News

Analysts see geopolitical designs behind India’s largesse

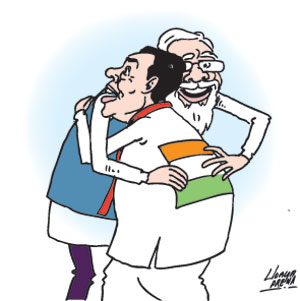

“It’s a game of chess and India has checkmated us in such a fashion that we don’t have any moves other than to shake their hand and go ahead with them unless we want our kings killed,” said a retired commander of the Armed Forces and maritime defence analyst, wryly. He did not wish to be named.

Amidst an unprecedented economic crisis, all options available to Sri Lanka involve varying degrees of pain, said H.M.G.S. Palihakkara, veteran diplomat and former Secretary to the Ministry of Foreign Affairs. The two choices for immediate funding assistance are an apolitical multilateral source like the IMF or bilateral geopolitical sources.

“The latter’s conditions are generally geopolitical in character, often non-negotiable and involve our sovereign assets,” he said. “Parceling out the country to geopolitical creditors could be costly in terms of economic and national security as well as foreign policy interests.”

The IMF’s requirements, however, are negotiable and based on Sri Lanka’s own plan, if there is one. They generally involve fiscal and budget discipline and prudence.

“The need is to consider an apolitical rather than geopolitical source for such emergency assistance, even if it is not politically expedient,” he urged. “ Whether this is too little too late since the authorities have been prevaricating so much for so long, is of course another story.”

The most transparent lenders are the banks, which have lending criteria, said Anura Ekanayake, independent economist. But Sri Lanka isn’t in a position to go to a bank or any kind of global financial institution, including IMF, for immediate money–because the lender, going by available macroeconomic data and ratings of global rating agencies, must establish clearly whether the country can repay the loans. And neither the ratings nor statements by these agencies give confidence to any institutional lender regarding Sri Lanka’s ability to honour its commitments.

“Even IMF can lend to countries which are solvent, which are able to meet the loan commitments,” Dr Ekanayake said. In the initial stage, therefore, it can only offer technical advice to the Government on how to become solvent.

“So there’s no choice but to go to individual countries with a begging bowl,” he continued. “Now it’s very late. It was different two years ago.” And when a bilateral lender lends, it is either to buy goods and services from that country–at whatever price or terms it cites–or to roll over earlier loans that Sri Lanka cannot immediately repay.

The Indian credit line of US$ 1bn is less than the value of month’s imports, he pointed out. It will not give Sri Lanka a big breathing space: “Probably the authorities think, ‘Let the people have a good Sinhala and Tamil New Year. They cannot think beyond that.”

Dr Ekanayake pointed to a lack of information, even regarding the bilateral loan. “We don’t know what is what,” he said. “It’s only speculation then. But the fact is no one ever gives anything for nothing. That has to be accepted. So we have to start asking what the terms are on which these loans have been given.” He referred to both direct and indirect conditions.

India is trying to increase its goalpost in Sri Lanka using loan negotiations, the retired military commander earlier quoted held. Sri Lanka is of strategic interest because China has already made heavy inroads into the country.

“So when they saw the mess we were in, and because China has temporarily suspended financial assistance, with us asking money for basics like fuel and medicine, they moved forward,” he said. Trincomalee Harbour is crucial. It is more of strategic advantage and commercial, and useful for having a foothold in that area.

India first demanded the Trincomalee oil tanks and Sri Lanka signed the agreement. “As we plummeted further into crisis, they asked for Sampur,” the retired commander now maritime defence analyst observed. “India always has an interest in Sampur because they don’t want any other foreign power there. And if we cannot give a coal power plant there, they asked for a solar power one. A renewable energy plant needs a huge amount of property, much more than coal power plant.”

“Anybody who controls Sampur controls the approach to Trincomalee Harbour,” he continued. “Additionally, every piece of land they’re asking for touches the sea. Nobody talks about how far the sea comes into these deals. And if they want to protect their assets, they have to bring in their security, their military and breach our integrity and sovereignty.”

“Every time India comes up with an agreement, we are tied up in it for the next 30 to 40 years,” he warned. “If you call India and China enemies, the far enemy is not too dangerous. The near enemy is extremely dangerous. Nobody is our friend right now.”

“When you see S Jaishankar’s interviews on Sri Lanka, you can understand where the Indians are taking us strategically,” he said. They are not giving us anything for free. “They have a trump card as far as financing goes. China has closed its doors. So India is lining up credit lines. We have no other place to go to than India.”

“You get trapped in that line of credit,” the Admiral asserted.” You finish one line then take another. India knows that we are bad at making calculations and using lines of credit to our advantage.”

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!