Columns

Criminal Justice Commission likely to punish big racketeers

View(s):- Bipartisan group of ministers make proposals to Cabinet to expedite probe on corruption and fraud cases

- Central Bank bond issue also to be included

- Ravi proposes legislation for foreign money to be brought back,but no concessions for secret account holders

By Our Political Editor

A formidable section of the Cabinet of Ministers have favoured the establishment of Criminal Justice Commissions (CJCs) to punish those responsible for “frauds, corruption and misuse of funds.”A Joint Cabinet Memorandum handed in by them missed the agenda for Tuesday’s weekly ministerial meeting but was listed as a supplement together with different other items. It was, however, not taken up for discussion since the meeting on Unduwap Poya day had extended beyond noon. President Sirisena was to assure that it would be discussed at the next meeting.

That has enabled the prime mover, Dr Sarath Amunugama, Minister of Special Assignments, to seek endorsements from more ministers. At the time of hand over on December 11 (Sunday), besides Amunugama, 14 ministers had placed their signatures on the Joint Cabinet Memorandum. These ministers, who have been assured support by more colleagues, opine that the CJCs should try those accused after the findings of investigative agencies like the Criminal Investigations Department (CID), the Financial Crimes Investigations Division (FCID) and the Special Crimes Investigation Unit (SCIU) which functions under the Police Chief are completed.

That has enabled the prime mover, Dr Sarath Amunugama, Minister of Special Assignments, to seek endorsements from more ministers. At the time of hand over on December 11 (Sunday), besides Amunugama, 14 ministers had placed their signatures on the Joint Cabinet Memorandum. These ministers, who have been assured support by more colleagues, opine that the CJCs should try those accused after the findings of investigative agencies like the Criminal Investigations Department (CID), the Financial Crimes Investigations Division (FCID) and the Special Crimes Investigation Unit (SCIU) which functions under the Police Chief are completed.

One of the SLFP ministers, a signatory, who spoke on grounds of anonymity, said they expected even the bond scam in the Central Bank of Sri Lanka (CBSL), to be placed before the CJC. This is on the grounds that there would be inordinate delays if indictments, if any, were made in courts. He said President Maithripala Sirisena has assured them (the SLFP Ministers) that he would institute a judicial mechanism no sooner Parliament debates the report of the Committee on Public Enterprises (COPE) which probed the bond issue. One or two days from January 24 to 27 are to be allotted for the debate where there will be no vote when it concludes. The Joint Opposition is demanding two days.

Then Prime Minister Sirimavo Bandaranaike’s Government introduced in Parliament the Criminal Justice Commission Act (No: 14 of 1972). Originally, it was the brainchild of the then Attorney General Victor Tennekoon. It was for the purpose of dealing with members of the Janatha Vimukthi Peramuna (JVP) for the abortive April 1971 insurgency. The law then empowered the Chief Justice to name a bench of judges to try the accused and provisions were included to override the provisions of the Evidence Ordinance. Then Chief Justice H.N.G. Fernando named a five judge bench which he chaired. Hundreds of JVPers were arraigned before courts in batches. Most were pardoned whilst some were handed down suspended sentences. Only some top rung leaders were imprisoned. University students were thus able to return to their studies and a number of youth to their previous employment. Justice Fernando noted during sessions that though there were provisions to overlook the Evidence Ordinance, the Commission was not going to do so.

The functioning of this CJC 1 was to inspire the then CID Director Tyrrel Goonetilleke. He lobbied Premier Bandaranaike, her senior ministers and officials to set up a CJC 2 to try those involved in exchange control offences. By then, the CID had launched investigations into a number of cases where there were violations of exchange control laws. Thus, a CJC 2, despite objections from some senior officials, came into being. Mubarak Thaha, who ran a string of night clubs including Atlanta and Tropicana was convicted. Also convicted was bookie owner A.R.M. Mukthar. They were politically associated with the UNP at the time.

Most Sri Lankans, getting impatient over what they see as undue delays in the probes on big corruption rackets, regularly carry out demonstrations such as this. Pic courtesy Daily Mirror

Some features of the CJC were arguably controversial. For instance, the burden of proof was placed on the accused. The Act says, “Any finding made, or sentence imposed by a Commission under this Act shall be final and conclusive, and shall not be called in question in any court or tribunal, whether by way of action, application in revision, appeal, writ or otherwise.”

