News

Huge oil refinery at H’tota: Controversies and major questions over project

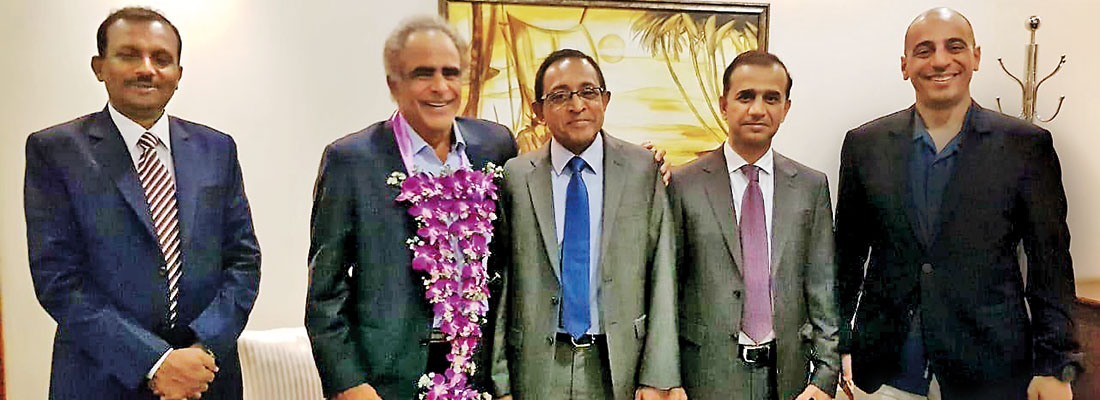

Oman’S Oil Minister Mohammed Hamad Al Rumhy arrived in Colombo, accompanied by Oman Oil Refineries and Petroleum Industries Co CEO Musab bin Abdullah Al-Muhrooqi yesterday. They were welcomed at the airport by Petroleum Resources Development Minister Kabir Hashim, Oman’s Ambassador Jumah Hamdan Hassan Al-Shehhi and Sri Lanka’s Ambassador in Oman, K. Pathmanathan.

By Namini Wijedasa

The son of a controversial Indian politician from the Dravida Munnetra Kazhagam (DMK) is a director in, not just one, but two companies recently incorporated in Sri Lanka. The second was set up ostensibly to implement a US$ 3.85 billion (Rs 685.5 billion) oil refinery project in Hambantota.

But the initiative is mired in confusion. The Sri Lankan Government first announced the involvement of the Omani Ministry of Oil and Gas. However, Oman swiftly denied it had any part in the multibillion dollar investment.

This contradicted multiple documents –including Cabinet and Board of Investment (BOI) papers the Sunday Times has seen–that conclusively say the Omani Ministry will hold a 30 percent stake in the relevant joint venture with the remaining 70 percent going to Silver Park International (Pte) Ltd of Singapore.

The BOI then issued a statement admitting that “there is no agreement that has been signed between Oman’s Ministry of Oil and Gas and Silver Park International Pte Ltd with regard to equity arrangements of the project.”

But the Oman Oil Company “has registered their firm intention to participate in equity up to 30 percent, subject to reaching agreement between the parties”, it said, indicating that the Omani participation had been heavily overplayed well before a deal was made.

Yesterday, the Development Strategies and International trade Ministry circulated an “urgent” media statement, announcing that Oman’s Oil and Gas Minister Mohammed Hamad Al Rumhi had arrived in Colombo with the Chief Executive Officer of Oman Oil Refineries and Petroleum Industries Co (ORPIC) for the groundbreaking ceremony of the oil refinery in Hambantota. This, too, said ORPIC “has expressed its firm interest” in partnering with Silver Park International in the project.

It is clear, therefore, that the proposed deal between Silver Park and the Omani entity is still under negotiation. Now, the identity of the investors and the source of promised foreign investment–the largest Sri Lanka will ever have received, if it comes in full–have aroused local interest.

India’s The Hindu newspaper named three of Silver Park International’s four directors as Jegath Rakshagan Sundeep Anand, Jagathrakshakan Sri Nisha and Jagathrakshakan Anusuya. They are the son, daughter and wife of S. Jagathrakshakan, a DMK stalwart.

Mr. Sundeep Anand and his wife Sri Nisha are also directors of Silver Park International (Pvt) Ltd and Silver Park Petroleum (Pvt) Ltd incorporated in Sri Lanka, the Sunday Times found. The first was set up on September 10, 2018. The second was formed as recently as February 21 this year–only six days after Development Strategies and International Trade Minister Malik Samarawickrama submitted his latest Cabinet paper on the subject.

