Columns

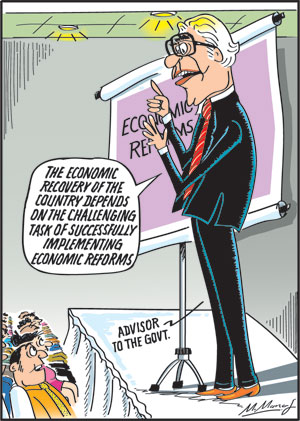

Implementing IMF reforms vital for economic stabilisation and growth is a challenging task

View(s):The success of the International Monetary Fund (IMF) programme depends on whether the country would follow pragmatic economic policies and prudent economic management, eliminate corruption, undertake economic reforms, and properly utilize the funds. These are difficult given the country’s political culture and social milieu.

Ex-Governor

Central Bank’s former Governor Dr Indrajit Coomaraswamy told a webinar last week that there were three most important priorities for Sri Lanka in the implementation of the IMF programme.

These were implementation, implementation and implementation of the agreed-upon benchmarks of the IMF programme. This is the crux of the problem.

Implementation

The success of the IMF programme to stabilize the economy and generate economic growth is dependent on the successful implementation of the economic reforms. This indeed is a challenging task in the country’s political context and culture. Failure to implement the wide range of fiscal, monetary and other reforms will surely result in underdevelopment and weak external finances.

Economists

Most economists are of the view that this is an opportunity to break with past unsustainable policies and follow a path of economic discipline to stabilise the economy and achieve economic development.

However, the country’s political culture is ideologically against IMF involvement and reforms, though those opposing the programme do not have a viable alternative.

Opposition parties

Several vociferous opposition parties that have few seats in parliament are ideologically anti-IMF. They consider the multilateral agency, of which Sri Lanka has been a member for seven decades, as an agent of the capitalist West that undermines developing countries. They view the IMF facility and reforms as a step towards further indebtedness and dependence on the West.

Popular view

This perception is also held by a large proportion of people, who do not have an understanding of economics. In contrast, many economists are articulate in the need to follow the reform programme.

For instance, economists from the Colombo and other universities, Verite Research, Advocata Institute and other think tanks, and non-political, pragmatic economists have explained the rationale for adopting the IMF’s reform programme. They have also suggested some modifications in taxation so that it will be more equitable.

Popular perception

Nevertheless, the popular perception is one of opposition to the IMF’s rescue package and conditions, particularly to the privatisation of state-owned enterprises.

Reasons for such antipathy are the hardships imposed by the IMF conditions for fiscal stabilisation, and the electoral agendas of political parties.

Popular culture

This is reinforced by a popular culture of entitlements. The popular view of government finances is that the government has inexhaustive finances to confer benefits to people. They expect benefits from the government without paying taxes.

Benefits

Illustrative of this political culture is the expectation of various benefits without commensurate government revenue. People have a notion that the government has the capacity to give numerous benefits without taxing them. Lee Kwan Yu characterised Sri Lanka’s elections as an auction of non-existent resources.

This is not new. It is a post-independence feature of the country’s political culture and popular economics. This is the underlying reason for opposing income taxes.

Conditions

Political and social conditions are not conducive to the adoption of reforms that are vital to make the economy function at its potential. Protests, strikes and political and social unrest could hamper the needed reforms for good economic management, fiscal consolidation and monetary stabilisation that are prerequisites for economic recovery and growth.

Turning point?

The road to economic growth and development is long and arduous. Tough decisions and hard times are ahead. Could we make this IMF arrangement a turning point in the country’s economic development?

Will the country make this a tipping point in the nation’s economic history to revive the economy or fritter away the opportunity for economic growth due to the political motives of some party leaders?

Consensus

A strong political commitment and a broad political consensus are needed to effectively implement the required economic reforms. Is there a possibility for at least the two main political parties to come to a consensus, as happened in India in 1991?

Political unrest

The current spate of strikes, political protests, social unrest and discontent are not conducive to the functioning of the economy and an upsurge in economic activity. Political stability and law and order are vital to achieving economic growth.

Concluding reflections

Are we on the road to economic recovery? We must have a strong resolve, a national consensus and a commitment to implement a recovery programme.

Will we use this opportunity to put the economy on the road to economic development? Are we at a tipping point towards economic recovery and economic growth? Will the current political upheavals weaken the needed reforms?

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment