Edible oil imports and the Tariff structure: Current status, issues and possible impacts

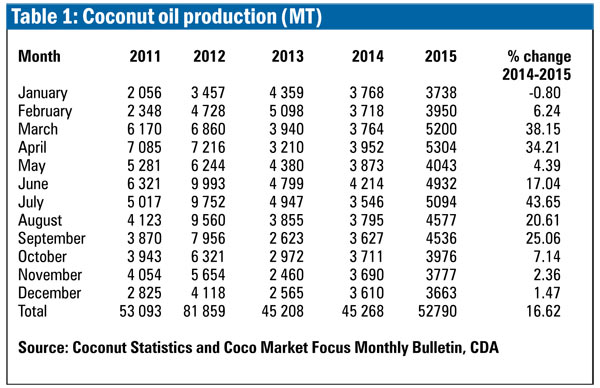

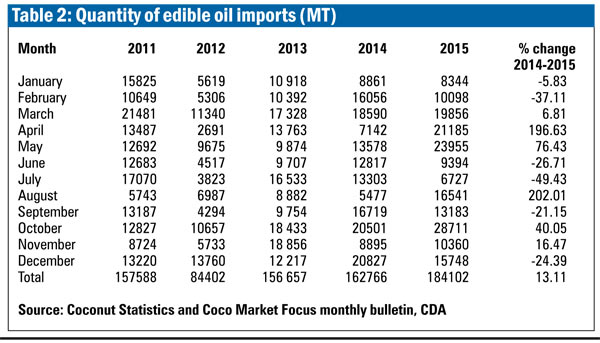

The consumer survey of the Department of Census and Statistics has revealed that per-capita edible oil consumption in Sri Lanka is around 4.31 kg per year. This indicates that the total national edible oil requirement for consumption is 90,440 metric tonnes (MT). Half of this demand is met by locally produced coconut oil and the balance requirement is supplemented with imported edible oils (Tables 1 and 2). When considering the total demand from other industries, the demand for oil is around 80,000-90,000 MT but according to the Sri Lanka Custom records the quantity of edible oil imports in 2015 is 184,102 MT, which is equal to the total oil requirement of the country.

The consumer survey of the Department of Census and Statistics has revealed that per-capita edible oil consumption in Sri Lanka is around 4.31 kg per year. This indicates that the total national edible oil requirement for consumption is 90,440 metric tonnes (MT). Half of this demand is met by locally produced coconut oil and the balance requirement is supplemented with imported edible oils (Tables 1 and 2). When considering the total demand from other industries, the demand for oil is around 80,000-90,000 MT but according to the Sri Lanka Custom records the quantity of edible oil imports in 2015 is 184,102 MT, which is equal to the total oil requirement of the country.

These un-controlled imports have inhibited our coconut oil production and the country has spent Rs. 18,549 million to import edible oils in 2015. This is 45 per cent of the total foreign earnings from coconut kernel products in the year 2015 (Rs. 41,667 million) (Table 3). It is also necessary to note that already locally produced palm oil has also been added to the local market, which has still not been taken into account in the policy making process.

Taxes imposed on edible oil imports

The tariff on imported coconut oil and other edible oils was changed into a Special Commodity Levy with effect from 13 January 2012. It has continued this year as well. Virgin coconut oil and other substitute oils namely soya bean, palm oil, sun flower seed, safflower, cotton seed were included under Special Commodity Levy. The levy was amended in the budget 2012 to Rs. 80 and Rs. 110 per kilogram (kg) for crude and refined oils respectively. This was effective from 1 January 2013.

Coconut oil and palm kernel oil were not included under this levy earlier but those were also included into special commodity levy with effect from 1 January 2013. This tariff structure was amended in the 2014 budget and increased the crude oil tax to the level of Rs. 90 per kg, palm oil Rs. 110 and other Rs. 110 per kg. The next revision was in 18 June 2015 and the revised tariff level for crude palm oil was increased from Rs. 90 to Rs. 110 per kg, palm kernel and refined oil tariff to the level of Rs. 130 per kg.

