26th December 1999

Front Page|

News/Comment|

Editorial/Opinion| Plus|

Sports|

Sports Plus| Mirror Magazine

![]()

Tourism on the up

The

industry has sustained the momentum gained in winter 98/99, with summer

1999 (May-October) arrivals up 15% compared to the same period last year.

The upturn in Western European arrivals has been the catalyst for this

growth and is a direct benefit to the resort hotels since most arrivals

are leisure traffic. Arrivals from East Asia are also up 30%, mostly due

to the impressive growth in Japanese arrivals (up 30%). This growth over

the last winter and summer seasons has been facilitated by the lack of

conflict outside the theatre of war in the North and East and the consequent

easing of Travel Advisories issued by Western countries. Sri Lankan Airlines

also carried out a special promotion in Japan through April and May '99.

The

industry has sustained the momentum gained in winter 98/99, with summer

1999 (May-October) arrivals up 15% compared to the same period last year.

The upturn in Western European arrivals has been the catalyst for this

growth and is a direct benefit to the resort hotels since most arrivals

are leisure traffic. Arrivals from East Asia are also up 30%, mostly due

to the impressive growth in Japanese arrivals (up 30%). This growth over

the last winter and summer seasons has been facilitated by the lack of

conflict outside the theatre of war in the North and East and the consequent

easing of Travel Advisories issued by Western countries. Sri Lankan Airlines

also carried out a special promotion in Japan through April and May '99.

Factoring the current bookings for the winter season it is possible that the industry will hit an all time high in arrivals from key Western European destinations (Austria, France, Italy, Germany, Netherlands, Switzerland and UK). During winter 1998/99 the industry recorded an all time high in seasonal arrivals from these destinations (152,952). The recently concluded summer season (May- Oct '99) also registering record arrivals. Of the total arrivals to the country a substantial portion is on non-leisure tours. It is estimated that only around 50% of the total arrivals to the country is leisure traffic, though this proportion varies from source to source.

Average countrywide occupancy over the year has been up 10% against last year. Occupancy levels at graded hotels have shown higher growth compared to the average countrywide. However, off-season (summer) utilization is well below capacity and there is great potential to improve on off-season performance.

East Asia .......a complimentary factor

The industry has successfully absorbed the impact from the East Asian Crisis recording gains as against the concerns of stiffer competition. This is partly because the Sri Lankan travel industry is small compared to East Asian destinations like Thailand which receives 7-8mn arrivals per annum. Thai arrivals during the rate slumps went up to approximately 10mn. The Thai industry, unlike Sri Lanka, is not seasonal, and Sri Lankan tour operators consider the higher influx into Thailand as complimentary to Sri Lanka.

Given the similarities between Thailand and Sri Lanka, it is thought that increased promotions by Thailand, which has attracted the long haul traffic into the region has also aided Sri Lankan long haul arrivals. In this context, the Maldives is also regarded as a destination complimentary to Sri Lankan tourism.

Excess capacity in the region, which led to rate cuts, is easing with the improvement in the flow of intra-regional traffic (30-35% of arrivals to the regional countries prior to the Crisis). Though the rates in US$ terms in East Asia are still below pre-crisis levels they have risen significantly since hitting lows. High gearing (foreign currency borrowings) in many hotels in the region has acted as a floor on rates.

The Thai Baht has appreciated nearly 25% since January '98 to date against the US dollar and has recovered most of the value lost during the East Asian Crisis (Thai Baht to US$ June '97-THB 24.3, Jan '98-THB 52.5,Oct '99- THB 39.4).

The real competitors....

Competition varies by product and market segment. Given that the Sri Lankan product encompasses wildlife, culture and beaches, leading tour operators consider Mexico and Kenya as providing direct competition to Sri Lanka. These countries, though geographically apart, offer similar products and target similar market segments in long haul markets. However, the geographically closer countries such as Thailand and the Maldives are more complementary as Sri Lanka also peripherally benefits from increased tourist flows.

The absence of a negative element like Sri Lanka's North East conflict gives them an added advantage, and tour packages to these countries command better prices in Western markets when compared to Sri Lanka.