Minister Samarawickrama sought approval for the BOI to pursue the project and to allocate 400 acres of land in Hambantota to the investors. Some 200 acres have already been earmarked.

According to incorporation papers filed with the Registrar of Companies in Sri Lanka, Mr. Sundeep Anand and Ms. Nisha are also initial shareholders of Silver Park International, along with a 39-year-old man from Ward 02 Mulliyavalai in Mullaitivu. He is named Kunasingam Jasoharan.

The company’s stated objectives are: “to carry out the business of manufacturing, importing, exporting, distributorship, intending, brokering, real estates, transportation and wholesale trade; to participate in Government tenders in order to implement the same project and to carry on bulk or wholesale trading activities; to operate as an investment holding company; to act as an agent or representative to any other person or companies; and to carry out any other business whatsoever the company may decide at a directors’ meeting”.

The Silver Park Petroleum directors are Sundeep Anand, Sri Nisha, Kunasingham Jasoharan and Talagala Achchimaddumage Gnanachandra Gunasekara–or engineer, Dr TAG Gunasekara. There are no Omani nationals or representatives of any Omani parties in either company.

Cabinet papers say the investors created that company to build a 10 MMPTA (million metric tons per annum) petroleum refinery for exports at Hambantota. The original investment proposal was submitted to the BOI as far back as November 10, 2016, as “a joint venture between Silver Park International (Pvt) Ltd, Singapore, and the Ministry of Oil and Gas of the Sultanate of Oman”, Cabinet papers state.

A Cabinet memorandum dated February 15 this year reaffirms that Silver Park International (Pte) Ltd of Singapore will hold 70 percent of shares while 30 percent will be owned by “the Ministry of Oil and Gas of Sultanate of Oman”. The debt to equity ratio is placed at 49:51. Export revenue is estimated at US$ 9000 million, expected in the tenth year of operation. And the project, to be completed in 44 months, is tipped to provide 565 Sri Lankans direct employment and up to 185 jobs for foreigners.

A letter dated March 12 this year from the BOI to Silver Park International in Singapore also refers to an undertaking from that investor to “set up a project for 10 MMPTA Green Field oil refinery in Hambantota for export market with an envisaged investment of US$ 3,850 or its equivalent in Sri Lankan rupees in collaboration with the Sultanate of Oman Ministry of Oil and Gas, PO Box 55, Muscat, Oman”.

The letter says the project will take 48 months (not 44, as Cabinet papers state) to complete. The construction and completion of the tank farm and ancillary facilities will cost US$ 1,850 million. The construction and operation of the oil refinery will cost US$ 2,000 million. All refined products are to be exported.

According to information available online, Silver Park International (Pte) Ltd is a private company incorporated on June 15, 2017, in Singapore. It was, therefore, set up several months after the first investment proposal was submitted to the BOI in Sri Lanka.

Silver Park’s registered address is 18, Roberts Lane, #03-01 Goodland Building, Singapore (218297). This is the main address of an entity called Sigma Corporate Solutions whose business is to set up companies (“Asia’s company formation specialist”).

Sigma’s websites says it specialises in ten major jurisdictions: British Virgin Islands, Cayman Island, Samoa, Seychelles, Hong Kong, Singapore, Anguilla, Bahamas, Delaware and Mauritius. All are notorious for shell companies, with some of the featuring widely in global investigations on money-laundering and tax invasion. Sigma lends its Singapore address to many different entities, including Silver Park.

Publicly available information shows that Jegathrakshagan Sundeep Anand is registered with the Indian Ministry of Corporate Affairs as a director of at least 19 companies. It was not immediately clear why the investors needed to set up a new company in Singapore to channel their investment into Sri Lanka.

Meanwhile, one of the Sri Lankan addresses of Mr Jagathrakshakan and his wife is listed as 143B, Messenger Street (renamed as M.J.M. Lafeer Mawatha), Colombo-12. But that location is a shop near Armour Street called Bath Galaxy that sells wall and floor tiles, sanitary ware, sinks, aluminium doors and bathroom accessories. The person who answered the telephone said there were no Indians associated with the business.

The other address, listed in the Silver Park Petroleum incorporation papers, is 50, Allium Tower, 4/3 Suwisuddharama Road, Colombo 6, Thimbirigasyaya. That flat has been taken on rent by a party, sources said, but it had no inhabitants at present.