Present tariff levels

Tariff levels for crude palm oil and palm kernel oils were revised on 13 May 2016. This revised tariff is for crude or refined soya bean oil, palm oil, sunflower oil, ground nut oil, coconut oil, palm kernel oil, margarine and others. With this revision, the crude palm oil tariff was increased to Rs. 130 and for refined Rs. 150.

Effect of tariff change on oil prices

Tariff change has been a positive influence to change the market price of coconut oil, palm oil price and copra prices. According to market information palm oil average prices have gone up to Rs. 270-275. Since palm oil prices have gone up, coconut oil prices also have increased to the level of Rs. 165 while allowing coconut oil to compete with the imported palm oil. Also this will prevent the mixing of palm oil with coconut oil. However it is necessary to note here that it is essential to maintain the price gap between palm oil prices and coconut oil prices since it prevents the mixing of palm oil with coconut oil.

Even though tariff changes have benefited some industries, still farm-gate prices remain at the level of Rs. 22 to Rs.24. One reason is that still middlemen are enjoying the advantage of prices changes. The second reason is that still palm oil suppliers pump the refined oils which were imported at lesser tariff levels. The third reason is that even though the demand for coconut oil has increased, coconut oil producers and copra processors need time to start their production as most of the production units were not in operation for long period.

Impact of imported unrefined, bad quality palm oil

If the importers continue this process over the years, it will become a very critical factor for the coconut industry as well as for the health aspects of the people of this country. Therefore the Coconut Research Institute (CRI) wishes to propose policies necessary to prevent these illegal activities. In order to adopt these policy recommendations the following information has to be obtained.

1. What is the type of oil they have imported and Harmonisation Code they use to import this oil to the country?

2. What is the tariff level applied for these imports?

3. What is the purpose of importing this oil?

4. Who are the importers?

5. To whom have they distributed these oils and the purpose of purchase?

6. How long will this process continue?

7. If these imports are under a BOI project, whether they have re-exported oil.

8. Whether these importers have retail sales and if available, the type of oil that they sell.

9. Steps required to quality check available oils in the market.

The CRI is in the process of analysing the effect of tariff change on prices of coconut, and those prices on other industries as well. If tariff changes stimulate one industry and absorb more nuts what will be the effect on other industries? Also there is a need to conduct an analysis to decide the gap which should be maintained between the prices of imported edible oil prices and coconut oil prices to properly operate the coconut oil industry as this gap will help to prevent mixing of palm oil with coconut oil.

| Coconut growers urge Government to restrict palm oil imports | |

| By Quintus Perera The Coconut Growers Association of Sri Lanka (CGA) has said that the government needs to take urgent steps to prevent the coconut industry from collapse – palm oil imports being the culprit. An official of the CGA noted that the coconut production is increasing with output this year expected to be around 3 million nuts compared to 2.8 million last year and 2.4 million a decade ago. Uncontrolled import of palm oil and adulterating it with coconut oil is the major cause for the impending downfall of the coconut industry, the CGA has said in a letter addressed to the Prime Minister on April 21 alerting him of a dangerous situation. In that letter CGA has informed the Premier that in 2010 the import of palm oil stood at only 15.29 million kg costing Rs. 1,469 million but now it has risen to massive 169.91 million kg at a cost of Rs. 19,030 million – a tenfold increase. In US dollar terms the amount spend is $152 million. CGA has told the Prime Minister that according to the Sri Lanka Census of Agriculture over one million acres are under coconut cultivation, 83 per cent of these lands belonged to smallholders with less than 20 acres while more than 3 million people or 14 per cent of the population are directly involved in coconut cultivation. If the palm oil imports are curtailed coconut exports could become the number one agriculture export even outdoing tea. GA has urged the authorities to implement the following proposals to safeguard consumers from health hazards and smallholders of coconut plantation: Testing and labeling of all types of edible oils; audit palm oil imports and exports including local usage and bring palm oil imports under licensing. |