|

1st August 1999 |

Front Page| |

|

New board to regulate insurersBy Mel GunasekeraInsurers will be regulated by a board instead of the controller if proposed new laws are passed. The new law says that insurance companies will have to get a listing on the CSE and also get a licence to operate. New laws will also not permit commercial banks, development banks and registered finance companies to function as brokers. The new law expected to be tabled in parliament shortly replacing the existing Control of Insurance Act (No: 25 of 1962) also refers to the establishment of an insurance fund. With the proliferation of insurers and brokers, regulators have decided to amend the Control of Insurance Act to eliminate weaknesses. Licensed commercial banks, development banks and registered finance companies will not be able to function as an insurance broker or be registered as an insurance broker under the provisions of the new bill. A copy of the new insurance law obtained by The Sunday Times Business shows that a statutory Insurance board will replace the Controller of Insurance with powers to register supervise and regulate the industry. The board of seven appointed by the minister, will be initially financed by the Treasury and at a latter stage from a maximum 0.5% cess of each insurance company's net premium income. The Minister can issue general directives to the board on policy. The board's top function would be to monitor the financial viability of insurance companies to ensure they would be able to meet the legitimate claims of policyholders. Accordingly, the regulators will raise the present share capital (amount not specified) to keep pace with inflation. All insurers operating in Sri Lanka would have to be registered and licensed by the board. To qualify for registration, an insurer should be a public company and fulfill other requirements yet to be determined by the board. An annual licence fee will be charged under the new Act, though there are no such provisions in the present Act. Insurers will be have to get a quotation on the CSE within one year from the date of registration. Insurance Funds, one for life and one for general business have to be maintained. The board could prescribe the solvency margins for various categories of insurance. Insurers will have to maintain at least 20% of the General Insurance Fund assets and 30% of the Life Fund assets in government securities. The present requirement to give 15% of gross annual premium received under contracts and policies of fire and marine insurance as reinsurance to National Insurance Corporation has been deleted since it is another insurance company competing for insurance business. Insurance agents will not be recognised under the new law, which permits only individuals to be employed as agents by insurers or by brokers. To compensate corporate entities for the removal of right to be institutional agents they will be made eligible for a quantity discount from the premium. Brokers should be corporate entities with a minimum prescribed share capital. The Insurance board will have the power to fix minimum tariff rates in respect of motor, fire and employers liability insurance and also the maximum for motor insurance. The board could prescribe the maximum rate of commission to be paid by an insurer to intermediaries.

More securitised debt from Mercantile LeasingMercantile Leasing Ltd (MLL) will issue the second tranche of Rs. 200 mn in securitised debt later this month. MLL entered into the largest ever asset backed securitisation so far of Rs. 800 mn with Citi National Investment Bank. The first tranche was placed in June, senior company officials said. A trust has been incorporated solely for this purpose, with Deutsche Bank AG being appointed trustee. The second tranche of Rs. 200 mn will be issued in trust certificates from three to 45 months tenures. The debt, issued in trust certificates of Rs. 100,000 denomination, will have a zero-coupon upto 12 months and a coupon thereafter, MLL Managing Director, Ranjith de Silva said. Securitisation is the process of pooling together a group of receivables from financial assets and the issuing of fixed income instruments to investors based on the strength of the stream of cash flows. The transaction pools together a number of lease receivables arising out of lease contracts between the lessor (MLL) and the lessees, de Silva explained. MLL will act as a servicer to collect the lease rentals and deposit them on receipt to the trust account. MLL also undertakes to substitute performing contract for any non-performing contracts. Mr. de Silva said that the issuer has to execute a mortgage over the leased assets in favour of the trust. In the event the lessee defaults on the rental payments and the issuer is unable to service the lease, the trust is in a position to execute the mortgage and use the proceeds from the sale of the asset to service the trust certificates. Payments to investors are on a quarterly basis but rentals are collected monthly. MLL's shareholding structure underwent a significant change with the NDB Group acquiring a 30% strategic stake in 1998. At present there are over 32 financial institutions granting leasing facilities with a Rs. 15 bn portfolio. Central Finance and LOLC are the market leaders, with MLL controlling 8% market share. The industry is expected to grow at an average of 12% - 13% in the future. MLL recorded an unprecedented 200% growth in leasing volume last year, surpassing the Rs. 1 bn mark for the first time and in the process doubling its market share. The growth was due to new funding lines, organisational re-structuring and improvement in operating procedures, MLL Chairman, A N U Jayawardena said. MLL turnover in 1999 recorded a 64% growth mainly from an injection of fresh funds after the change in shareholding structure. However, MLL embarked on strategy to reduce interest rates to attract new clients in the low risk category. This has resulted in lower net profit margins as well as lower interest cover, Mr. Jayawardena said.

