Columns

Economic objectives of 2026 budget: Will it achieve fiscal consolidation to spur growth?

View(s):The economic objectives of the NPP government’s second budget should be to achieve fiscal consolidation—a prerequisite to enable economic stability and growth.

Fiscal consolidation

A low fiscal deficit should be the foremost objective of the 2026 budget, as the economic growth that is expected this year can be accelerated only if there is fiscal consolidation. In simple words, the budget deficit has to be small.

Expectations

Last Sunday’s column dealt with the popular expectations such as lower taxes, higher salaries and more dole outs. Readers would know by now whether much of these expectations have been met by the budget presented on Friday.

Fiscal outcome

Our focus today is on the fiscal measures expected from the 2026 budget that was presented against a favourable background of an improved fiscal performance. Today we focus on what should be the economic and financial outcomes of this budget.

Indications

Indications are that the budget expects the fiscal deficit to be contained by increased revenue and curtailment of some expenditures described as “wasteful”.

The government has made it clear that taxation levels would not be raised further. The government expects “to provide relief to as many industries as possible and to “build a production-oriented economy”. This has been President Disanayake’s objective.

Fiscal outcome

Insofar as the economy is concerned, the significance of the 2026 budget lies in whether it would achieve fiscal consolidation to enable the initial growth momentum that has been achieved and whether it could be accelerated to 5 to 6 per cent in 2026.

Fiscal consolidation, or a low budget deficit, is the foremost economic precondition for economic growth.

Economic expectation

The foremost economic expectation of the budget is a firm commitment to fiscal consolidation. A large fiscal deficit vitiates economic growth in multiple ways, like diabetes affecting many parts of the body.

Investors

Investors will look for a budget that targets a sustainable deficit and demonstrates a clear strategy to achieve revenue targets.

The containment of the fiscal deficit is expected by a revenue enhancement strategy, as expenditure on education, health, poverty alleviation, salaries, pensions and interest payments are rising committed expenditures.

Revenue

Improved tax administration and broadening of the tax base by reducing tax evasion and tax avoidance by property and wealth taxes are expected to achieve this objective. Savings on government expenditure are also expected to reduce expenditure.

Continuity

The continuity in fiscal policy is key to lowering perceived risk. The changes in policies have been a deterrent to investment in the past.

Fiscal outturn 2025

The budget deficit more than halved in the first nine months of this year. This has been achieved mainly by an increase in government revenue from increased import duties and a more effective tax administration. Government expenditure too has been contained by cutting down expenditure that is considered wasteful.

Persistent deficiency

A persistent feature of Sri Lanka’s fiscal performance has been the shortfalls in revenue and overruns in government expenditure supported by supplementary votes. It is to the credit of the government that this has not happened in the first budget of the JVP/NPP government. In fact, the budget deficit more than halved in the first nine months of this year, according to the Finance Ministry’s latest Fiscal Review Report.

Concluding reflection

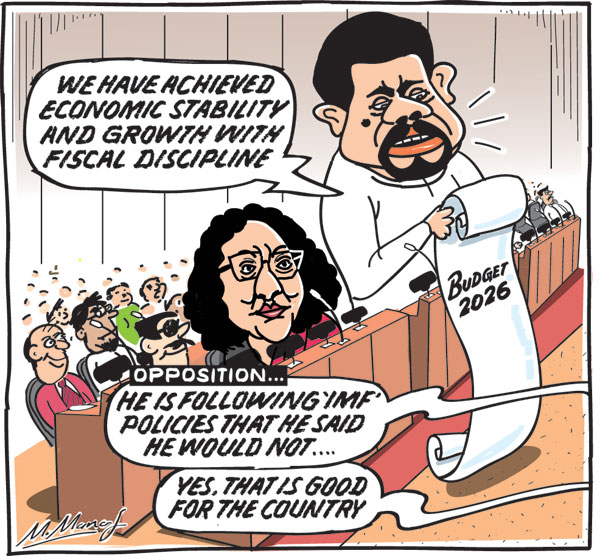

The fact that the JVP/NPP changed its pre-election stance of not continuing with the IMF’s Extended Fund Facility (EFF) was a pragmatic move in the right direction that has stabilised the economy. Furthermore, the containment of the fiscal deficit this year is an important economic achievement that could stimulate growth. On the other hand, the inaction in reforming loss-making state-owned enterprises is, however, an impediment to further fiscal consolidation and economic growth. Hopefully, there will be progress in these reforms in 2026. The all-important issue of the 2026 budget is whether it would achieve a low fiscal deficit and spur economic growth.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment