News

Vibrant network of Northern-based cooperative societies support communities across the Province

View(s):By S Rubatheesan

During the global pandemic, Mayuran Despriya signed up for a new pilot project introduced by a local cooperative society hoping that the new credit system to purchase essential items on an interest-free monthly cycle would be beneficial if she was short of cash. This programme would be a lifesaver to run the household later as the country witnessed its worst economic crisis.

Dr Ahilan Kadirgamar

“We never expected this crisis would push us to this level. Since both of us (husband) are daily workers in farms, we are able to manage our house expenses through this system,” Ms Despriya, mother of two from Varrivalavu, Karainagar of Jaffna told the Sunday Times.

She is one of the beneficiaries of the Cooperative Coupon System, a pilot project started by Northern Cooperative Development Bank (NCDB), established in 2019 with seed capital in partnership with Northern-based cooperative societies which have a vibrant network at the grassroots level among farmers, women-headed households and rural banded industrial unions across the Province.

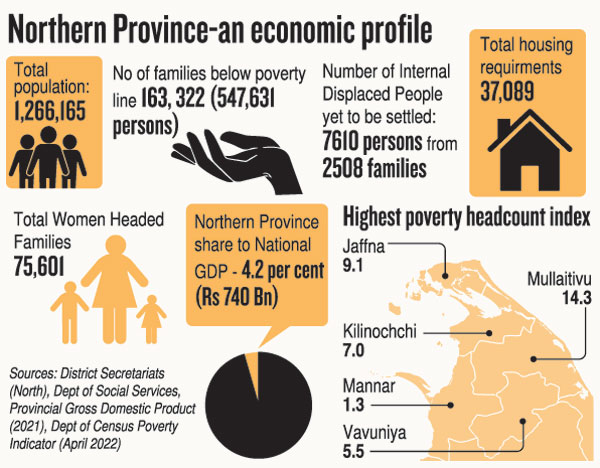

Under the credit scheme that targeted families below the poverty line a family is entitled to purchase goods at the cooperative outlet with an initial credit limit of Rs 2,000. The one-month interest-free credit allows beneficiaries to purchase goods; and based on proper repayment history, it can be eventually increased up to Rs 10,000.

To mitigate food security concerns, the Bank came up with another scheme of selling rice at Rs 50 lower than market price for beneficiaries. A family that consists of five members is eligible to purchase 5 kgs of rice per week.

Beneficiaries who cannot settle within one month can also repay in small instalments. Those who resettle before the due date will be given an incentive of three per cent of the credit deposited in their rural banking account.

With the current high inflation which reduced the purchasing power of citizens, a Rs 2,000 credit limit is not enough. Despriya thinks credit limits should be increased. “Those days, we can purchase a significant amount of goods under Rs 1,000. Nowadays, two items would cost that much,”

Cooperative societies have been supporting communities through several schemes.

Sepamalai Peter Justin, Manager of Karainagar Multi-Purpose Co-operative Society (MPCS) told the Sunday Times that the rice ration system is popular among daily labourers. “There have been no defaults by beneficiaries in my outlet; they are selected considering their past involvement with the cooperative society,” Justin, who has been in a managerial role for over 17 years in the cooperative said.

Since the pilot programme commenced, at least 150 beneficiaries registered within 6 months at the Karainagar and Kalapoomi cooperative outlets. By end last year, at least 300 beneficiaries were registered in MPCS outlets in Palai, Iyakkachchi, Vavuniya, Pooneryn, and Akkarayaan in addition to Jaffna.

NCDB provides low-cost loans targeting small industry development, and offers agricultural credit schemes in addition to developing marketing links to connect the cooperative sector.

As food security concerns loom significantly, the Government introduced a similar rice coupon system of 10 kg of rice per month to 2 million low-income families, including Samurdhi beneficiaries, for a period of two months. “If the cooperatives can do it efficiently, so can the Government. But it is not sustainable, since many families would sell it in the market,” said Dr Ahilan Kadirgamar, senior lecturer, University of Jaffna and Honorary Chair of the Bank.

“Cooperatives can sustain the current crisis if cooperatives and federations are supported,” Dr Kadirgamar stressed. With unemployment on the rise, Dr Kadirgamar noted that there is an interest among workers, particularly fresh graduates, to join cooperative societies for various reasons such as reducing additional costs, ability to work near home and within the community, to name a few.

Dr Kadirgamar believes that cooperatives with adequate support and access to capital, along with proper management, can serve local communities better in the long run.

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!