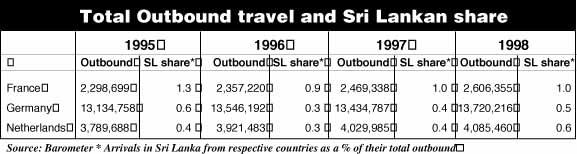

Market share... See Table (A)

Although the outbound travel in these key markets have shown steady growth, the Sri Lankan share continues to be negligible, and even that has fluctuated with the intensity of the war. The tour operators and the hotel industry are of the opinion that there is a significant upside potential for Sri Lanka and any impact from economic downturns may not be drastic. However, it should also be noted that Sri Lanka continues to attract budget traffic, due to the ethnic conflict, poor image building and a lack of products. In an economic recession, it is the lower end of the market which is likely to be affected most.

Why is the potential not tapped?

Indian potential........ overlooked !

Despite tremendous potential and ad hoc interest shown in developing the Indian market, Sri Lanka has not made any noteworthy progress in tapping this vast market.

Though there have been intermittent promotions to market the destination amongst Indian tour operators by various local tour operators, this is seen as inadequate considering the size and diversity of the market. A sustained and concerted effort with the necessary financing to reach a minimum audience is needed to develop the market, whose potential is considered to be as lucrative as that of western markets. Sri Lanka is a destination that can be marketed alongside the famed resort destinations of India such as Cochin, Goa and Agra given that the airfare, which is equivalent to the Indian domestic rates, is much lower as against the long haul rates from Western Europe. This will enable the industry to offer much better packages. It is estimated that approximately 40-50% of the value of a European tour package to Sri Lanka is airfare.

The middle class Indian population of 300mn. is the same number as the entire population of Western Europe. It is estimated that the per capita annual income of the middle class ranges from US$10,000-US$600,000 in PPP terms, with the upper middle class real annual income estimated at US$120,000. The 40mn. population of the Indian upper middle class is also too lucrative to be ignored, along with the potential in the upper class. The entire middle class in India is estimated to grow at 5-10% p.a. Though the overall per capita income of the population stands at less than US$500, the opportunity lies within the middle class. It is estimated that the average middle class traveler spends more money on domestic tours in India than the average western tourist in Sri Lankan hotels.

The infrastructure is a serious impediment in the development of this market. Indian routes are frequently overbooked and the number of flights are inadequate even for current demand. A significant improvement in the number of flights to Indian destinations is needed if the market is to be developed and sustained.

Indian domestic airlines such as Sahara and JetAir need to be encouraged to fly charters or regular flights to Colombo. The visa procedure is another impediment, though this is a difficult issue to tackle given the current security situation. However, measures have to be taken to make it convenient for the traveller to obtain visas. Hotels will have to adapt on guest relations and food and beverage as they are now geared to cater to Western European markets.

Promotion inadequate

Image is considered the key factor in creating and sustaining the desirability of a destination. Though Sri Lanka has tremendous potential for its culture, heritage, beaches and wild life, this has not been effectively communicated to the end user. The industry has traditionally been concentrating on push strategies, targeting the international tour operators and relying on them to sell the destination and the hotels to the end user. Though the industry is aware of the inadequacy of this strategy in developing and sustaining an image and attracting a quality clientele (i.e. high spenders), it has not produced a sustained campaign to achieve this objective due to financial constraints.

Sri Lanka would need a large budget if it is to run a successful promotional campaign, given the size of its major tourist markets, Germany, France, Austria, UK, and Netherlands. This, given that the image needs a complete transformation from a budget destination to one sought after for product features such as eco-tourism, beaches and heritage sites. For example Thailand spends an Average US$50mn on promotions per year. Australia US$100mn and South Africa US$25mn.

It is quite apparent that there has to be a joint effort from the private the public sector and the Government, to plan, fund and implement a sustained campaign to develop the country's image. Tourism is Sri Lanka's natural strength, and its benefits have not been maximised due to a lack of proper policy.

Sri Lankan Airlines and the Government have jointly funded a US$1mn. campaign with the theme "beaches and beyond" over the last few months in key European markets, UK, Germany and France. The campaign was carried out through the press and magazines and not on TV, which is regarded as the vital media in image building. The industry expects this to aid arrivals during the current season. However, long term success will depend on a sustained and effective campaign which is adequately funded.

The presence of internationally acclaimed resort and hotel chains is also vital to attract major tour operators and airlines, quality clientele and to reposition the country's image as a sought after destination

Eco tourism.....great potential

Sri Lanka is blessed by nature and wild life which could be utilised in an environmentally friendly manner to position Sri Lanka as one of the top sought after "Green" destinations. "Green" destinations are a fast growing concept encompassing environmentally sustainable tourism and development. Many destinations are vying to achieve this label with campaigns to reposition themselves and are improving their infrastructure to augment the offering.