The CJC Act now remains repealed. This was after the enforcement of the law led to heavy pressure being brought on Premier Bandaranaike. She directed that a Criminal Justice Commissions (Repeal) Law be introduced in 1977. Hence, setting up of new CJCs will necessitate the introduction of a new Bill in Parliament, which ministers say, could incorporate more new provisions. Such provisions, they argue, should include deterrent clauses to prevent bribery and corruption from becoming a hobby of some politicians whatever political side they may belong to.

Here is the full text of the 19-point Joint Cabinet Memorandum titled “Tribunal to Inquire into Corruption” signed so far by 15 members, or a third of the Cabinet of Ministers:

“1. There is now a widespread public desire that corruption be investigated and sanctions imposed on those found guilty expeditiously and in a transparent manner compliant with the principles of natural justice. Corruption per se could lead to the infraction of the criminal law and also the contravention of commercial and civil law.

“2. As such, it is imperative that a Tribunal that can deal with both these aspects be contemplated. Presently none exist within the legal framework. For instance, breaches of the criminal law are tried in a regular Court which is beset with delay. The same delay exists within the framework of the civil and administrative law.

“3. The following options arise for consideration:

“4. Commissions under the Criminal Justice Commissions Act No. 14 of 1972 (CJC Act) had jurisdiction over offences in relation to inter alia offences in relation to currency or foreign exchange of such nature as to endanger the national economy or interest, (Section 2 (1) )

“5. However, in dealing with the above offences the said Commissions had wide powers ranging from inquiring into the matter to imposing sanctions on those found guilty (Sections 2, 5 and 15).

“6. Section 2 (2) (b) / (c) empowered the CJC to inquire and determine whether any person is guilty of such offences and to deal with the persons so found guilty or not guilty in the manner prescribed by this Act.

“7. In terms of Section 15 the CJC shall make a finding that he is guilty of such offence and shall sentence him to any punishment, other than death, to which he might have been sentenced if he had been tried and convicted by the Supreme Court.

“8. Moreover, these commissions also had the power to cause the arrest of any person whose custody was necessary during the pendency of the inquiry (Section 14).

“9. The CJC Act was limited in duration to eight years unless extended by Parliament (vide Section 28). However, this Act was repealed in 1977 by the Criminal Justice Commissions (Repeal) Law (No. 12 of 1977) Act.

“10. Thereafter, the Special Presidential Commission of Inquiry Law No. 7 of 1978 as amended by No 4 of 1978 (Special Presidential Commission of Inquiry Act- SPCI -) was enacted.

“11. By contrast an SPCI duly established has very limited power in comparison with the CJC having regard to the powers vested in the CJC to impose sanctions after a finding of guilt.

“12. Presidential commissions only have the power to inquire into and report upon such administration conduct or matter (Section 2).

“13. An SPCI is not empowered to impose sanctions.

“14. These commissions can only recommend the imposition of civic disabilities which is imposed by Parliament (Section 9).

“15. A striking example is the imposition of civil disabilities on the former Prime Minister Hon. Sirimavo Bandaranaike and her expulsion from Parliament and the imposition of civic disabilities on other politicians not from the Government of the time.

“16. As such, an SPCI cannot impose punishment per se which has to be after due trial by a separate Court of law. It is precisely this two tier approach which is the principal shortcoming of the SPCI.

“17. Therefore, it is apparent that the model under the CJC Act together with reforms serves the public interest of having a legally established Tribunal to deal with corruption rather than having a Special Presidential Commissions of Inquiry.

“18. This is because such a Tribunal could be empowered with a wider range of powers including the power to impose sanctions. Thereby, it saves resources (time and money), for an SPCI only has the power to inquire into, determine and report on matters. This necessitates the subsequent initiation of separate legal proceedings in a court of law to hear and determine if offences have been committed and thereafter impose appropriate sanctions. This will inevitably lead to protracted legal proceedings and inevitable delay which is inimical to the national and public interest.