Team up for more clout, says ex regulatorBy Dinali GoonewardeneSecurities and Exchange Commission (SEC) and the Registrar of Companies, should be amalgamated for more effective regulation suggests a former high profile regulator. Ex SEC Director General, Arittha Wikramanayake told The Sunday Times Business that such an amalgamation would give more clout to regulation. Mr. Wikramanayake was commenting on the proposed changes to the Companies Act now with the legal draftsman. At present both listed and unlisted companies are regulated by the Registrar of Companies while listed companies are additionally regulated by the Colombo Stock Exchange and SEC. "The Registrar of Companies is ineffective and this has created a wide disparity between regulation over listed and unlisted companies. This is a disincentive for companies to list," Mr. Wikramanayake said. He added that the government-funded Registrar of Companies could not afford to employ on government salaries the multidisciplinary team required to enforce effective regulation. Formed under an Act of Parliament, the SEC is self funded, and very effective. Regulation of unlisted and listed companies is carried out by one regulator in most countries. The Companies Act, now being redrafted, permits companies to do away with annual general meetings (AGM) with the consent of at least 80 per cent of the shareholders. This is justified on the basis that it facilitates the operations of the company. "This provision ignores the fact that most Sri Lankan listed companies have a very limited public float. The only avenue for shareholders to voice their concern is the AGM," Mr.Wikramanayake said. Most boards of directors are answerable to shareholders for their actions when they face them at the AGM. Doing away with the AGM would lead to shareholders being marginalised further, Mr.Wikramanayake said. If the company is unable to pay its debts when they fall due, the draft act requires directors to call a meeting to determine whether a liquidator should be appointed. Failure would make them liable to make good creditors losses.

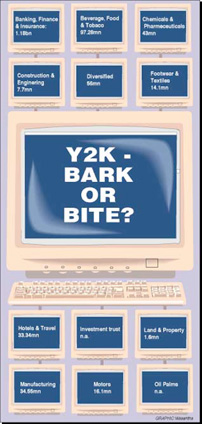

All this expense... is it really needed ?Who says the Y2K bug would not affect Sri Lanka? Well if it does not affect us how come 70 Sri Lankan companies spent an estimated Rs. 1.5 billion on Y2K related activities, according to SEC figures companies amount to less than 30 per cent of the total listed companies and probably a fraction of the country's businesses and households. The SEC last year required all listed companies to disclose the company's Y2K readiness in their annual reports. Although most companies complied, some companies left it out since their companies were not automated. It is estimated that at least Rs. 2 billion will be spent on Y2K related activities in Sri Lanka. But the question is was most of this really spent on Y2K readiness activities? Y2k is biting our purses not date integrated appliances. The finance sector, by far the largest to be automated, is estimated to have incurred the bulk of the cost having spent Rs 1178.68 million on Y2K compliance. They had the layout expenditure because all companies had paid constancy fees and some paid for upgrades. But, industry sources say that the bulk of the money went into purchasing equipment, mainly computers. We understand that most companies got their equipment in the recent past. Therefore they were probably compatible already for those who had old systems as it was time anyway to replace the old systems because they were obsolete. Ancient in terms of computers. The long and short of it being that this was a good opportunity for companies to get their systems on line.

Mind your businessBy Business BugLook outIf you thought the cellular war was over when the networks stopped their discounting, you are surely mistaken. Now, agents for cellular phones have entered the fray and are marketing with a vengeance, phones for as low as four thousand rupees. Some agents, unable to compete in this cut-throat environment have asked the authorities to intervene but the answer has been a polite 'no', so consumers can hope for more discounts coming their way.... Book ployInternational schools are big business but it can be made into an even bigger business when contracts are signed with bookshops. In return for a fee some such schools send out booklists to parents with instructions that all items should be purchased from a particular bookstore. Some parents have protested at this illegal practice and an inquiry is underway.. TV Ad warWhen it comes to advertising on television, the clients are relatively few though there are many TV stations. So, there is a silent war among the TV stations to capture advertising even though viewers may feel that they are bombarded by too many commercials. One network is now trying to entice advertising away from its more established rivals by offering the lowest rates among local TV stations but still there are few takers, they say. And that explains why there are so many ads featuring family businesses..

