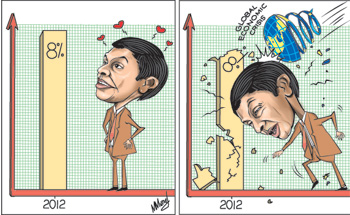

The optimistic economic scenario for 2012 and 2013 outlined by the Central Bank in its Road Map is becoming increasingly difficult to achieve owing to the emerging global economic conditions. These difficulties have been further aggravated by government economic policies that have added considerable uncertainty and impaired business confidence.

Even at the time of presentation of the Road Map there were doubts that the targets were realistic. Now global economic developments make it difficult to achieve the high growth rate and favourable external financial developments envisaged by the Central Bank.

Apart from the global slowdown and especially the tardy economic growth of Western countries, another serious threat to the economy is the possible Western sanctions on Iranian oil exports. This could have serious repercussions on the international prices for oil and Sri Lanka's imports of oil.

An embargo on Iranian oil, however implemented, could have a serious impact as the country imports Iranian oil on credit terms and at special prices. An embargo on Iranian oil is expected to increase international prices and this would in any case have an adverse impact on the trade balance and balance of payments.

The implications of these are that the country faces a tough year ahead, perhaps one that could once again be a crisis year.

Global developments

The economic growth forecasts are certainly dim. A slowdown in the global economy is clear. The economic situation of Western countries is particularly relevant as these countries are the main markets for Sri Lankan exports. A slowdown of these economies could affect Sri Lankan exports badly. Developed countries are expected to grow by only a little more than 1 percent. The countries of the European Union are expected to register a negative growth rate. This would hurt the country's exports.

The World Bank slashed its 2012 growth forecasts for developed, emerging and developing economies, from its earlier estimates of only six months ago, and warned the world is on the verge of a new global recession that could be as bad as the crisis four years ago. In its latest report on global economic prospects, the World Bank expects the global slowdown to affect developing countries adversely.

It states that the slowdown of economic conditions of Western countries has been taking its toll on South Asia, with merchandise export volumes declining speedily in the second half of 2011. It said: "A deepening of the Euro Area crisis would lead to weaker exports, worker remittances and capital inflows to South Asia."

The World Bank also said: "The EU-27 countries account for a significant share of South Asia merchandise export markets, although not as much as for some developing regions." This is especially so for Sri Lanka. In fact the expansion of exports last year was mainly to the US and European countries.

The World Bank forecasts that "even if the crisis does not worsen in Europe and other shocks are avoided, the global economy will grow at 2.5 percent, down from estimated growth of 2.7 percent last year and 4.1 percent growth in 2010."

The report says developed economies are expected to experience anaemic growth of only 1.4 percent, down from the earlier estimate of relatively solid 2.7 percent growth. The worst expectations are for European Union economies whose growth is expected to shrink 0.3 percent, rather than grow by 1.8 percent as previously expected. The rest of the developed world (excluding the euro zone) is expected to grow at 2.1 percent. Emerging economies are forecast to grow at a 5.4 percent rate this year, down from its earlier forecast of 6.2 percent growth.

Expectations

The Central Bank's expectations for the economy, especially with respect to external finances were quite optimistic. It argued that the ongoing structural changes in the economy would increase earnings from tourism to US$ 1.2 billion, worker remittances were expected to increase to US$ 6.5 billion, foreign direct investment (FDI) was projected to reach US $ 2.0 billion. In addition debt capital to the private sector was expected to increase significantly in 2012.

These capital inflows were expected to turn a large trade deficit of about US$ 11 billion into a balance of payments surplus. The expectation was that there would be substantial inflows of these in the first few months to warrant intervention in the foreign exchange market to keep it at the current exchange rate without allowing it to depreciate further.

Impact of global developments

How would the adverse global developments affect Sri Lanka? The overall impact would be in slowing down the growth momentum. It would be quite impossible to maintain an eight percent growth with export growth falling or even declining this year. The World Bank has reported that Sri Lanka's economic growth is slowing owing to financial problems in key Western markets that could reduce demand for exports. It also expects the crisis in the West to hit worker remittances and earnings from tourism. Consequently it has lowered its forecast for Sri Lanka's economic growth to 6.8 percent in 2012 and 7.7 percent in 2013. This is a significant drop from the 8.3 percent growth last year and the expected growth of 8 percent projected by the Central Bank for this year.

The Central Bank forecast export earnings in 2012 to reach US$ 9 billion. This is a significant increase in exports from that of last year. If exports were to remain at around that of last year and import expenditure increases mainly due to increases in oil prices, then the trade deficit may even exceed the projected US$ 11 billion. This means that the current pressures on the exchange rate would be accentuated.

Although the World Bank expects tourist earnings to decline, this may not happen as any decrease in tourists from the West are likely to be offset by tourists from other destinations, especially East Asia, India and the Middle East. There has been a trend of diversification of tourist destinations that gives credibility to this expectation. However it is vital that the law and order situation in the country is improved so that tourists are not scared away from the country.

The growth in worker remittances too would be affected. The expected US$ 6.5 billion of remittances may not materialize, owing to unsettled conditions in the Middle East as well as the European crisis. This is because there is a significant amount of remittances from European countries as well.

The largeness of the trade deficit and the slowing down of remittances has resulted in worker remittances offsetting a smaller proportion of the trade deficit in 2011. In 2010, 80 percent of the trade deficit was offset by remittances. This dropped to about 55 percent in 2011. The current developments are likely to lead to a still lower proportion of the trade deficit being offset this year.

The projected amount of foreign direct investment is also unlikely to be realized. This is due to the initial estimate being high, as well as due to local conditions not being conducive to private foreign investment. The global conditions will further hamper FDI.

In fairness to the Central Bank it must be said that the projections recognized that they were with the given global conditions. It recognized that these could change. "The Central Bank's own projections and policy propositions have been based on assumptions and judgments, which would need to be modified in line with emerging developments in the global as well as Sri Lankan economy. Naturally therefore, any deviations in trends in the economy would be watched even more closely, and policies and strategies altered….."

Conclusion

What is important is to recognize that there are global changes that are likely to impact adversely and make mid course corrections. Both monetary and fiscal instruments must be used to take countervailing measures to mitigate the impact. They must be taken in time and in adequate measure. The management of the exchange rate, appropriate interest rate policies and fiscal prudence are three essential actions that are needed.

The several deterrents and road blocks to the country's economic development discussed last week remains a serious concern. The external shocks to the economy-- the global economic downturn, international prices and the Iranian oil embargo -- are beyond the control of the country.

In contrast, the factors discussed last week such as the rule of law, the law and order situation and the building of a hospitable business climate are within the realm of governance and should be ensured so that there is strength to face external shocks.

Business confidence is at a low level, as witnessed in the dip in the stock market that has become the worst performing market in Asia, down from the best and the second best performing one a few months ago. Unfortunately the policy framework, economic practice and poor governance within the country weakens the ability to face the external shocks.

|