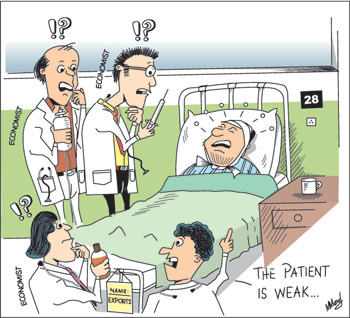

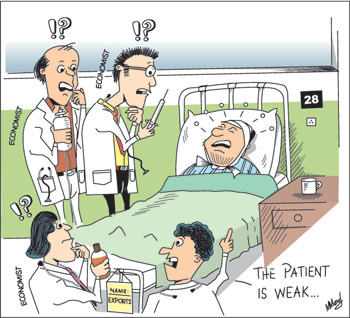

Sri Lanka's exports are woefully inadequate to finance the country's imports, they have declined as a proportion of GDP and the export share in world trade has decreased.

There was consensus among economists who addressed the annual sessions of the Sri Lanka Economics Association (SLAE) that the country's export performance was inadequate. Although there was a spurt in exports this year, it was insufficient to lessen the trade gap. The country's exports are declining in relation to the country's GDP and disappointing compared to the growth of exports of other countries. These were the considered views of several economists who addressed the SLEA annual sessions on the October 14 and 15.

Economists suggested ways and means by which the country's exports could be expanded. A flexible exchange rate policy that makes exports internationally competitive and imports dearer, export promotion through free trade agreements and increased trade with Asian countries were among the suggested policies. The view of inadequate export performance is incontrovertible, the prescriptions for export development are however debatable. Economists suggested ways and means by which the country's exports could be expanded. A flexible exchange rate policy that makes exports internationally competitive and imports dearer, export promotion through free trade agreements and increased trade with Asian countries were among the suggested policies. The view of inadequate export performance is incontrovertible, the prescriptions for export development are however debatable.

Export performance

SLEA President Prof. A. D. V. de S. Indraratna in his address drew attention to the growing trade deficit, despite the growth in exports. He pointed out that the growth in exports was inadequate to constrain the trade deficit and that the balancing of the trade deficit through foreign borrowing was increasing the country's foreign debt. The growth in exports was inadequate to stem the deficit caused by a massive increase in imports. Consequently there was a reduction in net reserves.

Dr. Koshi Mathai, the IMF Representative in Sri Lanka in his keynote address drew attention to the inadequate growth in exports in relation to the country's GDP. The exports to GDP ratio has declined in the last few decades from as much as 30 percent of GDP in 1970 to as low as 18 percent in 2010. This declining ratio portends severe economic difficulties for an export-import economy. Sri Lanka's trade performance in relation to the rest of the world is also disappointing.

Mr. Mathai revealed that the proportion of Sri Lanka's international trade that was on an increasing trend from the 1970s fell from a peak of around 24 percent to as little as 0.6 percent of world trade.

It may be unrealistic to expect a small country like Sri Lanka to hold its position at such a high level as the Newly Industrialised Countries (NICs) of Asia expanded their trade by leaps and bounds and in more recent years the exports of China and India diminished other country trade ratios. Even while making allowances for these developments, it is irrefutable that Sri Lanka's export performance could have been much better had it not turned to inward looking and import substitution strategies at the very time East and South East Asian countries were adopting an export led polices.

The exchange rate management and low amounts of exportable surpluses too played a role in diminishing the country's export capacity.

Dr Saman Kelegama, Executive Director of the Institute of Policy Studies (IPS), pointed out that Sri Lanka has maintained an appreciated exchange rate in the last five years for political reasons and consequently its export share has declined globally as well as relative to GDP, while imports have increased disproportionately. The large trade imbalances tend to exert pressure on the exchange and interest rates in the process of attempting to balance the trading account. However capital inflows in the form of borrowed funds have enabled this adjustment to be avoided. Thereby the fundamental disequilibrium in the trade balance between exports and imports, Dr. Kelegama pointed out has not been addressed. Consequently the country is moving further into difficulties in balancing the trade gap.

Fundamental causes

Sarath Rajapatirana, former Economic Advisor of the World Bank and leader of World Bank Missions to several Asian and Latin American countries, made several fundamental observations that placed the trade imbalance in broader perspective.