Costa Rica is regarded as a destination that has successfully positioned itself as a green destination. The Green Globe Association, regarded as a prestigious institution in promoting environmentally sustainable development, has awarded the Green Globe award for environmental excellence to Kandalama Hotel. The association has endorsed Costa Rica as a "Green destination" which has greatly benefited their eco-tourism. Sri Lanka too has the necessary features such as tropical forests and wild life and can earn the same endorsement enhancing the country's image.

Though the Travels and Hotels industry has been working on developing this segment with various activities such as limited camping facilities, trekking, white water rafting and bird watching, it has been in an adhoc manner and not as a fully fledged eco based package. International tour operators market wild life and nature based packages for countries like Kenya, Costa Rica, Tanzania and Zimbabwe which encompass stays in wild life areas. In this regard, Sri Lanka is still at a very teething stage without a clear direction as to how this product should be developed. It is essential that there is a concerted effort to develop this segment whilst preserving the environment.

Whilst direct benefits to specific hotels from the development of this segment will vary depending on their location, the industry in general would benefit from the inflow of an improved clientele and would aid in easing the seasonality of tourist arrivals to Sri Lanka. Off-season arrivals could well be boosted if this segment is effectively developed and sustained.

Infrastructure.....far from good

Domestic transport and highways

The discerning traveller faces a culture shock on the first day of his trip to Sri Lanka mainly due to the highway system .The highways, in areas with potential for cultural & eco-based tours, are of a poor standard and need drastic improvements if the high spending traveller is to be attracted. Domestic transport had been a problem for the industry and the Government has approved duty free imports of buses for tour operators.

In addition, the absence of domestic air travel is another significant drawback. The domestic air services that were provided by the industry were very popular with tourists until it was halted by the government on security concerns.

Flights and airport services

The restriction on Charter flights have been all but removed by the Government, and this is expected to give the industry a tremendous boost considering the proportions of leisure traffic flown in by the Charters. However, it should be noted that for the destination to thrive, a sustained and steady flow of international flights is also essential.

Restrictive air policies and expensive airport services are considered key factors in discouraging international flights. The Ceylon Petroleum Corporation has a monopoly on fuel supplies and Sri Lankan Airlines a monopoly over ground handling, the charges for both services are considered high by international standards. Privatisation of Sri Lankan Airlines is expected to solve some of these issues. However, changes need to be made to make these services competitive and attractive enough for international airlines to fly regularly to Colombo.

Sri Lankan Airlines is re-fleeting with a number of new modern aircraft. The airline will fly direct flights to and from key European destinations and add new destinations (Australia, Scandinavian destinations and Beirut) in the upcoming winter season. These developments will boost the winter traffic and will aid the industry.

Attracting internationally renowned hotel chains

The

presence of internationally renowned hotel chains is important for a destination

and whilst being a necessary element for a discerning traveller, is also

a strong factor in enhancing the image of a destination. The presence of

resort chains like Four Seasons and Banyan Trees has been a significant

factor in making the Maldives a sought after destination for the high-end

market traveller. Four Seasons is due to commence operations in India shortly

increasing its presence in the region. This is expected to be a boost for

the Indian destination's overall offering and in strengthening its position

as a sought after destination.

The

presence of internationally renowned hotel chains is important for a destination

and whilst being a necessary element for a discerning traveller, is also

a strong factor in enhancing the image of a destination. The presence of

resort chains like Four Seasons and Banyan Trees has been a significant

factor in making the Maldives a sought after destination for the high-end

market traveller. Four Seasons is due to commence operations in India shortly

increasing its presence in the region. This is expected to be a boost for

the Indian destination's overall offering and in strengthening its position

as a sought after destination.

Even though the ethnic conflict has been the overriding factor in keeping the "top" names out of Sri Lanka, other factors also have played a role. Proper infrastructural, regulatory and other investment related support should be extended in a proactive manner to attract these chains.

Other facilities

Sri Lanka needs to develop other facilities such as quality golf courses . In most of the resort areas the tourist has no alternative but to have his meals in the hotel restaurants. These areas lack quality restaurants outside the hotels and there is hardly any entertainment for guests other than for what is offered within the hotel. For instance, although there is substantial potential to develop beach related entertainment activities this has not happened.

Economic turnaround in Western Europe....