South East Asian optimism peps up bourseOnce again there is an air of optimism in the Colombo Share Market. Share prices have climbed up quite noticeably. And once again this bullishness has been induced by foreign buying. The rise in the market, and indeed the earlier fall in the market, had little to do with conditions in the country. They are the fall out of developments in the international capital market and decisions of fund managers. International factors are mostly responsible for the changes. The foremost factor in the flow of foreign funds to our market is that fund managers have taken a view that South East Asia is once again ripe for investment. The worst of the South East Asian crisis is considered over. The prospect for renewed economic growth is no doubt the propelling reason for diverting funds to South East Asian markets. In turn the improvement in share prices has added a much needed dose of optimism to the South East Asians themselves. In Thailand and Malaysia domestic demand appears to be increasing and local investors themselves are looking to gain from market trends. All these are cumulative in impact. At least for some time we could expect capital inflows into Asian markets. This, despite sharp declines in the Tokyo, Hongkong and Seoul markets. Despite the crisis South East Asian countries faced, they had inherent economic strengths. They had high rates of domestic savings, a good work ethic, quality standards in their products, good economic infrastructure and developed financial institutions, among others. It is these strengths which would matter in the latest wave of recovery. Foreign investors, too, know that these strengths would enable a fast recovery once the ailments are cured and the correct policies are put in place. Foreign and domestic confidence are both most important for the recovery and these are growing at present. The growth in Asian economies would feed into a global recovery and an export dependent economy like ours should benefit in due course. But the current wave of foreign investment flows are due to the decision of fund managers to come back to Asian markets. Sri Lanka's stock market is indeed very small to most foreign investors, but in their decision making to come to the region we get a small share significant enough to make a dent in our market. Foreign investors have no doubt looked at our price earnings ratios and been tempted by their attractiveness as well. Their interest has however been mainly in a few selected blue chip companies. Apart from the decision of investors to move into the region, they also look at the economic fundamentals of the country they invest. It is here that we may falter. The economic indicators are by no means rosy. The budget deficit is expected to increase, exports have decreased significantly in the first half of the year and corporate profits appear to be taking a downturn. Worst of all, the prospect of an election next year is a depressing thought for the economy as unproductive expenditure of the government are likely to rise, the government's focus would not be on the economy, and a considerable amount of disruption in economic activities is likely. Fortunately there is a prospect of an improvement in our tea prices and tourist earnings are likely to rise with the growing number of tourist arrivals. The point we wish to make is this. We may gain by an initial wave of foreign investments in our share market, but if we are to retain and enhance the foreign flow, our economic fundamentals must be strong. Otherwise, foreign funds may leave us as suddenly as they have come. The current inflow should not be taken as an indication of large inflows in the near future. This does not appear likely given the trends in the economy. We must keep our focus on the economic fundamentals. There is no other way by which we can attract either portfolio investments or foreign indirect investments to the country.

