank bombshell

By The Sunday Times Special Assignment Desk

Front Page|

News/Comment|

Plus| Business| Sports|

Sports Plus| Mirror Magazine

![]()

Mergers

or acquisitions are the name of the game in the hard and often-brutal corporate

world and most international companies have come to realise that it is

easier to survive through a merger or a strategic alliance where they compete

against each other.

Mergers

or acquisitions are the name of the game in the hard and often-brutal corporate

world and most international companies have come to realise that it is

easier to survive through a merger or a strategic alliance where they compete

against each other.

Some of the giants in the international corporate world have resorted to worldwide mergers or acquisities which invariably lead to downsizing of staff and selling under one joint brand name in a bid to increase market share.

This survival game is not new to Sri Lanka which has had mergers in the past like the Vanik acquisition of the Forbes Ceylon group, the John Keells group purchase of Whittall Boustead and its subsidiaries including the lucrative Cold Stores or Elephant House many years ago, the DFCC acquisition of a sizable stake in Commercial Bank and so on.

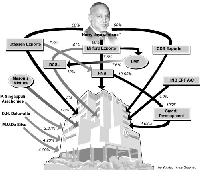

Probably the biggest takeover came from George Ondatjee's Canadian-based Ondatjee Corporation which paid around two billion rupees to purchase Forbes Ceylon Ltd and its subsidiaries some years ago. The deal stirred a lot of interest in Colombo corporate world but not as much as last month's hostile takeover bid for Sampath Bank.

Earlier last month, Hatton National Bank (HNB) and multimillionaire businessman Harry Jayawardene's Stassens group launched the much-talked about takeover of Sampath Bank, buying millions of shares in the Colombo stock market directly and through front companies.

While the acquisition of shares for controlled interests itself may have not raised many eyebrows in the now accepted world of mergers and acquisitions, what was seen as unsavoury by shareholders, bank employees and bank directors was the manner in which the two investors launched their bid!

The two main investors using HNB, HNB EPF and Stassens funds through front companies and HNB senior managers amassed upto a 44 percent stake in the bank and then announced they wanted four positions on the board.

Bank employees and directors accused the investors of blatantly violating Central Bank rules and the Takeovers & Mergers Code enforced by the Securities and Exchange Act in amassing shares beyond laid down limits (see box on rules).

When Sampath Bank officials raised the issue with the Central Bank and the SEC, the first response was that there was no violation of the law. But subsequently as pressure mounted against the takeover bid both institutions responded.

The SEC said on Wednesday it was investigating the transaction in terms of the Takeovers & Mergers Code. "Upon completion of the investigation, if there is material to substantiate charges that parties acting in concert have in fact incurred a requirement to make a mandatory offer, the SEC will take steps to ensure due compliance with the Takeovers & Mergers Code of 1995," the statement said.

The Central Bank on Thursday said some transactions made in the purchase of Sampath Bank shares appeared to be improper. Dr Anila Dias Bandaranaike, director of the Central Bank's bank supervision department wrote to Sampath Bank Chairman Edgar Gunatunga saying "according to the Monetary Board it appears the objective of the Banking Act has been violated in the said purchases."

But Sampath Bank employees who took the protest campaign against the takeover to the bank's large shareholder base across the country had the final say through the Colombo District Court. The court, responding to a plea by three senior bank executives, issued an enjoining order restraining HNB and Stassens from exercising a vote in excess of a total 10 percent of Sampath Bank's shareholdings at the annual general meeting.

Sanity then prevailed at the annual general meeting of Sampath Bank with all directors being re-elected to office. (See box for story).

"It was a major victory for us, the shareholders. We won the first battle and now the scene will probably shift to the courts," noted a happy Sampath Bank director.

HNB and Harry Jayawardene, possibly the richest man in Sri Lanka today with a string of acquisitions in his pocket, have lost the first battle but not the last, business circles say.

"He will stage a comeback you wait and see," said one business analyst.

Both sides are expected to battle it in courts and outside the boardroom.

Most analysts say the first salvo has been successfully fired by Sampath Bank and it is interesting to see how HNB and its new partner Harry Jayawardene would react.

The successful defence of the takeover bid by the Sampath Bank directors, the staff and shareholders will be a test case in the future of corporate mergers and acquisitions. "It is the first time a hostile takeover bid has been resisted in this country," noted an analyst.

In the case of Sampath Bank, it is the second crisis in the bank's 13-year long history the first being when founder chairman N.U. Jayewardene was eased out in 1991 after the Central Bank stepped in to prevent a run on the bank's deposits.

This time around, the situation is slightly different in that the highly-profitable bank was targeted by a group of investors resulting in huge transactions at the Colombo Stock Exchange and a rapid change in shareholdings.

