The Central Bank expects worker remittances, earnings from tourism and other services, foreign direct investment and other capital inflows to bridge the trade deficit this year. It is this expectation that leads the Central Bank to not allow a further depreciation of the currency or increase interest rates. It's anybody's guess whether this expectation would be realised.

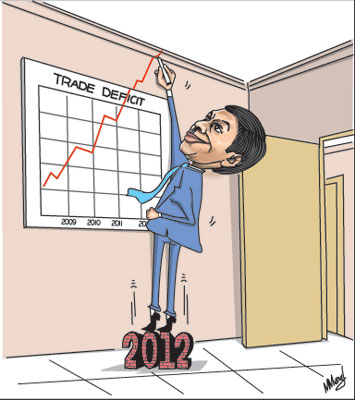

There is little doubt that the country would have a large trade deficit in 2012, as in 2011. Hopefully it would be somewhat less than in 2011. This year too substantial increases in remittances, tourist incomes, foreign direct investments and other capital inflows are needed to wipe out the large trade deficit.

Trade balance in 2011

The external finances of the country have been weakened by the large trade deficit of last year. The trade deficit for 2011 is likely to be around US $ 8.5 to 9 billion. This is about 75 percent more than the trade deficit of US$ 5.2 billion in the previous year (2010). Although worker's remittances, tourist earnings, other services income and foreign direct investment have all increased, they are unlikely to bridge the trade deficit to achieve a current account surplus in the balance of payments in 2011.

This is different to the experience of the previous two years (2009 and 2010), when the trade deficit was wiped out by these incomes (mainly remittances) to turn the overall balance of payments into a surplus, despite a deficit in the current account. The inability to achieve a balance of payments surplus despite the large inflow of remittances is due to the trade deficit in 2011 being much larger than in the previous two years.

Likely trade deficit in 2012

There is little prospect for the trade deficit being contained at a much lower amount this year than in the last, despite the depreciation of the currency and possible further depreciation during the course of the year.

The reason for this is that despite the depreciation and higher tariffs on imports, the country profile of imports is such that the volume of imports are unlikely to decrease by much, as the demand for most imports are inelastic. What this means is that when prices of imports increase, the decrease in demand is not likely to result in a reduction of consumption by much.

This is evident from the fact that about 25 percent of import expenditure is on petroleum imports. These imports are not likely to decrease as they are essential for transport, electricity generation, industrial production and other essential needs.

This does not mean that a reduction of oil imports is impossible, but the policy decisions that have to be taken to reduce petroleum consumption are not likely to be taken. For instance it is unlikely that the pricing of petroleum products would be raised significantly as it would affect transportation costs and costs of consumer goods that would fuel inflation.

Conservation of petroleum use is the means by which import expenditure on oil could be reduced. This too is unlikely. Conservation measures could help reduce imports of oil. There is a considerable wastage of electricity with the illumination of buildings, unwarranted street lighting and wasteful public consumption. Some of these extravagant uses were conspicuous in the illumination during Christmas and New Year celebrations.

Far from admonishing the public to refrain from such extravagant uses, it is believed that both public entities and private enterprises were encouraged to illuminate buildings to perhaps generate a feeling of prosperity in the country.

Much of petroleum consumption is by the government itself. The fleet of vehicles used by the government, the use of helicopters and planes for domestic travel and personal use of government vehicles are reasons for high consumption of oil. Then there is the essential need of oil imports for the generation of electricity that is another huge item of oil consumption. All these factors imply that an increase in the price of petroleum products will not decrease the demand for oil by much.

In this context, the only possibility of a decrease in oil import expenditure could come from a decline in international prices of oil. The slower economic growth in the West, China and India may reduce the pressures on international oil prices to some extent, but the unsettled conditions in the Middle East, a possible war on Iran, and the consequent speculation may keep oil prices high.

Even though there has been a decline in prices of oil recently, it is difficult to expect this decline to continue. Oil prices are extremely volatile in a world of international turmoil enhanced by speculation.

If, however, oil prices decline, it would have a very significant impact on import expenditure that would reduce the trade deficit significantly. This is what one would hope for the country.

Another factor that could help is good rainfall this year. If rainfall is high then the generation of hydropower would reduce the need for oil for thermal generation.

The possibilities of decreasing other imports too are limited as much of the other high import costs are for essential food items such as wheat, sugar and milk, raw materials and capital imports that are needed to enhance the country's production and exports eventually.

Therefore the curtailment of such imports is neither possible nor desirable.

Therefore, it is not realistic to expect a significant decrease in import volumes. There could be a moderate decline in some imports due to increased consumer prices owing to the continuing depreciation of the rupee and higher import duties. Considerable relief could come from declining prices of oil and food imports such as wheat, sugar and milk.

Exports

The huge trade deficit of last year was in spite of an export growth of around 24 percent. However, total export earnings were only about half of import expenditure and this was the reason for the huge trade deficit last year. Therefore, even with a further growth in exports, it is unlikely to have a large impact on reducing the trade deficit as import expenditure is high. This is more so this year as global growth is likely to slow down.

The sluggish economic growth in the West coupled with the currency crisis in Europe does not augur well for the country's exports, as these countries are the country's main markets.

However, the recent diversification of exports and new export enterprises are likely to mitigate these unfavourable trends. Yet exports will return modest earnings in comparison with import expenditure in 2012.

Remittances, tourism and services

With little prospects for the trade deficit to be reduced, the Central Bank is of the view that there are good prospects of capital inflows bridging the deficit. Remittances, earnings from tourism and other services, and foreign investment are expected to narrow this deficit.

An increase in tourist earnings could be expected this year. More than 800,000 tourists visited the country last year and earnings from tourism are expected to be about US$ 900 million.

There is every prospect that the trend in tourist arrivals would increase this year and yield more than US$ 1 billion. This is indeed a handsome contribution to the balance of payments.

In contrast, the turmoil in the Middle East is likely to affect the growth in remittances. However, it is likely that remittances would be substantial at around US $ 4-5 billion.

Another encouraging feature is the increase in services earnings. Among them is the increase in earnings from information technology services. There is a prospect that these services could bring in about US$ 0.5 billion.

The Central Bank expects a large inflow of foreign investment this year. This is an unrealistic expectation. Even last year's foreign direct investments were largely from sale proceeds of land rather than investment in industrial enterprises.

There are many reasons why the country has been unable to attract large amounts of the right type of investments. This is mainly due to the inability to develop a hospitable business climate. Last year witnessed a setback to business confidence by the passage of the Revival of Underperforming Enterprises and Underutilized Assets Act.

International ratings are likely to plummet and the country likely to be viewed as a risky destination for foreign investment. It is therefore unlikely that the high expectations of foreign investment would materialise.

Outcome in 2012

Even with an increase in exports and a decrease in import expenditure it is unlikely that the trade deficit would be much less than last year's. Such a large deficit in the trade balance is unlikely to be bridged by capital inflows to turn the current account deficit into an overall balance of payments surplus. Therefore, it is imperative that measures are taken to reduce imports to reduce the trade deficit. A nation, like a household cannot continuously live beyond its means.

|