Columns

The Importance of accurate economic statistics

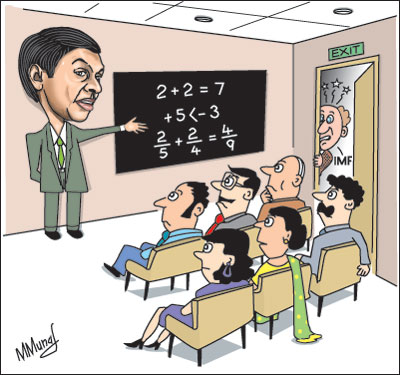

View(s):There has been much scepticism about the reliability of economic statistics. This is particularly so with respect to estimates of the Gross Domestic Product (GDP) and the Colombo Consumer Price Index (CCPI) that measures price increases. Both these are calculated by the Department of Census and Statistics and used for assessments of economic growth and inflation.

There is a common view that GDP estimates are overestimated while consumer price increases are underestimated. Such perceptions are based on deficiencies in the statistical design and methods of statistical data collection and biases of those responsible for computing these statistics. Although this column has drawn attention to these deficiencies several times, it is difficult to be definite about the degree of inaccuracy of the official statistics, without alternate data sources.

IMF criticism

The IMF has openly criticised several of the decisive statistics that indicate the state of the economy and its performance. Apart from the GDP measurement, the IMF report has also pointed out that the fiscal deficit is inaccurate, as it does not include losses of public enterprises. The consolidated government budget deficit that includes the losses incurred by state owned enterprises, especially those of the Ceylon Electricity Board (CEB) and the Ceylon Petroleum Corporation (CPC), amounted to 8.6 percent of GDP in 2012 and not 6.4 percent of GDP, according to the IMF.

The IMF has pointed out that the Government’s methodology for deriving the country’s GDP was unsatisfactory. “The methodology for deriving GDP at constant prices is not satisfactory. Expenditure estimates are available only annually and rely mostly on commodity flow techniques. Whenever possible, estimates are validated and checked with other sources”.

In a recently released staff report, the IMF said:”The national accounts suffer from insufficient data sources and undeveloped statistical techniques. The country does not have periodic comprehensive benchmarks or a system of regular annual surveys of establishments. A statistical business register, which would serve as the main basis for conducting sample surveys, is not available. As a result, the few surveys that are conducted do not have good sample frames.”

It agreed that most data used are obtained on a timely basis.”However, detailed data needed to measure both output and intermediate consumption are mostly unavailable or not collected. As a result, the estimates of gross value added are prepared directly relying on outdated fixed ratios established from the base year 1996, often with outdated studies or ad hoc assumptions. Quarterly indicators are used for compiling quarterly value-added estimates,” the IMF claimed.

Substantial defects

These are very specific criticisms of the practice of national accounting in Sri Lanka that the IMF has pointed out. It is owing to these deficiencies that there are differences in the IMF and Central Bank forecasts of growth. The IMF has forecast a lower growth of 6.3 percent for 2013, compared to a much higher estimate of 7.5 percent by the Central Bank. Last year’s growth was estimated at 6.4 percent, whereas many knowledgeable institutions and analysts placed it below 6 percent.

GDP estimates have inherent weaknesses and inconsistencies. These have been pointed out by analysts from time to time. Estimating the GDP in an economy where much of the economic activities are of an informal nature is no easy task. There are reliable statistics only in a few subsectors such as tea production.

Import-export statistics are basically accounting figures and can be relied on. However these provide only indirect evidence for GDP estimates and even these appear to have been ignored. For instance, in 2012 export of manufactures fell by 8 percent, but the GDP statistics gave an increase in industrial output. This is possible only with a huge spurt in manufactured production for domestic consumption. Do other sources of production statistics provide such evidence? Such inconsistencies have led to doubt about the integrity of statistical computations.

There are many areas of economic activity where it is difficult to collect reliable information. The production of many food crops are on a small scale and it is difficult to collect them in a systematic manner. The current methods of collecting these are biased guesstimates. The fact that these crops for which there are no reliable statistics account for about one half of the agricultural production figure distorts agricultural production estimates.

There is scepticism as to whether the systematic methods for the collection of paddy crop production through crop cutting surveys are conducted properly. Agriculture suffered from droughts and floods last year and even the Government said that paddy and food crop production was affected, first by drought and then by floods. Yet the paddy production figure did not fall. Apparently the yield in paddy had increased to compensate for the damage caused by the natural disasters.

Interventions

Much of the performance of the economy is assessed in relation to the GDP. The relationships between vital economic data to the GDP are accepted economic indicators. Since the GDP figure is used as a denominator in several critical indices, such as the burden of debt, a higher value of the GDP gives a more favourable picture than it really is. In a few indicators, however, a higher GDP gives a worse picture. For instance the revenue to GDP ratio has fallen to as low as 11 percent though there has been an increase in the nominal value of tax revenue.

In most cases a higher GDP gives a favourable ratio that could lead to complacency, inaction or lack of policy correctives. There is, therefore, a tendency to massage the GDP figures. The deficiencies that the IMF has brought out make the task relatively easy.

These reasons have led to estimates of GDP growth by unofficial agencies, including the IMF, to be lower. However, most reviews of the country’s economic performance have been based on the government’s estimates of national income that give a favourable picture.

Implications

Deficiencies in these statistics impact on the appraisal of economic performance. Furthermore, an overestimation of GDP and an underestimation of prices imply defective indicators of the debt burden, fiscal deficit and many other indicators that are evaluated as proportions of GDP. In brief the country’s economic performance and the state of public finances are not as glowing as we are expected to believe. A higher than actual GDP could be dangerously misleading.

There are dangers in assessing economic performance inaccurately. Exaggerations of annual economic performance lead to misleading policy makers about what actions should be taken. Indicators based on the GDP such as the debt to GDP ratio that is based on the bloated economic output give a false estimate of the burden of debt. Last year’s debt-to-GDP ratio increased to nearly 80 percent of GDP. Though high by international standards it is not alarming. Had the GDP figure been lower,then this ratio could have been in the danger zone. The severity of the problem is clear when it is realised that the public debt is of a magnitude that its servicing cost absorbs more than the revenue of the Government. When the losses of corporations are included, as they should, the fiscal deficit is far too high.

Correct computation

Accurate economic statistics and indicators are vital for taking corrective measures. The sooner this is done the lesser the danger of drifting into an economic crisis. Now that the IMF has pointed out the deficiencies, can we expect an improvement in the collection and disclosure of the country’s economic performance?

Follow @timesonlinelk

comments powered by Disqus