The ride's begun so don't miss outExcerpts from the recent strategy update: •Market rallies on IFC five. IFC index + 20.8%, ASP I + 7.5%. •F l1 inflow and Sentiment improvement in line with April Strategy expectations. •Implied valuations suggest pricing in of an excessively pessimistic 2.1% long term real earnings growth. •News floor will decide market direction in near term. • Macro-economic and earnings outlook better than 1QCY99. •Risks are mainly external and political. •Momentum currently favours the IFC5, but we believe the risk return trade off is in favour of mid caps. •Clients for whom superior stock liquidity is not an issue, we urge a switch into stocks such as DOCKS,LLUB,CTC, RCL and the Plantations Sector. By Amal SandaratneMarket Strategist Jardine Fleming Stock Brokers. Market ralliesOur contrarian and bullish view that Colombo would follow the rally in regional markets seems to have been vindicated by last week's rally. The 7.5% rise in the broader All Share Index of 237 stocks does not do justice to the outstanding performance of the most liquid counters. The result of aggressive bidding by Fl1's was seen in the 20.8% rise of the IFC investable index. The index in Sri Lanka consists of JKH, SPENCE, HAYL, NDB and DFCC. This performance was also partially reflected in the 11.48% gain of the Milanka index of 25 stocks while the JF tracker of 40 stocks rallied by 10.5%. Hotels boostNet Fl1 purchases exceeded sales by Rs.564.6m. Fl1 inflows were boosted on July 20th when the Asian Hotels Corporation sold their 51% stake in Hotel Services Ltd at Rs 26. Excluding this transaction net F11 inflows were Rs.174m. Market activity in the preceding week was also high due to the accumulation of 16% stake in Aitken Spence by the Distilleries Corporation. The purchase of Hotel Services was at a significant premium to the market price. This and the fact that Aitken Spence was bid up served as a revelation to some investors of the value available in the market. Sentiment on the corporates involved in the transactions also improved. April strategyIn our April strategy report, our view was that Colombo would follow the pattern set in 1993/94 bull run. In 1993/94 the rally began after a lag of five months to the region and thus the July1999 run up seems to be on schedule. From the 549 ASPI level at the date of the Strategy report we expected to see a gentle rise in the index to 600 at end August. Sentiment and Fl1 inflows were expected to turn strongly positive from August and power the Index to 750 by year end. Client feed back from our international road show at the end of April indicated that the Fl1 inflows could turn positive sooner than expected with stocks such as the DFI'c, JKH and SPENCE outperforming in an Fl1 led rally. Kashmir concernsFollowing the strategy report, though there was a short spark up in early May, the Kashmir issue saw the market fall further. Though macro numbers were disappointing, with market falling to the 520 levels, our view continued to be that market expectations were irrationally pessimistic. At that level, our Dividend Discount Model (DDM) suggested that the market was pricing in a long term real earnings growth of just 1.6%.With this much bad news being priced it was our view that it would not take spectacular news to cause a spectacular market performance. In addition, in a deeply discounted illiquid market such as Sri Lanka we believed that a small investment by international standards could have a dramatic impact on prices, especially of the blue chips. Implied growth rateThe initial reduction of the implied pessimism now seems to be on its way out. Looking in terms of the DDM argument the market is now pricing in a future real earnings growth of just 2.1%. Historical GDP Growth rates over 1984-1998 were 4.1% YoY, with real corporate Earnings growth of 7% YoY. By factoring in future real earnings Growth of 5% YoY, the derived value for the market is 1,123. In coming months, we expect the pessimism to ease somewhat and the market to factor in a future real earnings growth rate of at least 3% YoY. This implies a fair value of 674. Even at this level, the market is valued at a substantial discount to our own fair Value as it would still be pricing in a historically low rate of growth. Market directionValuations in Colombo are so deeply discounted that the yearend target of 750 set in the April strategy seems quite justifiable on fundamental ground. Given the discount the market is trading at even at an Index of 572 the market would be at a significant discount to the region. Other markets have moved so much that just catching up a bit could take us to 750. Rather than focus on the valuation arguments again we believe the speed and sustenance of the rally will depend on news floor and regional developments. SLT placementLooking forward the placement of 10.5% of SLT is possibly the first major news story that could hit the market. Expectations are that the 10.5% stake would sell for above US$70m. When the placement was announced, it proved to be a disappointing as the IPO expected towards the beginning 2000 was postponed to the 2HCY00. An SLT IPO would have given the market its first billion-dollar company with sufficient liquidity to generate a new foreign focus on Sri Lanka. However now that the disappointment with the postponed IPO is over, the Placement itself can have a small positive impact on sentiment. The placement if at the pricing expected could be a support to the rally as it is at a significant premium to the market. In addition, the revenue from the placement will cause some immediate downward pressure on interest rates. Tea pricesAlso as expected, the tea prices recovered last month. Our recent visit to plantation companies confirmed the view that the upturn will continue for a while with a better 2HCY99. Tea prices in the last two years have had an impact on the market, greater than their actual place in the real economy. In terms of both corporate earnings it is not just the four conglomerates that have exposure to the sector. During privatisation, stakes were bought by companies from even the ceramics sector. In terms of sentiment many retail investors have both made a killing and been burnt by this sector more so than other sectors. As such the sector has a significant impact on retail sentiment. Speaking of sentiment as many of the leading stockbrokers are also tea brokers an upturn in tea prices could lift the spirits of the local stock broking community. Commercial and development bank exposure to the plantations sector has been on the rise and a situation of rising prices will reduce the risk of NPL's. Quarterly GDPLast month, the disappointing 2.7%YOY growth in 1Q99 GDP figure added to the pessimism in the market. Though this was below our expectations as well, we felt that it fails to justify the depth of despair implied by market valuations. Now with the market, picking up the outlook priced in is less pessimistic. But still our DDM suggests that the market is pricing in a long run real growth of just 2.1%. Going forward the issue will be whether growth in the second quarter will be stronger and as such appear to show a turning point after a year of deceleration. We strongly maintain our view that growth in coming quarters will be stronger than in the 1Q and have left our forecast for 2000 unchanged at 5.4% while 1999 growth was reduced to 4% in June(was 5.2%) Company earningsThe slowdown in the economy seems to have been mirrored by a 9.1% decline in company earnings in 1Q99. However, this had been expected, as it would have required more than just a strong economy to achieve growth on the very high base seen in 1Q98 when earnings grew 82.5% YoY, driven largely by record tea prices. The decline in 1Q99 earnings reflected the impact of (1) provisions for losses in equity portfolios by financial institutions; (2) currently depressed tea prices and; (3) the overall sluggishness of the economy. In the 2QCY99 quarterly reports to be announced shortly we believe that the YoY picture for many stocks will be better than in the 1QCY99. The overall numbers may still likely to be negative but this we believe priced in market expectations. The YOY growth story for many mid caps are likely to be better than in many of the blue chips. However the issue is whether the steam in the IFC -5 rally could be taken out by the non spectacular earnings likely to be released for them in the 2Q. YoY numbers for the blue chips and the market as a whole will improve strongly from the 3QCY99 . The rebound in tea prices, a continuation of the tourism boom, exporters benefiting through the appreciation of competitor currencies, write-backs of equity provisions by financial institutions and better growth in the economy will be key. We believe that this rebound in earnings hasn't been factored in yet and as such could lend support to a rally at the end of the year, or be factored in now when sentiment changes.. Economy lagsWhen the Asian crisis first started, there was a time lag before the negative impact finally hit the Sri Lanka economy. Now, the recovery of the economy also appears to be lagging the region. Unlike other markets, there is still no amazing earnings growth story to sell. In fact, given relatively strong growth in previous years, full-year growth will decelerate. As 1Q98 was the strongest quarter in terms of both GDP and Earnings growth, GDP and corporate earnings in the remainder of 1998 were slower. We expect to see the opposite this year. The key is that months after August should see earnings and macro statistics with YoY comparisons better than those in 1Q99 and higher than market expectations. External risksOn the negative side we think the chief risks come in the external side and politics. As Kashmir issue demonstrated Fl1 selling can have an irrational impact in the illiquid market with a lack of big local institutional investors. As demonstrated the risk in terms of a downturn would be most in the IFC five. Sri Lanka also would not be immune to a potential financial panic sparked off by the Chinese devaluation or a Wall Street devaluation. At home, national elections are due next year. The 1999 budget was expected to be populist but it was not. However as the government's victory in the provincial council elections held recently was narrow, there is an increased risk of lack of fiscal discipline. Though this has been often discussed, with the market having moved up there is a risk that serious fiscal indiscipline could halt the index rise or bring it down. Dividends at 480April's strategy report said that 480 would constitute the maximum downside if a very negative scenario occurred. Here the market would provide an after-tax return equal to the return on debt instruments, and we still see that as the bottom to the market. This risk is less than the potential upside. In terms of risk the high yield stocks, found in the mid cap and small cap segments offer much more protection than the IFC -5. Cash positionsLooking forward, the next impact of the transactions and the Fl1 inflows will be in the likely rise in the cash positions of parties selling out. The recent large trades saw many players in the market selling stakes to what is seen to be new money in the market. The cash of the selling parties could always be put back in the market. This potential new cash comes in a situation where there is little expected new paper to absorb it. Renewed Fl1 portfolio buying could have a similar effect in boosting the cash positions of domestic investors and thus have an impact on future stock selection. Of course YTD and in 1998 domestic investors have had to absorb most of the Fl1 selling. With domestic cash positions likely to rise on domestic profit taking on the IFC-5 we expect to see a rotation into mid cap favourites which are feasible options from the liquidity requirements of local fund managers. Favours mid capsMomentum and continued aggressive Fl1 buying seem to favour the IFC-5. Fl1 buying in the IFC-5 has support and they are still at substantial discounts to regional valuations and have to still to reach our price targets based on conservative required rates of return and PE multiple assumptions. However following the IFC -5 out-performance we believe that the risk reward outlook and valuations are more favourable on the mid caps. Absolute performance from new is also likely to be stronger in our favoured mid caps and plantations. |Even, if Fl1 's do not buy into mid caps due to liquidity constraints, profits from local sales of IFC-5 shares to Fl1 should see a rotational move to laggard stocks. If overseas turmoil again cuts short the market rebound given their strong dividend yields there is greater downside protection on stocks such as DOCKS, LLUB, RCL, TKYO and CTC. In our JF HNB model portfolio which we use as a means of tracking our recommendations we have taken some profits from SPENCE and moved it into CTC,DOCKS and TKYO. However our cash position which was primarily from accumulated dividends was cut, while our holdings in SPENCE is still heavily over weight relative to the market. Our April Strategy ended with the view that you should not take the risk of missing out on what could be a very profitable ride. It's begun. Don't miss out on the rest of it.