“19. In order to make this model more beneficial, the jurisdiction of the proposed Tribunal and scope of the matters which falls within the jurisdiction of these Tribunals need to be expanded to include inquiry into breaches of civil and commercial law obligations and provision of appropriate relief including imposition of monetary damages, recovery of illegal proceeds and restitution and compensation.”

Bipartisan support

Among ministers who have signed the Joint Cabinet Memorandum besides Sarath Amunugama are: W.D.J. Seneviratne, Patali Champika Ranawaka, Rajitha Senaratne, Mahinda Amaraweera, Susil Premajayantha, Kabir Hashim (who is also General Secretary of the UNP), Ranjith Madduma Bandara, Talatha Athukorale, Faiszer Musthapha, Chandrani Bandara, Field Marshal Sarath Fonseka and Arjuna Ranatunga.

In the light of the bi-partisan character the Joint Cabinet Memorandum has assumed since both SLFP and UNP ministers have signed it, and with more due to sign, highly placed Government sources believe, it would receive the approval of the Cabinet of Ministers. These sources said fresh legislation would follow thereafter. Whether provision will then be made to include violators of exchange control laws is not immediately clear.

Bring money back to Sri Lanka

This, as our front page story today reveals, is in the wake of Finance Minister Ravi Karunanayake’s new plans to allow those holding funds in foreign banks, earned through ‘legitimate’ means, to bring them to Sri Lanka. However, he said, such a concession under proposed liberalised exchange control laws will not apply to those who have stacked moneys in foreign bank accounts and have been made through questionable means. They cover not only those held in Swiss Bank accounts but also in other safe havens by Sri Lankans after they had set up offshore companies in Panama. Details of the local account holders from a wealth of data exclusively made available to the Sunday Times from America’s International Consortium of Investigative Journalists (ICIJ) and Germany’s Suddeutsche Zeitung on offshore accounts set up with the help of Mossack Fonseka, a Panamanian firm, appear in a box story on this page.

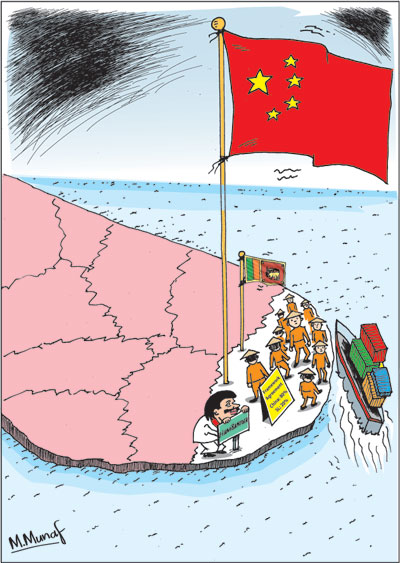

The latest proposals by the group of ministers for a judicial mechanism to probe “frauds, corruption and misuse of funds” come during a twin phase. On the one hand, several cases of frauds, corruption and instances where public funds have been embezzled are still being probed. On the other, questions are being raised on some of the mega deals now being awarded by the Government prompting accusations of corruption within the new administration. The Joint Opposition has raised issue over some of these matters, particularly the Hambantota Port Project and the granting of 15,000 acres of land to a Chinese company for an industrial estate. The company in question plans to install its own power generating system to remain self-sufficient in electricity instead of depending on Sri Lanka’s national grid.

Colombo Port expansion deal

The Hambantota Port project has been wrapped up notwithstanding objections raised by Ports and Shipping Minister Arjuna Ranatunga – the minister in charge of the subject. The Sri Lanka Ports Authority (SLPA) refused to sign the agreement (on behalf of the Government) with China Merchants Port Holdings Company Limited, the Chinese firm that has been allowed a 99-year lease of the Hambantota Port. He had earlier raised objections on various grounds including “national security concerns.”

Now, Minister Ranatunga has cried foul again. This time he has raised issue over the Colombo Port Expansion Project, particularly the development of the East Container Terminal. In a three-page note to his colleagues, Minister Ranatunga has charged that “additional selection criteria” have been introduced for the selection of an investor and complained that this “criteria will create negative consequences in the whole bidding process.” The matter came up at Tuesday’s weekly ministerial meeting where a Minister, largely instrumental for the Hambantota Port Project, stayed away from the ministerial meeting when the subject was discussed saying his brother represented a bidding local firm that had tied up with an Indian company.

