The reasons for the recent reduction of import duties on some items are as intriguing as the uncertainty of its consequences. Various motives and objectives have been adduced for the surprising move to reduce import duties on a range of goods from motor vehicles to imports that are generally described as luxury goods. The intentions for the liberalization of different items vary. Particularly significant to the economy in the long run is the reduction in import duties of raw materials for industry.

The liberalization of imports is especially surprising as the country is heading for a large trade deficit this year owing to increasing expenditure on imports. This it appears is not considered important for several reasons. There is an increasing inflow of remittances, earnings from tourism is expected to increase and there is an expectation of net capital inflows being significantly positive. The argument is that even if there is a large balance of trade deficit, these items would offset it to generate a balance of payments surplus. Even if these do not offset the trade deficit, it is argued that the country has a large foreign exchange reserve to meet any likely balance of payments deficit.

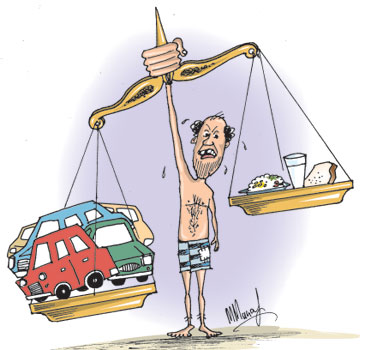

|

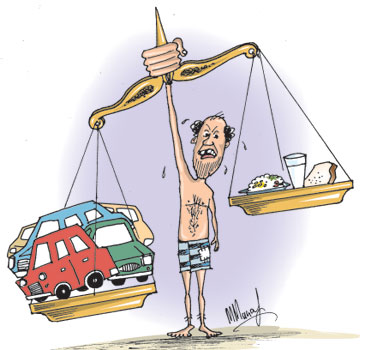

The rationale for the reduction of import duties varies with each category of imports. The duties on car imports have been reduced in order that the reviving tourist industry would be able to import vehicles. Motor car importers have had poor sales owing to the high duties. As a consequence the collection of revenue from import duties on cars has been low. Therefore this reduction of duties is also a measure to increase government revenues that are at a low level. However, the economics of liberalizing imports of cars are uncertain. If the reduction of duties on car imports increase imports sharply then it would increase revenues but affect the trade balance adversely. On the other hand, if the increase in car imports is not considerable then it is possible that government revenue may even decrease, as the revenue from each car import is less. For there to be an increase in revenue, car imports would have to increase by a higher proportion than the reduction in import duties.

Car importing firms would definitely benefit if the duties remain on the books. There is speculation that the reduction in import duties is temporary. Such speculation is unhealthy, as it could lead to a higher volume of imports than necessary for present needs. Such an immediate large inflow of imports would strain the trade balance immediately. Traders who have large stocks of already imported vehicles would suffer losses. Therefore, in as far as the trade in motor vehicles is concerned there would be both gainers and losers.

One of the reasons given for the reduction in import duties on cars is the need for vehicles for tourist transport. The travel related tourist industry would benefit from the reduced duties. The travel trade that is a vital complement to tourism would be able to support the hospitality trade. However, the benefits will not be confined to the travel trade but all those who desire to import new vehicles, and a flood of vehicle imports could be a sizeable increase in import expenditure, increase petrol and diesel consumption and add to the congestion on the roads.

The reduction in duties on electronic items and wristwatches are expected to complement this by encouraging shopping by tourists. The idea is to make the country a shopping hub to earn foreign exchange by making the prices of these items cheaper. It is difficult to conceive of this happening on a scale large enough to be of a significant benefit. Imports by Sri Lankans would undoubtedly flourish unless the depreciation of the Rupee acts to increase import costs.

The reduction in duties on raw materials is indeed a positive move, especially in the context of the country losing its competitiveness in industrial exports owing to escalating costs, on the one hand, and the denial of the GSP + status in the European Union, the country’s major export market, on the other. It is hoped that this move would encourage industrial exports and be an incentive to the development of new industrial exports. In fact one of the favourable developments recently has been an increasing number of new industrial exports. This diversification of the industrial export structure is a healthy development. Garment export that is the leading industrial export now accounts for about 50 per cent of industrial exports whereas it accounted for about 70 per cent some years ago.

This is a healthy development not merely because such a diversification reduces the vulnerability to international market fluctuations in demand, but the phasing down of garment export has been a phenomenon in South East Asian countries as well. Besides this it is hoped that this reduction in import duties would encourage industries with a higher value addition. This significant benefit from the reduction in import duties for raw materials has not got the attention of the general public owing to the focus being on the import of vehicles, electronic items and wristwatches.

This reduction in the costs of import of raw materials is especially important as garment export as well as ceramic export, which is another important export has been declining, and appears to be a continuing trend. Recently the industrial export growth has been in other goods. The reduction in duties of raw materials may provide incentives for industrial development of a wide range of industrial products. It is a good way to encourage diversification of industrial exports. This is especially salient in the context of the withdrawal of the GSP+ status that perhaps affects Sri Lanka’s traditional industrial exports more than new industrial exports.

The import liberalization appears to be a change in the traditional economic policy of the government. The new thrust in thinking could be of long term interests to the economy, even though it may have an adverse impact on the trade balance in the short run. It is worth recalling that it was the import liberalization in November 1977 that promoted a structural transformation of the country’s export structure from one dependent mostly on `gricultural produce to one based on industrial exports. |