The drama also angered some HNB employees who allege the HNB's Employees Provident Fund (EPF) was used to purchase the shares of a competitor at a price far above the market value. HNB's EPF which like any other bank-owned EPF is authorized to make good investments secured a 4.9 percent stake in Sampath Bank.

Though the dispute hit the headlines recently, the raid on Sampath Bank by Mr. Jayawardene and HNB had begun in November last year. Business analysts recall comments at that time made by HNB Managing Director Rienzie Wijetillake, as the then chairman of the Colombo Stock Exchange at a seminar on "Price Vs Value", pushing for the need for mergers and acquisitions.

"The statement would in normal circumstances have reflected the general trend all over the world but when HNB started buying shares of Sampath Bank in December or so, something suspicious was happening," one analyst said.

When HNB's annual report came out some weeks ago, Mr. Wijetillake expressed the same view on mergers and acquisitions and at the same time HNB and its connected companies were buying heavily into Sampath stocks using questionable ways of doing so.

"Otherwise why use HNB's EPF and also two senior managers of HNB to buy millions of shares? Did they have the approval of HNB employees to buy these shares at a higher than market-value? Where did the two managers amass so much money?" asked a spokesman for the Sampath Bank Employees Association.

HNB employees, in a letter to the banks Assistant General Manager Mallika Manuratne, who is in charge of training and productivity, said HNB directors had thrown caution to the winds and purchased Sampath Bank shares using all the money in the provident fund.

HNB's EPF funds were allegedly used to buy a nearly 10 percent stake in Sampath bank through two senior HNB managers D.N. Daluwatte (deputy general manager) and Upali de Silva (senior deputy general manager) in whose name these shares were registered.

This block was purchased from the Ireland-based BSDT Investors Pacific International Fund which had a 9.26 percent stake in Sampath Bank. (See box on old and new shareholdings).

Employees say that Mr. Wijetillake went on record saying that the foreign-held shares were bought by HNB as a benefit to the country, so that all shares would be locally held. "If that is the case, then he is openly admitting that Mr. Daluwatte and Mr. de Silva were buying on behalf of HNB and not as individual shareholders," the Sampath employees' spokesman said.

Informed sources say that Mr. Jayawardene approached the BSDT fund and made an offer and promised to match any offer from other parties.

Soon after that Mr. Daluwatte and Mr. de Silva purchased the block through a local brokerage with foreign contacts.

While HNB and Stassens would use the weekend to recover from the defeat and reassess the situation, many blame Sri Lanka's regulatory bodies for not stepping in and preventing an ugly confrontation between banks.

"There were clear violations but the regulators chose to remain silent," said a corporate lawyer, adding that the regulators lost a lot of credibility over the issue. "The regulators should have stepped in, investigated the issue and cleared the air."

He said the battle for control, using devious means, was negative publicity for the country and to corporate governance as a whole. "What happened to corporate governance and decency particularly when the interested parties command some respect in the business world?"

HNB's Mr. Wijetillake was until recently the respected chairman of the Cricket Board's interim committee and also a former chairman of the stock exchange while Mr. Jayawardene is a director of the exchange.

Insiders say the battle is not over yet and the HNB/Jayawardene alliance is likely to focus attention on the DFCC as the next target.

Control of DFCC would give it control of the Commercial Bank in which DFCC has a 28 percent stake thereby giving it a free run of the banking sector.

"After control of the banking sector, the takeover group may who knows make a bid for John Keells or Hayleys after having Aitken Spence in its pocket and probably control the private sector," one analyst said.

The cash-rich Distilleries Corporation has provided most of the funds for Mr. Jayawardene's recent buying spree.

Eyebrows were raised over his acquisition of a major stake in HNB some years ago which he backed with a huge stake in Aitken Spence, one of Sri Lanka's three biggest conglomerates listed on the stock exchange.

For the moment the dust has settled in the Sampath drama and a Harry Jayawardene-target has for the first time gone beyond his reach. What would be his next move?

Big battle at BMICH

The crowds had gathered as early as 6 am at the BMICH on Friday from across the island.

The stretch of Bauddhaloka Mawatha from the All Ceylon Buddhist Congress Building to the BMICH and Longdon Place junction was chock-a-block with buses and traffic.

Nearly 5,000 people mostly Buddhist monks and small businessmen had assembled at the BMICH for the crucial annual general meeting of Sampath Bank. Buses, carrying shareholders from all over the island, had parked on the road where the Otters Club is located. The same road was used by the nine directors of Sampath Bank to drive through the back entrance of the BMICH and enter the premises through the back door due to a tense situation.

The bank has more than 16,000 shareholders and most of them were present in a joint effort with the bank directors to prevent a takeover by the Hatton National Bank and multimillionaire businessman Harry Jayawardene and his companies. Sampath Bank directors met at an undisclosed location and then drove in two cars, escorted by police, to the BMICH through the hall's side entrance. In the meantime, hundreds of shareholders who had gathered from morning had been allowed into the hall, which was filled to capacity and overflowing.

