Columns

Economic indicators point to weak performance

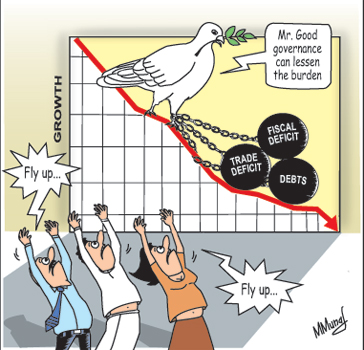

The emerging weak economic performance is of serious concern. Three important economic indicators — the trade balance, fiscal balance and debt — are on an unfavourable trend.

The failure of the monsoon has added a further setback to the economy. Poor governance has weakened economic prospects for the country for the near future. This year’s slow economic growth and poor governance are likely to damage the high growth trajectory that was expected after the end of the war. The peace dividend is fast fading away. It is likely that economic growth would slide further than expected earlier with all three sectors showing a poor performance.

There are a few favourable developments, too. Among the favourable developments is the rapid growth in tourism and investments in the hospitality trade. This has boosted several economic enterprises in the fields of arts and crafts, travel trade and gems and jewellery. Worker remittances have been growing and the development of infrastructure is continuing despite the financial constraints. However, on balance, these are inadequate to boost the economy.

Trade deficit

Being an export-import dependent economy, trade performance is an important determinant of the country’s economic performance. Therefore, unfavourable global economic conditions have been an important factor for the deterioration of these economic indicators. The poor performance of exports has had adverse repercussions on the economy. The trade deficit increased by 11.2 percent in the first half of this year to reach US$ 4.7 billion, compared to the deficit of US$ 4.2 billion in the first half of last year, when the trade deficit reached an unprecedented and unmanageable US$ 9.8 billion. This year’s trade deficit is on course towards a massive deficit of last year’s magnitude or more owing to the poor performance of exports and continuing large import expenditure. Import expenditure in the first half of the year was nearly twice (95 percent) export earnings. While export earnings were US$ 4.96 billion, import expenditure was US$ 9.66 billion.

Global economic conditions have affected exports adversely. Export earnings in the first half of the year decreased by 2.2 percent. Both agricultural and industrial export earnings have declined in the first half of the year. Tea exports declined by 4.2 per cent and exports of textiles and garments by 1.6 per cent. The continued decline of these two important exports that are likely to continue in the second half of the year is of serious consequence for this year’s trade balance. These trends in trade figures for the first half of the year could lead to a large trade deficit.

The poor performance of exports has had unfavourable backward linkages. The decline in manufactured exports is especially serious for the economy as it implies not only lower export earnings, but loss of employment and incomes. Arresting the decline in exports is a challenging task as global developments that have a significant bearing on import prices and export demand are beyond our control.

Fiscal deficit

The slowing down of the economy has been responsible for a growing gap between the government’s revenue collection and expenditure. Although an important objective of government fiscal policy was to reduce the deficit to 6.8 per cent of GDP this is becoming a mirage as government expenditure is growing, while tax revenues are declining. The fiscal gap as a percent of GDP will be particularly large as the 2012 GDP is likely to grow by a lower amount.

Meanwhile, the data showed that the government’s revenue, including grants stood at Rs. 389.1 billion for January-May 2012. This was a small increase from Rs.357.4 billion in the same period of the previous year. While tax revenue during the five months increased, non-tax revenue fell to Rs.33.3 billion from Rs.38.5 billion. Revenue from grants also fell to Rs.2.5 billion from Rs.3.1 billion in 2011.

These statistics imply that the fiscal deficit would be larger this year and the fiscal deficit as a proportion of GDP would go beyond the objective of the announced fiscal policy targets. A large fiscal deficit means that government borrowing will increase and the financing of the deficit is likely to generate inflationary pressures. Such destabilisation of the economy is likely to affect economic growth adversely.

Increasing debt

The public debt increased to Rs. 5,902 billion at the end of May 2012. This was a 23 per cent increase from the debt of Rs. 4,801 billion at the end of May 2011. Of the total debt, Rs. 3,142 billion was domestic debt, while foreign debt component stood at Rs.2760 billion up from Rs. 2,733 million at end May last year.

Low rainfall

The economy has been adversely affected by the failure of the monsoon and the slow growth internationally. The monsoon has affected food production as well as tea production. Besides this the low rainfall in the catchment areas has led to reliance to a larger extent on more costly thermal generation.

About 50,000 hectares of paddy are estimated to have been affected by the drought conditions. Vegetable and other food crops too have been badly affected. However there are parts of the country such as the Eastern Province where farmers have been able to cultivate fields with irrigation water. Yet the paddy crop is likely to have fallen appreciably.

Tea production has fallen by about 6 per cent in the first seven months. The annual tea crop is expected to be about 8 per cent less this year. Manufactured exports have been adversely affected by a fall in demand in western countries. Garments exports were 1.6 per cent less while earnings from other industrial export too have declined in the first half of the year.

The exception has been rubber manufactures whose export earnings increased by 5.5 per cent in the first half of the year. The decline in manufactured exports affects wages incomes and employment of workers in industry. These shortfalls in production imply slower economic growth.

Tourism and remittances

One of the bright spots in the economy is the growth in tourism. In the first six months of this year tourist arrivals have reached 452,867 and earnings from tourism reached US$ 460 million which is an increase of about 25 per cent from that of last year. Worker remittances grew by 12.1 per cent to US dollars 452 million in the first half of the year. It is likely that these two sources would bring in about US$ 2 billion this year. This would offset about 20 per cent of the likely trade deficit.

Conclusion

It is important to recognise that the economy is facing severe difficulties and take appropriate measures to mitigate the unfavourable developments. Most of the adverse developments are beyond the control of governments. However, good governance and appropriate economic policies could mitigate the adverse impacts and ensure stability in the short run and growth in the long term.

Follow @timesonlinelk

comments powered by Disqus