The Economies of major tourism generating countries for Sri Lanka, Germany, France and other Western European countries are rebounding from the slowdown in the 2H of 1998 due to the effects of the Asian Crisis. On the back of improving net exports and domestic consumption most of the European economies have shown positive growth in 1H 1999. With further Millennium related spending the Euro economy is expected to record a growth of over 2% YoY in 1999.

Income levels will have a direct bearing on the level of outbound travel from these countries and expenditure on overseas tours. Particularly the lower end of the market, which is the major portion of Sri Lankan arrivals, is likely to be more sensitive to economic cycles. Incentive tours offered to employees by companies, a fast growing segment, will be affected in the event corporate earnings are affected by economic downturns.

However, it should also be noted that there have not been wide fluctuations in the level of outbound travel with economic cycles, but the level of expenditure on overseas travel is likely to fall in the event of an economic downturn. In the current context of increased prospects for further economic growth, we believe, the levels of outbound travel from these markets and their expenditure on overseas travel will grow through Y2000 as well.

Capacity and concerns of infrastructure

The industry, if it sustains the current growth levels, will be at full capacity through the current winter season. Further growth in arrivals over the next winter season will need new capacity through expansion to the existing hotels or new hotels have to come in. Marginal growth might be achieved through improvements in off-season performance but this will be very limited until the security situation improves and the East Coast is open to the industry. Tour operators are also focusing on improving arrivals during the periods just before and after the peak season, thereby effectively extending the period of the season.

We believe, significant investment in the sector is unlikely unless the security situation eases. If the present momentum is sustained, the current industry players are likely to take the lead in making new investments.

The other option to improve earnings is through higher rates. This is dependent on the effectiveness of promotional campaigns and infrastructure improvements.

Developing the off season performance

For its long term success as an industry offering an adequate return on its investments, it is necessary that the performance of the industry over the off-season (May-October) is significantly improved. The occupancy rates during the off-season now average less than 45% and the room rates achieved are also lower than the seasonal rates. As such, off-season performances, tend to be around break-even levels with the dependence on seasonal turnout for a reasonable return. With capacity restrictions during the season and macro issues affecting rate gains the industry faces an earnings cap unless off season performances are improved.

Sri Lanka's key feature is its beaches and rough seas during the period May-October off the Western and Southern Coast is a major drawback in improving arrivals during this period. In this regard, access to the East Coast is eagerly awaited by the industry.

However, improvements in image, infrastructure and eco-tourism will aid off-season arrivals. Thailand and Maldives, for instance, do not have significant seasonality and record impressive year round performances.

In addition, winter in May-October in the Southern Hemisphere allows the industry to promote this destination to these markets and attract more of their outbound travel. The industry is also focusing on arrivals during the periods just prior to and after the peak seasons, in effect, extending the season.

However, the prevalent security situation will be the most crucial factor notwithstanding any of the above factors, for the industry to maintain its current momentum. If relative calm in areas outside the North and East continues and there is no major incident on the War Front, the hoteliers and tour operators consider it very likely that the industry will achieve significant growth in year round occupancy and rates from Y2000 onwards.

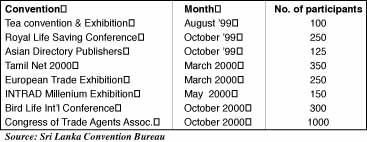

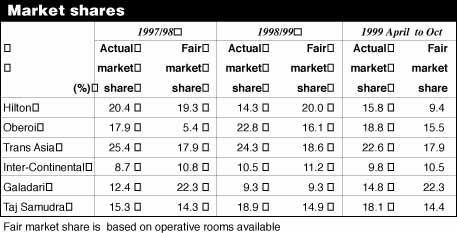

City hotels........limited prospects See Table B and C

Hotels in Colombo recorded a growth in business despite the increase in number of rooms (after the reconstruction and refurbishment of Galadari and Hilton) during summer 1999. However, the growth levels were not as high as those achieved by the resort hotels. The city hotels are predominantly patronised by business traffic and the general slowdown in the economy, coupled with the slump in arrivals from East Asia, saw a drop in business traffic over 1998.

Leisure oriented arrivals from East Asia, during May to October (particularly from Japan - up 30% YoY), who tend to patronise the city hotels more than European tourists, and a shortage of rooms in resort areas during the periods November to March were the main factors that improved business for city hotels. For this reason, rates and occupancy levels were maintained despite an increase in the number of operative rooms in the city. However, the slowdown in the economy and cut back in corporate spending has resulted in Food and Beverage revenues from out-house clientele declining over the past 6-8 months.

