President Mahinda Rajapaksa has had a series of discussions with organizations and groups to seek their views on the forthcoming budget. The President has met representatives of different sectors and interest groups recently to obtain their views on the Budget. These have included representatives of farmer associations, small entrepreneurs and trade chambers, chairmen and boards of directors of state banks. No doubt this is very practical and will expose the President to the views of diverse groups of persons on the economy. These discussions may elicit useful suggestions and proposals for what the President as Finance Minister promises to be a “People Friendly Budget”.

However such discussions are likely to bring out parochial interests rather than broad national interests. Each group is likely to suggest policies that are of benefit to themselves. Exporters are likely to suggest the currency be depreciated, as export competitiveness would be enhanced and their export earnings increased. Business enterprises and the corporate sector are likely to suggest a further reduction in taxation. Farmers are likely to ask for subsidies for inputs and better prices for their products. Importers may suggest further liberalisation of imports and reduction of tariffs.

Some of these suggestions may have merit, but are advanced in the self interest of the particular groups rather than what may be in the national interest. Furthermore there are severe fiscal constraints as government revenue is barely adequate for even recurrent expenditure and the country’s developmental needs are many. It is unfortunate that the Presidential Taxation Commission report that was submitted in October 2010 has not been released to the public. It could have provided the backdrop to a useful discussion on fiscal matters.

Fundamental principles of public finance

There are several fundamental principles of public finance that should be adhered to in the preparation of a budget in the national interest. These include prudence in government expenditure, the collection of adequate revenue without disincentives to economic development, equity in taxation when raising revenue, ensuring adequate capital expenditure on economic and social infrastructure and the direction of government expenditure to ensure both economic stability in the short run and economic development in the long run. A budget must achieve economic stability, economic growth and better distribution of incomes.

These objectives are not necessarily easy to achieve, especially as some of these objectives go counter to the achievement of other objectives. This indeed is the dilemma that all finance ministers face.

In the current Sri Lankan context one of the vital aims should be to align public expenditure to government revenue as much as possible to ensure that the fiscal deficit is of a reasonable level.

The government made important strides with respect to this fundamental prerequisite in fiscal management last year when the fiscal deficit was brought down to 7.9 per cent of GDP from 9 per cent of GDP. This year’s deficit is expected to be still lower.

The reduction of the deficit to around 5 per cent of GDP should be the objective in the next few years. It is not only this statistic that is important but how it is achieved. The reduction of the fiscal deficit should be achieved without the curtailment of capital expenditure that is vital for the economy’s growth. Curtailment of what is generally described as ‘unproductive expenditure’ is the means by which financial resources should be released for developmental expenditure. In as much as government revenue must be increased, government expenditure must be on the basis of national economic and social priorities.

Increasing revenue

There is a need to increase government revenue that is rather low by international standards. Revenue collection has been in the region of 15 per cent of GDP with most revenue being from indirect taxation. Many of the high yielding indirect taxes are regressive in that they fall heavily on the poor. Examples of this are the tariffs on basic food items such as dhal, sugar and milk. They are ostensibly meant to encourage domestic production of these or their substitutes. Whether this objective is achieved or not is debatable, but that the burden falls mostly on the poor is incontrovertible. In fact it has been necessary to impose such taxes as direct taxation measures yield inadequate revenue. Innovative taxation measures may be needed to yield better results in gathering higher revenues.

One of the fundamental problems in the country’s public finances is the inadequate collection of revenue. Government revenue should be in the region of 20 per cent of GDP. This should be a foremost objective of taxation measures for 2012.

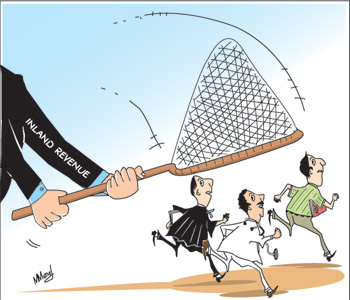

In 2010 direct taxes yielded only 18.7 per cent of total revenue while indirect taxes yielded 81.3 per cent of revenue. Various efforts have been made to gather in more direct taxes, but such measures have yielded poor results. The reasons for these are many. Those earning high incomes are able to avoid taxation through many subtle and innovative methods. Professionals such as lawyers, doctors, private tuition masters and many others are able to avoid taxation to such an extent that the proportion of their income paid in taxes is very low. The inefficiency, incapacity and corruption of the tax authorities are also reasons. It is believed that powerful rich persons are able to avoid taxation by the intervention of influential persons. The number of tax files with the Department of Inland Revenue and the amount of income taxes gathered is a reflection of the extent of tax avoidance and tax evasion. On the other hand, those who pay taxes are often harassed. This has been recognized and there is an announced policy that the revenue authorities would go after those who do not pay taxes rather than the middle level tax payers.

Taxation proposals based on an expectation of more efficient collection of income taxes is unrealistic. The question that arises is whether efforts to gather taxes from tax dodgers should be pursued or whether indirect taxes that would fall mostly on the rich are a more effective and better alternative. There should be efforts to increase unavoidable indirect taxes that fall on the rich. Many such taxes are rather low. A case in point is the annual motor car licensing fees that have not kept pace with increases in road maintenance costs as well as the incomes of the rich. Similarly there are many other tax rates that are low and could be raised with some discomfort to the rich. A focus on taxing high income consumption expenditures should be an objective of taxation measures.

Government expenditure

A very important area the budget should focus on is the extent of government expenditure on activities that do not yield an economic or social return. Prudence in government expenditure has been a principle of good governance and fiscal management from ancient times. It is widely recognized that government expenditure on many unproductive and conspicuous expenditure are very high. The curtailment of such wasteful expenditure is a vital ingredient of good fiscal management. Prudence in government expenditure may also increase the willingness of people to bear higher taxes.

The composition of government expenditure leaves much to be desired. Wages and salaries, interest payments and subsidies and transfers amounted to almost the entirety of government revenue and in some years these exceeded the entire revenue collected by the government. This huge expenditure is distorting priorities in government expenditure, increasing the fiscal deficit and increasing the public debt. Subsidies and transfers to loss making state owned enterprises is a severe strain on the public finances. These enterprises must be reformed and reorganized to ensure that they are a lesser strain on the public finances of the country.

Last word

A people’s friendly budget would be one that reduces the tax burden on the poor and yet increases revenue by increasing the incidence of taxation on the rich. The budget is the centrepiece of the government’s development strategy. Therefore it should increase expenditure where it is needed and curtail expenditure that is wasteful. Reining in government expenditure so that the fiscal deficit is brought down is vital for the country’s economic development.

|