Columns

Balance of payments surplus as increased remittances and tourist earnings offset large trade deficit

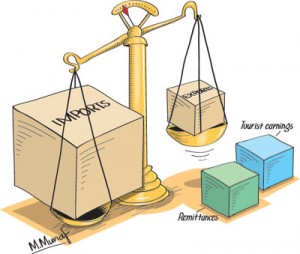

View(s):Despite a large trade deficit in the first eight months of this year, the current account of the balance of payments is in surplus by US$ 1.5 billion. Increased workers’ remittances together with higher tourist earnings during the first eight months exceeded the trade deficit to achieve this current account surplus.

Trade balance

Trade balance

Central Bank of Sri Lanka data disclose that the trade deficit increased by 1.6 percent to US$ 5.54 billion in the first eight months of the year (January to August 2016), compared to the same period last year. However, owing to increased remittances from Sri Lankans working abroad and higher earnings from tourism, this large trade deficit has been more than offset to achieve a current account balance of payments surplus of US$ 1.5 billion.

Although the trade deficit increased by 1.6 percent from US$ 5.45 billion to US$ 5.54 billion in the first eight months, it was offset by remittances and tourist earnings of US$ 7.05 billion to result in a current account surplus of US$ 1.5 billion. Workers’ remittances amounted to US$ 4.8 billion, while tourist earnings contributed US$ 2.2 billion.

Balance of payments

By the end of the year the current account in the balance of payments is likely to be in surplus by over US$ 2 billion owing to the large amount of remittances and increased tourist earnings. In contrast to a massive overall balance of payments deficit of US$ 1,794.5 million in the first eight months of last year, the overall balance of payments is in surplus by US$ 211.5 million. A modest overall balance of payments surplus could be expected this year.

Export performance

Export performance

The export performance for the first 8 months was unsatisfactory. Export earnings declined by 4.1 percent from US$ 7.2 billion in the first 8 months of last year to US$ 6.9 billion in the same period this year. Since last year’s export performance was itself inadequate and led to a massive trade deficit of US$ 8.4 billion, export earnings in the first eight months of this year are considerably inadequate. In contrast, import expenditure decreased by only 1.6 percent to as much as US$ 12.4 billion in the first 8 months of this year.

Trade deficit

This year’s trade deficit is likely to reach a new high exceeding US$ 8.5 billion, if the revival of exports in recent months does not continue and imports are not kept in check. An improved export performance from August lends a little hope of containing the increased trade deficit and enabling a significant current account surplus this year.

Export recovery

There has been a modest export recovery from August this year. Exports increased in August and September compared to those during these months last year. According to statistics of the Export Development Board (EDB), exports increased in August and September. In August export earnings increased by US$ 866 million or 8.4 percent. However this increase was due to a low export figure in August 2015. In September this year export earnings at US$ 898 million were 5.7 percent higher than in the corresponding month of last year.

Export earnings increased for the second consecutive month in September 2016 to US $ 898 million. This increase of 5.7 percent from a year ago, was a reversal of the decreasing trend of exports in the previous 17 months from March 2015. Also significant was the fact that all major categories of exports grew. These included transport equipment, food, beverages and tobacco and rubber products. There were increased export earnings in fish, textiles and several manufactures since August this year. Tea and rubber earnings too have increased in these two months.

If this trend continues, the trade deficit that has increased in the first eight months may dip a little, provided the decline in imports by 1.2 percent in the first eight months continues and does not increase owing to the higher end year import demand. Despite this improvement, total exports declined by 3.0 percent to US $ 7.76 billion during the nine months to September.

Closing comment

Once again workers’ remittances have buttressed the country’s poor trade performance to assist in achieving a current account surplus in the balance of payments. The increase in tourist earnings by 16 percent to US$ 2.25 billion also contributed significantly to turn the large trade deficit into a current account surplus. These favourable developments in the external finances should not mask the weaknesses in our external trade.

With exports being only 56 percent of our import expenditure, we are living beyond our means. A lower trade deficit that enables a significant balance of payments surplus is the way forward in decreasing our high foreign debt that is absorbing around one fourth our export earnings. Furthermore, both remittances and tourism are very dependent on global conditions as past experiences have taught us.

Tourism could also receive a set back if there aren’t peaceful conditions in the country. In July 1983 as well as afterwards tourism was drastically setback by communal disturbances, terrorism and the civil war. Other countries too such as Thailand, Indonesia, Egypt and Lebanon have had similar reversals in tourism. We, who are notorious for killing the goose that lays the golden eggs, need to ensure peaceful conditions and law and order to enable the growth of tourism that is of vital importance for the economy. The improvement of external finances must not be too dependent on worker’s remittances.

Increased earnings from other services, most importantly ICT (Information and communications technology), are the other prospect for improving export earnings. The recent uptrend in ICT exports must be fostered as there is much earnings potential. A substantial increase in export earnings is critical for a significant improvement in the country’s external finances and the reduction of the foreign debt.

External Finances January –August 2015 & 2016 US$ billions

2015 2016

increase/decrease percent

Exports 7.2 6.9 -4.1

Imports 12.6 12.4 -1.6

Trade deficit 5.45 5.54 1.6

Workers remittances 4.6 4.8 4.5

Tourist earnings 1.94 2.25 1.6

Source: Central Bank of Sri Lanka

Leave a Reply

Post Comment