Back to inflationary times!

View(s):

A farmer at an economic centre in Sri Lanka with a stock of vegetables.

The announcement of the latest headline inflation rate as 8.3 per cent for the month of October caught the attention of all sorts of media – electronic, print and social. The rate has moved beyond the “medium-term” flexible inflation targeting (FIT) framework of the Central Bank as well. Even before the increase in prices was confirmed by the statistical evidence, the consumers had already been nervous about it when they visited vegetable sellers, grocery shops, rice stalls, gas outlets, and other markets.

The Sri Lankan consumers who know how to make fun and laugh even in the midst of difficulties, started counting, not the prices of grams and kilograms, but the prices of a bean pod, one tomato, one potato and so on and, circulated price lists on social media. And they showed on video clips how to eat vegetable curry without consuming the few vegetables you purchased!

Price fluctuations

I dealt with the issue of “falling prices” during the crisis as well as that of “rising prices” during the recovery a couple of times in this column previously. What has been said about the forthcoming inflation in the global economy is now happening in front of our eyes. And here in Sri Lanka on top of global issues, more of the local issues have been added fueling rising inflation.

I thought of drawing our attention again on the issue of inflation and the possible policy responses. Although the subject matter is a boring argument for economists to keep the discussions and debates running, I want to touch upon its few fundamentals, of course, in a simple language. The main point I am going to stress is that it is the “nature” of long-term inflation to go up and down, but its short-term ups and downs in different countries can be fueled by domestic policy initiatives.

All major economies in the world have been experiencing a notable increase in their inflation, which was subdued, as the world approached the COVID-19 pandemic. If you extend the time period longer than that, you would see the long-term inflation in the world was at its peak about 40 years ago, which was on the downward path as the world approached the Global Financial Crisis in 2008-2009. During an economic downturn, whether it is due to the Global Financial Crisis or the COVID-19 pandemic, inflation is low and there were even deflationary situations in many of the advanced countries.

All major economies in the world have been experiencing a notable increase in their inflation, which was subdued, as the world approached the COVID-19 pandemic. If you extend the time period longer than that, you would see the long-term inflation in the world was at its peak about 40 years ago, which was on the downward path as the world approached the Global Financial Crisis in 2008-2009. During an economic downturn, whether it is due to the Global Financial Crisis or the COVID-19 pandemic, inflation is low and there were even deflationary situations in many of the advanced countries.

Now the tendency is reversed as the global economy is experiencing a recovery and it was supported by the COVID-19 vaccine administration; therefore, inflation is on the rise. A remarkable increase in world prices has been noted first in fuel and secondly in food. The price of crude oil has increased about four times in 18 months; it was below US$20 a barrel in April 2020 and, is now around $80. During the same period, world food prices have increased on average by about 45 per cent, according to the FAO Food Price Index. A notable increase in prices was seen in all major food categories – vegetable oils, cereals, dairy products, meat and sugar. As the Western Hemisphere is approaching the winter months, the energy and food prices are also expected to further rise in the coming months.

From the global economic point of view, recovery means the relaxation of the economic machinery so that all sort of economic activities begins to revive. The recovery accelerates demand resulting in pressure on prices. If the bigger countries such as China and India begin to accelerate their growth rates in the coming years, the global pressure on prices may continue to further rise.

Policy responses

What do the countries do against the rising inflation is a policy choice left for individual countries to decide. The immediate policy response should be an increase in the interest rates, but only if they see the rising inflation as a problem. Why interest rates? It is because interest rates declined as inflation fell and now as inflation rises, interest rates can be reversed. Interest rates in the world declined during the crisis time, because of the attempt for monetary policy stimulus to mitigate the crisis impact. Now during the recovery period inflation is on the rise so that there is a choice for increased interest rates. However, a fundamental issue here is that at a time that the countries needed to allow for the recovery, should they try to control inflation and thereby restrict the recovery process?

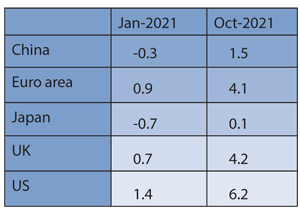

In this case the world appears to have been divided: All major countries listed in the table – the US, the UK, Euro area countries, Japan, and China opted to remain cautious without making any alteration to their interest rates. The US economy has experienced a high rate of inflation of 6.2 per cent – the highest in 30 years but does not want to disrupt its recovery. Obviously, if you have lowered the interest rates during the crisis, why do you want to reverse it when the economy is on the recovery path? Though it is a logical question, it does not rule out the possibility of changing the policy stance if inflation continues to rise.

In this case the world appears to have been divided: All major countries listed in the table – the US, the UK, Euro area countries, Japan, and China opted to remain cautious without making any alteration to their interest rates. The US economy has experienced a high rate of inflation of 6.2 per cent – the highest in 30 years but does not want to disrupt its recovery. Obviously, if you have lowered the interest rates during the crisis, why do you want to reverse it when the economy is on the recovery path? Though it is a logical question, it does not rule out the possibility of changing the policy stance if inflation continues to rise.

At the same time, some countries such as Singapore, South Korea, Russia, Brazil, UAE, Bangladesh and Vietnam have decided to raise their benchmark policy rates. They are of the view that as of now containing the inflationary pressure is important for maintaining economic and price stability.

Our discussion is incomplete if we do not bring the exchange rate issue into it, because all ‘three rates” are inter-related and present an “impossible trio” as a policy dilemma for policy makers. It means that ultimately you must choose two for the country and let the other go! If a central bank decides to keep the interest rate down when inflation is running low, the exchange rate tends to depreciate. If a central bank chooses to raise the interest rate when inflation is running high, then the exchange rate appreciates. But all these possibilities are under “normal” circumstances, whereas under “special” circumstances, the policy dilemma is worse than that.

Where are we?

Sri Lanka’s rising inflation is a result of not only the global price movements, but also domestic supply shortages and import controls. Sri Lanka was able to reduce interest rates significantly in the face of lower inflationary pressure, by adopting import controls and sacrificing official foreign exchange reserves. But even with that, the rupee depreciated significantly since there was no strong and stable foreign exchange inflows.

The impact of the removal of price controls, the fertiliser issue and alleged corruption, all these factors have contributed to domestic price hikes, while some of the issues are only temporary affecting short-term inflation. However, the main question is whether the increase in our inflation is short-term or not.

The global increase in fuel and food prices will continue to play a major impact on our domestic prices. Domestic supply shortages are likely to continue at least in the medium term. Import controls remain a considerable issue too as long as the tourism sector recovers and exports rise. Maintaining the government revenue for the coming year remains a challenge, as reflected in the Budget 2022. In the midst of all that a possible increase in interest rates appears to be a painful policy choice available for Sri Lanka in order to ease pressure on both domestic prices and exchange rates.

(The writer is a Professor of Economics at the University of Colombo and can be reached at

sirimal@econ.cmb.ac.lk and follow on Twitter @SirimalAshoka).

Hitad.lk has you covered with quality used or brand new cars for sale that are budget friendly yet reliable! Now is the time to sell your old ride for something more attractive to today's modern automotive market demands. Browse through our selection of affordable options now on Hitad.lk before deciding on what will work best for you!