|

18th July 1999 |

News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

Computer enters the 'thottam'By Shafraz FarookThe basic process of manufacturing tea has not changed much since the introduction of tea in 1867 by James

Taylor. The Tea Research Institute (TRI) is now pioneering a project to

improve the manufacturing process with the aid of computers. James

Taylor. The Tea Research Institute (TRI) is now pioneering a project to

improve the manufacturing process with the aid of computers.

Funded by USAID, the project aims at acquiring manufacturing parameters accurately and enhancing productivity. It will also aim at saving energy and develop a system for the tea industry to achieve a greater degree of consistency ensuring quality, Planters Association Secretary General, Sene Seneviratne said. Recent trends in the tea auctions have seen good quality teas earning a higher price, therefore, brokers feel this initiative will be very favourable. The change was a requisite to sustain the market share Sri Lanka enjoys amidst heavy competition. This year, so far, has been a year of records since tea production and export volumes were higher compared to the same period last year. Quantity was achieved at the expense of quality in most instances, which led to lower prices adding pressure to the already weak market. These innovations will lead to efficient management and make an efficient environment for the factory, Asia Siyaka Tea Brokers said. With a view to improving the production process, TRI Director, Dr. Wester Modder conducted a preliminary study to identify the areas that could be improved to produce better results. "Results on preliminary work are encouraging and steps are being taken to further develop this work," Dr. Modder told The Sunday Times Business. He said, the development will take place in three stages in order to achieve the above objectives. The first stage includes processes such as measuring hygrometric differences externally, weighing of leaf at collection points, quantifying moisture content of leaf, measuring hygrometric differences internally, measuring the rate of evaporation of moisture in withering troughs and weight of withered leaf prior to the rolling process. The second stage will comprise process control and automation while the third stage will consist of a complete rethink and redesign of some of the existing machinery.

Tussle over oil at seaBy Dinali GoonewardeneSri Lanka may lose valuable foreign exchange if a Lanka Marine Services decision not to sell fuel to Pioneering Bunker Services (Pvt) Ltd. is put into force.Pioneering Bunker Services is engaged in sells fuel to ships outside Sri Lanka's 12 mile radius, while Lanka Marine Services is a Ceylon Petroleum Corporation (CPC) subsidiary which sells fuel to ships in port. "Selling fuel at sea results in a loss of revenue to the Sri Lankan port as vessels do not anchor at port, thereby avoiding charges levied by the port. This is against national interest," Lanka Marine Services Chairman, Anil Obeysekere said, defending his decision not to sell the fuel. "This is a clear case of discrimination by the CPC," said E.D.Wickramanayake a leading lawyer expressing his opinion on CPC's decision. CPC has a monopoly to deal in fuels such as petrol, kerosene, diesel oil and furnace oil in Sri Lanka under the CPC Act. "The CPC Act does not apply beyond the territorial seas of Sri Lanka which extend to 12 nautical miles, measured from stipulated baselines," says Shibly Aziz, Presidents Council, expressing his opinion on the legality of supplying fuel to vessels offshore. "The market for off- shore fuel consists of Indian fishing fleets, Sri Lankan fishing fleets and vessels which ply this particular route," Pioneering Bunker Services Chairman Nahil Wijesuriya said. "We provide fuel to ships hundreds of miles away from the port so that they do not have to deviate from their route to come to the port. Most of these ships would not be coming to the port anyway. The price of fuel supplied at the port is much higher than that charged by my company and it is therefore cheaper for the ships," he said. Marine gas oil which costs US$ 225 in Sri Lanka is only US$ 144 in Singapore. Marine diesel oil is US$ 135 in Singapore while it is US$ 215 in Sri Lanka. Intermediate Fuel Oil costs US$ 97 in Sri Lanka and is US$ 96.50 in Singapore. Pioneering Bunkering Services would like to establish its presence through three ships in the East coast, West coast and sea lane south of Galle in order to exploit a potential market of around 33 ships which ply this route every day," Mr. Wijesuriya said.

