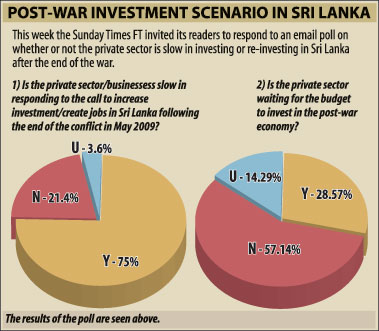

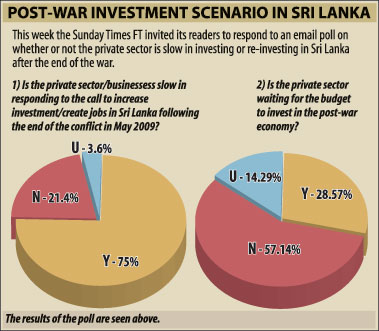

A poll this week by the Sunday Times FT suggests that an overwhelming majority, 75% in fact, feels that the private sector has been slow in taking advantage of investment opportunities brought on by the end of the war.

Meanwhile, 21.4% disagreed with this assertion, citing rapid expansion by conglomerates such as JKH (John Keells) as well as the recent Hemas Power IPO and increasing land prices as to why they felt otherwise. At the same time, the poll also indicated that, while most respondents (57.1%) thought that a lack of new investment was less because of a 'wait and see' stance by the private sector with regards to the upcoming national budget and possibly a greater aversion to risk, 28.6% opined that it was in fact ‘waiting for the budget’. Notably, a significant number of respondents (14.3%) remained undecided as to the impact of the budget on the private sector’s decision making process.

Asking for “Yes”, “No” and “Undecided” answers to “Is the private sector/businesses slow in responding to the call to increase investment/create jobs in Sri Lanka following the end of the conflict in May 2009?" and "Is the private sector waiting for the budget to invest in the post-war economy"; the Sunday Times FT Poll utilized a convenient sampling methodology, via email to a frequently tapped database numbering in the hundreds, to tap public opinion from private and public sector business leaders, decision makers and employees in sectors as diverse as finance and banking, IT, services, telecommunications, garment and textiles, electronics and others. Asking for “Yes”, “No” and “Undecided” answers to “Is the private sector/businesses slow in responding to the call to increase investment/create jobs in Sri Lanka following the end of the conflict in May 2009?" and "Is the private sector waiting for the budget to invest in the post-war economy"; the Sunday Times FT Poll utilized a convenient sampling methodology, via email to a frequently tapped database numbering in the hundreds, to tap public opinion from private and public sector business leaders, decision makers and employees in sectors as diverse as finance and banking, IT, services, telecommunications, garment and textiles, electronics and others.

Importantly, the poll also captured comments from several respondents, ranging from the clinically analytical to the highly emotional; which ultimately prove to be an eye-opener regarding why the business community was practicing greater caution, no matter what new opportunities were said to be available.

In fact, due the intricacies of the issues said to impact this area, as identified by the small sample responding to this poll, a host of new avenues for further study presented themselves. The potential areas and ramifications pertaining to this issue are widespread.

As a result of a request for five reasons to be furnished by those answering "Yes" to "Is the private sector/businesses slow in responding to the call to increase investment/create jobs in Sri Lanka following the end of the conflict in May 2009?", the Sunday Times FT poll was able to garner a 'deep' understanding of issues faced:

From a 'wait and see' approach by businesses, to a lack of funds needed for expansion, whether because of a slowdown in consumer spending or a global recession inhibiting exports, to even one or two comments identifying "GSP+ uncertainty" as the limiting factor; there seems to be no shortage of reasons why local private sector firms are wary of committing resources beyond what they deem essential for maintaining business as usual.

While just a few comments forming the majority opinion follow, it must be noted that numerous, some very detailed, had to be excluded because of space restrictions:

- Our revenues have to stabilize (from existing businesses), then expansion will happen

- No real growth recorded in North and East. Estimates say that it will take another 12 months for these two areas to start generating real income

- Export market should see a turn around for the economy to really recover

- Private sector does not invest/ create jobs because a call is made. They do so to earn profits and enhance shareholder value

- Despite all the euphoria in the aftermath of the war victory many marketers would admit that the sales figures are either static or have been below last year. Perhaps the post-war boom expected by the business economy is taking much longer than expected

- Too much red tape

n Obviously government must first show its commitment and prepare a conducive environment to make it happen

- Wait and see attitude

- Lack of focus in creating chains between the rural production sector and the elite export and manufacturing sector

- There is no agenda set out by either government or the business associations (who don't always have to watch and wait for government to steer the path) on a post war economic recovery - it needs to spell out available opportunities for investments, areas that need development - basically an overall plan for development

- The chambers of commerce should be taking a leadership position, steering the path, setting policy, not waiting for handouts from the ones that run the company. How can the private sector move if things are not in order?

- All that is highlighted in the media on post war is the IDP issue and general doom and gloom. Things are not looking up

- There was investment and growth even at the worst of times. So was conflict the problem? Are we asking the wrong question? Is it the conflict or something else?

- GSP+ uncertainty. Quite a number of garment factories have closed

- Declining consumer purchasing power. Companies are looking to keep above break even point until a more positive environment prevails.

- Budget shops growing in popularity not a good sign

Meanwhile, it is notable that, of the very few comments from those believing the private sector had in fact already started investing en masse; there was one respondent who identified "a lack of coordination between the private and the government sectors. Some officials do not understand the needs of the private sector [which] has resulted in slow movement of things". This commentator further suggests "setting up of a joint task force [to solve] some of the problems which hinder rapid pace of new investments".

In response to "Is the private sector waiting for the budget to invest in the post-war economy", comments proved to be more balanced. One respondent indicated they would "rather wait for things to happen or real implementation" while another said "budgets have always been bad for the general business. In recent years tax holidays for some businesses had been countered by higher taxes for the rest of the economy through various new forms of taxation.

Having said that it is always better to get the budgets out of the way, so that the burden and hindrances are known at least for a year".

Another, possibly more pragmatic, respondent goes even further, suggesting "the next budget would have to keep to the IMF conditionalities.

The sticking point would be the bringing down of the projected budget deficit from what it is looking like now - 10% to 7%. This will mean raising revenue by additional taxation and reducing expenditure on both recurrent and the capital side". |

Asking for “Yes”, “No” and “Undecided” answers to “Is the private sector/businesses slow in responding to the call to increase investment/create jobs in Sri Lanka following the end of the conflict in May 2009?" and "Is the private sector waiting for the budget to invest in the post-war economy"; the Sunday Times FT Poll utilized a convenient sampling methodology, via email to a frequently tapped database numbering in the hundreds, to tap public opinion from private and public sector business leaders, decision makers and employees in sectors as diverse as finance and banking, IT, services, telecommunications, garment and textiles, electronics and others.

Asking for “Yes”, “No” and “Undecided” answers to “Is the private sector/businesses slow in responding to the call to increase investment/create jobs in Sri Lanka following the end of the conflict in May 2009?" and "Is the private sector waiting for the budget to invest in the post-war economy"; the Sunday Times FT Poll utilized a convenient sampling methodology, via email to a frequently tapped database numbering in the hundreds, to tap public opinion from private and public sector business leaders, decision makers and employees in sectors as diverse as finance and banking, IT, services, telecommunications, garment and textiles, electronics and others.