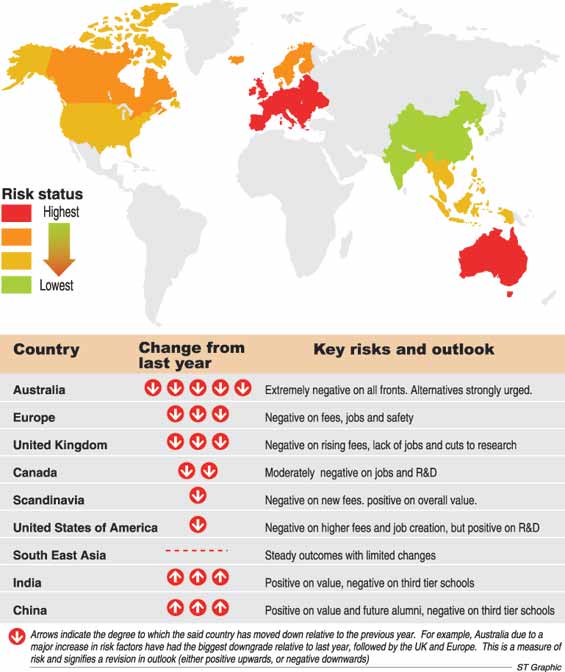

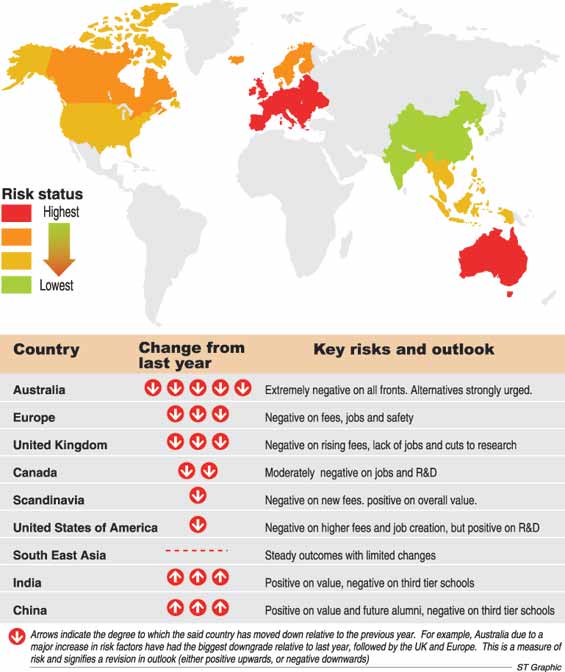

The release of annual budgets of major economies and important macro economic data over the past month has led to significant changes to the outlook for key household risks to investors. Nowhere is this more apparent than in the higher education sector, where my models now indicate it to has reached the highest risk status to families with children. Incidentally, retirement liabilities are second, followed by increasing food prices.

An austere Britain, a collection of strange bedfellows calling themselves the “tea party” in the United States, rising xenophobia across Europe and the potential arrival of foreign universities into Sri Lanka have all combined to have a major impact on my annual higher education household risk survey. In summary the days of families spending life savings on a ‘foreign’ education in a western country are numbered. A higher education from a top 50 university is still worth every cent or penny. However, the outcome from the other thousands which make up a long tail is now in a race to the bottom. Universities and colleges along this long tail is unfortunately where most students who pay a full tuition end up. An austere Britain, a collection of strange bedfellows calling themselves the “tea party” in the United States, rising xenophobia across Europe and the potential arrival of foreign universities into Sri Lanka have all combined to have a major impact on my annual higher education household risk survey. In summary the days of families spending life savings on a ‘foreign’ education in a western country are numbered. A higher education from a top 50 university is still worth every cent or penny. However, the outcome from the other thousands which make up a long tail is now in a race to the bottom. Universities and colleges along this long tail is unfortunately where most students who pay a full tuition end up.

The methodologies I use to view higher education from the perspective of an international student are multidimensional. The measures include, amongst a host of other variables, research budgets, the publications in top journals, tuition fees, aid to internaional students and employment rate of international students upon graduation. This is then overlaid with country risk assessments, which include criteria such as immigration rules for students to gain employment, guaranteed residency upon graduation, safety, macroeconomic outlook and overall cost of living outside of tuition.

The biggest change at a country level using my equal probability weighted scenario model is in Australia. Australia’s already fledgling academic reputation was given a knock out punch when it’s only competitive weapon (that of guaranteed residency upon graduation) was taken away by amendments to the immigration rules. Earlier rules placed hairdressers and chefs above Rhodes scholars, which incidentally made for some interesting dinner conversations at conferences, deeply embarrassing many academics.