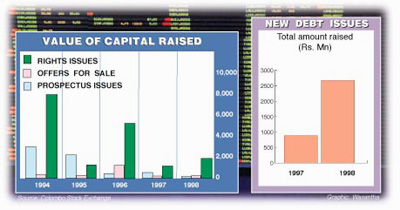

Getting into debtA total of Rs 2668.2 mn was raised through the issue of listed debt last year, compared to Rs 885.2 mn in 1997. There were six listings in 1998 compared to only one in 1997.Debt capitalisation is only 3 per cent at present. "However, the corporate debt market in Sri Lanka will expand every year and debt will become a very popular investing instrument," USAID Financial Markets Project training specialist, Seth Isaacs predicts. 1998 could well be the year the river ran dry as far as raising capital in the Colombo Stock Market was concerned. Reflecting the general downturn in Asian markets, Colombo's ASPI dropped from a 1997 high of 869.7 to close at 597.3 at end 1998. The ASPI dropped to a low of 461 during 1998. It is no surprise the CSE raised just a solitary IPO (except for plantations) last year. Royal Palm Beach Hotels Ltd offered 10 mn shares to the public at Rs. 11 each. The issue was fully subscribed and the company was listed on June 15, 1998. While only Rs. 110 mn was raised from the single IPO in 1998, 1997 in comparison had three IPO's raising a total of Rs 505 mn. The IPO's were by Lion Brewery (Ceylon) Ltd, Marawila Resorts Ltd and Light House Hotel Ltd. Lion Brewery Ceylon Ltd offered 12.5 mn shares to the public at Rs. 20 each, which was over- subscribed by 2.7 mn shares. The other two issues were under- subscribed with the underwriters taking up the balance shares. Some private sales have also raised capital on the CSE in 1997. Three Acres Farms Ltd issued 2.1 mn shares and raised Rs. 105 mn through a private placement in 1997. Rajiv Casie Chitty of CT Smith's Stock brokers attributed the decline partly to the sequence of misfortune that has plagued the market. These include the assassination of presidential candidates, bombing of the Kolonnawa oil depots, Central Bank bombing, Asian currency crisis, Russian currency crisis and nuclear testing in India. Vibes of an impending elections are dampening present sentiments.

SEC urges majority stake for foreignersBy Mel GunasekeraForeigners may be allowed to hold a majority stake in stockbroking houses under a Securities and Exchange Commission (SEC) recommendation.At present, foreign ownership is limited to 40 per cent. "We are of the view that majority ownership can't do much harm, it will also facilitate technical transfers," SEC Director General, Kumar Paul said. The SEC has written to the authorities seeking their permission. Since stockbrokers are licenced by the SEC, we will ensure the foreign investor will be of international repute, prior to approval, he said. The SEC is also conducting a study to de-regulate broking fees. Brokers have been lobbying for lower fees, as Sri Lanka's transaction costs are one of the highest in the region at present. Brokerage fees for local clients are set at 1.4 per cent (orders below Rs. 1 mn) and 1.15 per cent (orders above Rs. 1 mn). Foreign clients are charged 0.825 per cent (orders below Rs. 1 mn) and 0.7 per cent (orders above Rs. 1 mn). "We have been advocating a floating brokerage as it will increase transaction volumes," says, Chanaka Wickremasuriya, Head of Research NDBS Stockbrokers. "Brokers should be allowed to charge a minimum level as an incentive for people to trade more, Asanga Seneviratne of Asia Capital said. Opinions are divided, as a section of the brokers are against the concept. Some of the bigger firms are against it because their operating costs are high. They say the timing is not right and the concept should have been introduced when the market was booming. Certain brokers split their broking fees with their clients. High networth clients are paid kickbacks by the brokers through their parent companies. "In principle it (floating brokerage) is already happening and brokers will like it to continue as it gives them an unfair advantage. "It is done under the table,and we might as well legalise it anyway," a top broker said. "You can't take it in isolation, if brokerage comes down stockbrokers should have other alternatives of revenue," Nanda Nair of John Keells Stockbrokers said. Brokers should be allowed to do margin trading,and short selling as their entire survival is on a slim margin", he said.