Sampath staff, which successfully cooperated with its management to prevent the takeover, had mustered enough numbers of shareholders to fill the hall. Insiders said HNB management had also brought about 300 to 400 people to support their bid . But they stayed in separate conference rooms at the BMICH and did not move in.

(See Business Pages for details on meeting)

Sampath Bank officials said their resistance against the HNB/Harry Jayawardene high-stakes battle to take over the bank received a lot of support from the public, the Buddhist clergy, the Mahabodhi Society and international groups. Anil Moonasinghe, president of the Mahabodhi Society of Sri Lanka, said in a statement that veteran banker N.U. Jayawardene set up Sampath some years ago to be run with respect to Buddhist principles where it would neither lend capital to run liquor stores and bars or lend money for activities "in the taking of life."

He said although it appeared diverse persons purchased the bank shares, it was clear that this was a concerted effort by HNB and companies controlled by Harry Jayawardene against the national interest and particularly against the competitive background of local banking. The Mahabodhi president who is also the deputy speaker of parliament, urged the governor of the Central Bank and the Monetary Board to take action under the Banking Act "to prevent Sampath Bank being overwhelmed in this manner." Central Bank governor A.S. Jayawardene could not be reached for comment on the crisis.

The Asian Pacific Organisation of the Union Network International an international trade union secretariat representing 15 million workers worldwide sent a letter to President Chandrika Kumaratunga urging her to intervene in the crisis and take appropriate steps to abrogate the hostile acquisition.

Sampath employees also wrote to the president and the central bank governor to resolve the crisis. The saga saw HNB Managing Director Rienzie Wijetilleke and Sampath Bank chairman Edgar Gunatunga trading accusations on various issues closer to the meeting.

The share shuffleThe 20 largest shareholders of Sampath Bank as at 31st December 1999 Name % of shares 1) BSTT Investors Pacific International Fund 9.26 2) Hatton National Bank (A/c No. 1) 8.77 3) National Development Bank (A/c No. 3) 8.11 4) DFCC Bank 4.01 5) Distilleries Co. of Sri Lanka 3.13 6) Bank of Ceylon 2.82 7) HSBC International Nom. Ltd CMB-Abu Dhabi Investment Auth GT 2.37 8) M.S.H. Packaging Industries Ltd 2.03 9) S.E. Captain 1.95 10) Mercantile Credit Ltd 1.68 11) Bank of Ceylon A/c Ceybank Unit Trust 1.53 12) Stassen Exports Ltd 1.35 13) Citi Bank New York S/ Barclays Global Investors NA 0.98 14) HSBC Intl. Nominees Ltd - Bank Julius Baer 0.90 15) Central Finance Co Ltd (A/c No 3) 0.73 16) Capital Development Investment Co Ltd 0.73 17) Deutsche Bank Capital Markets (Asia) Ltd/DG Bank 0.68 18) Paints and General Industries Ltd 0.53 19) H.H. Abdulhussein 0.51 20) I.W.Senanayake 0.50 Here is how HNB and Stassens group (Distilleries Co. included) increased their holdings in the past few weeks Hatton National Bank 10.05 HNB-EPF 4.92 Distilleries Co 4.99 Stassen Exports Ltd 4.99 Smart Development (Pvt) Ltd 2.08 Masons Mixture Ltd 0.80 D. N. Daluwatte (DGM- HNB) 4.97 M.U.de Silva (senior DGM-HNB) 4.29 P. Singappuliarachchige Don 3.27 |

What the law says

Provisions of connected laws in relation to the controversial transactions. According to the Banking Act No. 30 of 1998 no single shareholder or group of people can hold more than 20 percent of the share capital of a licensed commercial bank, out of which an acquisition of over 10 percent requires the written concurrence of the Minister of Finance and the Monetary Board.

According to the Takeovers & Mergers Code of 1995, once a group of people acting in concert have acquired more than 30 percent of the shares of the company, they are required to make an offer to the other shareholders to purchase their shares at the highest price. Interestingly, the Securities and Exchange Commission (SEC), which has been accused of dragging its feet over the dispute, ran an advertisement in the Daily News on Tuesday, June 27 calling for public representations on revising and updating the Takeovers & Mergers Code.

"While seeking to provide greater protection to minority shareholders, the new code will seek to facilitate takeovers and mergers as an instrument of economic development," it said. "The timing of the advertisement was unfortunately more of a coincidence and not connected to the Sampath issue. We had been planning this advertisement for a long time," noted an SEC official, when asked whether the Sampath Bank issue and a call to revise the code were connected.

![]()

Front Page| News/Comment| Editorial/Opinion| Plus| Business| Sports| Sports Plus| Mirror Magazine

Please send your comments and suggestions on this web site to