Columns

Only small balance of payments surplus despite significant decrease in trade deficit

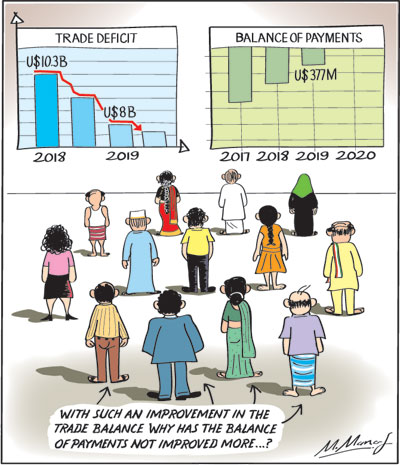

View(s):In spite of a significant decrease in the trade deficit by US$ 2.3 billion last year, the balance of payments (BOP) surplus was only US$ 377 million. The much reduced trade deficit last year did not improve the balance of payments by much owing to lower earnings from tourism, a dip in workers’ remittances and large capital outflows.

A much higher BOP surplus of US$ 2 billion or more is needed to strengthen the country’s foreign reserves and reduce the nation’s foreign debt and external financial vulnerability. An improvement in the trade balance, as well as the capital account, is needed to achieve this.

A much higher BOP surplus of US$ 2 billion or more is needed to strengthen the country’s foreign reserves and reduce the nation’s foreign debt and external financial vulnerability. An improvement in the trade balance, as well as the capital account, is needed to achieve this.

Expectation

The declining trade deficit during last year led to an expectation of a significant balance of payments surplus. Although the trade deficit decreased from US$ 10.3 billion to nearly US$ 8 billion, the BOP surplus was only US$ 377 million.

The large trade deficit of US$ 10.3 billion in 2018 resulted in a BOP deficit of US$ 1.67 billion. With the much reduced trade deficit of US$ 8 billion, the expectation was a balance of payments surplus of about US$ 2 billion. However the balance of payments surplus was a mere US$ 377 million.

Reasons

Reasons

Although the much lower trade deficit last year was expected to increase the balance of payments surplus to about US$ 2 billion, this did not materialise owing to lesser earnings from tourism, decreased workers’ remittances and net capital outflows. Consequently the decline in the trade deficit failed to strengthen the country’s external finances and financial vulnerability.

Trade deficit

During 2019, the trade deficit contracted significantly, mainly due to a sharp decrease in import expenditure of about US 3 billion or 10.3 percent from that of 2018. Export growth that was significant in the early part of the year tapered off to increase by only 0.4 percent in 2019 over that of 2018.

In spite of the decrease in the trade deficit by US$ 2.3 billion, the balance of payments surplus was oily US$ 377 million due to a decline in tourist earnings, workers’ remittances and a net outflow of capital, especially in December. Workers’ remittances were 4.3 percent lower in 2019 compared to 2018. Earnings from tourism decreased by 18 percent from US$ 4.4 billion to US$ 3.6 billion. Foreign direct investments too decreased from US$ 1,662 million in 2018 to US$ 772 million.

Capital outflow

In addition there was a notable outflow of foreign investment from the government securities market, especially during December 2019, and net outflows from the Colombo Stock Exchange. These resulted in the balance of payments surplus being only US$ 377 million, compared to a BOP deficit of US$ 1.667 billion in 2018, despite the large trade deficit of US$ 10.3 billion.

Trade balance

The decrease in the trade deficit last year was achieved mainly due to a sharp decline in imports of 10.3 percent rather than a significant export growth. In the first half of the year, there was an acceleration of export growth that tapered off in the latter months of the year to record an export growth of only 0.4 percent. While industrial exports increased by 1.8 percent, agricultural exports declined by 4.6 percent. Tea exports decreased by 5.7 percent.

Weaknesses

The analysis of the 2019 balance of payments once again discloses the weaknesses of the country’s external finances. In spite of the decrease in the trade deficit, it is too high to achieve a balance of payments surplus of significance. Furthermore, the decrease in the trade deficit of last year was brought about almost entirely by shrinkage in imports rather than increased exports. Such a lowering of the trade deficit is unsustainable.

Only a significant export growth would improve the country’s balance of payments and enable the Island’s import-export economy to achieve higher and more inclusive growth.

Exports

Export growth continues to be insignificant. An analysis of exports discloses that export growth is confined to a few exports, most notably garments that are facing severe competition. The recessionary conditions in the world this year and trade limitations could hurt manufactured exports.

Agricultural exports

Agricultural exports have fared dismally once again with a decrease of 4.6 percent, Earnings from tea, the country’s main export, decreased by as much as 5.7 percent last year. Other agricultural exports too have fared inadequately. The resuscitation of agricultural exports is vital to enhance total export earnings.

Concluding reflection

The performance of the country’s external finances do not augur well for the economy. The balance of payments continues to be weak and the country’s external financial vulnerability is increasing rather than ameliorating. A much improved balance of trade is vital to enable a significant balance of payments surplus that could reduce the nation’s external vulnerability.

A significant improvement in the country’s balance of payments could be achieved only with a reduced trade deficit brought about by a growth in exports. Revival of tourism, net inflow of capital and increased foreign direct investment that are vital for an improvement in the balance of payments and long term economic growth and economic development.

The current global economic conditions and the impact of the Coronavirus on tourism does not augur well for the improvement of the trade balance and balance of payments. The continuing outflow of capital in 2020 is a severe threat to the external finances of the country.

Leave a Reply

Post Comment