Mind your businessBy Business BugYour say: our wayThe big bird may have changed its name and logo but the transformation is ruffling quite a few feathers.Many agree that the logo is better than what it was but not that many are sure about the change of name. Even some top-rungers in the national carrier feel that the goodwill generated by the old airline in hospitality is wasted with a change of name which is tough on the tongue anyway. But the emirs would have none of it. So, those opposed, mostly local boys, had their say but the emirs had their way... Going cellular?If one were to ask what the most competitive trade in the country was, the answer would probably be the communications industry.Now, with so many players in the field, even the state giant is feeling the heat and believes its market share maybe threatened if innovations are not brought about. Therefore, as a first step they have offered discounts for high-users. And they are even thinking of operating their own cellular network, we hear... After pollsAmong the main items on the agenda at the forthcoming Aid Group meeting would be the privatisation of the two major state banks.But the powers that be know that whenever the privatisation issue was raised it ran into a storm of protest and not even introducing the word 'restructuring' has helped, really. So, the instructions are that there will be no change in the status quo, not until the polls are over. Soon after, changes are expected in the first flush of victory, or so it is planned...

Food and nutrition strategy neededThe latest issue of the Central Bank's Survey of Consumer Finances confirms a general observation that per capita rice consumption is decreasing. The latest data indicate a clear shift in consumption from rice to wheat flour and bread.Household consumption data are good indicators of many socio-economic changes. Changes in the patterns of consumption also have important implications for national development policy. According to the Central Bank Report of the Consumer Finances and Socio Economic Survey of 1996/97, the proportion of household expenditure on rice of the income group upto Rs. 9000 fell from 24 per cent in 1986/87 to 20 per cent in 1996/97. A drop of consumption expenditure on the traditional staple rice by 4 percentage points or by 17 per cent in a decade is a significant change in household expenditure. This change has several implications. We are moving from a largely home grown crop to a totally imported commodity. Therefore our self reliance on basic foods is declining. Second, this shift may be nutritionally detrimental. It is not an issue of the nutritional value of wheat flour versus rice. It is an issue more specific to our condition because the wheat flour available to our consumers is devoid of the wheat bran, which has most of the vitamins and nutritional value of the wheat grain. It is fairly well established that the incidence of illnesses like cardiovascular diseases and diabetes increased owing to the consumption of polished grains. The wheat flour we consume is much worse in this respect. Therefore the shift in consumption has to be viewed as a nutritionally backward step. In this connection it is worth mentioning that a similar development has occurred in rice consumption where polished rice is preferred. A greater nutrition awareness is much in need. A nutrition awareness program targeted especially at the youth should be mounted to prevent a further erosion in our national habits. The consumption of other coarse grains should also be encouraged both on nutritional and economic grounds. The substitution of wheat flour for rice is due to many reasons. Convenience in use is of course the most important. Wheat flour preparations are preferred to rice flour as they are easier to prepare and also more readily available. Bread in particular is an easy item for consumption for the busy household in which both husband and wife are working and little or no domestic help is available. Similarly take away food items mainly from wheat flour have become extremely popular in urban areas. Even rural areas appear to have moved to a higher consumption of bread. Perhaps the recent trends are irreversible. Yet a national food strategy should ponder over the implications of these changes from an overall economic perspective, the likely impact on food security and the all important nutritional implications. With respect to the nutritional issue where damage has already been done, an effective nutritional awareness program backed up by supportive price policies would be needed to ensure better nutrition and health for our people. This aspect could be easily ignored in a market oriented society. The consumers' choice may indeed be damaging to the nation's health and therefore the government has a duty to ensure that policies are in place to ensure better nutrition for the nation. The last decade has seen significant changes in the economy. These are reflected in the household consumption data disclosed in the Consumer Finances and Socio-Economic Survey Report. Many of the changes in the consumption pattern reflect improved economic conditions. People are spending money on higher value food and having a more diverse consumption basket. It is vital that the implications of these data are looked into from a developmental perspective. They provide a clue to what has been happening. More important, they provide the base for national food and nutrition strategy. Sri Lanka's once-thriving poultry business is buckling under imports, high feed costs and the privatisation of formerly free state services.Crisis in the poultry farmBy Feizal SamathIt reminds you of the classic chicken and egg situation! Somapala is a small-time chicken farmer. But unlike his father and grandfather - who were also in the same business - the young lad is struggling to make profits from his farm."We are hit by high costs of inputs, imports and taxes," he says. The character is fictitious but the story and the scenarios are real-life ones. Sri Lanka's once-thriving poultry business is buckling under imports, high feed costs and the privatisation of formerly free state services. Farmers are