Columns

Economy threatened by tariffs, geopolitical tensions, and other external shocks

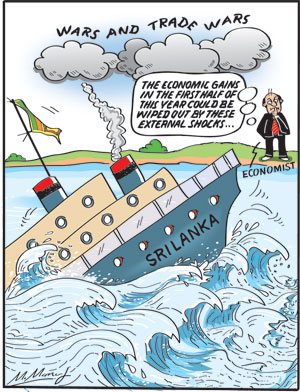

View(s):External shocks caused by the current trade wars, the West Asia crisis, the Russian-Ukrainian war, and a likely global economic recession could be severe setbacks to the Sri Lankan economy. These external shocks could wipe out our economic gains in the first half of this year.

First half

In the first half of this year, Sri Lanka’s economy stabilised and grew by 3.5 percent; inflation decelerated, and foreign reserves increased to US$ 7.1 billion by the end of June. And the economy was poised to grow by around 5 percent this year. All these economic indicators were expected to improve in the second half of the year but are very much dependent on global conditions.

Economic indicators

Despite the economy growing by 3.5 percent, inflation being deflationary in the second quarter, and foreign reserves at a comfortable US$ 7.1 billion, the months ahead are fraught with uncertainties and unpredictable economic conditions over which the country has little control.

External shocks

The external shocks in the form of higher tariffs on our exports, higher costs of imports owing to global tensions, and a reversal of the current tourist boom could be serious setbacks to the economy.

Tariffs

On Thursday, much to the government’s relief, the United States further reduced tariffs on our exports ahead of the August 1 deadline—from the previous 44 percent to 30 percent, and now to 20 percent. Readers may well ask how favourable these reductions truly are and whether any conditions must still be met.

Threats

However, as the current and emerging global conditions threaten the economy, the prospects of higher economic growth and enhanced external reserves in the second half of this year hinge on how effectively the government mitigates the external shocks.

Exports increase

According to the Export Development Board (EDB), the country’s exports have increased in July owing to a diversification of export products and export destinations. This is indeed a step in the right direction that must be pursued vigorously.

Impacts

The growth momentum and enhancement of foreign reserves in the first half of this year are positive developments that need to be maintained and protected from external shocks. Furthermore, if the country’s exports of garments and rubber goods decrease, there would be adverse backward linkages of unemployment and consequent increased poverty.

If the geopolitical tensions and wars continue, the Sri Lankan economy, which is very dependent on remittances from abroad, could face severe setbacks with workers in West Asia returning. That would weaken our external finances significantly.

The country’s tourism sector, which is currently booming, could suffer if international travel is disrupted, the costs of travel increase, and travel is considered dangerous.

These difficulties are not understood by people at large, and there could be popular discontent.

Summary and conclusion

The economic gains of the first half of the year could be jeopardised by external shocks. US tariffs, global trade wars, the Russian-Ukrainian war, the Israel-Palestine war, and a likely global economic recession could set back the growth of the economy.

The economy could face a setback after recording a 3.5 per cent growth rate in the second quarter, with inflation decelerating to be deflationary and foreign reserves at a comfortable US$ 7.1 billion at the end of June. In the months ahead, the government needs to skilfully navigate uncertainties and unpredictable economic difficulties over which it has no control.

If the tariff wars continue and, even more significantly, the geopolitical tensions in West Asia escalate into a major conflict, the country’s external trade would face an unprecedented crisis. Our exports can be seriously jeopardised by both the high tariffs in our main markets as well as disruptions in transport and higher shipping costs. On the other hand, our essential imports could cost much more owing to war-related disruption to supply chains. Petroleum prices could rise sharply, causing fertiliser, food, and other import prices to increase too. The Sri Lankan economy, which is very dependent on remittances from abroad, could have a severe setback that would weaken our external finances significantly. The government must take measures to mitigate the impacts of these external shocks.

These external shocks would have backward linkages on the economy. Prices of essential commodities would increase, and the decrease in exports would cause unemployment, especially in garment factories and rubber plantations.

Final word

Hopefully the current efforts to bring about peace in the two wars will succeed, and better sense will prevail on tariffs.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment