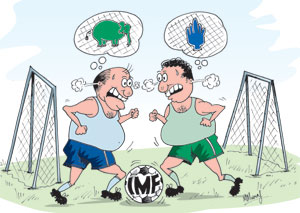

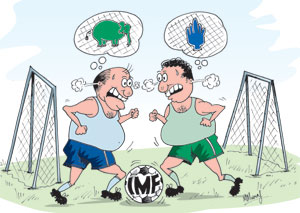

The IMF loan has become a political football which is kicked hither and thither with only political goals in sight.

The economics of the loan is surely the loser when political scores are the main concern of the players. Trying to gain popularity or denunciation of the government on the obtaining of an IMF loan is the name of the political game. No doubt the IMF is anathema to some beyond reason. To others their attitude depends on whether they are in the government or the opposition.

The rhetoric on both sides of the political divide has been extravagant and often misleading and the logic is sometimes puerile. It is in such a context that we are compelled to restate many of the issues that have been discussed in these columns before. The pertinent issues are whether the conditions imposed by the IMF could be met and whether the country’s compliance to these conditions is good for the economy. Then there is the question as to whether the burden of debt created by the loan of about US 2.6 billion dollars is too heavy. These are issues that could be discussed quite objectively and rationally. A third issue that is raised for political reasons is the transparency of the conditions of the loan.

|

Most relevant to the country’s economic future is whether the government would be able to comply with the conditions laid down by the IMF with respect to the containment of the fiscal deficit. The containment of the fiscal deficit to 7 percent of the GDP this year and its reduction to 5 percent of GDP by 2011 is indeed a tough task in the context of the recent fiscal experience. All budget speeches have expressed an aspiration to bring down the deficit and churned out figures quite inconsistent with the actions of the government. The outturn is always as expected, an overrun of expenditure over revenue that is much higher than the budget figures. For instance, last year’s fiscal deficit was nearly 8 percent when the expectation was that it should be 7 percent. The usual excuse has been the war expenditure that has been a sacred cow and undisputed. That excuse is no longer tenable, if ever it was, as there were other expenditures that could have been curtailed.

It is well known that government expenditure this year is outstripping revenue by a large margin. In the first half of the year itself the deficit has risen to a massive amount whose trend is likely to lead to a 9 percent deficit. Some commentators expect this trend to result in a deficit of over 10 percent of GDP. In this background of a growing deficit would it be possible to restrict expenditure and increase revenue to yield a deficit of only 7 percent of GDP?

Some very drastic measures are needed and only a few months remain for the implementation of these measures. To achieve such a target there is very little time to put in place measures to cut expenditure and increase revenue. In this predicament the best the government could do is to take some of the measures that are needed and demonstrate its willingness to curtail expenditure and increase revenue. This would provide space for further negotiations and willingness of the IMF to be flexible. There would be a greater prospect of improving the public finances next year by reducing defence expenditure, curtailing wasteful expenditure, improving efficiency of loss making public enterprises, new taxation measures, better compliance with tax regulations and casting the income tax net wider to bring in the large number of tax evaders in the country. The reduction of waste accords with the President’s message soon after the victory that we must cut down wasteful expenditure, bribery and corruption, all of which adds to government expenditure. Definite signs of such curtailment of expenditure together with measures to improve tax collection would no doubt be a means to get some leeway in this condition.

The loan is the highest ever facility the country has obtained. This fact itself is bandied about as both a negative factor and a positive one. Government spokesmen are advertising it as an achievement of the government. The opposition is driving fears into the people that we have incurred a heavy burden and that we may be unable to repay it. Much of the criticism is a reflection of political bias though the issue of whether the government would be able to comply with the conditions attached to the loan is a very relevant and pertinent issue. The fact is that the country had no alternative but to turn to the IMF. For sometime the country’s external finances were in a perilous state. In view of the balance of payments problem and low external reserves, the government turned to foreign commercial borrowing in recent years. This was a costly and imprudent measure, as these loans were at market interest rates that were particularly high for Sri Lanka with a low credit rating. Besides this, these loans were of a short duration and had to be repaid in full in what financiers call bullet payments. By borrowing from commercial sources at around 8 percent per annum, the government postponed the problem and in fact aggravated it. These loans relieved the immediate problem of diminishing foreign reserves by postponing it and adding further burdens in the form of high interest costs. In contrast the current IMF facility is a much larger one at a very nominal interest rate of one half of one percent and certain service charges that altogether amount to less than one percent. It is repayable over 20 years. This is indeed a near gift to the country and an opportunity to get its external disequilibrium sorted out. Therefore the argument that this loan is burdensome does not hold any water.

One of the issues continuously raised is the transparency in the conditions governing the loan. This is a political one suggesting that there are conditions to obtaining the loan that are not revealed. Perhaps, as never before, have the conditions of the loan been open and transparent as in this facility. The conditions of the loan are in the public domain and discussed publicly. Furthermore these conditions are being placed before parliament.

There may be discussions regarding the details of how to achieve the revenue collection or reduce government expenditure. These would be on-going technical discussions that are to be expected. It is also true that as time goes on the government would have to take tough measures to both increase revenue as well as reduce expenditure. These are implications of the broader conditions that are agreed to by the government and there could be various choices in what the government could do. The political limits and constraints would undoubtedly fashion the choices.

In the economic and financial condition that the country was in, the IMF loan facility was the best option. It provides the best opportunity to stabilize the economy and put in place policy measures that are in the long-term interests of the country. |