The Indian address of the couple is 1, 1st Main Road, Kasturibai Nagar, Adyar, Chennai 600020, Tamil Nadu. This is where the Bharath Institute of Higher Education and Research, started by Mr Jagathrakshan, is located. Minister Samarawickrama justifies the proposed project to the Cabinet by saying the country badly needs “export-catalytic high value investments for rapid and sustainable growth, creating high income generating employment and value addition”.

The proposed investment is US$ 3,580 spread over 44 months to set up the petroleum refinery. He points out that this is Sri Lanka’s largest foreign direct investment to date. (Even the Chinese investment in Port City stopped at US$ 1.4 billion , while it cost China Merchants Port Holdings US$ 1.12bn to lease and manage the Hambantota port).

“The investment is from a Singapore registered company and the Ministry of Oil and Gas of the Sultanate of Oman is one of the equity participants with 30% equity,” Minister’s last Cabinet memorandum on this states, prematurely. It says the investors have already initiated preliminary work and are urging the BOI to allocate land immediately to begin site-specific environmental impact assessment (EIA), geo-technical studies and detailed front-end engineering design.

The Cabinet paper states that action has been initiated to acquire suitable land parcels in Hambantota from the Mahaweli Authority for establishment of the Hambantota Industrial Zone, in which such projects could be established. The process, however, is time consuming “and the investor has expressed deep concern on delay in allocating land”.

“Considering above and to prevent the investor from shifting to another country, the BOI has applied to allocate 200 acres of land from the Mirijjawila Export Processing Zone on a 50-year lease based on applicable current rates as the initial segment of the land required, enabling the investor to commence the first stage of the project: that is, water treatment facility, desalination facility, storage tanks, etc, without further delay,” the Cabinet has been told.

With such allocation of land, the BOI will reportedly conduct a site-specific EIA while the investor will be able to begin the geo-technical studies for the first stage of the project. “Approximately 400 acres of land is expected to be allocated once the land transfer takes place from the Mahaweli Authority, based on the valuation of the Government Chief Valuer, probably in March 2019,” the memorandum states. “The environmental impact assessment and other relevant studies for the said site will be conducted as and when access is available and land is demarcated.”

The BOI’s 200 acres come at a non-refundable lease premium of the Sri Lankan rupee equivalent of US$ 20,000 per acre and a ground rent of US$ 4,235 per acre per annum.

Cabinet documents also reveal that, out of three prospective investors, a Chinese party that requested predominant local market access with downstream operations has already dropped out. A proposal from the other potential investor, Sugih Energy International, “is being pursued and will initiate upon allocation of initial plots of land, most probably in March 2019”.

“Discussions are ongoing with the Minister of Finance on incentives to be granted for such high value, large-scale, export-catalytic investments and a separate joint Cabinet memorandum seeking approval for incentives for both these projects is to be submitted in due course,” Minister Samarawickrama told the Cabinet.

| Allegations against the DMK’s billionaire politico S. Jagathrakshakan was first elected to the Tamil Nadu Assembly in 1984. Between 2009 and 2013, he held positions as Minister of State for Information and Broadcasting, Minister of State for New and Renewable Energy and Minister of State for Commerce and Industry. The senior politician has been embroiled in several allegations. It is widely reported that his personal wealth increased by 12 times in just two years. His 2009 election affidavit placed his assets at INR 5.9 crore (INR 59mn). This skyrocketed to INR 70 crore (INR 700mn) by 2011. Media reports said this was the highest percentage increase for assets among all ministers in the central Cabinet during that period. Mr Jagathrakshakan’s name was also associated with the infamous Indian coal allocation scam. Accusations of unexplained wealth have dogged the family for years. In 2016, income tax investigators raided around 40 properties, including residences owned and managed by Mr Jagathrakshakan and his family, on allegations of tax evasion. Journalists placed his personal worth at the time to be around INR 500 to 600 crore (INR 5000-6000mn) at the time. | |

| PM meets Omani oil minister The meeting at Temple Trees was more in the nature of a courtesy call, a spokesman for the Prime Minister’s office told the Sunday Times. No specifics were discussed, but the visiting Minister who will attend today’s ceremony showed “general interest in Sri Lanka” and will meet Ministers Malik Samarawickrama, Kabir Hashim and Rishad Bathiudeen. The spokesman confirmed that the Omani Government had not invested any funds, nor agreed to invest any money so far on the project, but was awaiting the feasibility report to take a decision. |