Here is Minister Ranatunga’s note: “Cabinet of Ministers by considering the memorandum dated 06 February 2016 submitted by the Hon. Minister of Ports and Shipping on “Colombo Port Expansion Project – Development Options to the East Container Terminal” along with the observations of the Minister of Finance, granted approval to appoint ADB (Asian Development Bank) as the SLPA’s (Sri Lanka Ports Authority) Transaction Advisor and to invite Expression of Interest (EOI) / Request for Proposal (RFP) / Business Proposals from interested parties for the project.

“Accordingly, SLPA entered into an agreement with the ADB to obtain the transaction advisory services for the project. Estimated cost of the advisory services is US$ 5.6 million. ADB transaction advisory services are available for this procurement, since its inception until finalisation of a Concession Agreement.

“Pre-qualification process for the selection of an operator to develop East Container Terminal on BOT (Build, Operate and Transfer) basis was commenced with the Invitation for EOI (Expressions of Interest) on 06 June 2016. As per the Invitation for EOI document, criteria based on terminal operation, shipping and financial capabilities were stipulated.

“Subsequently, during the EOI process, as per the decision of the CCEM (Cabinet Committee on Economic Matters) dated 20 July 2016, an additional criterion was introduced to give weightage to a consortium, which includes a strategic investor from the region, having no less than a 20% shareholding in the consortium. According to the decision, this is to be considered at the RFP stage.

“Invitation for EOI was closed on 20 September 2016 and the received EOI applications are being evaluated by the CANC (Cabinet Appointed Negotiating Committee) with the assistance of the ADB.

“An open and competitive bidding procedure, agreed and advised by the ADB is also, adopted in this procurement. Therefore, evaluation of EOI applications should be done strictly in accordance with the criteria stipulated prior to closure of applications.

“CCEM at its meeting held on 23 November 2016 has instructed to adopt the following criteria when selecting an investor for the project.

g No Government entities should be allowed to compete.

g Regional competitors also should not be allowed. The operators who are already engaged in Colombo Port should have experience in Terminal Operations and the other company also should have wide experience in Port Management.

“Pre-qualification of the project is already completed and new selection criterion cannot be introduced during the evaluation process. Any amendment or introduction of new criteria after the closing of applications is most ill- advised and leaves room for an affected party to seek relief in a court of law and lead to delay in procurement of a BOI concession.

“It is apparent that a number of applicants who have submitted EOI applications would be disqualified under the new criteria, and may even lead to a situation of disqualifying all applicants. In the event a sole applicant is allowed to remain in the process of bidding, it may damage the image of the government and other applicants may claim that the Government’s new criterion is especially designed to target a specific applicant. Moreover legality of the procurement process could be challenged even if one qualified applicant is disqualified consequent to the new criteria introduced.

“Therefore, it may be required to cancel the existing process and recommence the entire pre-qualification process if new criteria are to be introduced.

“The delay in the process of selecting an operator for ECT will cause serious impact while the market share of the Port of Colombo may also lose as the regional ports are in the process of expanding facilities.

“In the circumstances, through this Cabinet Note, I would like to enlighten the Cabinet of Ministers that additional selection criteria would create negative consequences in the whole bidding process of ECT.”

Minister Ranatunga’s note to his cabinet colleagues highlights a number of serious shortcomings. The most important is the lack of transparency and the resultant embarrassment to the very minister in charge of the subject. Sadly there is no mechanism to ensure checks and balances on such instances.

With barely two weeks to go for the dawn of 2017, the Sirisena-Wickremesinghe Government faces some serious challenges. Concerns expressed by a group of Ministers who are seeking tough action against “frauds, corruption and misuse of funds” underscore a serious situation. There is little doubt that remedial action would not only contribute to stability but also to greater public confidence.