First amend SEC act, the rules will followDelays in Amending the SEC Act are holding up the passing of SEC rules, officials said. The SEC rules of 1991, do not recognise the Central Depository System (CDS), or define market rules on front running and cherry picking, Head of SEC's Legal Division, Kithsiri Gunawardene said. Front running and cherry picking were not defined as offences but as malpractices, where a broker or unit trusts' licence could be cancelled. "We have defined these differences and listed them as separate offences. Market manipulation and wash sales have been identified and listed as separate rules," he said. The new amendments include CDS rules, but the SEC has dispensed with certain listing rules. "We have put broad guidelines on listing, but we have not taken detail situations, as we need to keep these rules for a longer period," he said. As a result, things like listing fees will not be stipulated under the new rules, with the Colombo Stock Exchange having the flexibility to change the listing fees. He added that some rules, which are vague and not drafted in a legal format, cannot be enforced and have to be shed, to avoid enforcement problems," he said. For instance, the rules pertaining to corporate disclosure have been put into a legal context. In the case of public information, a company should not submit itself to certain rumour situations nor should their publications be vague. "We have defined what is public information, what 'unusual market action' is, what the companies can be held liable to." "Ideally, the Act should be amended first and then the rules will follow," he said, adding that his only concern was that by the time the rules are gazetted, the SEC will have to go for another set of rules. (MG)

