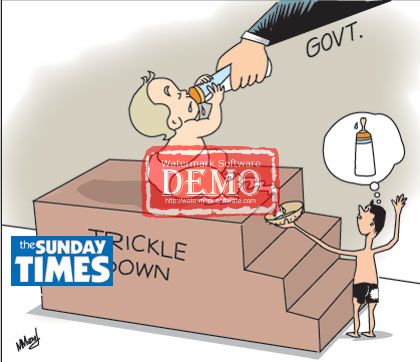

Addressing the recent South Asian Association for Regional Cooperation (SAARC) heads of state summit in the Maldives, President Mahinda Rajapaksa made a perceptive remark that the "benefits arising from economic development do not automatically percolate down to the grassroots level".

In fact, he was articulating a basic principle of Sri Lanka's economic and social policies since independence. It is precisely because of this that this country has had greater success in reducing poverty and ensuring upward social mobility. It is also because of this legacy of social policies, most notably free education and free health, that Sri Lanka is 'on track', to achieve most of the targets set in the Millennium Development Goals by 2015.

However, we cannot be satisfied with the progress as there are still a large number of persons below the poverty line and under nutrition is high while income inequality is growing. An international independent UN Committee of experts estimates that large sections of the population still do not enjoy the rights entitled to them even to access basic needs and services, despite annual economic growth rates in excess of 6 percent.

Economic growth and equity

There has been some concern that the economic growth achieved in the last few years may not be benefitting the poor as much as the rich. The President's statement is indicative of this. One of the reasons for this concern is that the main growth is in industry and services and in the main cities. It is well known that rapid economic growth often results in the developed sectors of the economy growing, while the underdeveloped regions are left behind.

Apart from this the thrust in growth requires capacities that are not there among the less-educated poor. There is also the tendency for increases in the costs of living to affect the poor more adversely with their real incomes being severely eroded. For these and other reasons, it is most important that the government adopts economic policies that are pro-poor and the participation of the less advantaged population is ensured. Every effort must be made to ensure economic growth with equity.

The Sri Lanka: State of the Economy 2011 report of the Institute of Policy Studies (IPS) on the theme of 'Post-conflict Sri Lanka: Towards Shared Growth' points out that while the country has made a rapid recovery, with GDP growth continuing at eight per cent into the first half of 2011, threats to sustained growth remain in view of a weakening global economic environment. It contends that fiscal, monetary and exchange rate policy flexibility to respond appropriately to changing economic conditions is vital for macroeconomic stability and growth that will allow Sri Lanka to meet its broader socio-economic development objectives of an inclusive growth process that will help bridge existing inequities.

Inclusive development

In this developing economic context the IPS report warns that rapid economic growth should not leave the vulnerable behind. These people have moved from poverty to the deprived. It points out that Sri Lanka's large share of informal sector workers, currently estimated to be 62 per cent of the workforce, are in less productive sectors such as agriculture and fisheries. It suggests policy options to broaden and enable equal access for economic opportunities for them.

The IPS contends that recent policies have tended to not recognise the importance of the informal sector. Consequently their ability to make a living and in some cases even their housing and livelihood has been destroyed. The IPS analysis includes an assessment of the vulnerabilities faced by poor informal employees and the unemployed in terms of socio-economic, political, and geographical factors, and existing social protection measures and their gaps. Have some people moved from poverty to the deprivation?

Budget and fiscal policy

The budget and the fiscal policy are means of achieving more equitable growth. Overall economic growth is a necessary condition for poverty reduction. A high rate of economic growth will filter down to the poor as well. But such filtering down is often too slow and too little and often aggravates income inequalities and does not achieve poverty reduction. Fiscal policies both on the revenue and expenditure sides could have an important impact on the condition of the poor.

The government must desist from gathering revenue by imposing higher indirect taxes on commodities consumed by the poor. In a context when the trade balance is in a large deficit, there is inclination for the government to impose higher import duties on basic food imports. The argument advanced for this is that such taxes provide incentives for increased domestic production and import substitution.

This is true to some extent, but such taxes are a burden on the poor. The counter argument for this is that the reasons for low productivity of food crops is inadequate funding for research, the extension services being in disarray and marketing of agricultural produce resulting in large market margins that result in low farm gate prices.

The government should attempt to increase its revenue that is low at present by a more effective administration of the Inland Revenue administration and higher taxes on imports that are consumed by the affluent.

There are many taxes that fall on the rich that could easily be increased without affecting the poor. We hope that tomorrow's budget will use such taxation measures rather than impose indirect taxes that affect the cost of living and livelihoods of the poor.

Government expenditure

Government expenditure plays an important role in reducing disparities. For many years expenditure on health and education was not increased on the grounds of the enormous war expenditure. It is once again time to give priority to health and education. Long term economic growth of the country is very much dependent on a healthy and educated population.

Health and education improvements benefit the poor and improve their capacity for increasing their incomes. Adequate funding is still a challenging task as government revenue continues to be too little in view of the huge expenditure on debt servicing.

Educational services as well as health are under-funded. Although the government's allocations for education and health have been increased for 2012, they are still inadequate. This is especially so with respect to the needs of rural schools that require considerable expenditure to provide facilities that would improve education standards. Providing science, computer, mathematics and English language skills are vital needs.

State health services are now mostly for the poor and the deterioration of these services create enormous burdens for the poor. State hospitals have a dearth of drugs and the poor who frequent these hospitals lack finances to purchase the drugs prescribed by doctors at state hospitals. The current allocation for health may not resolve this problem; we hope it would alleviate the situation.

Challenging task

The 2012 budget faces challenging tasks. While maintaining economic growth at about 8 per cent, in an inhospitable global economy, it must contain the fiscal deficit and inflation.

The budget should curtail the huge import bill that is a strain on the balance of payments. Economic growth must ensure benefits to the poorer sections of the population and disperse the economic growth more equitably.

Increased expenditure on health, education and social services, are vital. This has to be attained by curtailing extravagant, wasteful and unproductive expenditure, and by increasing revenue. One of the most serious constraints on public finance is losses of public enterprises. Reforming these enterprises to reduce their loss making is a fundamental requirement of the country.

The government revenue to GDP ratio is far short of the norm and effective tax measures to increase revenue must be a foremost objective of the budget. It is important that indirect taxes fall primarily on the rich and not on basic commodities. Increased expenditure on social infrastructure, health and education is vital to achieve equity.

The Budget 2012 has many demanding objectives. Economic growth with equity should be a primary objective. Revenue and expenditure should be geared to achieve this objective.

|