Does the Budget for 2011 give a clear indication of the direction of the economic policies of the government for the rest of its regime? The answer to this question is more important than the details of the Budget proposals. Whatever be the ideological orientation of the government or its promises at election time; and no matter what the expectations of the people are, the stark reality is that the government has accepted basically the economic policies that it condemned earlier. However there are some internal inconsistencies too in its policy strategy.

Despite the rhetoric of the Mahinda Chintanaya the driving force of the budget is to usher in a high growth trajectory with reliance on market forces and the private sector. This is no doubt a politically popular path. Perhaps the massive majority in parliament and a six year period ahead has emboldened it to follow such a course. Perhaps the advice of the IMF and the conditions placed by it for the continuation of the stand-by credit facility had something to do with it. It may also be the advice of the government’s own economic advisors. Whatever the underlying reasons, there is no doubt that the policy thrust of the Budget points towards a market friendly economic strategy. It has however not gone the full length of undertaking wide ranging reforms required in public enterprises, education, administration and several other key areas. Whether these would be attempted subsequently remains to be seen.

|

The reduction in certain import duties, lower rates of corporate taxes, removal of the debit tax, and simplification of the tax system among other policy measures are in this direction. Similarly the resistance to increase public service wages by as much as was promised is a highly controversial bold move. From a fiscal policy perspective, it is a healthy move as increases in public service salaries would have added substantially to government expenditure. On the other hand, it was a breach of the election promise to give a salary increase of Rs.2500 a month.

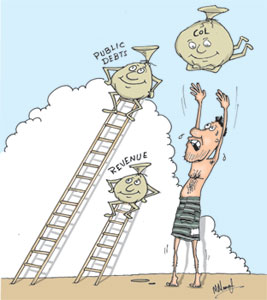

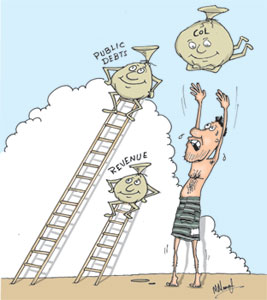

Trade union unrest is likely to follow owing to this. The increase in the cost of basic items owing to the increase in import duties of consumer items and the likelihood of increases in food import prices makes it a justifiable demand. Hard times may be ahead for the poor people of the country as a result of the budgetary stance, but revenue collection promises to be enhanced and the intent to reduce the fiscal deficit more likely of achievement.

Whether the policies and concessions of the budget would lead to increased savings and investment is arguable. Economic incentives alone do not determine foreign investment. Good governance, sound economic fundamentals, exchange rate policy, political conditions, labour laws, among others, determine investor confidence. The fact that foreign investment has not increased after the end of the war indicates there are conditions that are inimical to foreign investment. Perhaps for the same reasons the share market performance too has not shown investor confidence after the budget.

The effort to bring down the fiscal deficit as indicated by several revenue and expenditure proposals is an important move in the correct direction. Yet the realization of the targets remains an issue as in the past. The revenue growth at 21 per cent forecast in this year’s budget could be realized only if the economy does in fact grow at a predicted rate of 8 to 10 per cent and the tax collection is effective. The rate of inflation would also matter. There are indications that the rate of inflation would increase next year and perhaps reach double digit proportions again.

Decreasing the public debt is vital to reduce debt servicing costs over time, and this in turn is crucial to bring down the fiscal deficit as this is the highest expenditure in the budget. With debt servicing costs absorbing more than the annual revenue, there is little prospect of decreasing the fiscal deficit in the next few years. Will the expectation of reducing the public debt be achieved? This is very unlikely and hence the curtailment of the fiscal deficit becomes onerous. There is no evidence of efforts at decreasing the public debt. The scanty evidence points to an increase in the debt burden. In fact the budget estimates do not give a clear idea of the country’s debt liability and interest costs.

The reduction of Capital Expenditure is another option for achieving this. Reduction of capital expenditure could contribute towards achieving the target of reducing the fiscal deficit to 5 per cent over time. This could however adversely affect future economic growth. There is an increase in Capital Expenditure of 15 per cent or Rs 54 billion next year.

Two ways in which capital expenditure could be reduced is by prioritization of capital works as all infrastructure investments do not bring the same returns and the gestation period of some capital expenditure is very long. Reductions should be made by abandoning lower priority capital expenditure, while at the same time continuing priority capital expenditure on energy development, development of vital road links, repairs of roads, bridges, and irrigation channels. The other strategy is by private public partnerships that have been used in many countries rather than the government going it alone. This would improve infrastructure without being a burden on government expenditure.

Much attention has been drawn to the fact that defence expenditure has been increased to Rs.215 billion: an increase despite the conclusion of the war over one and a half years ago. The explanation for this has been that there are defence expenditure commitments from the past. The implication of this is that parliament was not aware of expenditures incurred: a violation of parliamentary control of public finances. The other explanation is that soldiers already in employment cannot be discontinued and have to be provided better accommodation than the make shift arrangements during war time.

The reduction in numbers would have to be achieved over time and soldiers would require to be deployed in economically productive activities such as infrastructure development. The change in the economic policy stance of the government was aptly described by opposition MP Eran Wickremaratne when he said “The Government need not be embarrassed by its new clothes.”

He said the Budget was a departure from the budgets that have been presented by the Mahinda Rajapaksa regime in the past and one explicitly committed to limiting itself to fiscal variable targets. His evaluation of the Budget is that it is a mainstream liberal economic policy statement with incentives for big business and little else in terms of relief for the poor. If the objectives of the budget are achieved the country may achieve higher economic growth but the process of economic growth may not reduce poverty except through higher employment opportunities for some. |