struggling to maintain farmsteads, pay back loans and are forced to sell below cost of production to stay in business. Often accused of arbitrary price hikes in the sale of eggs and chicken meat, poultry farmers say they are reeling under a combination of cheaper imports and high feed costs and survival is now the key to just feed their families - not profits or to break even. "There is no question of profits now. It is just a case of keeping the farms afloat and how," said Dr Dharmadasa Wanasinghe, chairman of the All Island Poultry Association (AIPA). Poultry is one of Sri Lanka's traditional home garden businesses. According to government estimates, more than 200,000 people are directly and indirectly involved in the trade. There are some 75,000 chicken and egg farmers spread across Sri Lanka. Most of them are located in what is called the Poultry Belt - from the Puttalam coast to Kalutara and are mainly non-Buddhists, either Roman Catholics or Moslems. But in recent years, many Buddhists have also got involved in poultry farming for socioe-conomic reasons. Most of the farmers are women who run small outfits at home. The small farmers belong to the small-scale sector which, according to an AIPA classification, brings in a small income that is not sufficient for dependency. The medium sector includes farmsteads whose incomes are sufficient for survival while the large scale sector are the big farms - like those run by Three Acre Farms, Bairaha or Christombu - that employ labour. The AIPA has 700 members who are involved in the poultry trade. They are farmers, feed manufacturers and feed retailers. Upto 70 percent of Sri Lanka's chicken and eggs is produced by small farms. According to consumption patterns, Sri Lanka is said to have the highest per capital consumption of chicken and eggs in South Asia. An average Sri Lankan eats four kg of chicken and 45 eggs a year. Globalisation and the middleman, as in many of Sri Lanka's traditional industries, is hurting the poultry industry and threatening to squeeze them out. Though imports of chicken and eggs are marginal and account for just two percent of annual consumption needs, it has a chain reaction on prices controlled by a mafia-type Colombo trader network. The high cost of feed, as much of the inputs are imported, and now the planned privatisation of two state laboratories will cost the industry dearly and ultimately lead to laying off staff or businesses closing down. Globalisation is a di lemma faced by many Third World countries. To skip this phase of development results in being isolated with the rest of the world. By embracing globalization - that has privatisation, free trade and cutting down tariff barriers as its key goals - governments risk hurting local industry to the extent of shutting down small, economical units. On the other hand, consumers deserve quality and cheaper products. So if imported goods are cheaper than local products, then buyers should be allowed that choice. The key here is healthy competition. Not unfair competition, like a small farmer competing against a giant multinational, which is the case in many Third World countries grappling with globalisation. There are many examples of how things have gone wrong in this small farmer-big company battle. Indifferent government attitudes add to local industry woes. In the agriculture sector, potato and onion farmers are constantly complaining about the influx of cheaper imports. In time, it would be cheaper to import a host of other food - even rice - since agricultural inputs are imported and add to the cost of production of local farmers. Local farmers are un able to produce food cheaper than their foreign counterparts particularly in India and invariably local prices are higher. The only way the government can protect farmers and their families is through higher import duties, cutting local taxes and either reducing the price of imported inputs or making available cheaper, locally-made inputs. Sri Lankan importers have however mastered the art of fiddling with invoices and often values listed in invoice are bogus ones and far below the actuals. The Customs Department, struggling to cope with an inflow of imports, is hardly in any sound position to study actual price trends in other countries to properly scrutinise under-valued invoices and enforce proper taxes. Under-valued invoices and poor quality imports are the bane of any Third World country struggling to protect its local industry and Sri Lanka is no stranger here. Colombo has free trade deals with many countries including the controversial one with India but in the absence of a proper invoice-assessment mechanism and effective quality control measures, the country is bound to see a flood of cheap imports easing out many local industries. Free trade is inevitable and allows the consumer a choice of goods at competitive prices. Still the government must strike a delicate balance between the producer and the consumer to ensure neither gets hurt in the process. That is sadly lacking in the government apparatus and has been proved in a hotchpotch of low duties, local taxes and high local production costs. The chicken business is a case in point. Take as an example, the import of 14,680 kg of chicken meat in to Sri Lanka between June 6 and 19th this year. The CIF - cost, insurance and freight - was valued at Rs. 38 a kilo. With a normal import tax of 40 percent, the cost to the importer would be Rs. 38 plus the tax. That works out to about Rs. 54 per kilo. This imported chicken is now available in the market at Rs. 110 per - a cool 100 percent-plus profit for the importer. This is still less than local chicken that sells currently at around Rs. 130 per, which is at least 15 percent more than the cost of production. "So you see how the industry has to battle against imports. All it takes for an importer is a fax machine, small office and a couple of inquiries and hey presto the consignment is at his doorstep. Local farmers have to struggle to earn a decent living," said Wanasinghe. On average about 100,000 to 120,000 kg of chicken is imported into the country every month. AIPA officials say they are not opposed to imports