Columns

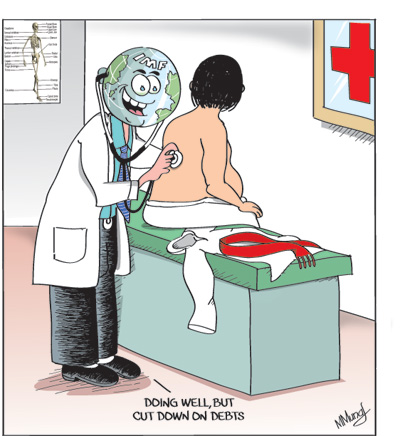

Growing fast, but are we moving towards external debt vulnerability?

View(s):The IMF has given a glowing assessment of Sri Lanka’s economic performance. Its July 29th statement says: “Sri Lanka’s economic growth has been one of the fastest among Asia’s developing economies in recent years. After falling to 6.3 percent in 2012, real GDP growth accelerated to 7.3 percent in 2013-driven primarily by a pickup in services activity, and supported by manufacturing and construction, but also benefiting from an increase in net exports.”

Furthermore, “Inflation has remained low, falling to 4.7 per cent at the end of 2013 and to 3.2 per cent year-on-year in May 2014. Fiscal consolidation has continued, with the overall fiscal deficit falling to 5.9 per cent of GDP in 2013. A strong recovery in exports in the second half of 2013 and into 2014, combined with declining imports and continued inflow of remittances and services receipts, has bolstered the balance of payments. Together with issuance of external debt, this has allowed the Central Bank of Sri Lanka to accumulate international reserves. Monetary policy has been accommodative, but private credit growth has been slow.”

Furthermore, “Inflation has remained low, falling to 4.7 per cent at the end of 2013 and to 3.2 per cent year-on-year in May 2014. Fiscal consolidation has continued, with the overall fiscal deficit falling to 5.9 per cent of GDP in 2013. A strong recovery in exports in the second half of 2013 and into 2014, combined with declining imports and continued inflow of remittances and services receipts, has bolstered the balance of payments. Together with issuance of external debt, this has allowed the Central Bank of Sri Lanka to accumulate international reserves. Monetary policy has been accommodative, but private credit growth has been slow.”

This is indeed an endorsement of recent policies and a good report of economic performance. The economy is growing, inflation is low, monetary policy is appropriate and foreign reserves are being strengthened. Yet some economic concerns are underscored in undertones.

Prospects

Prospects

The IMF assures us that the prospects for this year are bright. The short-term economic outlook “appears broadly positive, as Sri Lanka is well positioned to benefit from the global economic recovery and particularly stronger growth in advanced economies.” GDP growth is expected to remain robust at about 7 per cent in 2014, while inflation is likely to remain in the mid-single digits. The Government has targeted a further reduction of the fiscal deficit to 5.2 per cent of GDP, which should allow for even more reduction of public debt. With a continued robust export performance, the current account deficit is expected to narrow further and allow for some additional accumulation of international reserves.”

Near term risks

The near-term risks appear moderate according to the IMF, as the recovery of advanced economies is likely to continue and international commodity prices are stable. There are some medium-term risks if economic growth slackens in advanced countries and there are tighter external liquidity conditions and interest rates rise in international capital markets that would increase borrowing costs. However these are at present minimal.

Areas of concern

Even the glowing account of the country’s economic performance by the IMF is qualified by three concerns: fiscal consolidation, risks in external debt and exchange rate management. These are the very concerns that this column has repeatedly discussed. However, these concerns are couched in such diplomatic language and underplayed that the compliments on the economic performance is likely to be what arrests attention.

The IMF has drawn attention to the fiscal deficit while complimenting the Government for its solid commitment to fiscal consolidation and reduction of public debt. However it has “raised concern about the composition of further consolidation.”

As last Sunday’s column pointed out curtailing expenditure next year would be politically difficult. The IMF in its diplomatic terminology perhaps means something similar. “However, given sizeable investment needs, the staff was of the view that spending cuts may have reached their effective limit, and that the burden of adjustment needed to fall more squarely on increasing revenue.” The prospects of either are unrealistic. In the first four months of this year, revenue has fallen below the target and expenditure has increased. The consolidated fiscal deficit is likely to be much higher than the targeted 5.2 per cent of GDP.

External debt vulnerability

The IMF has pointed out that despite recent improvements in the trade and current account balances, “Sri Lanka remains vulnerable to external shocks. Medium-term sustainability will depend on maintaining an outward orientation, diversification of the export structure, and a judicious use of foreign borrowing-particularly given the rapid increase in debt servicing costs that have accompanied the shift from bilateral concessional debt to new loans on commercial terms.”

The country’s debt driven growth strategy has reached a situation when it is time for caution in further borrowing. As the IMF has pointed out “the Market Access Debt Sustainability Analysis (MAC-DSA) highlights the sensitivity of Sri Lanka’s debt sustainability to growth and foreign exchange shocks. The staff urges caution with respect to external borrowing through the banking system.”

It is imperative for the Government to take heed of this cautionary advice even though such advice these days is couched in mild diplomatic language. However softly spoken they should not be allowed to fall on deaf ears.

More serious

Moody’s more forthright assessment of the external debt vulnerability is that Sri Lanka’s short-term debt obligations against its official reserves still remains elevated but was on a declining trend. Sri Lanka’s debt maturing within 12 months is over and above the country’s official reserves, at 118.6 per cent in 2014.

Moody’s External Vulnerability Indicator (EVI) that measures the adequacy of a country’s official reserves to cover its short-term debt in the event of sudden stop in external credit extension was as high as 124 per cent in 2013, significantly above the 100 per cent threshold for external creditors. Sri Lanka’s external vulnerability is expected to fall this year and in the next. It is expected to be below 100 percent in 2015.

Future

The improvement in the balance of payments and the external reserves this year and possibly in the next should be an opportunity to reduce the country’s external debt vulnerability rather than be driven by complacency to increase its borrowing for unproductive expenditure. As the IMF has advised, “There is also room, in the mission’s view, to take another look at the medium- and long-term strategy for debt reduction, and consider a more ambitious debt target (more strongly associated with reduced vulnerability) over a longer time horizon.”

Economic stabilisation and growth require caution on the growing external debt, a strong thrust in export growth, prudence in public spending and proper management of the exchange rate. The wise course is not to be lulled by the compliments of the IMF but be awakened by its concerns.