Columns

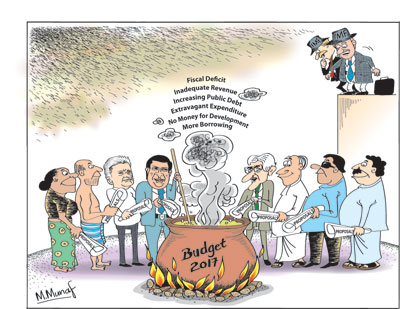

Preparing the 2017 Budget: Too many cooks may spoil the soup

View(s):Preparing the 2017 budget is a challenging task. Bringing down the deficit to 5.5 per cent of GDP; increasing revenue substantially; fiscal reforms to achieve these; finding the fiscal space for development and much needed social expenditure are enormously demanding tasks in the current economic and political context.

Furthermore, the processes and procedures of budget formulation have become more complex and confusing than ever before. This is a sequel to last year’s budget fiasco and the unity government being composed of two parties with different perspectives on the objectives of the budget, its priorities and principles of taxation.

Furthermore, the processes and procedures of budget formulation have become more complex and confusing than ever before. This is a sequel to last year’s budget fiasco and the unity government being composed of two parties with different perspectives on the objectives of the budget, its priorities and principles of taxation.

Last budget

The last budget had 16 amendments and revisions and its fiscal objectives remained mostly unrealised. These changes included the reintroduction of the capital gains tax, changing the income tax threshold, increasing and extending the Value Added Tax (VAT) and removing several tax exemptions. In fact these amendments have created considerable confusion about the taxation in 2016. Although the budget was passed by a two third majority there was much discontent from within the government itself and hostility from certain sections of the opposition. Some of the procedures that have been introduced have been to ensure a more acceptable budget by the two main parties of the government and the people.

Two committees

Consequently the government is putting in place a complex modus operandi for the preparation of the budget. Two committees have been appointed to finalize the 2017 budget proposals. One of them consists of the Prime Minister Ranil Wickremasinghe, Minister of Finance Ravi Karunanayake and Minister for Special Assignments Dr. Sarath Amunugama. Meanwhile President Maithripala Sirisena also has appointed a committee of six ministers to oversee the budget proposals to ensure that the 2017 budget proposals would be in line with the Sri Lanka Freedom Party policy manifesto. Conspicuously absent from both these committees are ministers who have knowledge and experience of economics and finance.

The objective of the President’s committee is to ensure that the 2017 budget reflects the SLFP political and economic principles and is not only a UNP one. On the other hand, the Prime Minister and Finance Minister though of the same party appear to be of different modes of thinking as seen in the divergences between the Prime Minister’s Economic Policy Statement of November 5th 2015 and the budget a few days later. There were fundamental differences in the approach to taxation. The 2016 Budget hardly reflected the economic strategy outlined by the Prime Minister.

Disagreements

The overall objective of these committees is to mould a more consistent and acceptable budget. However, it is highly unlikely that they would reach a consensus. There could even be differences within them. There is a likelihood that the process itself may generate much debate and disagreement and the compromises reached may render the achievement of the fundamental objectives of the budget difficult. These two committees could be at variance with each other and there could be differences within them as well.

Public proposals

Public proposals

In addition it has become a ritual of budget preparation for the Ministry of Finance to seek public views on the preparation of the budget. Is this a meaningful exercise that improves the budget or is it only a politically popular move?

According to a report in last Sunday’s Business Times, the reality is that the inclusion of proposals sent by citizens in previous national budgets has been minimal as most of them are confined to personnel needs of individuals and did not serve the country’s interest or government policy. Although one or two citizen’s proposals were incorporated in budgets presented during the last five years. In contrast around 30 to 50 per cent of proposals submitted by various organisations, trade unions, private sector institutions, the trade chambers, pressure groups and professionals have been incorporated in previous budgets.

According to this Business Times report public proposals for budget 2017 are “pouring into the Finance Ministry where officials are grappling to tackle the massive fiscal deficit, unbearable public debts and adverse trade deficit affecting the country’s economy. The Finance Ministry’s is sorting out suitable proposals in various fields relating to social welfare schemes, health and education, management of public sector income and expenditure and the infrastructure development, policy improvements in the area of trade and investment, SME sector and the deployment of the labour force.” According to this data, the department received 1,285 proposals for the 2016 budget, which was nearly a five-fold increase when compared with the proposals received for the 2015 budget. The average per year of citizen’s proposals for the budgets presented during the last five years was around 900 although the number of proposals dropped to 257 for the 2015 budget. Data shows that 609 proposals were included in the 2016 budget and of that around 300 had been submitted by various organizations, trade unions, private sector institutions, the trade chambers, pressure groups and professionals.

This is to be expected as most proposals would be from the perspective of personal advantage or vested business interest and would not be concerned with the stringent fiscal situation of the country. Hopefully some of these proposals would contribute towards more efficient revenue collection and finding the fiscal space for the country’s expenditure priorities.

Decisive issue

The critical issue is whether the next budget would address the key fiscal issues of containing the fiscal deficit, increasing revenue, finding fiscal space to finance education and health adequately and finance infrastructure and development projects without excessive borrowing. These are difficult tasks as recent experience has shown. However unless government revenue is increased substantially there would be no fiscal space for increasing expenditure on education, health and the development of infrastructure.

Fiscal imperatives

The main objectives of the 2017 budget has been stated as the reduction of the budget deficit to 5.5 per cent of GDP, maintain government investment at 6 to 8 per cent of GDP, maintain the economy’s investment rate at 30 per cent of GDP and achieve a GDP growth of more than 6.5 per cent.

Would the two committees and the public proposals come up with taxation proposals that would achieve this target and reduce the fiscal deficit to 5.5 per cent of GDP that the government is committed to achieve or will these committees and disagreements among them lead to a lack of adequate taxation measures to rein in adequate revenue?

Leave a Reply

Post Comment