Colombo’s stockmarket was topsy-turvy this week on the back of the US drama surrounding high networth investor Raj Rajaratnam who, despite facing insider trading charges in the US, can still buy or sell stock in Colombo.

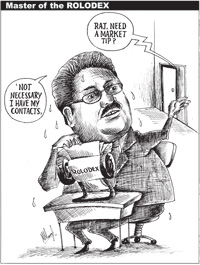

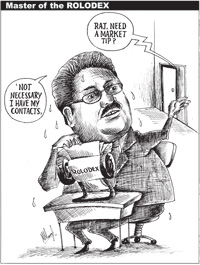

A Rolodex is a rotating device, placed on a desktop, in which cards containing names, addresses, etc. are held securely in place for ready reference. |

“He can buy or sell his shares at any moment. He is not barred from doing this here. That is entirely his decision. He is not suspected of any insider trading here,” Udayasri Kariyawasam, Chairman Securities and Exchange Commission (SEC) told the Sunday Times FT. Central Bank (CB) Governor Ajith Nivard Cabraal also agreed saying there is no barrier to him trading in Colombo.

The stockmarket reaction was instant on Monday, with sharp trades taking place in companies where he is a key investor. On Thursday, the market sank to a low turnover (Rs 293 million) compared to an average of around Rs 1 billion in the past three weeks, with brokers saying the frenzy was over the Rajaratnam issue and fears that Sri Lanka will lose the GSP Plus concessions.

While Colombo was completely absorbed in the developments surrounding Mr Rajaratnam and his Galleon fund in the US, other international markets have been largely unmoved by the fallout. Xavier Rolet, CEO London Stock Exchange (LSE) Group, on a visit to Colombo, told the Sunday Times FT that Mr Rajaratnam’s issue is ‘essentially an American one’. “He has been investing in the US and also emerging markets. His arrest has not affected the LSE,” he said. It was unclear whether Asian markets were affected with Galleon’s Asia operations headquarted in Singapore amidst reports that some Galleon investments in India were sold on Friday.

Mr Rajaratnam’s arrest and subsequent bailout on insider trading charges was the talking point in the stockmarket and social circles in Colombo apart from being widely reported in the world media with some businessmen saying he was being unfairly targetted because he is a Tamil (in the Sri Lankan context) and a non-white investor (in the US context). “He is the only Sri Lankan who made a name for himself out there in this field. There is no denying his genius in the field,” a well-known businessman who declined to be named, said. He said it is ‘sad’ that the allegations against Mr. Rajaratnam are slowly taking a communal slant. He was referring to the Central Bank (CB)’s Financial Investigation Unit (FIU) probe which is continuing and refers to alleged terrorist funding connections via investment in the Tamil Rehabilitation Organisation (TRO). US authorities also have said Mr Rajaratnam’s funding of TRO, banned in the US, is being probed. “The TRO-related investigation and the insider dealing case are two different things and unrelated,” he said. Sources close to Mr. Rajaratnam, told the Sunday Times FT that on Monday FIU officials visited the Deutsche Bank to check Mr. Rajaratnam’s accounts. “These officials had told the Deutsche Bank team that they wanted to peruse transactions in Mr. Rajaratnam’s accounts after 2007.”

The Colombo businessman added, “No one here in Sri Lanka is bothered about the jealousy and the antagonism Rajaratnam has to deal with by his ‘white’ competitors. This is a real issue in the US, but we in Sri Lanka are discounting this very true fact and trying to put him down further.” He was alluding to the general perception that most non-white investors who make it big in the US are subject to these kind of problems.

On Wednesday, Mr Rajaratnam, the biggest, single foreign investor in the Colombo market, proclaimed his innocence in a letter addressed to Galleon employees, clients and friends, saying he will vigorously defend himself and the company.

Denying charges that he relied on friends through the ‘rolodex’ for investment tips, the under-fire fund manager, said: “As many of you know, we have built our business on the fundamental belief in rigorous investment analysis combined with active trading around core positions. We have encouraged and invited our investors to attend our daily research morning meetings. Many of you have done so and got a first-hand look at our process. This research process is the core of our investment and trading strategy.”

Mr. Rajaratnam’s investment in the stockmarket is said to be in excess of US$ 40 million as at June this year, according to unofficial estimates. He has invested in the top 10 listed stocks in the Colombo bourse and exited from some of them.

Analysts said it is unlikely that there would be demands (from Galleon investors in the US) on Mr. Rajaratnam’s ‘small’ amount (of US$ 40 million) in Sri Lanka – just yet. “Presently his funds are having cash calls (demands) for billions of dollars. Immediately there may not be any calls for Rajaratnam’s holdings in Sri Lanka. But there is a chance that they will be called for eventually,” he said.

Some analysts and brokers who sang the praises of Mr. Rajaratnam just a few days prior to his arrest now play a different tune now. “His investments are just 1.2% of the stock market capitalisation. So it is relatively less important for the market to drop drastically,” one such analyst noted.

Others say that while this may be true, Mr. Rajaratnam is the only (international) investor who came into the market when it was ‘down in the dumps’ and invested, thereby building up confidence. Some analysts point out that Rajaratnam’s issue cannot change the fundamentals of listed companies in the stock exchange. “Perceptions, sentiments and the global impact matter, but a good company last week is a good company today (considering its fundamentals),” an analyst said.

Mr Kariyawasam from the SEC said the stock market regulator hasn’t launched any probe on trades by the crisis-hit fund manager. Earlier there were reports from SEC officials indicating that a probe was underway. |