He observed that trade imbalances are best seen as part of a macroeconomic imbalance, where excess demand spills over to the trade balance. Therefore he pointed out that one cannot address one imbalance without considering the others and that addressing a trade imbalance through trade restrictions cannot work as it does not address the excess demand in the goods market that has caused it in the first place. Similarly, he observed that one cannot address an overall imbalance without taking into account exchange rates, interest rates, wages and relative prices of goods.

Depreciation, he agreed with Mr. Mathai and Dr. Kelegama, was the best policy. Since an appreciated exchange rate acts as a tax on exports and a subsidy on imports and a depreciation corrects this distortion. In agreement with the others he pointed out that net foreign reserves that come from the accumulation of trade and current account balances are what matters, not borrowed gross reserves.

Three policy options

There were several remedies suggested. First and foremost a competitive exchange rate is essential to enable exports and to reduce imports. This, the government has not been willing to do as a depreciation of the currency would affect the costs of essential imports such as wheat flour, sugar, milk, fertilizer and oil. All these items have an important bearing on the country's price level or inflation. This is one of the primary reasons for not depreciating the currency. Yet, in the process it has made many other items of imports too attractively priced and therefore there has been a surge in imports.

A second reason is that the depreciation of the currency increases the foreign debt to GDP ratio as the foreign debt is converted to rupees and expressed as a proportion of GDP. This argument for not depreciating the rupee to keep the debt-GDP ratio low is a rather petty one and could hurt the country's economic fundamentals. The consequence of keeping the exchange rate over valued is that it makes imports relatively cheaper and exports dearer. Consequently it encourages imports and discourages exports. This is precisely what has happened and resulted in a huge trade deficit that is financed by foreign borrowing.

Third: the policy of directing trade to Asian markets is an attractive one on paper. It is somewhat unrealistic as there are two conditions that diminish the possibilities. First, is there a demand for our commodities in those markets? What are they? Had there been a market, there would have been a deviation of exports to those markets. What are the goods that we could export to these? These countries too produce similar goods and it would be difficult to sell our products there.

This does not mean that we should not explore selling to them, but to expect such a strategy to substantially increase exports is unrealistic. The second problem is that there are supply constraints. One product we could sell to several countries is rubber. But there is no supply elasticity and the entire exportable surplus is sold. Similarly there are few goods we could supply in sufficient quantities and at competitive prices. As Mr. Rajapatirana observed "Why our exports have stagnated mostly is due to supply side constraints than due to foreign demand constraints."

Both Mr. Mathai and Dr. Kelegama were of the view that the Comprehensive Economic Partnership Agreement with India would open out opportunities. Mr. Mathai said that it would be a pity if Sri Lanka did not exploit the huge Indian market with its economy growing at 8 percent. Dr. Kelgama thought the objections to joining CEPA was based on baseless and irresponsible fears.

Mr. Rajapatirana was cautious suggesting that we must consolidate existing Regional Trade Agreements (RTAs) rather than enter into new agreements. He was of the view that consolidation beyond trade must be done in a phased step-by-step manner rather than with a one-shot agreement, given that consolidation will involve investment, regulatory regimes, dispute settlements common standards that should apply across Indian states. Further, he cautioned that we should "not forget the politics in India. When the centre becomes weak the South can become strong and can create political problems that would become economic problems for us."

Conclusion

The country must enhance its exports, while at the same time decreasing expenditure on imports. Enhancing export capacity involves incentives for both agricultural and industrial production. The current supply inelasticity of exportable goods must be addressed. A realistic exchange rate that encourages exports and discourages imports is needed. Efforts to redirect trade to newer destinations and cautious use of regional free trade agreements could help. Nevertheless the structure of our exports implies that our major export markets would continue to be western countries. To neglect these would be to our further peril.

|

Economists suggested ways and means by which the country's exports could be expanded. A flexible exchange rate policy that makes exports internationally competitive and imports dearer, export promotion through free trade agreements and increased trade with Asian countries were among the suggested policies. The view of inadequate export performance is incontrovertible, the prescriptions for export development are however debatable.

Economists suggested ways and means by which the country's exports could be expanded. A flexible exchange rate policy that makes exports internationally competitive and imports dearer, export promotion through free trade agreements and increased trade with Asian countries were among the suggested policies. The view of inadequate export performance is incontrovertible, the prescriptions for export development are however debatable.