Columns

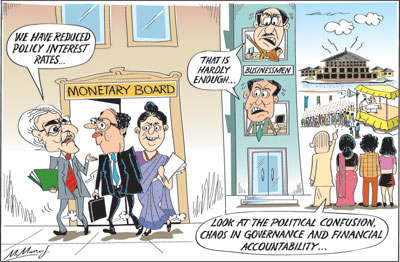

Will reduction of policy interest rates spur economic growth?

View(s): The Central Bank’s policy interest rate reduction is intended to give an impetus to investment and economic growth.

The Central Bank’s policy interest rate reduction is intended to give an impetus to investment and economic growth.

Although the interest rate reduction would assist business, it alone will not spur investment. A host of conditions, including political stability and economic certainty, are necessary to create an investment climate conducive to economic growth.

The Central Bank’s Monetary Board decided to reduce the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) by 50 basis points to 7 percent and 8 percent, respectively. It arrived at this decision after a “careful analysis of current and expected developments in the domestic economy and the financial market as well as the global economy, with the aim of further supporting the revival of economic activity in the context of low inflation prevailing at present and the medium term inflation outlook, which is well anchored in the desired 4-6 per cent range.”

Global conditions

In making the decision, the Monetary Board was also influenced by global financial and market conditions. The Central Bank statement announcing the reduction says: “Amidst weakening global demand due to uncertainties arising from trade tensions and geopolitical developments, many central banks in advanced and emerging market economies have reduced policy interest rates to support domestic economic growth, and have signalled that their stances will remain accommodative in the near term. Muted inflation and inflation outlook in these economies have acted in favour of such decisions.”

The lowering of interest rates in Sri Lanka is, therefore, part of a global wave of interest rate reduction. “Slowing global economic activity has prompted many countries to relax their monetary policies.”(Central Bank, Monetary Policy Review: No. 5 – 2019). Many countries, including India, have reduced policy interest rates to spur economic growth.

Response

Response

No doubt most business houses would welcome this reduction in interest rates. This is especially so as the depreciation of the rupee in the past months has increased production costs. The recent appreciation of the rupee and the lower costs of borrowing would no doubt benefit many enterprises. However, whether this lowering of interest rates would boost investment and reduce the output gap is highly unlikely.

Cost of money

The cost of money matters. The supply availability and cost of credit are important determinants of investment. The interest rate reduction would assist business, but whether it alone would be adequate to boost investment is questionable. Investors are likely to be circumspect in investing in the current climate of political and economic uncertainty.

This scepticism is based on the view that a low interest rate alone cannot boost investment. There has to be an environment of policy certainty and confidence in the business environment. These factors have been woefully lacking for some time and have deteriorated in the run up to the presidential election. Furthermore, there would be no certainty after this election as the country prepares for the parliamentary elections in 2020.

Too little

Another reason to doubt a positive impact of the lowering of the interest rate to increase investment is that it is too small. Marginal changes in interest rates do not make a large impact on investment decisions. Furthermore, although the rate of inflation has been kept at middle single digit level, the expenditure overruns that are occurring would lead to a fiscal slippage and inflationary pressures.

Trade prospects

A huge uncertainty is whether trade relations with Western countries which are the main markets for manufactured goods and sea food exports would be jeopardised by a change of government. This is worrisome in the current context of the noteworthy growth in exports since 2017.

Economic growth

The Central Bank implicitly recognises the limitations of the monetary policy, and specifically the interest rate policy, to stimulate economic growth. “Economic growth is likely to be hampered by adverse domestic and global developments.”

The Central Bank announcement observes: “Prevailing economic conditions and the developments observed in leading indicators point to modest economic growth during 2019 as well. Although economic growth is expected to recover gradually towards its potential in the medium term, domestic and global headwinds are likely to delay this recovery.” In this context the Central Bank has reduced policy interest rates to ease the prevailing constraints. “Therefore, it is essential that the available policy spaces are utilised to support productive economic activity without disrupting the improvements achieved in relation to macroeconomic stability.”

External finances

The silver lining in this inhospitable environment is the improvement in the trade balance and external finances. Exports have increased, imports have declined and the trade deficit has contracted significantly in the first half of the year. There have also been improvements in tourist arrivals and workers’ remittances have stabilised.

The Central Bank’s assessment of the external finances observes: “External sector remains resilient supported by an improved trade balance. The trade deficit continued to improve during the first half of 2019 with the sustained growth of exports and the notable contraction in the growth of imports. Tourist arrivals, which were impacted by the Easter Sunday attacks, continued to recover from the month of June. Workers’ remittances recorded a marginal growth in June, although a cumulative moderation was observed during the first half of the year. Foreign financial flows, in the meantime, have been mixed with a net outflow from the Government securities market and a net inflow to the stock market, including primary inflows, thus far during the year. The Sri Lankan rupee appreciated against the US dollar by 2.4 percent so far during the year, although some depreciation pressure was experienced during the past few days. The depreciation pressure, mainly driven by foreign withdrawals from the Government securities market by a few investors, is expected to be short-lived. Meanwhile, gross official reserves are estimated at US dollars 8.3 billion at end July 2019, providing an import cover of 5.0 months.”

Conclusion

All things considered, the marginal decrease in interest rates is not likely to boost investment. On the other hand, the further lowering of interest rates for savings and fixed deposits could be a disincentive for savings mobilisation. It would certainly decrease incomes of retirees and pensioners.

Money matters. The supply availability and cost of credit can influence investments, but the monetary policy alone cannot achieve economic growth.

Leave a Reply

Post Comment