but point out under-valued invoices or sub standard goods is the problem. Wanasinghe said they were absolutely certain that chicken was not available at Rs. 38 per kilo abroad since "we believe average chicken prices abroad are in the range of one US dollar (70 rupees) per kg." Often imports are also from doubtful countries of origin. Chicken imports usually come from Australia, the Netherlands or the United States of America but the country of origin can be a problem since there are transshipments from Dubai or other Middle East ports. Various diseases could come into the country through meat products and it is vital to know the country of origin. Chicken can be freely imported and it was only earlier this month that the Ministry of Livestock Development agreed to an AIPA request to enforce strict quarantine measures in chicken imports. "They (officials) were understanding but said they were helpless with regard to imports due to the country's free-market policies," Wanasinghe quoted ministry officials as saying during an AIPA July 3 meeting with the ministry. Customs representatives, present at the same meeting, said they had to go by the invoice values and had little response to AIPA's request for a more realistic value-based system of the Customs price-classification of imported items. Wanasinghe also says Sri Lanka is a dumping ground for surpluses of other countries. In most places, chickens used as layers for 80 weeks are disposed of and normally sold as pet food unlike broiler chicken, which is produced solely for human consumption. But some countries export the first category of chicken, which are discarded from farms. Government indifference and statements lacking in foresight or clarity are also not helpful. There is a dispute over imports between the ministers of trade and agriculture. The trade lobby, backed by Trade Minister Kingsley Wickremaratne, is for free trade and imports of cheaper food items if the consumer benefits. This position is hotly contested by his colleague, Agriculture Minister D.M. Jayaratne, who argues that food imports affect local farmers. Their contrasting positions have been widely reported by the media. In around December 1997, Minister Wickremaratne was quoted in newspapers as saying that he was planning to permit egg imports since local egg prices were high and arbitrarily jacked up by local producers to "make a killing during Christmas" That statement triggered panic and anxious responses from the industry. Egg prices tumbled and there were no imported eggs in the market. Local producers said they were compelled to sell below cost or possibly destroy unsold quantities if cheaper imported eggs flooded the market. Several months later, Minister Wickremara tne confessed - again according to newspaper reports - that he was not serious about imports in his first statement. "I just wanted to test the market reaction," was his caustic comment. A more relevant issue was that no special permits are necessary to import chicken or eggs. No one can deny the trade minister's anxiety to provide cheaper food to the people but what is questionable is whether ministers should make statements like this - which are taken seriously - and then joke about then? Incidentally imported eggs, from India, are available - on and off - in Sri Lanka and cost around Rs. 2.25 each. The production cost of local eggs is Rs. 3.70 rupees each but the farmgate price (sale of eggs from the farms to wholesale/retail traders) is Rs. 2.80 each, which is below production costs. During the panic that set in after the minister's threat to allow egg imports, at least 10 percent of farmsteads sold off their prime laying birds, fearing a glut of eggs in the market. "There was a kind of fear psychosis that built up. This is the same panic that spreads in the market when imported chicken is available," Wanasinghe said. Colombo's chicken and egg business is controlled by a few companies who set the terms and prices. Farmers are at their mercy, like the vegetable producers who are at the mercy of the middleman. Often when chicken or egg imports come in, these traders demand and force farmers to lower their prices. As pointed out earlier, imports generally account for only two percent of Sri Lanka's consumption patterns but Colombo's mafia-traders create an artificial glut situation and force farmers to lower their prices. Wanasinghe says that often triggers panic in the industry. Farmers say up to 80 percent of production costs goes on buying feed that is produced by local firms with imported ingredients. A Goods and Sales Tax (GST) of 12.5 percent is also hurting the industry, which was exempted under the earlier tax system. Then there is the problem of vaccines. For many years vaccines were produced by the Peradeniya-based Department of Animal Husbandry and Health and issued free to farmers until it was stopped in 1997 due to budget problems. Farmers now have to pay for costly im ported vaccines. The AIPA is also worried over plans by the government to sell off two state-owned diagnostic laboratories at Welisara and Polonnaruwa. The laboratories provide various services, free, to the industry and if sold to private interests would result in farmers having to pay for these services. "This is the second blow to the industry, the first being the scrapping of the vaccines programme," Wanasinghe said, adding however that the association was not opposed to privatisation if local farmers are not affected. While globalization is a necessary evil in most societies, local industry often gets left behind in the process. Staff cuts or shutting down businesses is commonplace and most industrialists prefer the import trade, which is more profitable and has lesser headaches. That has happened in many sectors in the past and increasingly so, if local industry is not price-competitive or quality conscious. But due to lopsided or politically-motivated policies, governments have failed in the present and the past to strike an effective balance between the consumer and the producer. Neither has benefited in the surge to protect both parties, and that is certainly a classic chicken and egg situation in the poultry business.