Sri Lanka goes blindly into electronic commerceSri Lanka is migrating towards an electronic commerce environment without the proper legislation in place, an IT legal expert warned. The free flow of information through the Internet and its use in trade and commerce have raised many complex legal issues across the world. The local banking sector is increasingly migrating towards the electronic environment, sans proper legislation. There are also no laws for data protection, nor laws to regulate electronic debit and credit cards, Head of CINTEC IT Centre, Kolitha Dharmawardene said. With the initial introduction of ATMs and the SWIFT system local banking operations now provide tele banking with access to a large number of banking services through the electronic medium. Electronic clearance systems, fund transfer systems and accounting and management systems too have migrated to the electronic medium thus facilitating inter intra bank operations. Hence, there is a need to review the existing banking laws and to introduce new laws and regulations as necessary to accommodate and regulate this new electronic environment in banking, he said. "At present, Sri Lanka does not have adequate laws specifically providing for or regulating the electronic environment in banking. This whole area remains largely unregulated." The Bankers Association as well as the Central Bank have recognised the need to review and reform the laws relating to finance and banking, particularly to accommodate and regulate the electronic environment in finance and banking. "The absence of data protection laws is seriously impeding business opportunity in Sri Lanka," he says. Data Protection in the electronic environment has been enforced in many countries as a result of the right to privacy and the ease in which personnel data could be disseminated and manipulated for personal gains and to the detriment of the data subject. E-commerce is in its infancy and most local websites do not have data privacy clauses in place. The absence of laws on the subject has placed many countries at a commercial disadvantage, since the EU and many other developed countries prohibit the transfer of personal data to countries that do not have adequate laws to recognise privacy and to protect personal data in the electronic medium. Dharmawardene says, credit and debit cards remain largely unregulated in Sri Lanka. "This whole area remains largely unregulated and recent instances of misuse in Sri Lanka have demonstrated the absence of proper legal mechanisms to properly address the issues." The credit card issuers association in Sri Lanka has identified the need for a regulatory framework for the proper use of these cards, but Sri Lanka is yet to draft the necessary legislation. (MG)

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|