More worrying are the uncompetitive nature of admissions and the pure focus of international students as a funding source. There is a worldwide view that most Australian universities are diploma mills for rich foreign students who are academically weak. While this idea may be debatable, the lack of an authoritative denial warrants an immediate upgrade of the risks present within the system. Disgruntled academics and alumni have also called for a comprehensive review of the overall sector. Second and third tier Australian universities should be complete “no go” zones on current analysis. All other destinations look attractive by comparison, and our advised clients have been asked to reconsider Australia from an academic and value perspective.

The United Kingdom is about to enter the age of austerity as described by the Chancellor of the Exchequer. Austerity for her citizens would mean punitive costs to international students via increased fees and lack of opportunities upon graduation. The lack of job creation and an over dependence on the finance sector in the City of London make the next seven years look very bleak for international students. Like with Australia, I doubt a meaningful lifetime payout from second and third tier universities in the United Kingdom at today’s full tuition and board costs.

Continental Europe like in many other areas will be irrelevant to discussions on education this century. That said, many grand universities are still attractive for the quality of research and student experience. Like in the UK, austerity and lack of job creation continues to be a worry as an international student. But, unlike the UK, I worry about violent outbursts from underlying social tensions in countries such as France. This risk and the overall dwindling influence of Europe on the world stage make the region unattractive for a host of different subjects. Engineering and sciences in Germany remain amongst the best in the world.

The Scandinavian region still remains attractive although many have now moved to charge fees from International students. Many countries offer generous scholarships, with instruction in English. Sweden still continues to offer free education to international students. Although a changing political landscapes across the region with a strong shift to right wing xenophobic outfits, along with weaknesses in mainland Europe makes me slightly negative about the outlook for international students in the region, this is offset by the current fee situation.

The United States continues to be the destination of choice, although it has been moved a notch below where it was last year due mainly to political uncertainty and funding for international students. The “tea party” movement has been vocal about cuts to public institutions, which has a ripple effect on some international student scholarships. Private funding is also stretched at the moment with endowments not having fully recovered post-GFC (Global Financial Crisis). The lack of jobs growth while worrying is offset by the continuing strength of the innovation engine and focus on research.

Unsurprisingly the best value destinations with lower risk now are India and China. India’s best universities are as competitive as the best in the US and offer comparable future outcomes. The second and third tier though is a bit more worrying and requires careful evaluation. China’s ascendancy is part due to major link-ups with the best universities from around the world and the potential for future students to establish deep links with future leaders of China. As with India the green light is restricted to the very best universities. Both countries offer a great opportunity for students to establish links with the two most important economies over the next few decades. I view that as a potential source of better outcomes over a decade after graduation.

As for options within Sri Lanka, SLIIT remains the only institution worthy of attention as a fully paid university education is not available. None of the affiliate or transfer colleges qualifies as higher education providers for comparison purposes. SIIT remains the best value of any private higher education option for Sri Lankans.

Foreign campuses planning to set up shop locally will not be the panacea for parents. These outfits will still charge unattractive fees minus the actual feeling of being in a university (a net loss all around). Any new fee paying option locally must be able to compete at the hundred thousand Rupees per year range to have a meaningful impact. As highlighted in previous columns, the focus of the government should be in collaborating with the best universities overseas to create colleges of the SLIIT ilk, if they are focused on a quality low cost option, as opposed to allowing third-rate fee gouges. Unfortunately it’s the fee gouging variety that seems to have shown the most interest in coming to Sri Lanka. It is also an opportunity for the country to use her much touted good relations with India and China (as a start) to invite the very best to set up shop locally, thus filling the vacuum on the research front. Did someone say, Indian Institute of Technology and Fudan University?

Amongst the most difficult question facing international students is the future job market. The lack of job creation across the world post-GFC should be worrying to most parents and future students alike. The various underlying reason for this state of affairs will be covered in a forthcoming column.

(Kajanga is an Investment Specialist based in Sydney, Australia. You can write to him at kajangak@gmail.com).

|

An austere Britain, a collection of strange bedfellows calling themselves the “tea party” in the United States, rising xenophobia across Europe and the potential arrival of foreign universities into Sri Lanka have all combined to have a major impact on my annual higher education household risk survey. In summary the days of families spending life savings on a ‘foreign’ education in a western country are numbered. A higher education from a top 50 university is still worth every cent or penny. However, the outcome from the other thousands which make up a long tail is now in a race to the bottom. Universities and colleges along this long tail is unfortunately where most students who pay a full tuition end up.

An austere Britain, a collection of strange bedfellows calling themselves the “tea party” in the United States, rising xenophobia across Europe and the potential arrival of foreign universities into Sri Lanka have all combined to have a major impact on my annual higher education household risk survey. In summary the days of families spending life savings on a ‘foreign’ education in a western country are numbered. A higher education from a top 50 university is still worth every cent or penny. However, the outcome from the other thousands which make up a long tail is now in a race to the bottom. Universities and colleges along this long tail is unfortunately where most students who pay a full tuition end up.