Catering to the spender touristBy Shafraz FarookTravel agents are calling for a regulation of their trade to cater to up -market high networth tourist.In 1998, over 380,000 tourists arrived, bringing in revenue of over Rs. 14 mn the Central Bank report said. Per capita tourist receipts for 1998 was Rs. 41,873, which travel agents say 'is what we (Sri Lanka) should be looking at increasing and not the number of tourists'. To do this, Sri Lanka should present an attractive atmosphere to lure high spending tourists and coax them to spend their money, a tour official said. "We should cater to their needs, provide them with a traditional but exquisite array of attractions giving them a reason to come here." Setting standards is very important, Gabo Travels Chairman, Gabo Peiris said. The eateries should be graded and classified according to what they have to offer and not known as hotels, he said. "Even these wayside eateries are known as Hotels, but according to statute, hotels have to have a minimum prerequisite. They should be licenced and checked on a regular basis to ensure they maintain standards or their licences should be revoked," he said. He believes eateries should display their menu along with the prices to let customers know what they have to offer and if it fits their purse. "The government should work towards providing a better environment for tourism," Mr. Peiris says. Everything should have a particular place so that it could be controlled, Mr. Peiris said, even prostitution. If there was a red light district, regulating it would be easy. "It is easier because we are a small country compared to most". This year's tourist arrivals are predicted to go above the 380,000 mark. 450 MW need to be commissioned by 2003 Power plants or darknessBy Dinali GoonewardeneThe timely implementation of thermal power plants and coal plants is essential to avert a crisis situation.Three combined cycle thermal power plants with a capacity of 450 MW need to be commissioned by 2003, a recent Ceylon Electricity Board Generation Planning report stated. A 150 MW combined cycle plant at the Kelanitissa power station, which is funded through an OECF soft loan, has to be completed by 2002. The 100 MW plant should be completed in 2001 and the balance 50 MW in 2002. This project is expected to be delayed by a year. Also expected to be delayed, is a 150 MW BOOT combined cycle plant billed to be completed in 2001. The existing hydro and thermal power plants will be strained to their maximum capacity if these projects are delayed. There will be no reserve margins in the system as it will be operated 24 hours a day. It is in this light that the plans to build a 300 MW coal plant in 2004 should be viewed. However, a question looms over the construction of this controversial plant. Although its capital cost is high the operational cost of this plant is low in comparison to other thermal plants. The report warns that power cuts and breakdowns will abound in a system that is already strained to a maximum as the demand for energy increases by an average of 8 per cent annually.

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

|

|