Panama Papers — the Lankan offshore companies The International Consortium of Investigative Journalists (ICIJ) in the United States and Germany’s Süddeutsche Zeitung granted exclusive access to the Sunday Times to search for Sri Lankan offshore companies from their database of 11.5 million files better known as the Panama Papers.That treasure trove of data was held by Mossack Fonseca, the world’s fourth biggest offshore law firm in Panama. The data cover nearly 40 years up to 2016 and link to people and companies in more than 200 countries. Whilst the ICIJ has identified some of the Sri Lankan companies and published them in its website, the Sunday Times is able to reveal most of the others today. However, such names do not include bank accounts (which are opened for them by Mossack Fonseca) or the remaining bank balances in the different jurisdictions including British Virgin Islands, Bahamas and Seychelles.It has to be borne in mind that there are legitimate uses for offshore companies and trusts. In revealing the identities of Sri Lankan companies or individuals whose names appear in the ICIJ Offshore Leaks Database, no suggestion is being made that they broke the law or otherwise acted improperly. The Sunday Times only records the presence of those names that could include those who may have operated them on legitimate grounds. The International Consortium of Investigative Journalists (ICIJ) in the United States and Germany’s Süddeutsche Zeitung granted exclusive access to the Sunday Times to search for Sri Lankan offshore companies from their database of 11.5 million files better known as the Panama Papers.That treasure trove of data was held by Mossack Fonseca, the world’s fourth biggest offshore law firm in Panama. The data cover nearly 40 years up to 2016 and link to people and companies in more than 200 countries. Whilst the ICIJ has identified some of the Sri Lankan companies and published them in its website, the Sunday Times is able to reveal most of the others today. However, such names do not include bank accounts (which are opened for them by Mossack Fonseca) or the remaining bank balances in the different jurisdictions including British Virgin Islands, Bahamas and Seychelles.It has to be borne in mind that there are legitimate uses for offshore companies and trusts. In revealing the identities of Sri Lankan companies or individuals whose names appear in the ICIJ Offshore Leaks Database, no suggestion is being made that they broke the law or otherwise acted improperly. The Sunday Times only records the presence of those names that could include those who may have operated them on legitimate grounds. At least two companies operating in Sri Lanka – Gamini Uduwara, Skyline Profits Ltd. registered in British Virgin Islands – and Palitha Mathew and a family member (for Palitha Mathew and Company) have been assisting clients in opening offshore accounts. They have been dealing mostly through the Singapore branch office of Mossack Fonseca. There is no minimum share capital to open an offshore account with Mossack Fonseca in the different jurisdictions. Only a minimum of one Director’s name is required together with a registered office. Within one week from receipt of all documents, an offshore company is formed. The UK branch of Mossack Fonseca, for example, charge Sterling Pounds 3,900 for company formation, tax registration and the opening of a bank account.

Empire Star Holdings incorporated in British Virgin Islands. The Directors: Johann David Peiries, David Percival Peiris, Palavinnege Sumith Kumaratunga, Esther Maureen Peiris and David Percival Peiris.

Lucky Stones Indus Ltd. incorporated in Seychelles. Jayakody Arachchige Dona Marian Srini Pamela Jayakody Interport Enterprises Limited incorporated in the Bahamas. Dilipan Tyagarajah Ashlin Property Holdings Ltd. incorporated in the British Virgin Islands Owners Nilanthi Soysa and Chandulal Stephen Soysa – Declared source of company funds is rent received from a property let out in London. Paskerville Trading incorporated in British Virgin Islands. Kim Sun Kan (of Seychelles), Kenneth John Pendergrast (Sri Lanka)and Umar Manikku (Maldives). Ultimo Capital Ltd. incorporated in British Virgin Islands. Directors Sivasubramaniam Sivayogarajasingham (Sri Lanka) and Sivayogarajasingham Saumian (Australia). Elinvest Ltd. incorporated in British Virgin Islands. Directors Valeri Gorianov, and Dmitry de Wansa Wickremeratne (Sri Lanka). Widespread expectations among Sri Lankans that some opposition politicians would be among those having offshore companies via Mossack Fonseca have been proved wrong. The vast majority of them are commercial enterprises for parking funds while the rest are from individuals. | |

Celweera Trading Limited incorporated in the Bahamas. Joanne M. Sawyer, President, Secretary and Director. Bandula Weerawardena, Managing Director.

Celweera Trading Limited incorporated in the Bahamas. Joanne M. Sawyer, President, Secretary and Director. Bandula Weerawardena, Managing Director.

Leave a Reply

Post Comment