It should be noted that a number of Western countries still maintain Travel Advisories advising tourists to avoid Colombo, though there are indications these will be gradually eased. It is feared that the return of all the players in the market, after the closure of some of the hotels due to the damages from the Galadari bomb, may affect the fragile understanding between the industry players on room rates and may result in price discounts once again.

The city hoteliers expect a boost in earnings over the December season due to Millennium related celebrations but are concerned about election related violence. Some of the city hotels have already received cancellations due to the elections.

Business events and conventions in the city have a positive impact on the level of occupancy and an upsurge in these events will benefit the city hotels. However, an increasing number of corporate resident seminars conducted by local companies have been shifting to outstation hotels with the improvements in facilities in those hotels.

Unless and until there is an upsurge in the level of commercial activity in the country, and a consequent growth in business activity, we do not anticipate significant growth prospects for city hotels.

Earnings to generate noteworthy gains

Improvements in receipts...volume led

Though the receipts during 1998 showed significant gains over 1997, it now shows signs of flattening out. Receipt per tourist upto August 1999 was US$603, which was the same for the corresponding period in 1998 (1998 year end average -US$606). This reflects the trend in US$ rates where a few well positioned hotels made marginal rate gains in US$ terms but for other hotels the only source of rate gain was the depreciation of the rupee (1998- nearly 11%, 1999E- 6%). The current winter season is expected to show marginal gains in US$ terms which would improve earnings, but the receipts are still predominantly volume led since Sri Lanka still struggles to reposition itself and attract better rates.

If the current trend continues it is likely that the industry will be in a good position to command better rates by winter 2000/01. However, it should be noted that the Sri Lankan industry is still aiming at long-term survival, with the North and East Conflict still a deterrent. The industry has been successfully marketing selective hotels to the more affluent traveller, along such themes as Ayurveda facilities, Green culture etc. However, it has been at a very slow pace due to the absence of an integrated campaign targeted at the consumer in western markets. We believe, further noteworthy rate gains (in US$ terms) would be dependent on effective repositioning, infrastructural improvement and the security situation in the country.

Cost structures and the impact of inflation.....takes off most of the gains on rupee depreciation

The predominant portion of costs are fixed on account of such items

as administration, staff, energy & maintenance. Hotels tend to recruit

an increasing number of minor staff on a casual basis so that at times

of slack business they can be laid off.

With rising costs in relation to energy / maintenance and administration, it is apparent that most, if not all, of the gains on the depreciation of the rupee is absorbed by inflation.

Interest rates.... favourable impact likely

Since the lowering of the Statutory Reserve Requirement by the Central Bank, interest rates have fallen. One year TB rates are around 12.3%, down from the 12.6% in April '99. With the apparent slowdown in business activity in the country, demand for commercial loans have slackened, and this is likely to stabilize interest rates unless Government borrowing in the local market increases drastically.

Considering the relatively high gearing (debt/equity) of hotels (estimated average-39%), fluctuations in interest rates will have an impact on the bottom line. We believe, the prevailing interest rates would further aid the bottom line over the current financial year.

Earnings...

June '98 and '99 earnings are negative mainly as a result of Ceylon Holiday Resorts closing two of its hotels for refurbishment

We have plotted the average earnings of well managed and marketed hotels against the quarterly arrivals from key markets, such as Austria, France, Italy, Germany, Netherlands, Switzerland and UK. Over the years, particularly towards the end of 1998, earnings have improved as against the levels of arrivals, indicating gradual improvement (though very marginal) in the quality of arrivals and efficiency of management.

Rates in US$ terms remained flat with a few well positioned hotels recording marginal gains. Higher occupancy levels enabled most of the well managed hotels to record noteworthy earnings growth over the period.

Most hotels, during the current season, are expected to operate at full capacity, with the well positioned hotels facing an issue of over-selling. As such, a good number of hotels will face a cap on earnings growth beyond the current season, unless there is improvements in off-seasonal performance and/or rates in US$ terms. Depreciation of the rupee, expected to be 8% by the end of the year, will be the key factor in increases in rates (together with marginal rate increases in US$ terms). Nevertheless, most, if not all, of this gain will be offset by cost increases due to inflation.

We expect the industry to post strong earnings growth, unless there is serious setbacks due to the elections or North East situation. Lower interest rates will be a plus factor, with the impact from inflationary pressures more or less fully covered by the gain on rupee depreciation.

Risk/ return considerations

Considering the quality of arrivals and the rates generated, it is considered that the most viable and highest yielding hotels are those in the 3-4 star grades. Investments in 5 star properties, though carrying an edge in marketing, still do not yield returns to compensate for the level of investment. As such, we continue to believe that significant returns to minority shareholders will accrue if and only when there is a balance between high construction costs, high interest rates and price sensitive budget travel to Sri Lanka.

With effective repositioning of hotels and astute management, it is likely that selective hotels will gradually move higher in the market and yield noteworthy gains in rates.

In addition, the tourism industry and the hotels sector in particular, is likely to be one of the few industries shielded from the adverse competitive fallout of trade developments such as the South Asian trade pact, WTO world trade liberalisation pact etc. However, long term success will depend on how effectively infrastructural and promotional issues are handled.

Investor considerations......

Most listed hotels are closely held and the resulting illiquidity together with low and negative earnings has meant that the sector has been trading at very high P/E ratios, presently 14.3 on historical earnings (market P/E 6.4), in spite of trading below book value (PBV of 0.7). Hence, even with an industry turnaround, it will be a while before any substantial upward revision of prices can be expected from the industry. We continue to recommend companies with reputed and experienced management, sound marketing, integrated services (including diversified offerings and tie-ups with strong tour operators), low gearing and a history of fairness toward minority shareholders.

NDBS Monthly update-December '99

SLT gets rating for Rs 1.5b debt

Last week Sri Lanka Telecom (SLT) received AA + rating from the recently set up rating agency Duff and Phelps Credit Rating Lanka Ltd.

SLT became the first unlisted company to get a listing for their Rs. 1.5 billion debt to be issued in January.

A DCR news release says that an AA + local rating extremely high credit quality as SLT's creditworthiness differs marginally from the implied SL AAA rating of the Government of Sri Lanka due to external risk factors and changes in policy environment. Current economic, political, and technological, market, and social transformations taking place locally and globally have accelerated the development of the telecommunications sector. While the political and regulatory environment in Sri Lanka favours open market competition, penetration levels remain low due to stagnant economic growth exacerbated by the protracted civil war and external macro economic shocks.

Divested in 1997, SLT is the strongest, most established and diversified service provider in the market, and has played a pivotal role in meeting the growing communication demand both in the fixed and mobile market. As evidenced by high capital expenditure and foreign currency debt outstanding, free cash flow will be constrained, as SLT has invested heavily in infrastructure development to capital expenditure and foreign currency debt development to capitalise on the growth potential.

As of June 30 1999, total debt outstanding was Rs 28 MM (US$ 395 MM). Approximately 40% of loans are foreign currency denominated with 27% of total loans in USD as of June 1999. Capital expenditure, which is largely discretionary, will be finances by borrowings until 2002. Thereafter, SLT is expected to fund its capital expenditure entirely from internally generated funds. Total debt-to-capital ratio is projected to remain below 59% and improve steadily from 2000.

Post privatisation proves that NTT has been instrumental in making SLT a financially viable and efficient company by offering competitive prices, providing quality, diverse and speedy service. This rating has taken into consideration, SLT's strong financial performance as evidenced by historical EBITDA coverage of interest expense of greater than 3.9 times (X) and Total-Debt to EBITDA of less than 2.7X. Year 2002 and beyond, SLT faces several challenges that will possibly hinder the future financial health and debt repayment capacity due to the loss of international monopoly and increased competition. SLT has successfully mitigated future risks by adopting a number of pre-emptive strategies. In view of the rapid decline of inward remittances from international in payments, SLT has positioned itself to accomplish growth by implementing a tariff rebalancing strategy to eliminate the cross subsidy that currently exists between local and international tariffs.

SLT has also given priority to network expansion. Currently 200 projects are underway to meet the growing demands. Further measures have been taken to improve the operating environment by improving working conditions, collections and marketing. Going forward despite changes in the economic , regulatory, political and business policy environment, DCR Lanka remains optimistic of the future financial and operating performance of SLT as it has the capacity and ability to be a top corporate in Sri Lanka.

In our last week's issue a news story on the SLT rating and debenture on the front page had the SLT chairman's name inadvertantly as Mr. Hemasiri Fernando who was the ex chairman of SLT. The present Chairman is Mr. Lalith de Mel

![]()

Front Page| News/Comment| Editorial/Opinion| Plus| Business| Sports| Sports Plus| Mirror Magazine

Please send your comments and suggestions on this web site to